Markets in Flux: Dollar Gains Momentum, European Stocks Dip

Markets in flux dollar gains momentum european stocks dip – Markets in Flux: Dollar Gains Momentum, European Stocks Dip sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset. The global financial landscape is a dynamic tapestry woven with threads of economic indicators, geopolitical events, and investor sentiment.

In recent weeks, we’ve witnessed a fascinating shift in the global market, with the US dollar gaining significant strength while European stocks experience a dip.

This trend raises several questions about the forces at play and the potential implications for investors. Is the US dollar’s surge a sign of economic resilience, or is it a temporary blip? What are the factors driving the decline in European markets, and how might these developments impact the global economy?

These are just a few of the questions we’ll explore in this post, delving into the intricate dynamics of the global market.

Global Market Fluctuations

Global markets are currently experiencing significant volatility, driven by a confluence of factors, including rising inflation, tightening monetary policy, and geopolitical tensions. These factors are creating uncertainty for investors, leading to fluctuations in asset prices across different markets.

The Impact of the US Dollar’s Gains

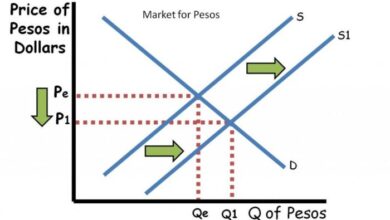

The recent strength of the US dollar has had a notable impact on global markets. A stronger dollar makes US assets more expensive for foreign investors, potentially leading to a decrease in demand for US stocks and bonds. Conversely, it makes foreign assets cheaper for US investors, potentially boosting investment in those markets.

This can create a ripple effect, influencing exchange rates and commodity prices.

The US dollar index, which measures the greenback’s value against a basket of major currencies, has risen by over 10% since the beginning of the year.

Performance of US and European Markets

US markets have generally outperformed European markets in recent months. This can be attributed to several factors, including the strength of the US economy and the Federal Reserve’s aggressive stance on inflation. The US stock market, as represented by the S&P 500 index, has gained over 15% since the beginning of the year, while the Euro Stoxx 50 index, a benchmark for European stocks, has remained relatively flat.

However, it is important to note that market performance can fluctuate significantly, and past performance is not indicative of future results.

US Dollar Strength

The US dollar has been on a tear in recent months, surging to its highest levels in years against a basket of major currencies. This surge has been driven by a confluence of factors, including the Federal Reserve’s aggressive interest rate hikes, a robust US economy, and safe-haven demand amid global uncertainty.

Factors Contributing to the US Dollar’s Strength

The US dollar’s recent surge can be attributed to several key factors:

- Aggressive Interest Rate Hikes by the Federal Reserve:The Federal Reserve has been aggressively raising interest rates in an effort to combat inflation. Higher interest rates make the US dollar more attractive to foreign investors, as they can earn a higher return on their investments in US assets.

- Robust US Economy:The US economy has remained relatively strong despite global headwinds, with a resilient labor market and strong consumer spending. This economic strength further bolsters the dollar’s appeal.

- Safe-Haven Demand:In times of global uncertainty, investors often flock to the US dollar as a safe-haven asset. The dollar’s status as a reserve currency and the perceived stability of the US economy make it a preferred destination for investors seeking to preserve capital.

Implications of a Strong US Dollar for the Global Economy

A strong US dollar can have both positive and negative implications for the global economy.

- Impact on Emerging Markets:A strong US dollar can put pressure on emerging market currencies, making it more expensive for these countries to import goods and services. This can lead to higher inflation and slower economic growth.

- Impact on Global Trade:A strong US dollar can make US exports more expensive and imports cheaper. This can lead to a decrease in US exports and an increase in imports, potentially impacting the US trade balance.

- Impact on Corporate Earnings:Companies with significant international operations can be affected by currency fluctuations. A strong US dollar can reduce the value of foreign earnings when converted back to US dollars.

Impact of the US Dollar’s Strength on US Exports and Imports

A strong US dollar can have a significant impact on US exports and imports.

- Exports:A strong US dollar makes US exports more expensive for foreign buyers, potentially reducing demand for US goods and services. This can lead to a decline in US exports and a negative impact on industries that rely heavily on foreign markets.

The markets are definitely in a state of flux, with the dollar gaining momentum while European stocks are dipping. It’s a time for investors to be cautious and consider their long-term strategies, especially when it comes to retirement planning. A recent study unveiling the surprising retirement patterns in the us know where do you stand reveals some unexpected trends that could impact how we prepare for our golden years.

Understanding these trends is crucial for navigating the current market volatility and ensuring a comfortable retirement.

- Imports:A strong US dollar makes imports cheaper for US consumers, potentially leading to an increase in imports. This can benefit consumers who can purchase imported goods at lower prices but could also hurt domestic industries that compete with imported products.

European Stock Market Dip: Markets In Flux Dollar Gains Momentum European Stocks Dip

European stock markets have experienced a recent decline, raising concerns about the potential impact on the global economy. Several factors contribute to this downturn, including rising inflation, the ongoing war in Ukraine, and the tightening of monetary policy by central banks.

Impact of European Stock Market Dip on the Global Economy

The decline in European stock markets can have a significant impact on the global economy. The European Union is a major economic power, and its stock markets are a key indicator of global economic health. When European stock markets decline, it can signal a loss of investor confidence in the region’s economic outlook.

