US Current Account Deficit Narrows to a Two-Year Low in Q3

Us current account deficit narrows to a two year low in q3 – US Current Account Deficit Narrows to a Two-Year Low in Q3, a glimmer of hope in a landscape of economic uncertainty. This shrinking deficit, a measure of the difference between a country’s earnings and spending with the rest of the world, suggests a potential shift in the US economic trajectory.

While the reasons behind this narrowing are complex and multifaceted, they offer insights into the evolving dynamics of global trade and investment.

The narrowing of the US current account deficit in Q3 2023, reaching its lowest point in two years, reflects a combination of factors. A stronger US dollar, driven by interest rate hikes, has made imports more expensive, while exports have become more competitive in the global market.

Additionally, the US economy’s resilience, despite inflation and rising interest rates, has contributed to increased demand for US goods and services abroad.

Current Account Deficit Overview: Us Current Account Deficit Narrows To A Two Year Low In Q3

The current account deficit is a key indicator of a country’s economic health, reflecting the difference between a nation’s income from exports and its spending on imports. When a country spends more on imports than it earns from exports, it results in a current account deficit.

This deficit signifies that the country is borrowing from the rest of the world to finance its spending.The US current account deficit has been a persistent issue for several decades, with significant fluctuations over time. It has been influenced by various factors, including global economic conditions, domestic economic policies, and the value of the US dollar.

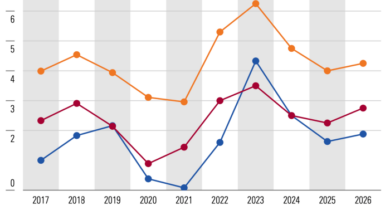

Historical Trends of the US Current Account Deficit

The US current account deficit has been a recurring feature of the US economy since the early 1980s. While it has fluctuated significantly over the years, it has generally trended upwards. The deficit reached a peak of over 6% of GDP in the early 2000s, driven by a combination of factors, including the housing bubble and the global financial crisis.

The narrowing of the US current account deficit to a two-year low in Q3 is encouraging news, but it’s important to keep an eye on the bigger picture. Upcoming economic indicators, particularly inflation and jobs data, will be crucial in understanding the long-term health of the economy.

These indicators will shed light on how effectively the Fed’s rate hikes are impacting inflation and the labor market, which ultimately influence consumer spending and the overall current account deficit.

- In the early 1980s, the US current account deficit began to widen due to a combination of factors, including rising oil prices, a strong dollar, and a growing trade deficit.

- The deficit narrowed in the late 1980s and early 1990s, as the US economy recovered from the recession and the dollar depreciated. However, it widened again in the mid-1990s, fueled by the rise of the dot-com bubble.

- The deficit reached its peak in the early 2000s, driven by the housing bubble and the global financial crisis. This period saw a significant increase in consumer spending, fueled by easy credit and rising asset prices. The decline in the value of the dollar also contributed to the widening deficit.

- The deficit narrowed significantly during the Great Recession, as consumer spending declined and the US economy contracted. However, it has been widening again in recent years, as the US economy has recovered and the dollar has strengthened.

Key Factors Contributing to the Current Account Deficit

The US current account deficit is driven by a combination of factors, including:

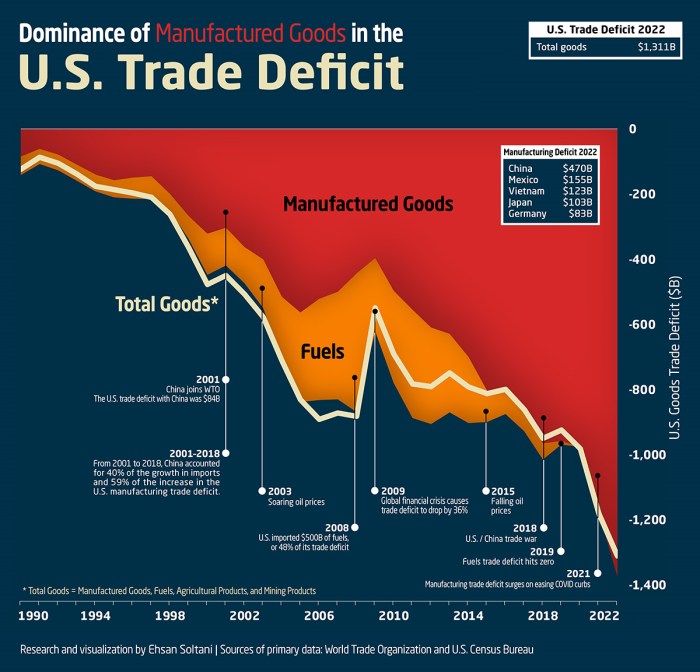

- Trade Balance:The trade balance is the difference between a country’s exports and imports of goods and services. The US has a persistent trade deficit, meaning that it imports more goods and services than it exports. This trade deficit is a major contributor to the current account deficit.

