Market Highlights: Apple & Amazon Earnings, July Jobs, Economic Outlook

Market highlights apple and amazon earnings july jobs report and economic outlook – The markets are buzzing with news, from tech giants Apple and Amazon reporting earnings to the latest July jobs report painting a picture of the economy’s health. This week, we’ll dive into these key market highlights, analyzing the financial performance of tech giants, the labor market’s trajectory, and the overall economic outlook.

It’s a time of both optimism and uncertainty, with inflation, interest rates, and geopolitical tensions impacting the global landscape. Let’s explore these factors and see what they mean for investors and the economy as a whole.

We’ll examine the key metrics from Apple and Amazon’s earnings reports, highlighting revenue growth, profitability, and the performance of their core businesses. Then, we’ll delve into the July jobs report, looking at the unemployment rate, job growth, and wage gains.

This data provides valuable insights into the strength of the labor market and its potential impact on the Federal Reserve’s monetary policy decisions. Finally, we’ll discuss the broader economic outlook, considering factors like inflation, interest rates, and consumer spending, to gain a comprehensive understanding of the current economic environment.

Apple and Amazon Earnings: Market Highlights Apple And Amazon Earnings July Jobs Report And Economic Outlook

Apple and Amazon, two of the world’s largest technology companies, released their quarterly earnings reports in recent weeks, providing insights into their financial performance and future prospects. Both companies have shown resilience in the face of macroeconomic challenges, but their growth trajectories and strategies differ significantly.

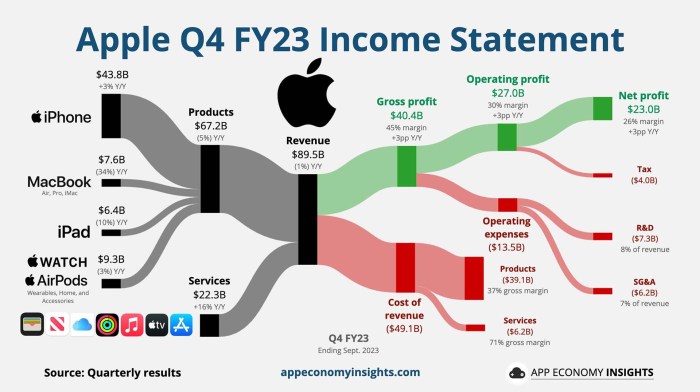

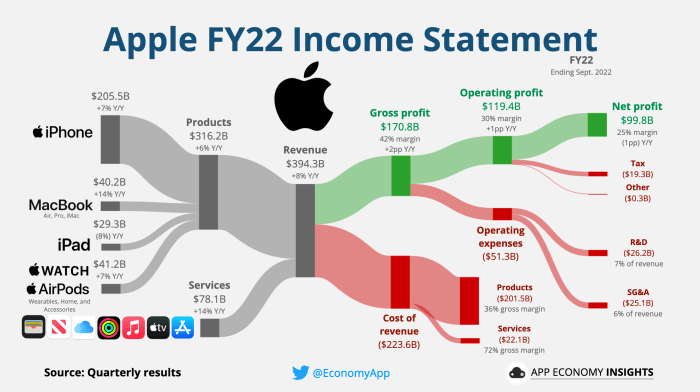

Apple’s Financial Performance

Apple’s Q2 2023 earnings report revealed strong revenue growth, driven by robust demand for its iPhone and services businesses. The company’s revenue increased by 5.5% year-over-year to $94.8 billion, exceeding analysts’ expectations. Apple’s profitability remained high, with a gross margin of 43.3% and operating margin of 25.3%.

The iPhone continues to be Apple’s flagship product, generating $51.3 billion in revenue during the quarter. Services, which include subscriptions like Apple Music and Apple TV+, also saw strong growth, reaching $21.2 billion in revenue. The Mac and iPad segments experienced modest growth, while the Wearables, Home, and Accessories category saw a slight decline.

Amazon’s Financial Performance

Amazon’s Q2 2023 earnings report highlighted continued growth in its cloud computing business, AWS, but its e-commerce segment faced headwinds. The company’s revenue increased by 13% year-over-year to $134.4 billion, slightly below analysts’ estimates. Operating income for the quarter was $7.7 billion, a significant decline from the previous year due to increased costs in its e-commerce operations.AWS remains Amazon’s most profitable business, generating $22.1 billion in revenue and $7.2 billion in operating income during the quarter.

