September Stock Market Forecast: Surprises, AI, Cash & Apple

September stock market forecast potential surprises ahead ai cash and apple in focus – September Stock Market Forecast: Surprises, AI, Cash & Apple – as we enter the final quarter of the year, the stock market is poised for potential surprises. This month could see a confluence of factors influencing market direction, from the continued rise of AI and its impact on various sectors to the cash flow situation of tech giants like Apple.

This month, investors will be closely watching economic indicators, geopolitical events, and the ongoing evolution of the AI landscape. The performance of Apple, a bellwether for the tech sector, will also be a key indicator to watch, as its product roadmap and cash flow situation could impact market sentiment.

September Market Outlook

September is often considered a volatile month for the stock market, and this year is no exception. The market is facing a confluence of factors that could lead to unexpected moves.

September’s stock market forecast is full of potential surprises, with AI, cash flow, and Apple taking center stage. But the news that the Senate’s most prominent advocate for cryptocurrency, known as the “Crypto Queen,” has unveiled a far-reaching new bill focused on Bitcoin could significantly impact the market’s direction.

This unexpected development adds another layer of complexity to the already volatile environment, making September’s market behavior even more unpredictable.

Historical Market Trends in September

Historically, September has been a mixed bag for the stock market. While it has seen periods of strong performance, it has also experienced some of the most significant market declines. For example, the 1987 stock market crash, known as “Black Monday,” occurred on October 19, 1987, but the seeds of the crash were sown in September.

September’s stock market forecast is buzzing with potential surprises, especially with AI, cash, and Apple in focus. The EU’s record-breaking billion-euro fine on Meta for data privacy violations, as reported in this article , could be a major catalyst for a shift in investor sentiment.

This event highlights the growing importance of data privacy and its impact on tech giants, which will undoubtedly influence how the market reacts to Apple’s upcoming announcements and the overall AI landscape.

The month of September has also seen significant market corrections, including the dot-com bubble burst in 2000 and the global financial crisis in 2008.While past performance is not indicative of future results, it’s important to acknowledge these historical trends and be prepared for potential volatility.

Current Economic Landscape and its Potential Impact on the Stock Market

The current economic landscape is characterized by high inflation, rising interest rates, and geopolitical uncertainty. These factors are weighing heavily on investor sentiment and could lead to increased market volatility in September.The Federal Reserve’s aggressive rate hikes are aimed at curbing inflation, but they also risk slowing economic growth.

The war in Ukraine has disrupted global supply chains and contributed to higher energy prices, further exacerbating inflationary pressures.These economic challenges are creating uncertainty for businesses and consumers, which could impact corporate earnings and spending.

Key Economic Indicators to Watch in September

Investors will be closely watching several key economic indicators in September to gauge the health of the economy and the direction of the stock market.

- Inflation data: The Consumer Price Index (CPI) and the Producer Price Index (PPI) will provide insights into the pace of inflation. A sustained decline in inflation would be a positive sign for the market, while a continued rise in inflation could fuel further rate hikes and increase economic uncertainty.

- Employment data: The monthly jobs report, which includes data on nonfarm payrolls and unemployment rate, is a crucial indicator of the health of the labor market. Strong employment growth could support consumer spending and boost corporate earnings.

- Retail sales data: Retail sales data provides insights into consumer spending, which is a significant driver of economic growth. A decline in retail sales could signal a weakening economy and put pressure on the stock market.

- Earnings season: September marks the start of the third-quarter earnings season for many companies. Strong earnings reports could boost investor confidence and support the stock market. However, disappointing earnings could weigh on the market and exacerbate volatility.

Potential Surprises: September Stock Market Forecast Potential Surprises Ahead Ai Cash And Apple In Focus

The stock market, despite its reputation for predictability, is often subject to sudden and unexpected twists and turns. September is no exception, and several factors could potentially shake up the market in ways that even seasoned investors might not anticipate.

Geopolitical Risks

Geopolitical risks remain a significant factor that could influence market sentiment in September. Ongoing conflicts, such as the war in Ukraine, could escalate, leading to further economic sanctions, energy price volatility, and uncertainty. The possibility of tensions between the US and China, particularly over Taiwan, also remains a source of potential disruption.

September’s stock market forecast is buzzing with potential surprises, with AI, cash flow, and Apple in the spotlight. While the market’s direction remains uncertain, it’s a good time to consider building a financial safety net. If you’re a student looking for passive income streams without investing, check out these passive income ideas for students without investment to bolster your finances.

Ultimately, a diversified approach, coupled with a solid understanding of your financial goals, will help navigate the September market and beyond.