- Income Flows:Income flows include payments for services, investment income, and wages and salaries. The US has a net income deficit, meaning that it receives less income from its investments abroad than it pays to foreigners for their investments in the US.

This income deficit also contributes to the current account deficit.

- Unilateral Transfers:Unilateral transfers are payments made by one country to another without any expectation of repayment. These include foreign aid, remittances, and pensions. The US has a net unilateral transfer deficit, meaning that it makes more payments to foreigners than it receives from them.

This deficit also contributes to the current account deficit.

Impact of the Current Account Deficit on the US Economy

The current account deficit can have both positive and negative impacts on the US economy.

- Positive Impacts:The current account deficit can be a sign of a strong economy, as it reflects a high level of demand for US goods and services. It can also help to finance investment in the US, as foreign investors are willing to lend money to the US to buy its assets.

This can lead to economic growth and job creation.

- Negative Impacts:The current account deficit can also lead to a decline in the value of the US dollar, which can make US goods and services more expensive for foreigners and make it more expensive for US consumers to buy imported goods.

This can also lead to a decrease in investment in the US, as foreign investors become less willing to lend money to the US.

Q3 2023 Current Account Deficit

The US current account deficit narrowed to a two-year low in the third quarter of 2023, reflecting a combination of factors including a decline in imports and a rise in exports. This narrowing of the deficit is a positive sign for the US economy, as it indicates that the country is becoming less reliant on foreign borrowing to finance its spending.

Q3 2023 Current Account Deficit Data

The US current account deficit narrowed to $193.6 billion in the third quarter of 2023, according to the Bureau of Economic Analysis. This represents a decrease of 15.8% from the previous quarter’s deficit of $230.1 billion. The deficit as a percentage of GDP also declined to 2.7% in Q3 2023, down from 3.2% in Q2 2023.

Reasons for the Narrowing of the Current Account Deficit

Several factors contributed to the narrowing of the current account deficit in Q3 2023.

- A decline in imports: The value of US imports decreased in Q3 2023, driven by a slowdown in consumer spending and a decrease in demand for imported goods. This decline in imports helped to narrow the trade deficit, which is a major component of the current account deficit.

- A rise in exports: The value of US exports increased in Q3 2023, reflecting strong global demand for US goods and services. This increase in exports helped to offset the decline in imports and contributed to the narrowing of the current account deficit.

- A decrease in net income from abroad: The US received less net income from abroad in Q3 2023, as foreign investors earned less income from their investments in the US. This decrease in net income from abroad contributed to the narrowing of the current account deficit.

Comparison to Q2 2023

The Q3 2023 current account deficit was significantly lower than the deficit in Q2 2023. This narrowing was driven primarily by the decline in imports, which was more pronounced than the increase in exports. The decrease in net income from abroad also contributed to the narrowing of the deficit.

Impact of the Narrowing Deficit

A narrowing current account deficit, like the one observed in Q3, can have significant implications for the US economy, influencing various aspects from currency valuation to economic growth. While the deficit is a complex economic indicator, understanding its potential effects can provide insights into the trajectory of the US economy.

Impact on the US Dollar

A narrowing current account deficit can strengthen the value of the US dollar. When a country imports more goods and services than it exports, it creates a demand for foreign currencies to pay for those imports. This can lead to a depreciation of the domestic currency.

The news of the US current account deficit narrowing to a two-year low in Q3 is a positive sign for the economy, but it’s hard to ignore the looming uncertainty on Wall Street. As tensions escalate in the Middle East , investors are bracing for a subdued start to the week, which could impact the broader economic outlook and potentially dampen the positive impact of the narrowing deficit.

However, a narrowing deficit indicates that the US is importing less or exporting more, reducing the demand for foreign currencies and potentially leading to an appreciation of the US dollar. A stronger dollar can make US exports more expensive, potentially hindering growth in export-oriented sectors.

However, it can also make imported goods cheaper, potentially benefiting consumers.

Factors Influencing the Deficit

The recent narrowing of the current account deficit to a two-year low in Q3 2023 is a positive development for the economy. Several factors have contributed to this improvement, including global economic conditions, commodity prices, consumer demand, and government policies.

