Stock Market vs. Real Estate: Which Path to Wealth?

Stock market investment vs real estate which path leads to wealth – Stock market investment vs. real estate which path leads to wealth – it’s a question that has plagued investors for generations. Both offer the potential for significant returns, but they come with different risks, rewards, and strategies. The stock market, a dynamic ecosystem of publicly traded companies, allows investors to buy and sell shares, hoping to profit from price fluctuations.

Real estate, on the other hand, provides a tangible asset that can generate income through rentals or appreciate in value over time.

This article will delve into the intricacies of both investment avenues, examining their historical performance, risk profiles, and potential for wealth creation. We’ll compare their liquidity, growth opportunities, and tax implications, ultimately providing you with a comprehensive understanding of which path might be best suited for your financial goals and risk tolerance.

Introduction

The pursuit of wealth is a common goal for many, and two popular avenues for achieving this are stock market investment and real estate investment. Understanding the nuances of each can help you make informed decisions about where to allocate your capital.This article delves into the fundamentals of these two asset classes, exploring their differences, historical performance, and potential benefits and drawbacks.

Definition and Fundamental Differences

Stock market investment involves buying and selling shares of publicly traded companies. These shares represent ownership in the company, and their value fluctuates based on market factors, company performance, and investor sentiment.Real estate investment, on the other hand, involves acquiring and holding properties, such as residential homes, commercial buildings, or land.

The value of real estate can be influenced by factors such as location, market demand, and economic conditions.The key differences between the two asset classes lie in their liquidity, risk profile, and potential for returns.

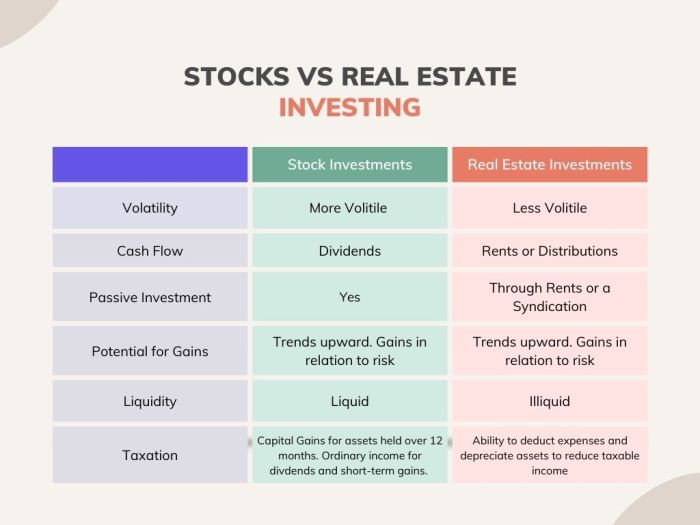

- Liquidity:Stocks are generally more liquid than real estate, meaning they can be bought and sold more easily. This makes them more suitable for short-term investment strategies. Real estate, on the other hand, requires more time and effort to sell, making it a less liquid investment.

The age-old debate about whether stocks or real estate are the better path to wealth is always a hot topic. It’s interesting to consider how these discussions sometimes feel like a game of chance, especially when you see news like this: peloton recalls 2 2 million bikes over injury and fall concerns.

This type of news reminds us that even the most popular investments can carry risks, highlighting the importance of thorough research and understanding the intricacies of each investment path before committing.

- Risk:Stocks are considered a riskier investment than real estate. Their value can fluctuate significantly in the short term, making them susceptible to market volatility. Real estate investments tend to be less volatile, but they can also be subject to market downturns and economic conditions.

- Potential Returns:Both stocks and real estate have the potential to generate significant returns. However, stocks offer the potential for higher returns over the long term, while real estate investments are typically considered more stable and less risky.

Historical Performance

Historically, both stocks and real estate have provided positive returns over the long term.