Unexpected Policy Changes, September stock market forecast potential surprises ahead ai cash and apple in focus

The Federal Reserve’s monetary policy decisions, particularly regarding interest rate hikes, continue to be a key driver of market volatility. While the Fed has signaled its intention to continue raising rates, unexpected changes in the pace or magnitude of these hikes could send shockwaves through the market.

Regulatory Shifts

New regulations or policy changes, particularly in sectors like technology, healthcare, or finance, could have a significant impact on specific companies and the broader market. For example, increased scrutiny of tech giants or new regulations for the healthcare industry could lead to stock price fluctuations and investor uncertainty.

Economic Data Surprises

Economic data releases, such as inflation figures, employment reports, and consumer confidence surveys, can provide insights into the health of the economy and influence market sentiment. Unexpectedly strong or weak data could trigger market reactions, particularly if they deviate significantly from expectations.

Corporate Earnings

Company earnings reports, which are typically released throughout the quarter, can provide valuable information about the performance of individual companies and the broader economy. Unexpectedly strong or weak earnings could lead to significant stock price movements, particularly for companies that are heavily weighted in the market.

Natural Disasters

Natural disasters, such as hurricanes, earthquakes, or wildfires, can disrupt supply chains, impact infrastructure, and create economic uncertainty. These events can have a significant impact on the stock market, particularly for companies operating in affected regions.

Cybersecurity Threats

Cybersecurity threats, such as data breaches or ransomware attacks, can disrupt businesses, damage reputations, and lead to financial losses. These events can also impact investor confidence and stock prices, particularly for companies in sectors that are highly vulnerable to cyberattacks.

Technological Advancements

Breakthroughs in artificial intelligence, biotechnology, or other emerging technologies can create new opportunities and disrupt existing industries. While these advancements can be positive for the economy, they can also lead to uncertainty and volatility in the stock market.

Unexpected Events

The stock market is constantly evolving, and unforeseen events, such as political scandals, unexpected leadership changes, or global health crises, can have a significant impact on market sentiment. These events can be difficult to predict and can create a high degree of uncertainty for investors.

AI in Focus

Artificial intelligence (AI) has rapidly evolved from a futuristic concept to a transformative force across various industries. The stock market, being a reflection of economic trends and technological advancements, is deeply influenced by the rise of AI.

Current State and Market Impact

The AI industry is experiencing explosive growth, driven by advancements in computing power, data availability, and algorithms. This growth has fueled a surge in AI-related investments and stock market activity. AI companies are attracting significant capital, leading to increased valuations and IPOs.

Key AI Companies and Growth Prospects

Several companies are at the forefront of the AI revolution, shaping the future of various industries.

- Nvidia (NVDA):A leading provider of graphics processing units (GPUs), crucial for AI training and inference. Nvidia’s GPUs are widely used in data centers, self-driving cars, and other AI applications. The company’s revenue and stock price have soared in recent years, reflecting the increasing demand for its AI-powered hardware.

- Microsoft (MSFT):Microsoft is heavily investing in AI, integrating it into its products and services. Azure, its cloud computing platform, offers a range of AI services, including machine learning, natural language processing, and computer vision. Microsoft’s AI initiatives are driving its growth and expanding its market reach.

- Alphabet (GOOGL):Google, a subsidiary of Alphabet, is a pioneer in AI research and development. Google’s AI technologies power its search engine, advertising platform, and other products. The company’s AI expertise has positioned it as a leader in areas such as natural language processing, machine learning, and computer vision.

- Amazon (AMZN):Amazon is leveraging AI to enhance its e-commerce operations, logistics, and cloud computing services. Amazon Web Services (AWS) offers a suite of AI tools and services, enabling businesses to build and deploy AI applications. Amazon’s AI investments are driving efficiency and innovation across its vast ecosystem.

Impact on Various Sectors

AI is poised to revolutionize various sectors, transforming business models and creating new opportunities.

- Healthcare:AI is being used to diagnose diseases, personalize treatment plans, and accelerate drug discovery. AI-powered medical imaging tools can detect abnormalities with greater accuracy, while AI-driven chatbots provide 24/7 patient support.

- Finance:AI is transforming financial services, automating tasks, and improving risk management. AI-powered algorithms can analyze vast datasets to detect fraudulent transactions, assess creditworthiness, and personalize investment strategies.

- Manufacturing:AI is driving automation and optimization in manufacturing processes. AI-powered robots can perform repetitive tasks with greater efficiency, while predictive maintenance algorithms can prevent equipment failures and reduce downtime.

- Retail:AI is enhancing customer experiences, personalizing recommendations, and optimizing inventory management. AI-powered chatbots can provide instant customer support, while AI-driven recommendation engines can suggest relevant products based on customer preferences.