Global Economic Conditions

The global economic environment has played a significant role in influencing the current account deficit. The recovery from the COVID-19 pandemic has led to increased demand for goods and services, boosting exports and contributing to a narrowing of the deficit.

For example, the strong growth in emerging markets, particularly in Asia, has created a robust demand for exports from the country. Additionally, the easing of supply chain disruptions has also helped to improve the trade balance.

Commodity Prices

Fluctuations in commodity prices have a direct impact on the current account deficit. A decline in commodity prices, particularly for imported oil and gas, can significantly reduce the import bill, thereby contributing to a narrower deficit. For instance, the recent decline in oil prices, driven by factors such as increased global supply and weaker demand, has helped to reduce the import bill and improve the trade balance.

Consumer Demand

Domestic consumer demand can also influence the current account deficit. When consumer spending is robust, imports tend to increase, widening the deficit. Conversely, a slowdown in consumer demand can lead to a reduction in imports, thereby narrowing the deficit. The current economic climate, characterized by rising inflation and interest rates, has led to a moderation in consumer spending, contributing to the narrowing of the deficit.

Government Policies

Government policies, such as trade agreements and fiscal stimulus, can also have a significant impact on the current account balance. Trade agreements can promote exports and reduce import barriers, leading to a narrowing of the deficit. Conversely, fiscal stimulus measures, such as tax cuts or increased government spending, can boost domestic demand and lead to an increase in imports, widening the deficit.

The government’s recent focus on promoting exports and attracting foreign investment has contributed to the narrowing of the deficit.

The news of the US current account deficit narrowing to a two-year low in Q3 is certainly encouraging, but it’s interesting to note how the stock market reacted. Today, tech stocks surged, with Meta leading the charge, driven by hopes of the Fed slowing down its rate hikes.

Check out this insightful article on the tech stock surge and the Fed’s rate hike expectations for a deeper dive into the market’s current sentiment. While the current account deficit news is positive, it remains to be seen if this trend will continue in the coming quarters.

Future Outlook for the Deficit

The narrowing of the US current account deficit in Q3 2023 offers a glimmer of hope for the future, but it’s important to consider the broader economic landscape and potential influencing factors. The outlook for the deficit in the coming quarters hinges on various economic trends and projections.

Factors Influencing the Future Trajectory of the Deficit, Us current account deficit narrows to a two year low in q3

The future trajectory of the US current account deficit will be influenced by several factors, including:

- Economic Growth:A robust US economy typically leads to higher imports, potentially widening the deficit. Conversely, a slowdown in economic growth could reduce imports and narrow the deficit.

- Consumer Spending:Increased consumer spending, particularly on imported goods, can contribute to a wider deficit. Conversely, a decline in consumer spending can help narrow the deficit.

- Energy Prices:Rising energy prices can increase imports and widen the deficit, especially if the US relies heavily on imported energy sources. Conversely, falling energy prices can help narrow the deficit.

- Interest Rates:Higher interest rates can attract foreign investment, potentially reducing the need for borrowing and narrowing the deficit. However, higher rates can also slow economic growth, potentially leading to a wider deficit.

- Global Economic Conditions:Global economic growth and demand for US goods and services can significantly impact the current account deficit. Strong global growth can lead to higher exports and a narrower deficit, while a slowdown in global growth can lead to a wider deficit.

Expert Opinions and Forecasts

Experts and analysts hold diverse views on the long-term sustainability of the US current account deficit. Some believe that the deficit is a long-term structural issue that requires fundamental policy changes, while others argue that it is manageable and can be addressed through market forces and adjustments in economic policies.

- The International Monetary Fund (IMF)projects that the US current account deficit will remain relatively stable in the coming years, but it emphasizes the need for fiscal consolidation and structural reforms to address the underlying imbalances.

- The Congressional Budget Office (CBO)forecasts that the US current account deficit will gradually widen in the coming decades, driven by aging demographics and rising healthcare costs.