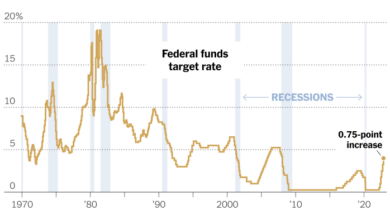

- Stocks:The S&P 500 index, a widely used benchmark for the US stock market, has historically generated an average annual return of around 10% over the past century. This includes periods of both significant gains and losses.

- Real Estate:Real estate investments have also shown consistent growth over the long term. According to the National Association of Realtors, the median home price in the US has increased by an average of 4% per year since 1968.

It is important to note that past performance is not necessarily indicative of future results. Market conditions and economic factors can influence the performance of both asset classes.

The age-old debate about stock market investment vs real estate rages on, with both paths promising wealth creation. But today, the market seems to be in a holding pattern, with the Nifty crossing 17650, as reported in live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors.

Whether this blip is a sign of things to come or just a temporary lull remains to be seen, but it highlights the inherent volatility of the stock market and the need for careful consideration when choosing your investment path.

Stock Market Investment

The stock market, a dynamic and complex ecosystem, offers individuals the opportunity to participate in the growth of businesses and potentially generate significant returns on their investments. Understanding the intricacies of this market is crucial for navigating its complexities and making informed investment decisions.

Structure and Key Players

The stock market is a global network of exchanges where buyers and sellers trade shares of publicly listed companies. These exchanges facilitate the buying and selling of securities, enabling investors to purchase ownership in companies. At the heart of this system are the key players who drive its activity:

- Exchanges: Platforms like the New York Stock Exchange (NYSE) and Nasdaq provide a centralized marketplace for trading stocks. They establish rules and regulations for trading, ensuring fair and transparent practices.

- Brokers: Individuals and institutions rely on brokers to execute trades on their behalf. They facilitate the buying and selling of securities, provide research and analysis, and offer investment advice.

- Investors: Individuals, institutions, and even governments participate in the stock market, seeking to invest their capital and potentially generate returns.

- Companies: Businesses that seek to raise capital through the issuance of shares list themselves on exchanges. These companies offer investors the opportunity to become shareholders and participate in their growth.

Types of Stocks

Stocks are classified into different categories based on their characteristics and the companies they represent. Understanding these classifications is essential for making informed investment decisions:

- Common Stock: The most common type of stock, common shares represent ownership in a company and grant voting rights to shareholders. They typically have the potential for higher returns but also carry greater risk.

- Preferred Stock: Preferred shares offer investors a fixed dividend payment, typically paid before common shareholders receive dividends. These stocks are considered less risky than common stocks but may have limited growth potential.

- Growth Stocks: These stocks represent companies expected to experience significant growth in earnings and revenue. Growth stocks typically have higher price-to-earnings ratios (P/E ratios) than other types of stocks, reflecting investor expectations for future growth.

- Value Stocks: Value stocks are considered undervalued by the market. They may have lower P/E ratios and often represent companies with strong fundamentals but have been overlooked by investors.

- Blue-Chip Stocks: These stocks represent large, well-established companies with a history of profitability and stability. Blue-chip stocks are generally considered less risky than other types of stocks.

Risks and Potential Rewards

Investing in the stock market involves inherent risks and potential rewards. It is essential to understand these factors before making any investment decisions:

- Market Volatility: The stock market is subject to fluctuations, influenced by economic conditions, geopolitical events, and investor sentiment. Volatility can lead to significant price swings, both positive and negative, making it crucial to consider risk tolerance.

- Company Performance: The performance of individual stocks is directly tied to the underlying company’s financial health and growth prospects. Poor financial performance, regulatory issues, or competitive challenges can negatively impact stock prices.

- Inflation: Inflation can erode the purchasing power of investments, particularly fixed-income securities. Investing in stocks can provide a hedge against inflation, as company earnings may increase with inflation.

- Potential for High Returns: The stock market offers the potential for significant returns over the long term. Historically, stocks have outperformed other asset classes, such as bonds, providing investors with the opportunity to grow their wealth.

