Warren Buffett Remains Confident Despite Fitchs Credit Downgrade

Warren buffett remains confident despite fitchs credit downgrade – Warren Buffett remains confident despite Fitch’s credit downgrade sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The news of Fitch’s downgrade of the US credit rating sent shockwaves through the financial world, prompting many investors to reassess their strategies.

Yet, amidst the uncertainty, one figure stands out: Warren Buffett, the legendary investor, remains steadfast in his optimism about the long-term prospects of the US economy.

Buffett’s unwavering confidence is rooted in his deep understanding of market cycles and his belief in the resilience of the American economy. He views the current situation as a temporary blip on the radar, a mere bump in the road on the long journey of economic growth.

This perspective is informed by his decades of experience navigating market fluctuations and his ability to identify opportunities amidst volatility. His investment philosophy, focused on value investing and long-term growth, remains largely unchanged despite the recent downgrade.

Warren Buffett’s Confidence in the Face of Downgrade

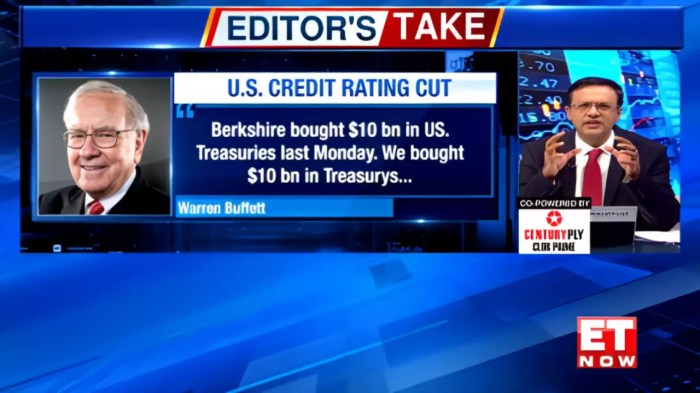

The recent downgrade of the United States’ credit rating by Fitch Ratings sent shockwaves through the financial markets, prompting concerns about the country’s economic outlook. However, amidst this turmoil, Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has remained steadfast in his confidence in the American economy and the long-term prospects of the stock market.

His unwavering optimism, despite the negative news, is a testament to his deep understanding of market cycles and his belief in the resilience of the US economy.

Reasons for Warren Buffett’s Confidence

Buffett’s confidence stems from his long-term investment perspective and his understanding of the cyclical nature of the market. He views the current economic challenges as temporary blips in the grand scheme of things, and he remains convinced that the US economy will continue to grow over the long term.

His confidence is further bolstered by the strong fundamentals of the American economy, including a robust consumer base, a dynamic innovation ecosystem, and a resilient financial system.

Warren Buffett’s confidence in the market is unwavering, even in the face of Fitch’s credit downgrade. He’s likely taking a long-term view, focusing on the underlying strength of the economy. It’s a stark contrast to the news of Peloton recalling 2.2 million bikes over injury and fall concerns , a company facing immediate challenges.

Buffett’s approach highlights the importance of staying calm amidst market volatility and focusing on the bigger picture.

Fitch Downgrade and its Impact on the US Economy: Warren Buffett Remains Confident Despite Fitchs Credit Downgrade

Fitch Ratings, a major credit rating agency, downgraded the US credit rating from AAA to AA+ in early August 2023. This decision, while not unexpected, has sparked concerns about the potential implications for the US economy. Understanding the reasons behind this downgrade and its potential impact is crucial for investors and policymakers alike.

Warren Buffett’s unwavering confidence in the market is evident despite Fitch’s recent credit downgrade. His Berkshire Hathaway’s recent move to completely divest its holdings in TSMC, as reported in this article , might seem counterintuitive. However, it’s important to remember that Buffett’s investment decisions are based on long-term value, and this move likely reflects his assessment of the semiconductor market’s future.

His confidence in the broader market, however, remains steadfast, suggesting that he sees opportunities amidst current economic uncertainty.

Factors Leading to the Downgrade

The downgrade was primarily attributed to the US’s mounting debt levels and the projected trajectory of its fiscal health. Fitch cited concerns about the “expected fiscal deterioration over the next three years” and the “erosion of governance standards” in its decision.

The agency highlighted the increasing political polarization in the US, making it challenging to address the country’s fiscal challenges effectively.

Potential Implications for the US Economy

The downgrade is likely to have a multifaceted impact on the US economy. One of the most immediate consequences is the potential increase in borrowing costs for the US government. A lower credit rating signals increased risk, leading to higher interest rates on US Treasury bonds.

This increased cost of borrowing could put pressure on the federal budget and potentially lead to higher taxes or spending cuts. Another significant concern is the impact on investor confidence. The downgrade could erode confidence in the US economy, leading to a decrease in investment, both domestic and foreign.

