US Job Openings Surge Signals Potential Rate Hike

Surge in us job openings signals potential interest rate hike – US Job Openings Surge Signals Potential Rate Hike: The US job market is booming, with a recent surge in job openings. This robust hiring environment has raised concerns about inflation, prompting speculation that the Federal Reserve may soon raise interest rates.

The Fed’s primary goal is to control inflation and maintain economic stability, and a hot job market can contribute to inflationary pressures.

This surge in job openings reflects a strong demand for labor across various industries. The tight labor market has pushed up wages, which can further fuel inflation. The Federal Reserve closely monitors these economic indicators to gauge the overall health of the economy and determine the appropriate course of action regarding interest rates.

Job Market Dynamics

The recent surge in US job openings paints a complex picture of the economy, signaling a strong demand for labor but also potentially fueling inflation and prompting the Federal Reserve to consider raising interest rates. This trend is a key indicator of the health of the job market, and understanding its drivers and implications is crucial for businesses and individuals alike.

Factors Contributing to the Surge in Job Openings

The surge in job openings is a result of several intertwined factors.

- Strong Labor Demand:Businesses are actively seeking to fill open positions due to strong economic growth, increasing consumer demand, and ongoing supply chain challenges. This demand is particularly pronounced in sectors like healthcare, technology, and manufacturing, where growth is outpacing the availability of qualified workers.

- Hiring Trends:The “Great Resignation” and the “Quiet Quitting” phenomenon have led to an increase in worker turnover, prompting businesses to actively seek replacements and expand their hiring efforts. Additionally, the rise of remote work has broadened the pool of potential candidates, leading to increased competition for talent.

- Industry-Specific Growth:Some industries, such as technology and healthcare, are experiencing rapid growth, creating a significant demand for skilled workers. These industries are often characterized by high wages and attractive benefits, further fueling the competition for talent.

Relationship Between Job Openings and Unemployment Rate

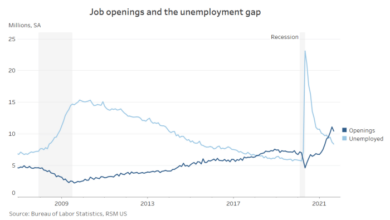

The relationship between job openings and the unemployment rate is not always straightforward. While a high number of job openings generally suggests a strong economy, it doesn’t necessarily mean that unemployment is low.

The JOLTS (Job Openings and Labor Turnover Survey) report, released monthly by the U.S. Bureau of Labor Statistics, provides valuable insights into the relationship between job openings and unemployment.

The JOLTS report highlights that the number of job openings can outpace the number of unemployed workers, indicating a mismatch between available jobs and the skills and qualifications of those seeking employment. This mismatch can contribute to persistent labor shortages in certain industries and sectors.

Interest Rate Hike Considerations: Surge In Us Job Openings Signals Potential Interest Rate Hike

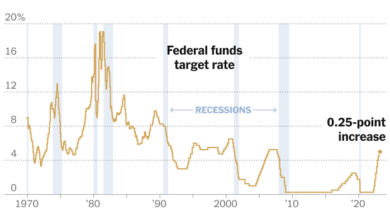

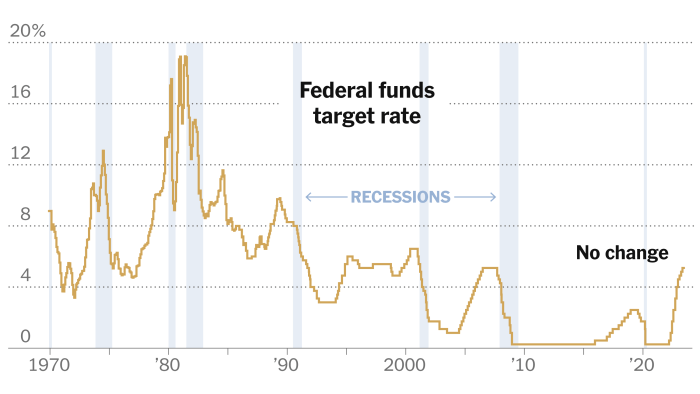

The recent surge in job openings in the US has sparked speculation about the Federal Reserve’s potential decision to raise interest rates. This increase in job openings reflects a robust labor market, which could influence the Fed’s strategy for controlling inflation and maintaining economic stability.

The Impact of Job Market Surge on Interest Rate Decisions, Surge in us job openings signals potential interest rate hike

The Federal Reserve closely monitors the job market as a key indicator of economic health. A strong job market, as evidenced by the surge in job openings, can signal a robust economy and potentially lead to inflationary pressures. The Fed’s primary mandate is to control inflation and maintain price stability.

To achieve this, the Fed may consider raising interest rates to cool down the economy and prevent inflation from spiraling out of control.

The Fed’s Goals for Inflation Control and Economic Stability

The Fed aims to maintain a stable and healthy economy, with a target inflation rate of around 2%. When inflation rises above this target, the Fed may implement policies to slow down economic growth and bring inflation back under control.

Raising interest rates is a common tool used by the Fed to achieve this goal. Higher interest rates make it more expensive for businesses to borrow money, which can slow down investment and economic activity. This, in turn, can help curb inflation.

Historical Relationship Between Interest Rate Hikes and Job Market Performance

Historically, interest rate hikes have had a mixed impact on the job market. While higher interest rates can slow down economic growth and potentially lead to job losses, they can also create a more stable and sustainable economic environment in the long run.

The relationship between interest rates and job market performance is complex and depends on various factors, including the overall health of the economy, the severity of inflation, and the timing and magnitude of interest rate changes.

The recent surge in US job openings is a strong indicator that the economy is humming along, but it also signals a potential interest rate hike. This could be a double-edged sword for businesses, as rising rates can make borrowing more expensive.

However, understanding the potential impact of AI on the job market is crucial for navigating these economic shifts. To learn more about the secrets of AI and its implications, check out this insightful guide: know the secrets of ai your essential guide to understanding artificial intelligence.

By understanding the potential of AI, businesses can better position themselves to thrive in the face of economic uncertainty and leverage technology to their advantage.

The recent surge in US job openings is a strong signal that the Federal Reserve might be inclined to raise interest rates. This could potentially impact retirement planning, as higher interest rates often lead to increased returns on cash investments.

If you’re looking for insights into how this trend might affect your retirement portfolio, be sure to check out this article on cash investments seeing record returns. While a potential interest rate hike may bring challenges, it also presents opportunities for savvy investors to adjust their strategies and secure a comfortable future.

The surge in US job openings is definitely a signal that the Fed might be considering an interest rate hike. It’s like those Mega Millions jackpots that keep climbing, but the chances of winning stay frustratingly low. The economy is looking good, but it’s a bit of a gamble whether that growth will continue without a cool-down.