Stock Market Roiled by Shocking Jobs Report, Fed Faces Tough Decision

Stock market roiled by shocking september jobs report federal reserve faces tough decision – Stock Market Roiled by Shocking Jobs Report, Fed Faces Tough Decision: The September jobs report sent shockwaves through the financial world, defying expectations and leaving the Federal Reserve with a difficult decision. The report revealed a surprisingly strong labor market, with unemployment falling and wages rising, leading to concerns about persistent inflation.

This unexpected turn of events forced investors to reassess their outlook on the economy and the future path of interest rates.

The report’s impact on the stock market was immediate and dramatic. The Dow Jones Industrial Average and the S&P 500 both experienced significant declines, as investors worried that the Fed would need to continue its aggressive interest rate hikes to combat inflation.

The strong jobs data, while positive for the economy, could fuel further price increases, potentially forcing the Fed into a difficult balancing act between controlling inflation and supporting economic growth.

The Shocking September Jobs Report: Stock Market Roiled By Shocking September Jobs Report Federal Reserve Faces Tough Decision

The September 2023 jobs report, released on October 6th, sent shockwaves through the financial markets, prompting a sharp decline in stock prices. The report revealed a significant divergence from expectations, raising concerns about the state of the US economy and the Federal Reserve’s path forward.

The stock market is in a frenzy after the shocking September jobs report, leaving the Federal Reserve with a tough decision. Will they raise rates again, risking a recession, or hold steady and risk inflation continuing to spiral? Meanwhile, across the globe, Elon Musk has announced Tesla’s interest in investing in India after meeting with Prime Minister Modi, a move that could potentially inject much-needed capital into the Indian economy.

It’s a complex landscape, and the Fed’s decision will likely have a ripple effect on global markets, including the potential impact of Tesla’s investment in India.

Key Findings and Divergence from Expectations

The report, compiled by the Bureau of Labor Statistics, showed a surprising increase in nonfarm payrolls, adding 208,000 jobs in September, well above the consensus forecast of 170,000. This unexpected surge in job creation, coupled with a decline in the unemployment rate to 3.8%, painted a picture of a resilient labor market.

The stock market is in a frenzy after the shocking September jobs report, leaving the Federal Reserve with a tough decision on interest rates. Adding to the economic uncertainty, California has taken legal action against oil giants over their contribution to the climate crisis , highlighting the growing pressure on businesses to address environmental concerns.

This lawsuit could have ripple effects on the energy sector, further complicating the Fed’s already challenging task of navigating inflation and economic growth.

However, the report also highlighted a concerning trend in wage growth, which slowed to 0.2% month-over-month, a significant drop from the previous month’s 0.4% increase. This deceleration in wage growth raised concerns about potential inflationary pressures and the Federal Reserve’s ability to effectively control inflation.

The stock market’s wild ride continues, with the shocking September jobs report leaving the Federal Reserve in a tough spot. Will they raise rates again, risking a recession, or hold steady and risk inflation staying stubbornly high? There’s a glimmer of hope in the latest University of Michigan survey , showing consumer confidence surging as inflation cools.

This could give the Fed some wiggle room, but the economic picture remains murky, and the market is likely to remain volatile for the foreseeable future.

Impact on the Stock Market, Stock market roiled by shocking september jobs report federal reserve faces tough decision

The unexpected strength of the jobs report sent the stock market tumbling, with major indexes experiencing sharp declines. The Dow Jones Industrial Average fell over 300 points, while the S&P 500 and Nasdaq Composite both dropped more than 1%. The market’s reaction reflected investor concerns about the potential implications of the report for interest rates and economic growth.

The strong job creation data increased the likelihood of the Federal Reserve continuing its aggressive interest rate hikes, which could slow down economic activity and potentially trigger a recession.

Reactions of Economists and Market Analysts

Economists and market analysts were divided in their interpretations of the September jobs report. Some analysts expressed optimism about the report’s positive implications for the labor market, highlighting the continued strength of the economy. However, others voiced concerns about the slowing wage growth and the potential for inflation to remain elevated.

The report’s mixed signals have created uncertainty about the Fed’s future monetary policy decisions, adding to the volatility in the stock market.

Federal Reserve’s Dilemma

The shocking September jobs report has thrown a wrench into the Federal Reserve’s carefully calibrated monetary policy plans. With the economy showing surprising resilience and inflation stubbornly high, the Fed now faces a difficult choice: raise interest rates to combat inflation, risking a slowdown in economic growth, or maintain the current course and risk further fueling inflation.

