Charlie Munger, Warren Buffetts Partner, Passes at 99

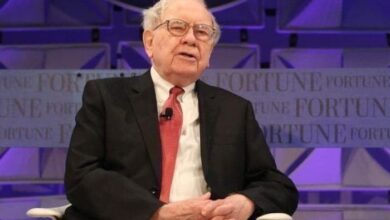

Charlie munger longtime partner of warren buffett and investing legend passes away at 99 – Charlie Munger, longtime partner of Warren Buffett and an investing legend in his own right, passed away at the age of 99. Munger’s influence on the investment world extends far beyond his partnership with Buffett, leaving behind a legacy of wisdom and a unique investment philosophy that has shaped generations of investors.

Munger’s approach, known for its emphasis on rational thinking, multidisciplinary knowledge, and a deep understanding of human psychology, stands in stark contrast to traditional investment strategies. He championed a value-oriented approach, focusing on identifying undervalued companies with strong fundamentals and long-term potential.

Charlie Munger’s Legacy

Charlie Munger, the longtime partner of Warren Buffett and an investing legend in his own right, left an indelible mark on the world of finance. Beyond his remarkable partnership with Buffett, Munger’s unique investment philosophy and wisdom have influenced generations of investors.

His contributions extended far beyond the realm of investing, impacting fields such as business, psychology, and even ethics.

Munger’s Impact on the Investment World

Munger’s impact on the investment world can be attributed to his unique approach to investing, which diverged significantly from traditional methods. His philosophy emphasized a multidisciplinary approach, incorporating elements of psychology, economics, and history. This holistic perspective allowed him to identify opportunities that others might overlook.

It’s a bittersweet week for the world of finance. We mourn the loss of Charlie Munger, the legendary investor and longtime partner of Warren Buffett, who passed away at 99. While we reflect on his wisdom and legacy, news breaks of the United States imposing sanctions on Chinese and Mexican companies linked to counterfeit pill-making equipment.

This move aims to crack down on the production of dangerous counterfeit drugs , a stark reminder of the importance of ethical business practices, a value that Charlie Munger championed throughout his career.

Munger’s Investment Philosophy

Munger’s investment philosophy can be summarized by a few key principles:

- Multidisciplinary Thinking:Munger believed that understanding a wide range of disciplines, including psychology, history, and economics, was crucial for making sound investment decisions. He often cited the “mental models” framework, advocating for the use of diverse intellectual tools to analyze situations.

- Focus on Value:Munger emphasized the importance of identifying undervalued businesses with strong fundamentals. He believed that investing in companies with intrinsic value, rather than chasing short-term trends, was the path to long-term success.

- Circle of Competence:Munger stressed the importance of investing within one’s “circle of competence,” focusing on areas where one has deep understanding and expertise. This approach prevented overreaching and helped investors avoid costly mistakes.

- Long-Term Perspective:Munger believed in taking a long-term view of investing, avoiding short-term speculation and focusing on building wealth over time. This patient approach allowed him to weather market fluctuations and reap the rewards of compounding.

Munger’s Wisdom in Action

Munger’s investment philosophy was not just theoretical; he consistently demonstrated its effectiveness through his real-world decisions. One notable example is his investment in Coca-Colain the 1980s. Munger recognized the company’s strong brand, dominant market share, and long-term growth potential, making a significant investment that yielded substantial returns over time.

“The best way to get rich is to find a moat, and then sit on it.”

Charlie Munger

The world of investing mourns the loss of Charlie Munger, the sharp-witted and influential partner of Warren Buffett, who passed away at 99. His legacy of insightful wisdom and value investing principles will continue to shape the financial landscape.

While Munger’s passing is a significant loss, the world of innovation marches on, as seen in Renault’s ambitious 32 billion euro investment in eight new cars and an electric focus worldwide. This commitment to the future echoes Munger’s own philosophy of investing in long-term growth and adapting to changing times.

This quote highlights Munger’s focus on identifying companies with sustainable competitive advantages, or “moats,” that would protect their profitability and market share over the long term.

Munger’s Influence on Others

Munger’s wisdom and investment philosophy have had a profound impact on countless individuals, inspiring a new generation of investors to adopt a more thoughtful and disciplined approach. His teachings have been shared through books, speeches, and lectures, reaching a global audience.