Investment Strategies

Investors employ various strategies to navigate the stock market and achieve their financial goals:

- Buy-and-Hold: This long-term investment strategy involves purchasing stocks and holding them for an extended period, often years or even decades. The strategy is based on the belief that stocks will appreciate in value over time.

- Value Investing: Value investors seek to identify undervalued stocks, often with strong fundamentals, that are trading below their intrinsic value. They believe that these stocks will eventually rise in price as the market recognizes their true worth.

- Growth Investing: Growth investors focus on companies expected to experience rapid growth in earnings and revenue. They are willing to pay a premium for these stocks, anticipating significant future returns.

- Dividend Investing: Dividend investors seek companies that pay regular dividends to shareholders. These investors focus on generating income from their investments, while also potentially benefiting from capital appreciation.

- Index Investing: Index investors invest in a basket of stocks that track a specific market index, such as the S&P 500. This strategy offers broad market exposure and typically involves lower costs than actively managed funds.

Real Estate Investment: Stock Market Investment Vs Real Estate Which Path Leads To Wealth

Real estate investment offers a tangible asset with the potential for long-term wealth generation. Unlike stocks, which are intangible and subject to market fluctuations, real estate provides a physical asset with inherent value.

Types of Real Estate Investments

Real estate investments encompass a wide range of properties, each with its own set of characteristics and potential returns.

- Residential Real Estate:This category includes single-family homes, townhouses, condominiums, and multi-family dwellings. It often caters to individuals or families seeking primary residences or rental properties. Residential real estate can provide consistent rental income and potential appreciation over time.

- Commercial Real Estate:Commercial properties are designed for business purposes, such as office buildings, retail stores, shopping malls, and hotels. These investments often involve larger capital outlays but can offer significant rental income and appreciation potential.

- Industrial Real Estate:Industrial properties are used for manufacturing, warehousing, and distribution. These investments are typically larger in scale and may involve long-term leases. They can offer stable rental income and appreciation potential, especially in areas with strong industrial growth.

Factors Influencing Real Estate Values

Several factors contribute to the value of real estate, shaping market trends and influencing investment decisions.

- Location:The location of a property is a key determinant of its value. Factors such as proximity to amenities, transportation, employment centers, and desirable neighborhoods significantly influence real estate prices. For example, properties in high-demand areas with excellent infrastructure tend to appreciate more rapidly than those in remote or less desirable locations.

- Economic Conditions:The overall economic climate impacts real estate values. Factors such as interest rates, employment levels, inflation, and consumer confidence can influence demand and pricing. During periods of economic growth, real estate values tend to rise, while economic downturns can lead to price corrections.

- Supply and Demand:The balance between the supply of available properties and the demand for them influences market prices. In areas with high demand and limited supply, prices tend to increase. Conversely, areas with an oversupply of properties may experience price declines.

- Property Condition:The condition of a property plays a significant role in its value. Well-maintained properties with modern amenities and desirable features command higher prices than those in need of repairs or lacking desirable features.

Advantages of Real Estate Investment, Stock market investment vs real estate which path leads to wealth

Investing in real estate offers several advantages:

- Tangible Asset:Real estate is a tangible asset that provides a physical presence and potential for appreciation. Unlike stocks, which are intangible, real estate offers a sense of security and stability.

- Rental Income:Rental properties can generate consistent cash flow, providing a steady stream of income. This income can help offset expenses and contribute to long-term wealth accumulation.

- Tax Benefits:Real estate investments offer various tax advantages, such as deductions for mortgage interest, property taxes, and depreciation. These benefits can help reduce taxable income and enhance overall returns.

- Inflation Hedge:Real estate values tend to rise with inflation, making it a potential hedge against inflation. As prices increase, the value of real estate can also increase, protecting investors from the erosion of purchasing power.

- Leverage:Mortgages allow investors to leverage their capital, using borrowed funds to purchase larger properties. This can amplify returns, but it also increases risk.