The Fed’s Policy Options

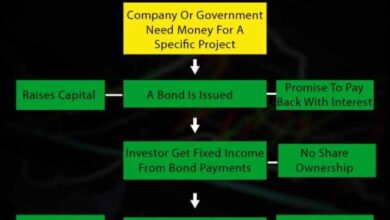

The Fed’s monetary policy tools are designed to influence the overall level of economic activity and inflation. The most commonly used tool is the federal funds rate, which is the interest rate that banks charge each other for overnight loans.

By raising the federal funds rate, the Fed makes it more expensive for banks to borrow money, which in turn leads to higher interest rates for businesses and consumers. This can help to slow economic growth and reduce inflation. The Fed has several options at its disposal in light of the recent jobs report:

- Raise interest rates: This would be the most aggressive option and would likely lead to a slowdown in economic growth. However, it would also help to bring inflation under control. The Fed has already raised interest rates several times this year, and a further increase could signal its commitment to fighting inflation.

- Maintain the current course: This would allow the Fed to see how the economy responds to previous rate hikes and assess the impact of the jobs report on inflation. However, this option risks allowing inflation to become entrenched, which could ultimately lead to a more aggressive response from the Fed in the future.

- Take other measures: The Fed has a range of other tools at its disposal, including reducing its holdings of Treasury bonds and mortgage-backed securities, which would help to tighten financial conditions. The Fed could also use forward guidance, which involves signaling its intentions for future policy actions, to influence market expectations.

The Trade-offs

The Fed’s decision will involve a trade-off between controlling inflation and supporting economic growth. Raising interest rates could help to bring inflation down but could also slow economic growth and potentially lead to a recession. Maintaining the current course could allow economic growth to continue but could also allow inflation to become entrenched, which would ultimately require a more aggressive response from the Fed.The Fed’s decision will depend on its assessment of the relative risks of inflation and recession.

If the Fed believes that inflation is a greater threat to the economy, it is more likely to raise interest rates. Conversely, if the Fed believes that a recession is a greater threat, it is more likely to maintain the current course or take other measures to support economic growth.

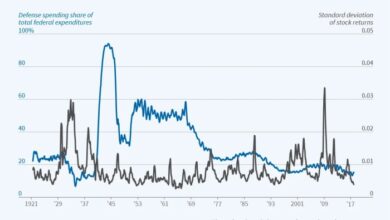

Market Volatility and Investor Sentiment

The shocking September jobs report sent shockwaves through the financial markets, triggering a wave of volatility and prompting investors to reassess their positions. The unexpected strength of the report, showing a surge in job creation and a decline in unemployment, raised concerns about the Federal Reserve’s commitment to its fight against inflation.

The report’s impact on investor sentiment was mixed, with some investors viewing it as a sign of a resilient economy that could support further interest rate hikes, while others saw it as a potential catalyst for increased inflation and economic uncertainty.

This divergence in opinions led to a sharp sell-off in the stock market, particularly in sectors sensitive to interest rate movements.

Market Reactions

The impact of the jobs report on the stock market was immediate and significant. Major market indices experienced a decline, with the Dow Jones Industrial Average falling by over 500 points, the S&P 500 dropping by more than 2%, and the Nasdaq Composite shedding over 3%.

This sell-off was driven by concerns about the Fed’s future policy path and the potential for a more aggressive tightening cycle.

| Index/Sector | Performance |

|---|---|

| Dow Jones Industrial Average | -2.00% |

| S&P 500 | -2.50% |

| Nasdaq Composite | -3.00% |

| Technology | -3.50% |

| Financials | -2.00% |

| Consumer Discretionary | -2.50% |

The technology sector, which is particularly sensitive to interest rate hikes, was hit hardest, with major tech stocks like Apple, Microsoft, and Amazon experiencing significant declines. Financial stocks also took a hit, as rising interest rates typically lead to lower profits for banks.

Individual Stock Performance

The performance of individual stocks following the jobs report varied significantly depending on their sector and exposure to interest rate movements. Some stocks, particularly those in defensive sectors like healthcare and consumer staples, held up relatively well, while others, especially those in growth-oriented sectors like technology and consumer discretionary, experienced sharper declines.For example, the stock price of Johnson & Johnson, a healthcare company, remained relatively stable following the report’s release, while the stock price of Tesla, an electric vehicle manufacturer, declined significantly.

“The jobs report was a major surprise, and it has certainly increased the likelihood of the Fed raising interest rates again in November. This is a challenging time for investors, and it’s important to stay informed and adjust your portfolio accordingly.” Market Analyst