Munger’s Partnership with Warren Buffett: Charlie Munger Longtime Partner Of Warren Buffett And Investing Legend Passes Away At 99

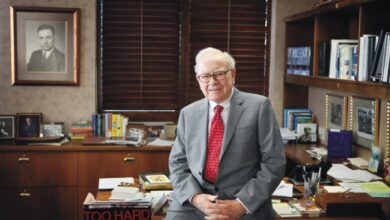

Charlie Munger, the legendary investor and longtime partner of Warren Buffett, played a pivotal role in shaping the investment philosophy and success of Berkshire Hathaway. Their partnership, spanning decades, is a testament to the power of complementary skills and shared values.

The Genesis of a Partnership

Munger and Buffett’s paths first crossed in the 1950s, when Munger was a young lawyer and Buffett was a budding investor. They shared a common interest in value investing, a philosophy that focuses on identifying undervalued companies with strong fundamentals.

Their initial interactions were professional, but a mutual respect and admiration soon blossomed.

The passing of Charlie Munger, Warren Buffett’s longtime partner and investing legend, at the age of 99, is a significant loss for the financial world. While we mourn his passing, the markets continue to churn, with stocks mixed as Wall Street braces for the Fed meeting news today.

Munger’s legacy of wisdom and sharp intellect will undoubtedly continue to influence investors for generations to come.

- In the early 1970s, Munger joined the board of Berkshire Hathaway, a textile company that Buffett had taken control of. Munger’s sharp intellect and business acumen quickly impressed Buffett, and he became a trusted advisor.

- Munger’s influence on Berkshire Hathaway’s investment strategy became increasingly significant over time. He encouraged Buffett to diversify beyond his traditional focus on undervalued businesses, and to explore new sectors like technology and consumer goods.

Munger’s Influence on Berkshire Hathaway’s Investment Strategy

Munger’s contributions to Berkshire Hathaway’s investment strategy went beyond simply providing advice. He brought a unique perspective that challenged conventional wisdom and pushed Buffett to think more critically about the businesses they invested in.

- Munger’s emphasis on “mental models” helped Buffett to develop a more comprehensive understanding of the world and to identify investment opportunities that others might miss.

- He also instilled in Buffett a strong sense of risk aversion, which has helped to protect Berkshire Hathaway from significant losses over the years.

Complementary Skills and Perspectives

The success of Munger and Buffett’s partnership is largely attributed to their complementary skills and perspectives. Buffett’s strengths lay in his ability to analyze financial statements, identify undervalued companies, and negotiate favorable deals. Munger, on the other hand, brought a broader understanding of business, psychology, and human behavior.

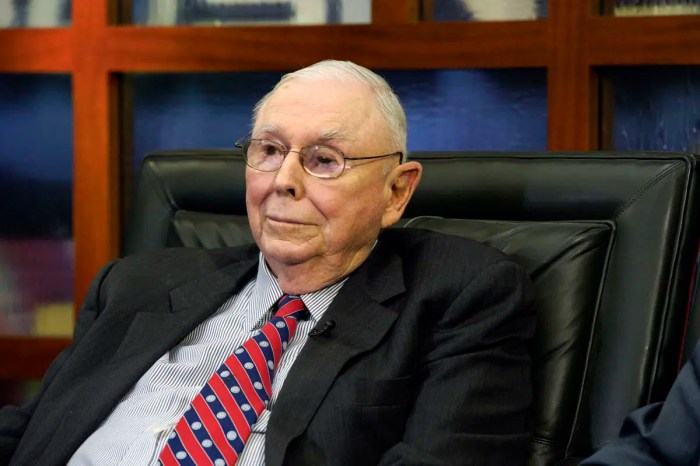

“Warren is the best I’ve ever seen at figuring out intrinsic value. And I’m better at figuring out what’s going to happen, which is just as important in a business. We complement each other.”

Charlie Munger

- Their shared values, including a focus on integrity, long-term thinking, and a commitment to shareholder value, further strengthened their partnership.

- Munger’s ability to challenge Buffett’s assumptions and to offer alternative perspectives helped to ensure that Berkshire Hathaway made sound investment decisions.

Munger’s Insights on Business and Investing

Charlie Munger, the longtime partner of Warren Buffett and a renowned investor, was a brilliant thinker whose insights extended far beyond the realm of finance. He possessed a unique ability to synthesize knowledge from various disciplines, including psychology, economics, and ethics, to inform his approach to business and investing.

His wisdom, gleaned from a lifetime of learning and experience, continues to inspire generations of investors and business leaders.

Psychology and Decision-Making

Munger emphasized the importance of understanding human psychology in making sound decisions, both in business and in life. He believed that irrationality and cognitive biases often cloud our judgment, leading to poor choices. He identified several common biases, including:

- Confirmation Bias:The tendency to seek out information that confirms our existing beliefs and ignore contradictory evidence.

- Availability Bias:The tendency to overestimate the likelihood of events that are easily recalled or vivid in our minds.

- Anchoring Bias:The tendency to rely too heavily on the first piece of information we receive, even if it’s irrelevant.

- Framing Effect:The tendency to make different decisions based on how a problem is presented, even if the underlying information is the same.

Munger’s insights on psychology and decision-making can be summarized in his famous “multidisciplinary approach”:

“I call it the ‘latticework of mental models.’ You’ve got to have a few of these mental models in your head. And you’ve got to use them. You’ve got to be able to use them in combination. You’ve got to be able to use them flexibly. And you’ve got to be able to use them to think about the world.”

He believed that by understanding these biases and developing a framework for thinking, we can make more rational and effective decisions.

Economics and Business, Charlie munger longtime partner of warren buffett and investing legend passes away at 99

Munger’s understanding of economics and business was deeply rooted in his belief in the power of compound interest and the importance of long-term thinking. He stressed the need for:

- Focusing on intrinsic value:Investing in businesses with strong fundamentals and a clear path to future growth.

- Seeking competitive advantages:Identifying companies with a durable moat that protects them from competition.

- Investing in businesses you understand:Only investing in companies where you have a deep understanding of their operations and industry dynamics.

- Patience and discipline:Avoiding short-term speculation and holding investments for the long term.

He also highlighted the importance of:

- Understanding the “circle of competence”:Only investing in areas where you have a genuine understanding and expertise.

- Being contrarian:Identifying opportunities that are overlooked by the market and investing when others are fearful.

- Avoiding “Mr. Market”:Recognizing that the market is irrational and often driven by emotion, and not letting it dictate your investment decisions.

Ethics and Integrity

Munger emphasized the importance of ethical behavior and integrity in both business and personal life. He believed that:

- Honesty and integrity are essential for long-term success:Building a reputation for fairness and trustworthiness is crucial for earning the trust of investors, customers, and employees.

- Shortcuts and unethical behavior ultimately lead to failure:Engaging in dishonest or unethical practices may provide short-term gains, but will ultimately damage your reputation and lead to long-term losses.

- A strong ethical foundation is the bedrock of a successful business:Creating a culture of integrity and ethical behavior fosters trust, collaboration, and innovation.

Table of Munger’s Most Impactful Quotes

| Topic | Quote | Significance |

|---|---|---|

| Psychology | “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” | Emphasizes the importance of avoiding common cognitive biases and making sound, rational decisions. |

| Economics | “I think it’s a terrible mistake for people to get caught up in the short term. The short term is just noise. It’s the long term that counts.” | Highlights the importance of long-term thinking and avoiding short-term speculation. |

| Business | “I’ve always thought that a business should be run like a symphony orchestra, not a one-man band.” | Stresses the importance of collaboration, teamwork, and having a diverse range of perspectives in a successful business. |

| Ethics | “I think the best way to live your life is to focus on doing what you’re good at and what you enjoy.” | Emphasizes the importance of finding your passion and pursuing your strengths. |

Munger’s Influence on Future Generations

Charlie Munger’s legacy extends far beyond his remarkable investment success. His wisdom, generously shared through decades of public speaking and writings, has profoundly influenced aspiring investors and entrepreneurs worldwide. Munger’s teachings, rooted in multidisciplinary thinking and a deep understanding of human psychology, continue to resonate with a new generation seeking guidance in navigating the complexities of the modern investment landscape.

Munger’s Teachings: A Timeless Guide for Investors

Munger’s teachings offer a unique perspective on investing, emphasizing a holistic approach that goes beyond traditional financial metrics. His principles, often expressed in his characteristically blunt and insightful style, provide a framework for making sound investment decisions in an ever-changing world.

- Focus on Understanding Businesses:Munger repeatedly stressed the importance of thoroughly understanding the businesses you invest in. He believed that true investment success stems from identifying companies with sustainable competitive advantages, strong management teams, and sound business models.

- Embrace Multidisciplinary Thinking:Munger’s approach to investing is rooted in the belief that drawing insights from diverse fields like psychology, history, and philosophy is crucial. He encouraged investors to consider the broader context surrounding a business, including its competitive landscape, regulatory environment, and social trends.

- Recognize the Importance of Human Behavior:Munger recognized the powerful influence of human psychology on investment decisions. He cautioned against the common cognitive biases that can lead to poor judgment and urged investors to develop a strong understanding of their own psychological tendencies.

- Practice Patience and Discipline:Munger emphasized the importance of long-term thinking and the ability to withstand market volatility. He believed that true investment success requires patience, discipline, and a willingness to hold onto winning investments for the long haul.

Munger’s Principles in Action: A Hypothetical Scenario

Imagine a young investor, Sarah, who is considering investing in a promising new technology company. Applying Munger’s principles, Sarah begins by thoroughly researching the company’s business model, management team, and competitive landscape. She evaluates the company’s financial performance, considering its revenue growth, profitability, and debt levels.

Sarah also analyzes the company’s regulatory environment and potential social impact. Furthermore, Sarah considers the potential cognitive biases that might influence her investment decision. She recognizes the allure of “hot” investments and the tendency to chase past performance. To mitigate these biases, Sarah focuses on understanding the company’s long-term potential and avoids making hasty decisions based on short-term market fluctuations.Through her rigorous analysis and disciplined approach, Sarah ultimately decides to invest in the company, confident that she has made a well-informed decision based on Munger’s timeless principles.

Reflections on Munger’s Life and Work

Charlie Munger, the brilliant mind behind Berkshire Hathaway’s success alongside Warren Buffett, was more than just an investor; he was a philosopher, a teacher, and a mentor. His life was a testament to the power of intellectual curiosity, lifelong learning, and a relentless pursuit of wisdom.

While his sharp wit and insightful observations on life and business will be deeply missed, his legacy will continue to inspire generations to come.

Personal Reflections and Anecdotes

Munger was known for his dry wit and his ability to cut through the noise and get to the heart of the matter. He was a master of mental models, using them to understand complex situations and make sound decisions.

His lectures were a mix of humor, wisdom, and practical advice, leaving audiences both entertained and enlightened. One of his most famous quotes, “I’d rather be approximately right than precisely wrong,” encapsulates his approach to life and investing. He believed in the power of common sense and in questioning assumptions, always seeking a deeper understanding of the world around him.

Timeline of Munger’s Life and Career

Munger’s life was a journey of continuous learning and achievement. Here is a glimpse into his remarkable life:

- 1924:Born in Omaha, Nebraska.

- 1943:Graduated from the University of Michigan with a degree in mathematics.

- 1948:Graduated from Harvard Law School.

- 1950s:Practiced law and invested in real estate, developing a keen understanding of business and finance.

- 1959:Joined the board of Berkshire Hathaway, marking the beginning of his long and successful partnership with Warren Buffett.

- 1960s:Served as a key advisor to Buffett, contributing significantly to Berkshire Hathaway’s growth.

- 1970s-1980s:Continued to expand his investments, becoming a renowned investor in his own right.

- 1980s:Became a prominent figure in the investment world, sharing his wisdom through lectures and writings.

- 1990s-2000s:Continued to serve as Vice Chairman of Berkshire Hathaway, providing invaluable guidance and mentorship.

- 2010s-2020s:Remained active in the business world, sharing his insights and wisdom with a global audience.

Munger’s Lasting Legacy

Munger’s impact on the investment world is undeniable. His influence extends far beyond the realm of finance, touching upon various fields like business, psychology, and philosophy. His insights on value investing, the importance of multidisciplinary thinking, and the power of mental models have shaped the thinking of countless investors and entrepreneurs.

He emphasized the importance of understanding the psychology of human behavior, recognizing that emotions often cloud judgment. Munger’s contributions to the investment world will continue to inspire future generations of investors. His teachings on the importance of critical thinking, the power of compound interest, and the value of patience are timeless principles that will remain relevant for years to come.

His legacy is not just about financial success but also about the pursuit of knowledge, the development of wisdom, and the importance of living a life of meaning and purpose.