Wall Street Eyes Upward Surge as Fed Hints at Rate Adjustments

Wall street anticipates upward surge as federal reserve hints at rate adjustments – Wall Street Eyes Upward Surge as Fed Hints at Rate Adjustments – The financial world is buzzing with anticipation as the Federal Reserve signals potential adjustments to interest rates. This move, while seemingly small, could have significant ripple effects on Wall Street, potentially triggering an upward surge in the market.

The Fed’s decision-making process is heavily influenced by the current economic landscape, a complex tapestry of factors like inflation, unemployment, and consumer confidence.

The market’s reaction to the Fed’s potential rate adjustments will depend on various factors, including investor sentiment, key economic indicators, and the performance of different sectors.

Federal Reserve’s Rate Adjustments

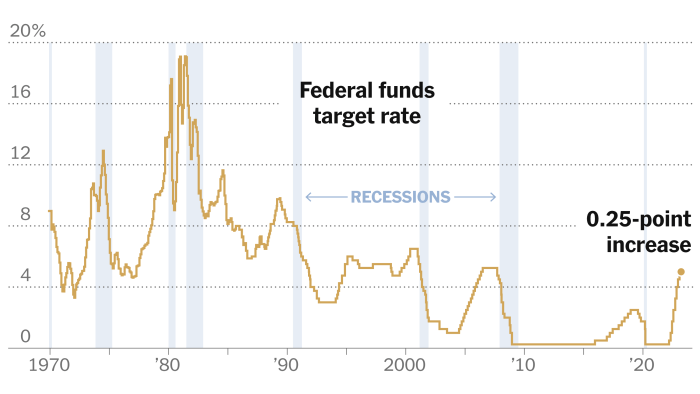

Wall Street is anticipating an upward surge, fueled by hints from the Federal Reserve about potential rate adjustments. The Fed’s pronouncements have sparked a wave of optimism, leading investors to believe that the market is poised for growth. This optimism stems from the historical relationship between Fed rate changes and market movements, with rate cuts often coinciding with market rallies.

The Impact of Rate Adjustments on Wall Street

The Fed’s rate adjustments are expected to have a significant impact on Wall Street’s anticipated upward surge. A reduction in interest rates can stimulate economic activity by making borrowing cheaper for businesses and consumers. This, in turn, can lead to increased investment and spending, boosting corporate earnings and driving stock prices higher.

Conversely, an increase in interest rates can have the opposite effect, making borrowing more expensive and potentially slowing economic growth.

Historical Relationship Between Fed Rate Changes and Market Movements

Historically, the relationship between Fed rate changes and market movements has been complex and often counterintuitive. For example, during periods of economic uncertainty, the Fed may cut interest rates to stimulate growth, even if inflation is already rising. This can lead to a short-term rally in the market, but if inflation continues to rise, the Fed may be forced to raise rates later, leading to a market correction.

The Current Economic Landscape and the Fed’s Decision-Making Process

The Fed’s decision-making process is influenced by a range of economic indicators, including inflation, unemployment, and economic growth. In the current economic landscape, inflation remains elevated, while unemployment is relatively low. The Fed is facing a delicate balancing act, trying to tame inflation without triggering a recession.

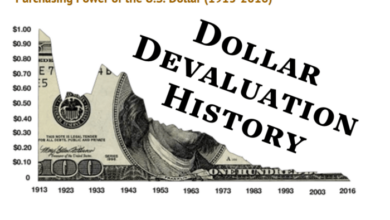

The Fed’s rate adjustments are a key tool in its efforts to manage inflation. By raising interest rates, the Fed aims to cool demand in the economy and slow the pace of price increases. However, aggressive rate hikes can also stifle economic growth and lead to a recession.

Wall Street is buzzing with anticipation as the Federal Reserve hints at potential rate adjustments, signaling a possible shift in the economic landscape. Amidst the uncertainty, Bank of America maintains a bullish outlook for stocks amidst bearish sentiments , suggesting that the market might be poised for an upward surge.

