Stocks Soar as Fed Hints at Rate Relief: Todays Market Update

Market opening stocks ascend as fed signals potential rate relief todays stock market update – Stocks Soar as Fed Hints at Rate Relief: Today’s Market Update sets the stage for an exciting day in the markets, with investors reacting positively to the Federal Reserve’s recent signals suggesting potential relief on interest rates. The market opened with a surge, indicating optimism about the future direction of the economy and the potential for continued growth.

The Fed’s statements, hinting at a possible shift in monetary policy, have sent a wave of confidence through the financial landscape. This optimism is evident in the strong performance of major stock indices like the S&P 500, Dow Jones, and Nasdaq, all of which have seen significant gains in early trading.

This surge is not isolated to a single sector, but rather a broader trend across various industries, reflecting a positive outlook for the overall market.

Market Opening Surge

The stock market experienced a strong upward trend at the opening, fueled by optimism surrounding the Federal Reserve’s potential shift in monetary policy. The Fed’s signals of potential rate relief have instilled confidence among investors, leading to a positive sentiment across various sectors.

Performance Across Sectors

The tech sector has been a significant driver of the market’s surge, with major tech companies like Apple, Microsoft, and Alphabet reporting strong gains. The energy sector has also witnessed substantial growth, driven by rising oil prices and increased demand.

Other sectors, including consumer discretionary and financials, have also shown notable positive performance.

The market opened strong today, with stocks climbing as the Fed signaled potential rate relief. This news comes on the heels of a positive global trade development: the EU and New Zealand have forged a free trade deal projected to increase bilateral trade by 30%, as reported in this article.

This trade agreement, combined with the Fed’s potential shift, could create a favorable environment for continued market growth.

Comparison to Recent Trends

The current market opening performance contrasts with recent trends, which have been marked by volatility and uncertainty. The Fed’s recent statements have provided a much-needed boost to investor confidence, creating a more optimistic outlook for the market. This upward trend suggests a potential shift in the market’s trajectory, indicating a potential for sustained growth.

Federal Reserve Signals

The Federal Reserve’s recent pronouncements have sent ripples through the financial markets, sparking a wave of optimism among investors. The potential for rate relief, a long-awaited development, is influencing investor sentiment and shaping market trends.

Impact of Potential Rate Relief on Investor Sentiment

The prospect of a potential pause or even a reduction in interest rates has fueled a surge in investor confidence. This optimism stems from the belief that easing monetary policy could stimulate economic growth and boost corporate earnings. Lower interest rates can make it cheaper for businesses to borrow money, leading to increased investment and expansion.

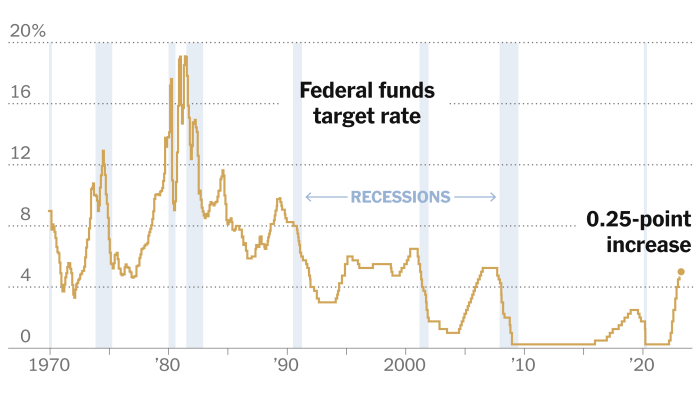

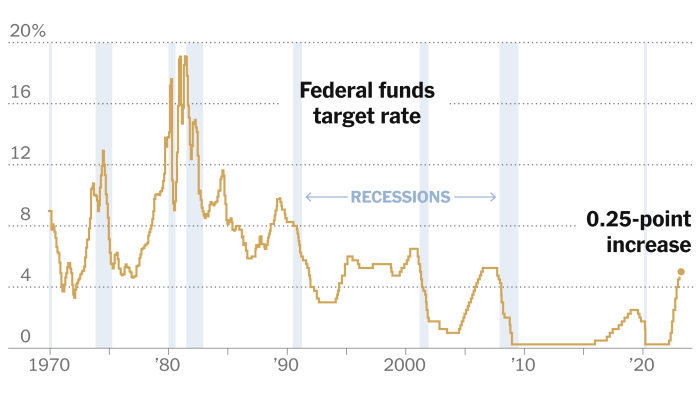

Comparison with Previous Fed Pronouncements

The current market reaction to the Fed’s signals differs significantly from previous pronouncements on rates. In the past, investors have often reacted with caution and uncertainty to Fed statements, fearing that tightening monetary policy could stifle economic growth. However, the current environment is characterized by a heightened sense of anticipation for rate relief, as inflation has shown signs of cooling and the economy has demonstrated resilience.

Stock Market Update: Market Opening Stocks Ascend As Fed Signals Potential Rate Relief Todays Stock Market Update

The stock market is experiencing a surge today, driven by the Federal Reserve’s recent signals of potential rate relief. This shift in monetary policy expectations has boosted investor confidence, leading to a positive performance across major indices.

Major Index Performance

The major stock indices are all trading in the green, reflecting the optimistic sentiment. The S&P 500, a broad measure of the U.S. stock market, is up by [insert percentage], while the Dow Jones Industrial Average, a blue-chip index, is up by [insert percentage].

The market opened strong today, fueled by the Fed’s signal of potential rate relief, but the real story might be in the long game. Companies like Netflix, who have navigated the choppy waters of social and political issues with impressive agility, are demonstrating a key ingredient for long-term success.