This can lead to a decrease in investment, both domestically and from foreign investors. A decline in investment can slow economic growth and potentially lead to job losses.

The markets are in flux today, with the dollar gaining momentum while European stocks dip. This comes amidst a flurry of crypto news, as the Senate’s most prominent advocate for cryptocurrency, known as the “Crypto Queen,” has unveiled a far-reaching new bill focused on Bitcoin.

It remains to be seen how this will impact the global financial landscape, but it’s certainly a development worth watching as the markets continue to shift.

Role of Geopolitical Factors in the European Stock Market Decline

Geopolitical factors play a significant role in the recent decline of European stock markets. The ongoing war in Ukraine has created uncertainty and volatility in global markets. The war has disrupted supply chains, driven up energy prices, and raised concerns about the potential for wider conflict.

The global markets are in a state of flux, with the dollar gaining momentum and European stocks dipping. Amidst this volatility, the potential takeover of Portugal’s TAP by Lufthansa has been making headlines. However, the Lufthansa CEO has asserted that any discussions on a potential takeover are premature, as reported by The Venom Blog.

This uncertainty adds another layer of complexity to the already volatile market landscape, leaving investors wondering what the future holds.

These factors have contributed to a decline in investor confidence and a decrease in stock prices. Additionally, the war has exacerbated existing economic challenges in Europe, such as rising inflation and energy shortages. These challenges have further weighed on stock markets, contributing to the recent decline.

Economic Outlook

The current economic landscape is marked by significant uncertainty, with a confluence of factors influencing global market sentiment. The US and Europe face distinct challenges, with inflation and interest rate hikes playing a central role in shaping the economic outlook.

Global Market Risks and Opportunities

The global market is navigating a complex environment, with both risks and opportunities emerging. The ongoing geopolitical tensions, supply chain disruptions, and rising inflation pose significant challenges to economic stability. However, opportunities for growth exist in sectors such as renewable energy, technology, and healthcare, driven by innovation and increasing demand.

Inflation and Interest Rate Hikes

Inflation remains a key concern for both the US and Europe. The Federal Reserve and the European Central Bank have embarked on aggressive interest rate hikes to curb inflation. These measures aim to cool down economic activity and bring inflation under control.

However, there are concerns that aggressive rate hikes could lead to a recession.

Impact on Global Markets

The impact of inflation and interest rate hikes on global markets is multifaceted. Rising interest rates can lead to a slowdown in economic growth, as businesses and consumers face higher borrowing costs. This can impact corporate earnings and stock market valuations.

Additionally, higher interest rates can make it more expensive for governments to finance their debt, potentially leading to increased fiscal pressure.

“The global economy is facing a confluence of challenges, including inflation, supply chain disruptions, and geopolitical tensions. The Federal Reserve and other central banks are raising interest rates to combat inflation, but this could slow economic growth. Businesses and consumers need to prepare for a period of volatility and uncertainty.”

[Source

Financial Times]

Investment Strategies

Navigating the current market volatility requires a thoughtful and strategic approach. Investors need to consider their risk tolerance, investment goals, and time horizon when making investment decisions. Diversifying across different asset classes can help mitigate risk and potentially enhance returns.

Asset Allocation Strategies

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, real estate, and commodities. By diversifying your investments, you can reduce the overall risk of your portfolio.

- Stocks: Stocks represent ownership in companies and can provide the potential for high returns over the long term. However, stocks are also more volatile than other asset classes, meaning their prices can fluctuate significantly in the short term.

- Bonds: Bonds are debt securities that represent loans to governments or corporations. They typically offer lower returns than stocks but are also less volatile. Bonds can provide stability to a portfolio during periods of market uncertainty.

- Real Estate: Real estate can be a good hedge against inflation and can provide steady income through rental payments. However, real estate investments can be illiquid and can be subject to local market conditions.

- Commodities: Commodities are raw materials, such as oil, gold, and agricultural products. They can provide diversification benefits to a portfolio and can potentially benefit from inflation.

The optimal asset allocation strategy will vary depending on individual circumstances and risk tolerance. Investors should consult with a financial advisor to determine the most appropriate asset allocation for their needs.

Risk Management Strategies

Risk management is essential for protecting your portfolio during periods of market uncertainty. Here are some strategies that can help mitigate risk:

- Diversification: Diversifying your investments across different asset classes can help reduce the overall risk of your portfolio.

- Dollar-Cost Averaging: Dollar-cost averaging is a strategy of investing a fixed amount of money at regular intervals, regardless of market conditions. This can help reduce the impact of market volatility on your investment returns.

- Rebalancing: Rebalancing your portfolio involves adjusting your asset allocation periodically to ensure that your investments remain in line with your risk tolerance and investment goals.

By implementing these strategies, investors can help protect their portfolios during periods of market uncertainty.

Investing in a Volatile Market, Markets in flux dollar gains momentum european stocks dip

Investing in a volatile market can be challenging, but it can also present opportunities for long-term investors. Here are some key considerations:

- Maintain a Long-Term Perspective: Market fluctuations are normal, and it’s important to remember that investing is a long-term game. Short-term market movements should not dictate your investment decisions.

- Focus on Value: Look for companies with strong fundamentals, a solid track record, and a competitive advantage in their industries.

- Be Patient and Disciplined: Don’t panic sell your investments during periods of market decline. Instead, stay calm, stick to your investment plan, and ride out the volatility.