This optimistic stance, despite the current economic headwinds, adds another layer of intrigue to the evolving market dynamics, leaving investors to navigate the complexities of potential rate changes and their impact on the stock market.

The Fed’s decision-making process is complex and involves careful consideration of various economic factors. The Fed’s pronouncements about potential rate adjustments are closely watched by investors, as they can provide insights into the Fed’s outlook for the economy and its policy intentions.

Market Sentiment and Investor Confidence

The recent hints from the Federal Reserve about potential rate adjustments have sparked a wave of optimism on Wall Street, leading to anticipation of an upward surge in the market. This optimism stems from a confluence of factors that are boosting investor confidence and shaping market sentiment.

Factors Contributing to Investor Confidence

The Federal Reserve’s stance on rate adjustments is a significant driver of investor confidence. While the exact timing and magnitude of these adjustments remain uncertain, the expectation of a shift towards a more accommodative monetary policy is generally viewed as positive for the market.

Lower interest rates can stimulate economic activity, boost corporate earnings, and encourage investment. Another key factor influencing investor sentiment is the ongoing strength of the US economy. Recent economic data, including strong job growth and robust consumer spending, suggests that the economy is resilient and capable of weathering potential headwinds.

This economic strength provides a foundation for corporate profitability and stock market growth.

“The US economy is in a strong position, with low unemployment and solid consumer spending. This provides a favorable backdrop for corporate earnings and stock market performance.”

[Source

Renowned Economist or Financial Analyst]

Furthermore, the recent decline in inflation has also contributed to investor confidence. As inflation eases, businesses can pass on lower costs to consumers, potentially leading to higher profit margins and increased stock valuations.

Investment Strategies Aligned with the Anticipated Market Trend

Given the prevailing market sentiment and expectations of an upward surge, investors are increasingly adopting strategies that align with this anticipated trend. * Growth-oriented investments:Investors are seeking out companies with strong growth potential, particularly in sectors that are expected to benefit from the economic recovery, such as technology, healthcare, and consumer discretionary.

Value investing Investors are also focusing on undervalued companies with strong fundamentals and the potential for future growth.

Sector rotation Investors are actively rotating their portfolios to capitalize on specific sectors that are expected to outperform the broader market.These strategies are driven by the belief that the market is poised for a period of growth and that investors can benefit from taking advantage of this upward trend.

Key Economic Indicators and Their Impact

The Federal Reserve’s rate adjustments will inevitably impact the economy, and investors will closely watch key economic indicators to gauge the effectiveness of these adjustments and their potential influence on market sentiment. These indicators provide valuable insights into the health of the economy and can predict future economic trends, influencing investor decisions and market direction.

Impact of Key Economic Indicators on Market Sentiment

Several key economic indicators are likely to influence the market’s reaction to the Fed’s rate adjustments. These indicators offer insights into the economy’s health, revealing potential trends and influencing investor decisions and market direction.

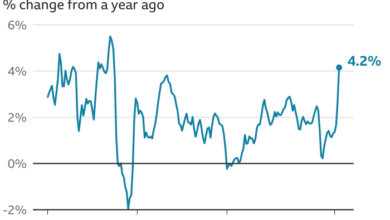

- Inflation:The Federal Reserve’s primary objective is to control inflation, and the Consumer Price Index (CPI) is a key indicator of inflation. If the CPI shows signs of slowing down, it suggests the Fed’s rate adjustments are working, potentially boosting investor confidence and leading to an upward surge in the market.

Conversely, if inflation remains high or accelerates, it could signal that the Fed needs to raise interest rates further, which might dampen investor sentiment and negatively impact the market.

- Gross Domestic Product (GDP):GDP growth reflects the overall health of the economy. A robust GDP growth rate indicates a strong economy, which can support an upward surge in the market. Conversely, a slowing GDP growth rate or contraction can signal economic weakness, potentially leading to market volatility and a downward trend.

- Unemployment Rate:The unemployment rate is a significant indicator of labor market conditions. A low unemployment rate suggests a healthy job market, which can boost consumer spending and economic growth, contributing to a positive market sentiment. Conversely, a rising unemployment rate indicates weakening labor market conditions, potentially impacting consumer confidence and leading to market uncertainty.

Wall Street is buzzing with anticipation for an upward surge in the market, fueled by the Federal Reserve’s hints at potential rate adjustments. This optimistic outlook is further supported by the recent news that the US stock market opened higher amid steady yields, as reported in this article.

While the market remains volatile, these positive indicators suggest a potential shift towards a more bullish sentiment, with investors hoping for continued growth in the coming weeks.

- Retail Sales:Retail sales data provides insights into consumer spending patterns. Strong retail sales indicate consumer confidence and economic strength, supporting an upward market trend. However, weak retail sales suggest a decline in consumer spending, potentially signaling economic weakness and impacting market sentiment negatively.

Sector-Specific Analysis

The anticipated upward surge in the market, driven by the Federal Reserve’s rate adjustments, is expected to impact different sectors in varying ways. This analysis will explore the potential performance of key sectors, outlining the factors influencing their growth or decline, and highlighting investment opportunities and risks associated with each.

Expected Sector Performance, Wall street anticipates upward surge as federal reserve hints at rate adjustments

The following table provides a general overview of the expected performance of different sectors based on the anticipated upward surge.

| Sector | Expected Performance | Factors |

|---|---|---|

| Technology | Positive | High demand for tech products and services, continued growth in cloud computing, artificial intelligence, and cybersecurity. |

| Healthcare | Positive | Aging population, rising healthcare costs, and advancements in medical technology. |

| Consumer Discretionary | Mixed | Strong consumer spending, but potential for inflation to impact discretionary purchases. |

| Financials | Positive | Rising interest rates, increased lending activity, and improved economic outlook. |

| Energy | Positive | Higher oil and gas prices, increased demand for energy, and investments in renewable energy. |

| Materials | Positive | Increased demand for raw materials due to economic growth and infrastructure projects. |

Technology Sector

The technology sector is expected to benefit from the upward surge in the market. Several factors are driving this anticipated growth:

- High Demand for Tech Products and Services:The global demand for tech products and services remains strong, fueled by the increasing adoption of digital technologies across various industries.

- Continued Growth in Cloud Computing:Cloud computing continues to expand, offering businesses greater flexibility, scalability, and cost-effectiveness. This growth is expected to benefit cloud computing providers.

- Advancements in Artificial Intelligence (AI):AI is rapidly evolving and finding applications across various sectors, from healthcare to finance. Investments in AI are likely to continue, driving growth in the technology sector.

- Cybersecurity Concerns:As businesses become more reliant on technology, cybersecurity concerns are rising. This is expected to drive demand for cybersecurity solutions and services.

Healthcare Sector

The healthcare sector is anticipated to perform well during the upward surge. The sector benefits from several key factors:

- Aging Population:As the global population ages, the demand for healthcare services is expected to increase.

- Rising Healthcare Costs:Healthcare costs continue to rise, driven by factors such as technological advancements, chronic diseases, and an aging population.

- Advancements in Medical Technology:Advancements in medical technology, such as personalized medicine and gene therapy, are driving innovation and creating new opportunities in the healthcare sector.

Consumer Discretionary Sector

The consumer discretionary sector is expected to experience mixed performance. Consumer spending is expected to remain strong, driven by a robust economy and low unemployment. However, rising inflation could impact discretionary purchases, as consumers may prioritize essential goods and services over non-essential items.

Financials Sector

The financials sector is anticipated to benefit from the upward surge. Several factors are expected to drive growth in this sector:

- Rising Interest Rates:Rising interest rates typically benefit banks, as they can charge higher interest rates on loans, boosting their profits.

- Increased Lending Activity:As the economy grows, lending activity is expected to increase, further benefiting banks and other financial institutions.

- Improved Economic Outlook:A positive economic outlook generally leads to increased investment activity, benefiting financial institutions.

Energy Sector

The energy sector is expected to perform well during the upward surge. Higher oil and gas prices, driven by increased demand and geopolitical factors, are expected to benefit energy companies. Additionally, investments in renewable energy sources are likely to continue, creating opportunities for companies in this sector.

Materials Sector

The materials sector is expected to benefit from the upward surge, driven by increased demand for raw materials. Economic growth and infrastructure projects are expected to drive demand for materials such as metals, chemicals, and construction materials.

Wall Street is buzzing with anticipation of an upward surge, fueled by the Federal Reserve’s hints of potential rate adjustments. However, the market’s optimism is tempered by the recent downturn in chip stocks, which has cast a shadow of uncertainty over the broader market.

It’s a delicate dance of optimism and caution, with investors closely watching for clues from the Fed’s upcoming pronouncements. As we await Powell’s speech, it’s worth keeping an eye on the broader market sentiment, particularly as it relates to the tech sector.

Read more about the recent decline in chip stocks and its impact on the market. Ultimately, the Federal Reserve’s decisions will have a significant impact on the trajectory of the market, and investors will be keenly watching for any signs of a shift in monetary policy.

Potential Risks and Challenges: Wall Street Anticipates Upward Surge As Federal Reserve Hints At Rate Adjustments

While the Federal Reserve’s hints at rate adjustments have sparked optimism in the market, it’s crucial to acknowledge that potential risks and challenges could hinder the anticipated upward surge. These factors could negatively impact investor confidence and market sentiment, potentially leading to a downturn in the market.

Unforeseen Events and Market Volatility

Unforeseen events and market volatility can significantly impact investor sentiment and market performance. Geopolitical tensions, natural disasters, and unexpected economic shocks can trigger sudden market swings, causing investors to become risk-averse and pull back from investments.

For instance, the outbreak of the COVID-19 pandemic in early 2020 triggered a sharp market downturn, with the S&P 500 index falling by over 30% in a matter of weeks.

Inflation and Interest Rate Hikes

Persistent inflation and aggressive interest rate hikes by the Federal Reserve can negatively impact economic growth and corporate profitability. Higher interest rates increase borrowing costs for businesses, potentially slowing down investment and economic activity.

The Federal Reserve’s recent interest rate hikes have already begun to impact the housing market, with mortgage rates reaching their highest levels in over two decades.

Global Economic Slowdown

A global economic slowdown could negatively impact US markets, as businesses and consumers face reduced demand and economic uncertainty. Factors such as rising energy prices, supply chain disruptions, and geopolitical tensions could contribute to a global economic slowdown.

The ongoing war in Ukraine has already disrupted global supply chains and contributed to rising energy prices, posing a significant risk to the global economy.

Valuation Concerns

High valuations in the stock market can make it vulnerable to corrections. As interest rates rise, investors may demand higher returns on their investments, leading to a revaluation of stocks and potentially causing a market downturn.

In 2022, the Nasdaq Composite index experienced a significant correction, losing over 30% of its value, driven by concerns about rising interest rates and valuation multiples.

Alternative Perspectives

While the prevailing sentiment suggests an upward surge in the market driven by the Federal Reserve’s hints at rate adjustments, it’s crucial to acknowledge that not all market participants share this optimistic outlook. There are dissenting opinions and contrarian views that warrant consideration, particularly given the inherent complexities and uncertainties surrounding the market’s future trajectory.

Potential for Unexpected Market Reactions

The market’s reaction to the Federal Reserve’s actions can be unpredictable, influenced by a multitude of factors. For instance, investors may interpret the Fed’s rate adjustments differently, leading to diverse reactions. Some may perceive the adjustments as a signal of economic strength and a catalyst for growth, while others may view them as a sign of tightening monetary policy and a potential drag on economic activity.

This divergence in interpretation can lead to unexpected market movements.