US Service Sector Slowdown in September: Economic Insights

US service sector sees modest slowdown in september economic insights, a trend that has sparked concern among economists and policymakers. The September slowdown, while modest, represents a shift in the economic landscape, particularly within the service sector, which has been a significant driver of growth in recent years.

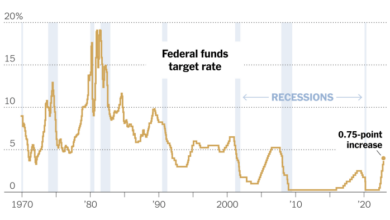

This slowdown can be attributed to a confluence of factors, including rising inflation, interest rate hikes, and softening consumer confidence. While these factors have impacted various sectors of the economy, the service sector, with its reliance on consumer spending and discretionary purchases, has been particularly susceptible.

September Service Sector Slowdown

The latest economic data reveals a modest slowdown in the US service sector during September. This trend, while not alarming, suggests a potential shift in economic momentum, prompting closer examination of the underlying factors.

Service Sector Slowdown: Key Indicators, Us service sector sees modest slowdown in september economic insights

The slowdown in the service sector is reflected in several key indicators. The Institute for Supply Management (ISM) Non-Manufacturing Index, a widely watched gauge of service sector activity, dipped to 54.5 in September, down from 56.9 in August. This decline, while relatively small, signals a moderation in growth.

Comparison to Previous Months and Overall Economic Performance

This slowdown follows a period of robust growth in the service sector earlier in the year. The ISM Non-Manufacturing Index consistently remained above 50 for several months, indicating expansion. However, the September reading suggests a potential cooling in the sector’s momentum.

Significance of the Service Sector’s Performance

The service sector accounts for a significant portion of the US economy, making its performance crucial for overall economic health. A slowdown in the service sector could potentially ripple through the economy, impacting consumer spending and job creation.

Contributing Factors to the Slowdown: Us Service Sector Sees Modest Slowdown In September Economic Insights

The September slowdown in the service sector was a multi-faceted phenomenon, driven by a confluence of economic forces. While the sector had shown resilience in the face of inflation and rising interest rates, the impact of these factors, coupled with softening consumer confidence and shifts in the labor market, ultimately contributed to the slowdown.

Inflation and Interest Rates

Inflation and interest rates played a significant role in the service sector slowdown. The rising cost of goods and services, fueled by persistent inflation, eroded consumer purchasing power, leading to reduced discretionary spending on services. Higher interest rates, aimed at curbing inflation, further dampened consumer spending by increasing borrowing costs and making it more expensive for businesses to invest and expand.

Consumer Confidence

Consumer confidence, a key driver of service sector activity, took a hit in September. Rising inflation, concerns about a potential recession, and the ongoing geopolitical uncertainty weighed heavily on consumer sentiment. As confidence waned, consumers became more cautious with their spending, leading to a decline in demand for services.

Labor Market Dynamics

Labor market dynamics also contributed to the slowdown. While the labor market remained relatively strong, with low unemployment rates, businesses faced challenges in attracting and retaining qualified workers. This led to wage pressures and increased operating costs, which in turn impacted service sector performance.

The US service sector saw a modest slowdown in September, reflecting a cooling economy. While this may seem like a typical economic cycle, it’s interesting to see how the legal battles in the crypto world are impacting investor sentiment.

The recent case of Coinbase countering the SEC lawsuit by drawing parallels to baseball cards in crypto trade highlights the uncertainty surrounding regulation and its potential effect on the market. Ultimately, this ongoing legal battle will likely have a ripple effect on the broader economy, especially in the service sector where consumer confidence plays a crucial role.

While the US service sector saw a modest slowdown in September, there are still signs of resilience in the economy. A significant investment in the future of electric vehicles was announced recently, with Ford and SK On’s joint venture securing a $9.2 billion US government loan for battery production facilities.

This move highlights the government’s commitment to supporting clean energy initiatives and underscores the importance of the automotive industry in driving economic growth. The service sector slowdown may be a temporary blip, and we’ll need to watch closely to see how the economy evolves in the coming months.

The US service sector saw a modest slowdown in September, reflecting a broader trend of economic uncertainty. This comes as global economic headwinds continue to impact various sectors, including the tech industry. For example, the Israeli tech scene is experiencing a period of flux, with startups exploring overseas moves amid judicial changes, as reported in this article.

While the US service sector slowdown is concerning, it’s important to remember that economic fluctuations are cyclical, and we can expect to see a rebound in the coming months.