The e-commerce segment, however, faced challenges due to slowing consumer spending and increased competition. Amazon’s North America retail business saw a 4% decline in revenue, while international retail sales grew by 8%.

Comparison of Apple and Amazon

Apple and Amazon have distinct business models and growth strategies. Apple focuses on premium products with high margins, while Amazon prioritizes market share and low prices. Apple’s reliance on hardware sales makes it more vulnerable to economic downturns, while Amazon’s diversified business model provides more resilience.Apple’s strong brand loyalty and ecosystem of services provide a competitive advantage.

Amazon’s vast logistics network and cloud computing platform give it a significant edge in e-commerce and digital services. Both companies face challenges from competition, but their innovative products and services continue to drive growth.

This week’s market highlights were a mixed bag, with Apple and Amazon earnings generating buzz, the July jobs report painting a picture of a resilient economy, and the overall economic outlook remaining cautiously optimistic. Amidst this backdrop, US stocks rallied, fueled by a rebound in tech stocks, and the Dow Jones Industrial Average is on track for its 10th consecutive win, as reported in this article.

Whether this positive momentum can be sustained remains to be seen, but it’s certainly a welcome change after recent market volatility.

Future Outlook for Apple and Amazon

Apple is expected to continue its growth trajectory, driven by the iPhone’s popularity and expansion of its services business. The company’s focus on innovation and premium products positions it well for future success. Amazon’s growth is expected to be driven by AWS, which remains a dominant force in the cloud computing market.

The market is buzzing with news about Apple and Amazon earnings, the July jobs report, and the overall economic outlook. It’s a fascinating time to be observing the interplay of these factors, and it’s a reminder that companies need to be nimble and adaptable to succeed.

A great example of this is Netflix, which has shown remarkable resilience in navigating social and political issues, as detailed in this insightful article netflix success in adapting to social and political issues insights from a corporate board veteran.

As we continue to analyze these market highlights, it’s clear that companies like Netflix, who embrace change and understand the evolving landscape, are likely to thrive.

The company’s e-commerce business is likely to face continued headwinds due to macroeconomic factors and increased competition.Both companies are expected to invest heavily in artificial intelligence (AI) and other emerging technologies. Apple is developing AI-powered features for its products, while Amazon is using AI to improve its e-commerce operations and enhance its cloud services.

July Jobs Report

The July jobs report painted a mixed picture of the U.S. labor market, showcasing continued job growth but also highlighting some signs of cooling. While the unemployment rate remained steady, job growth slowed, and wage gains moderated. This report provides valuable insights into the current state of the economy and offers clues about the future direction of monetary policy.

Impact on Federal Reserve’s Monetary Policy

The July jobs report provides the Federal Reserve with more data points to consider as it navigates the delicate balancing act between fighting inflation and supporting economic growth. While the continued job growth suggests a strong economy, the moderation in wage gains and slowing job growth might give the Fed some breathing room to consider pausing or even slowing the pace of interest rate hikes.

The Fed’s primary goal is to bring inflation down to its 2% target, and the jobs report will help inform their decision-making process.

Implications for the Labor Market

The July jobs report highlights the ongoing strength of the labor market, but also points to some potential challenges. The continued low unemployment rate suggests a tight labor market, where employers are struggling to find workers. This could lead to continued wage pressure, as employers compete for a limited pool of talent.

The recent market highlights, including Apple and Amazon earnings, the July jobs report, and the overall economic outlook, provide a mixed bag of signals. While some indicators point to resilience, others suggest a cautious approach. Understanding the nuances of this economic landscape is crucial, especially when considering investments.

For those looking for a tangible asset class, exploring real estate in the United States, state by state, can be a worthwhile endeavor, as detailed in this comprehensive analysis of residential and commercial properties exploring real estate in united states state by state analysis residential commercial properties.

This deep dive into the real estate market can help investors make informed decisions about where to allocate their capital, aligning their investments with the current economic trends.

However, the slowing job growth might indicate that the labor market is starting to cool down, potentially easing some of the pressure on wages.

Potential Risks and Uncertainties

The global economic slowdown and the increasing adoption of automation pose potential risks to the labor market outlook. The global slowdown could lead to reduced demand for U.S. goods and services, potentially leading to job losses. The increasing adoption of automation could also displace workers in certain sectors, particularly those involving repetitive tasks.

While these risks are present, it’s important to remember that the labor market is constantly evolving, and new opportunities are emerging. The key is to stay adaptable and prepare for the future by acquiring new skills and knowledge.