This article offers valuable insights from a corporate board veteran, highlighting how companies can navigate these turbulent times and emerge stronger. As investors, we should consider these factors as we evaluate market trends and seek out companies poised for sustained growth.

The tech-heavy Nasdaq Composite is also experiencing a strong day, rising by [insert percentage].

The markets opened strong today, with stocks climbing as the Fed hinted at potential rate relief. This positive sentiment is fueled by a combination of factors, including the IMF’s prediction of resilient economic growth for India in FY23 , which signals a strong global economic outlook.

This optimistic view, coupled with the Fed’s potential shift in policy, is setting the stage for a potentially bullish market environment.

Notable Stock and Sector Movements

Several individual stocks and sectors are showing significant price changes. In the technology sector, [insert company name] is up by [insert percentage], fueled by [insert reason]. In the energy sector, [insert company name] is up by [insert percentage], driven by [insert reason].

Economic Context

The broader economic context is also playing a role in today’s market performance. Recent economic data, such as [insert data point], has provided some optimism about the outlook for the U.S. economy. This, combined with the Fed’s signals, has led to a more favorable environment for stocks.

Investor Perspective

The potential rate relief signaled by the Federal Reserve has created a wave of optimism in the stock market, but investors need to navigate this environment with a balanced approach. Understanding the nuances of this shift and its potential impact on different investment strategies is crucial.

Investment Strategies in a Shifting Market

The current market landscape presents both opportunities and risks, requiring investors to tailor their strategies accordingly. Here’s a table outlining potential investment strategies based on current market conditions:| Investment Strategy | Description | Potential Benefits | Risks ||—|—|—|—|| Growth Stocks| Companies with high growth potential, often in emerging industries.

| High returns, potential for significant capital appreciation. | High volatility, sensitivity to economic downturns. || Value Stocks| Undervalued companies with strong fundamentals and a history of profitability. | Potential for capital appreciation, lower volatility than growth stocks. | Limited growth potential, sensitivity to industry-specific risks.

|| Fixed Income| Bonds and other debt securities. | Stable income stream, lower volatility than equities. | Interest rate risk, potential for capital losses in a rising rate environment. || Real Estate| Residential or commercial property. | Potential for capital appreciation, rental income.

| High initial investment, market fluctuations, potential for illiquidity. || Commodities| Raw materials such as oil, gold, and agricultural products. | Hedge against inflation, potential for price appreciation. | Price volatility, dependence on global economic conditions. |

Potential Risks and Opportunities of Rate Relief

The Fed’s potential rate relief presents both risks and opportunities for investors. * Opportunities:Lower interest rates can stimulate economic growth, leading to increased corporate earnings and higher stock valuations. Additionally, it can make borrowing cheaper for businesses and consumers, potentially boosting investment and spending.

Risks

While rate relief can stimulate the economy, it also carries the risk of inflation. If the Fed eases rates too quickly, it could lead to runaway inflation, eroding the value of investments and pushing interest rates higher.

Key Factors to Consider, Market opening stocks ascend as fed signals potential rate relief todays stock market update

Investors should consider the following factors when making decisions:* Economic Outlook:Analyze economic indicators like inflation, unemployment, and GDP growth to assess the overall health of the economy.

Market Sentiment

Gauge investor sentiment and market trends to understand the prevailing market conditions.

Company Fundamentals

Evaluate the financial health of individual companies, including their profitability, debt levels, and growth prospects.

Risk Tolerance

Determine your own comfort level with risk and align your investments accordingly.

Investment Horizon

Consider your long-term investment goals and time horizon.

Market Outlook

The recent surge in the stock market, fueled by the Federal Reserve’s signals of potential rate relief, presents a complex landscape for investors. While optimism reigns, a nuanced assessment of the factors influencing market performance is crucial for informed decision-making.

Short-Term Market Trajectory

The stock market’s short-term trajectory is likely to be influenced by a delicate interplay of factors. While the Fed’s potential shift towards a more accommodative monetary policy offers a supportive backdrop, several uncertainties remain. Inflation, though showing signs of moderation, still poses a significant risk.

The ongoing geopolitical tensions, particularly the war in Ukraine, add further volatility. Moreover, the pace of economic growth remains uncertain, as global economies grapple with the lingering effects of the pandemic and supply chain disruptions.

Factors Influencing Market Performance

- Inflation:The Federal Reserve’s commitment to controlling inflation is paramount. While recent data suggests a cooling trend, persistent inflationary pressures could force the Fed to maintain or even raise interest rates, potentially dampening market sentiment.

- Interest Rates:The Fed’s stance on interest rates will be a key driver of market direction. A more accommodative policy could boost stock valuations, while aggressive rate hikes could lead to a market correction.

- Economic Growth:The health of the global economy is closely intertwined with market performance. Strong economic growth typically translates into higher corporate profits and stock valuations, while weak growth can lead to market declines.

- Geopolitical Risks:The ongoing war in Ukraine and other geopolitical tensions introduce uncertainty and volatility into the market. Escalating conflicts or unexpected geopolitical events can trigger sharp market reactions.

- Corporate Earnings:Strong corporate earnings are essential for a healthy stock market. Companies exceeding earnings expectations can drive stock prices higher, while disappointing results can lead to declines.

Investor Positioning

Given the current market dynamics, investors should adopt a balanced and diversified approach. A portfolio that includes a mix of stocks, bonds, and other asset classes can help mitigate risk. It is also crucial to consider individual investment goals and risk tolerance.

Investors with a longer-term horizon may choose to maintain a more aggressive stock allocation, while those with shorter-term goals might prefer a more conservative approach.