Comparison with Other Economies

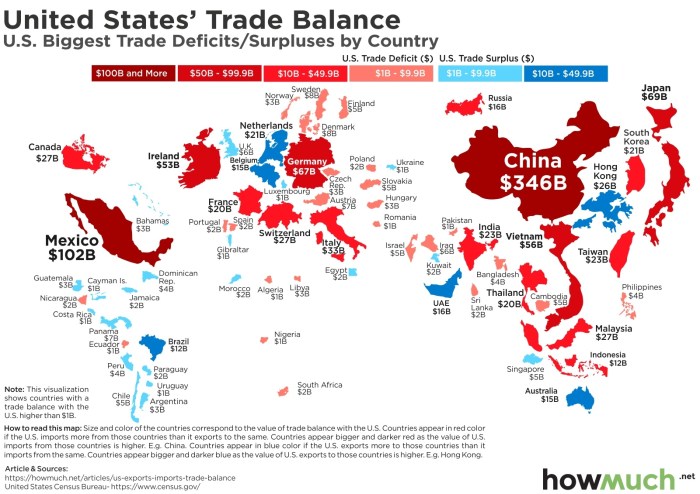

The US current account deficit, while narrowing in Q3 2023, remains a significant factor in the global economic landscape. It is important to compare this deficit to those of other major economies to gain a comprehensive understanding of its implications for global trade and stability.

Comparison with Other Major Economies

The US current account deficit is not unique. Many major economies experience current account imbalances, reflecting differences in savings, investment, and trade patterns. Here’s a comparison with the Eurozone, China, and Japan:

- Eurozone:The Eurozone has generally maintained a smaller current account deficit than the US, often running a surplus. This is attributed to its higher savings rate and a more export-oriented economy. However, the Eurozone’s current account balance has fluctuated in recent years, influenced by factors such as the global financial crisis and the COVID-19 pandemic.

- China:China has traditionally run large current account surpluses, driven by its export-led growth strategy and high savings rate. However, its surplus has been shrinking in recent years as domestic consumption increases and its economy transitions towards a more balanced growth model.

- Japan:Japan has experienced a long-term current account surplus, fueled by its high savings rate and strong export sector. However, its surplus has been shrinking in recent years due to factors such as a declining population and weak domestic demand.

Reasons for Differences in Current Account Balances

Several factors contribute to the differences in current account balances across countries, including:

- Savings Rates:Countries with higher savings rates tend to have larger current account surpluses, as they have more resources available for investment and lending abroad. For example, Japan’s high savings rate has contributed to its persistent current account surplus.

- Investment Levels:Countries with high investment levels, particularly in infrastructure and technology, may experience larger current account deficits as they borrow from abroad to finance these investments. The US, with its high levels of investment, has historically had a large current account deficit.

- Trade Patterns:Countries with large trade surpluses, driven by strong exports and weak imports, tend to have positive current account balances. China’s export-oriented growth strategy has resulted in large current account surpluses.

- Government Policies:Government policies, such as fiscal stimulus measures or trade agreements, can also influence current account balances. For example, the US government’s policies to stimulate economic growth through increased spending have contributed to its current account deficit.

Implications for Global Economic Stability and Trade Flows

The differences in current account balances across countries have implications for global economic stability and trade flows:

- Currency Fluctuations:Large current account deficits can lead to currency depreciation, as the demand for the country’s currency decreases. This can make imports more expensive and exports cheaper, potentially impacting trade flows.

- Global Imbalances:Persistent current account imbalances can contribute to global imbalances, where some countries accumulate large surpluses while others experience large deficits. This can create tensions in the global economy and potentially lead to protectionist measures.

- Financial Flows:Current account deficits are often financed by capital inflows, which can be volatile and susceptible to sudden reversals. This can create financial instability and potentially lead to economic crises.

Policy Implications

The narrowing current account deficit presents both opportunities and challenges for policymakers. It suggests that the economy is becoming more competitive and less reliant on external financing. However, it also highlights the need to address the underlying factors contributing to the deficit, such as low investment and high consumption.

Policy Responses to Address Factors Driving the Deficit

Policymakers should consider a range of measures to address the factors driving the deficit, such as:

- Promoting Investment: Policies aimed at boosting investment, such as tax incentives for businesses, infrastructure development, and regulatory reforms, can help increase domestic production and reduce reliance on imports.

- Encouraging Savings: Measures to encourage savings, such as tax incentives for retirement savings or promoting financial literacy, can help reduce consumption and increase domestic funding for investment.

- Improving Export Competitiveness: Policies that enhance export competitiveness, such as trade agreements, export promotion programs, and investment in infrastructure, can help increase exports and reduce the deficit.

- Managing Exchange Rates: A stable and competitive exchange rate can support export growth and reduce the deficit. However, manipulating exchange rates can have unintended consequences, so policymakers must proceed cautiously.

Effectiveness and Challenges of Policy Options

The effectiveness and challenges of different policy options depend on the specific circumstances of the economy. For example: