Wall Street Faces New Challenges: Rising Costs & Middle East Tensions

Wall street faces new challenges rising borrowing costs and middle east tensions – Wall Street Faces New Challenges: Rising Costs & Middle East Tensions sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The financial world, always in a state of flux, is now grappling with a potent combination of rising borrowing costs and escalating geopolitical tensions in the Middle East.

This perfect storm is creating a volatile landscape, forcing investors and market players to adapt their strategies to navigate the uncharted waters ahead.

From the impact of higher interest rates on mergers and acquisitions to the potential for a slowdown in economic growth, Wall Street is feeling the pinch. Simultaneously, the ongoing instability in the Middle East is casting a long shadow over global energy markets and investment sentiment.

This confluence of factors has created a complex environment, where risk assessment and careful decision-making are paramount.

Middle East Tensions

The Middle East, a region historically known for its geopolitical complexities, is currently facing heightened tensions that have significant implications for global markets. These tensions, driven by a confluence of factors including political instability, regional rivalries, and the ongoing conflict in Yemen, pose a range of risks to the global economy.

Impact on Global Oil Prices and Energy Markets

The Middle East is home to some of the world’s largest oil reserves, making it a crucial player in the global energy market. Any disruption to oil production or supply chains in the region can have a significant impact on oil prices and energy markets.

The ongoing conflict in Yemen, for instance, has already disrupted oil production and exports from the country, contributing to higher oil prices.

- Increased Volatility:Tensions in the Middle East often lead to increased volatility in oil prices, making it difficult for businesses and consumers to plan for the future.

- Supply Chain Disruptions:Geopolitical instability can disrupt oil production and transportation, leading to supply chain disruptions and higher prices for energy products.

- Economic Impact:Higher energy prices can have a ripple effect throughout the global economy, increasing costs for businesses and consumers, and potentially slowing economic growth.

Impact on Investment Sentiment and Market Volatility

Middle East instability can also negatively impact investment sentiment and market volatility. Investors may become hesitant to invest in regions perceived as being politically unstable, leading to capital flight and reduced investment.

- Uncertainty and Risk Aversion:Geopolitical tensions create uncertainty, leading investors to become more risk-averse and potentially pulling funds out of markets perceived as being more volatile.

- Market Volatility:Increased volatility in the Middle East can spill over into global financial markets, leading to fluctuations in stock prices, bond yields, and currency exchange rates.

- Impact on Emerging Markets:Middle East instability can disproportionately impact emerging markets, which are often more reliant on foreign investment and vulnerable to capital flight.

Vulnerable Sectors of the Economy, Wall street faces new challenges rising borrowing costs and middle east tensions

Several sectors of the economy are particularly vulnerable to Middle East tensions.

- Energy:The energy sector is directly affected by disruptions to oil production and supply chains, leading to price volatility and potential supply shortages.

- Transportation:The transportation sector is also impacted by higher energy prices, which can increase the cost of fuel and transportation services.

- Tourism:Tourism is another sector that can be affected by Middle East instability, as tourists may avoid destinations perceived as being unsafe.

- Financial Markets:Financial markets are vulnerable to the spillover effects of geopolitical tensions, which can lead to increased volatility and reduced investment.

Long-Term Implications: Wall Street Faces New Challenges Rising Borrowing Costs And Middle East Tensions

The current confluence of rising borrowing costs and Middle East tensions presents a complex and multifaceted challenge for the global economy, potentially reshaping the financial landscape and investment strategies for years to come. While the immediate impact is evident in market volatility and economic uncertainty, the long-term implications are far-reaching and require careful consideration.

Impact on Global Economy

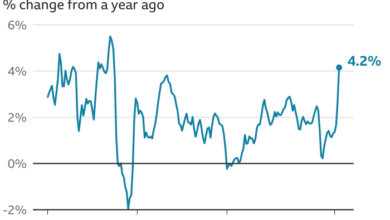

The interplay of these challenges could significantly impact the global economy, leading to a period of prolonged uncertainty and potential economic slowdown. Rising borrowing costs, driven by central bank tightening to combat inflation, can stifle investment and economic growth. The ripple effect of these higher costs can be felt across various sectors, including businesses, consumers, and governments.

Moreover, the geopolitical instability stemming from Middle East tensions can disrupt global supply chains, fuel commodity price volatility, and hinder international trade, further exacerbating economic woes.

Reshaping the Financial Landscape

The confluence of these challenges is likely to reshape the financial landscape, forcing investors to adapt their strategies and seek out new opportunities. The era of low interest rates and abundant liquidity is likely to come to an end, requiring investors to reassess their risk tolerance and portfolio composition.

Emerging Investment Opportunities

Despite the challenges, the evolving financial landscape could also present new investment opportunities. Investors may seek out assets that provide a hedge against inflation, such as commodities, real estate, and certain equities. The increased focus on energy security and sustainability could also drive investment in renewable energy, clean technologies, and resource-efficient industries.

Timeline of Key Events

The following timeline Artikels key events and developments that could shape the future of Wall Street and the global economy in the coming years:

- Short-Term (1-2 years):Continued interest rate hikes by major central banks, potential recessionary pressures, volatility in commodity prices, and geopolitical uncertainty in the Middle East.

- Medium-Term (3-5 years):Potential shifts in global power dynamics, increased focus on energy security and sustainability, and the emergence of new investment trends and technologies.

- Long-Term (5+ years):Restructuring of global supply chains, potential geopolitical realignment, and the emergence of new economic powers.

Wall Street is facing a perfect storm of challenges, with rising borrowing costs and Middle East tensions weighing heavily on investor sentiment. The recent volatility in the markets highlights the need for a deeper understanding of the economic forces at play, and it seems the US Federal Reserve may be engaging in covert stress testing, as revealed in this insightful article us federal reserves covert stress testing and bidenomics revealed.

These actions, combined with the ongoing implementation of Bidenomics, are likely to shape the trajectory of the economy and influence the decisions of Wall Street players in the coming months.

Wall Street is navigating a turbulent landscape, with rising borrowing costs and geopolitical tensions in the Middle East adding to the pressure. This backdrop highlights the importance of financial transparency, a topic that’s currently in the spotlight as Adani Ports questions Deloitte’s exit amid a financial transparency debate.

As investors grapple with these challenges, scrutiny of corporate practices and a clear understanding of financial reporting are more crucial than ever.

Wall Street is navigating choppy waters, facing the twin headwinds of rising borrowing costs and Middle East tensions. But even in these turbulent times, it’s worth remembering the timeless wisdom of investing legends like Warren Buffett, whose journey to success is explored in unleashing the oracle of omahas success the journey of warren buffett.

His focus on long-term value and disciplined approach offer valuable lessons for investors navigating today’s challenging market landscape.