Economic Outlook

The US economy continues to navigate a complex landscape marked by persistent inflation, rising interest rates, and ongoing uncertainty about the future. While recent economic data has shown some signs of resilience, the path forward remains unclear, with several risks and uncertainties looming on the horizon.

Current Economic Landscape

Inflation remains a key concern, although recent data suggests a potential cooling trend. The Consumer Price Index (CPI) rose 3.0% in June, indicating a slowdown from the previous month’s 4.0% increase. However, core inflation, which excludes volatile food and energy prices, remained elevated at 4.8%.

The Federal Reserve has been aggressively raising interest rates to combat inflation, and while this has led to a cooling in the housing market and other sectors, the full impact on the economy is still unfolding.

Impact of Recent Economic Data, Market highlights apple and amazon earnings july jobs report and economic outlook

The July jobs report provided a mixed picture of the labor market. While the unemployment rate remained at a historically low 3.6%, job growth slowed to 187,000, a significant decline from the previous month’s 209,000 increase. This slowdown could be a sign of the Fed’s interest rate hikes starting to take effect.

Corporate earnings reports have also shown mixed results, with some companies exceeding expectations while others falling short. This reflects the ongoing challenges facing businesses, including rising costs, supply chain disruptions, and weakening consumer demand.

Key Risks and Uncertainties

The global economy faces several significant risks and uncertainties. Geopolitical tensions, particularly the war in Ukraine, have disrupted global supply chains, driven up energy prices, and created uncertainty about the future of the global economy. Supply chain disruptions have persisted, leading to shortages and higher prices for a wide range of goods and services.

Climate change is also posing increasing risks to the global economy, with extreme weather events causing disruptions and damage.

Potential Trajectory of Economic Growth

The trajectory of economic growth in the coming months and years will depend on a number of factors, including the path of monetary policy, fiscal policy, and consumer confidence. The Fed’s ongoing interest rate hikes are expected to continue to slow economic growth, but the ultimate impact will depend on how quickly inflation comes down.

Fiscal policy will also play a role, with the government’s spending plans and tax policies influencing the overall economic environment. Consumer confidence is a crucial factor in driving economic growth, and recent surveys suggest that consumers are feeling increasingly pessimistic about the economy.

Market Highlights

The market is navigating a complex landscape characterized by elevated inflation, tightening monetary policy, and ongoing geopolitical tensions. These factors are influencing investor sentiment and driving volatility across asset classes.

Performance of Major Asset Classes

The recent performance of major asset classes reflects the current economic environment.

- Stocks:The stock market has experienced volatility in recent months, with major indices like the S&P 500 and Nasdaq Composite fluctuating as investors grapple with inflation, interest rate hikes, and recession concerns. While some sectors have performed better than others, the overall trend has been one of caution and adjustment.

- Bonds:Bond yields have risen significantly in response to the Federal Reserve’s aggressive interest rate hikes. This has led to losses for bondholders, as bond prices move inversely to yields. However, bonds continue to offer diversification benefits and potential downside protection in a portfolio, particularly in periods of market uncertainty.

- Commodities:Commodity prices have been volatile, influenced by factors such as supply chain disruptions, geopolitical events, and changes in demand. Oil prices have surged due to supply concerns, while other commodities like gold have benefited from safe-haven demand during periods of market uncertainty.

Impact on Different Sectors

The current economic environment is impacting different sectors of the economy in varying ways.

- Technology:The technology sector has been under pressure, with valuations declining amid rising interest rates and concerns about slowing growth. However, some tech companies with strong fundamentals and growth prospects continue to attract investor interest.

- Healthcare:The healthcare sector has generally held up well, driven by factors such as aging demographics and continued demand for healthcare services. However, rising costs and regulatory pressures are creating challenges for some companies.

- Consumer Discretionary:The consumer discretionary sector is facing headwinds from inflation, which is eroding consumer purchasing power. However, companies that can offer value and convenience are likely to perform better in this environment.

Investment Opportunities and Risks

Investors are navigating a challenging environment with both opportunities and risks.

- Opportunities:Investors may consider opportunities in sectors that are less sensitive to economic cycles, such as healthcare and utilities. Additionally, value stocks, which are typically undervalued relative to their fundamentals, may offer potential upside in a market that is experiencing a shift away from growth stocks.

- Risks:Key risks include inflation, rising interest rates, recession, and geopolitical uncertainty. Investors need to carefully assess their risk tolerance and investment horizon before making any decisions.