Warren Buffett’s unwavering confidence in the U.S. economy, even amidst Fitch’s recent credit downgrade, highlights the importance of long-term perspective. Understanding the nuances of the real estate market across different states, as explored in this detailed analysis of residential and commercial properties exploring real estate in united states state by state analysis residential commercial properties , is crucial for making informed investment decisions.

Buffett’s belief in the resilience of the American economy suggests that even in challenging times, opportunities for growth and value creation remain, especially in the real estate sector.

This could further dampen economic growth and potentially exacerbate the current economic challenges.

Comparison with Previous Credit Rating Changes, Warren buffett remains confident despite fitchs credit downgrade

The Fitch downgrade is not the first time the US has faced a credit rating change. In 2011, Standard & Poor’s downgraded the US credit rating from AAA to AA+, citing concerns about the country’s fiscal outlook. The impact of that downgrade was relatively muted, as the US economy was already in a period of economic recovery.

However, the current economic environment is different. The US economy is facing higher inflation, rising interest rates, and a potential recession. This makes the impact of the Fitch downgrade potentially more significant, as it could exacerbate existing economic vulnerabilities.

Market Reactions and Investor Sentiment

The Fitch downgrade sent shockwaves through global financial markets, triggering immediate reactions across various asset classes. Understanding these reactions is crucial to assess the broader impact of the downgrade and its potential influence on future investment decisions.

Stock Market Fluctuations

The downgrade’s impact on stock markets was mixed. While some sectors, like financials, experienced initial dips, broader indices like the S&P 500 and Nasdaq remained relatively resilient. This suggests that investors, while acknowledging the downgrade’s seriousness, may not view it as an immediate threat to the overall economy.

However, sustained negative sentiment could lead to more significant market corrections in the coming weeks or months.

Bond Yields

Bond yields, which move inversely to prices, initially rose following the downgrade. This reflects a perception of increased risk associated with US debt, leading investors to demand higher returns for holding government bonds. The rise in yields, particularly for long-term bonds, can impact the cost of borrowing for businesses and individuals, potentially slowing economic growth.

Currency Movements

The US dollar weakened against major currencies like the euro and Japanese yen following the downgrade. This indicates a decline in investor confidence in the US economy and its ability to maintain its global financial dominance. A weaker dollar can make US exports more competitive but also increase the cost of imports, potentially fueling inflation.

Investor Sentiment

The downgrade has undoubtedly dampened investor sentiment, creating uncertainty and prompting some to re-evaluate their investment strategies. While some investors might choose to hold their positions, others may seek safer havens like gold or US Treasury bonds. The downgrade could also lead to a flight to quality, where investors shift funds from riskier assets to more stable investments.

Impact on Global Financial Landscape

The downgrade has raised concerns about the global financial landscape, particularly for countries heavily reliant on US debt. The downgrade could lead to a reassessment of sovereign debt ratings for other nations, potentially triggering a domino effect. Furthermore, the downgrade could hinder US efforts to attract foreign investment, as investors might become more cautious about the perceived risk associated with US assets.

Impact on International Trade

The downgrade could impact international trade by increasing the cost of borrowing for businesses and making US exports less competitive. A weaker dollar can also make imports more expensive, potentially fueling inflation and impacting consumer spending. These factors could lead to a slowdown in global trade and economic growth.

Long-Term Implications for the US Economy

The Fitch downgrade, while a significant event, is unlikely to cause a sudden collapse of the US economy. However, it does raise concerns about the country’s long-term fiscal health and its ability to manage its debt burden effectively. The downgrade could have far-reaching implications for the US economy, influencing factors such as fiscal policy, government debt, and economic growth.

Potential Challenges and Opportunities

The Fitch downgrade could present both challenges and opportunities for the US economy. The downgrade could lead to higher borrowing costs for the US government, making it more expensive to finance its debt. This could, in turn, lead to a reduction in government spending, potentially impacting infrastructure development, social programs, and other vital areas.

However, the downgrade could also act as a catalyst for the US government to implement structural reforms and address its fiscal challenges. This could involve measures such as reducing spending, increasing revenue, or a combination of both.

Government Response and Economic Policies

The US government’s response to the downgrade will be crucial in mitigating its potential negative impacts. The government could take a number of steps to address the concerns raised by Fitch, including:

- Implementing a credible fiscal consolidation plan to reduce the deficit and stabilize the debt-to-GDP ratio.

- Strengthening the independence of the Federal Reserve to ensure monetary policy remains focused on price stability and sustainable economic growth.

- Investing in infrastructure and human capital to enhance productivity and competitiveness.

- Promoting a more equitable and inclusive economic system to address income inequality and boost economic growth.