Cash and Apple

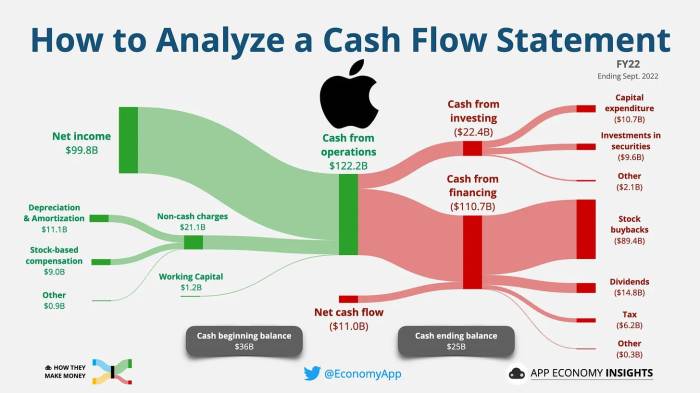

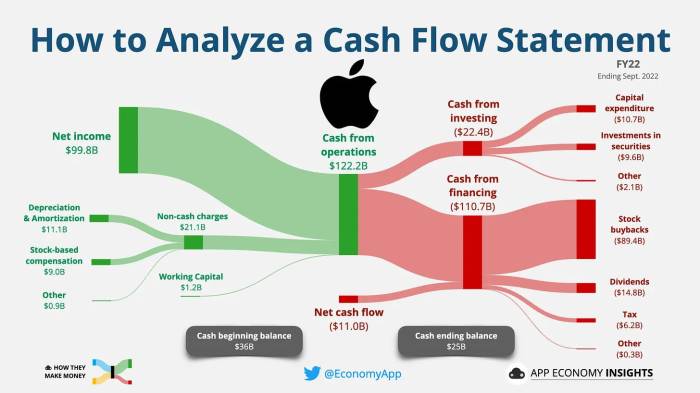

Apple, a technology giant known for its innovative products and loyal customer base, is a company that consistently generates substantial cash flow. Analyzing Apple’s cash flow situation and its product roadmap can provide insights into its potential impact on the market.

Apple’s Cash Flow Situation

Apple’s robust cash flow stems from its strong product sales, particularly its iPhones, Macs, and services like Apple Music and iCloud. This cash flow allows Apple to invest in research and development, acquire other companies, and return value to shareholders through dividends and share buybacks.

- Strong Product Sales:Apple’s iPhone continues to be a major revenue driver, with consistent demand from consumers worldwide. The company’s Mac product line also sees steady sales, driven by the popularity of its laptops and desktops.

- Growing Services Revenue:Apple’s services segment, which includes Apple Music, Apple TV+, iCloud, and Apple Pay, is experiencing significant growth. This segment is less cyclical than hardware sales and provides a more stable source of revenue.

- Efficient Operations:Apple is known for its efficient operations and tight control over its supply chain. This allows the company to maximize profitability and generate substantial cash flow.

Apple’s Product Roadmap

Apple’s product roadmap is closely watched by investors and analysts, as it often signals the company’s future direction and potential growth opportunities. Apple has been investing heavily in areas like artificial intelligence (AI), augmented reality (AR), and wearables, with the goal of expanding its product portfolio and creating new revenue streams.

- AI Integration:Apple is integrating AI into its products and services to enhance user experience and create new features. Examples include Siri’s improved voice recognition and natural language processing capabilities, as well as features like Apple’s “Crash Detection” for emergency services.

- AR and VR Investments:Apple is reportedly investing heavily in AR and VR technologies, potentially hinting at future products or services in these areas. The company has acquired several companies specializing in AR and VR, suggesting its commitment to these emerging technologies.

- Wearables Growth:Apple’s wearables category, which includes the Apple Watch and AirPods, is experiencing strong growth. The company is expected to continue investing in this segment, developing new features and expanding its product lineup.

Apple’s Performance Compared to Other Tech Giants

Apple’s financial performance consistently places it among the top technology giants. The company’s strong cash flow, profitability, and market capitalization make it a major player in the tech industry.

- Market Capitalization:Apple is currently the most valuable publicly traded company in the world, with a market capitalization exceeding $3 trillion. This reflects investor confidence in the company’s long-term growth potential.

- Profitability:Apple consistently generates high profit margins, thanks to its premium pricing strategy and efficient operations. This profitability allows the company to invest in research and development, acquisitions, and shareholder returns.

- Innovation:Apple is known for its innovative products and services, which have consistently set trends in the tech industry. The company’s ability to innovate and create products that consumers desire is a key driver of its success.