Disadvantages of Real Estate Investment

While real estate investment offers potential benefits, it also comes with certain drawbacks:

- High Initial Investment:Purchasing real estate requires a significant upfront investment, which can be a barrier for some investors.

- Illiquidity:Real estate is generally less liquid than stocks or bonds. Selling a property can take time, and finding a buyer at the desired price may be challenging.

- Management Responsibilities:Owning rental properties involves ongoing management responsibilities, such as tenant screening, maintenance, and rent collection. This can be time-consuming and require expertise in property management.

- Market Volatility:Real estate values are subject to market fluctuations, and downturns can lead to price declines. Economic conditions, interest rates, and local market trends can all impact property values.

- Risk of Vacancy:Rental properties are not guaranteed to be fully occupied. Vacancies can lead to lost income and reduced returns.

Ways to Invest in Real Estate

Investing in real estate offers various options to suit different investment goals and risk tolerances.

- Direct Ownership:This involves purchasing properties directly, such as residential homes, commercial buildings, or land. It provides the most control over the investment but also requires significant capital and management responsibilities.

- Rental Properties:Investing in rental properties involves purchasing properties with the intention of renting them out for income. This can be a hands-on approach, requiring active management, or a passive approach, using property managers.

- REITs (Real Estate Investment Trusts):REITs are companies that own and operate income-producing real estate. They offer investors the opportunity to participate in real estate without directly owning properties. REITs are publicly traded, providing liquidity and diversification.

- Crowdfunding:Real estate crowdfunding platforms allow investors to pool funds to invest in properties. This provides access to larger projects and diversification, but it also involves potential risks associated with the platform and the underlying properties.

- Real Estate Syndications:Syndications involve a group of investors pooling funds to acquire and manage properties. This approach allows investors to access larger deals and share management responsibilities.

Comparing Stock Market and Real Estate Investment

Choosing between investing in the stock market and real estate is a significant decision, as both asset classes offer unique advantages and drawbacks. This comparison explores the liquidity, risk profiles, potential returns, and tax implications associated with each investment option to help you make an informed choice.

Liquidity

The ease with which an investment can be converted into cash without affecting its market value is known as liquidity. Stock market investments are generally considered more liquid than real estate.

The debate about stock market investment versus real estate for wealth creation is a hot topic, and it’s clear that both avenues have their own set of risks and rewards. The recent federal reserve report on SVB collapse highlighting mismanagement and supervisory failures serves as a stark reminder that even seemingly stable investments can be vulnerable to unforeseen circumstances.

This underscores the importance of careful due diligence and diversification in any investment strategy, regardless of whether you’re focused on stocks or property.

- Stocks:Stocks can be bought and sold quickly and easily on exchanges, with transactions typically completed within a few minutes. This liquidity allows investors to quickly access their funds if needed.

- Real Estate:Selling a property can take months, involving various steps like finding a buyer, negotiating the price, and completing legal paperwork. Real estate investments are considered less liquid than stocks due to the time and effort involved in selling a property.

Risk Profiles

Risk refers to the possibility of losing money on an investment. Both stock market and real estate investments carry inherent risks, but their profiles differ significantly.

- Stocks:The stock market is known for its volatility, with stock prices fluctuating rapidly due to various factors like company performance, economic conditions, and investor sentiment. This volatility creates both opportunities for high returns and the risk of substantial losses.

- Real Estate:Real estate investments are generally considered less volatile than stocks but still carry risks. Factors like interest rate changes, property values, and local economic conditions can impact returns. Additionally, real estate investments require significant upfront capital, making them less accessible to investors with limited resources.

Potential Returns and Growth Opportunities

The potential returns and growth opportunities associated with each asset class vary depending on market conditions and investment strategies.

- Stocks:Historically, the stock market has delivered higher average returns than real estate over the long term. Stocks offer the potential for significant capital appreciation and dividend income.

- Real Estate:Real estate investments typically provide lower returns than stocks but offer potential for steady income through rent payments and appreciation in property value over time.

Tax Implications

Tax implications are an important factor to consider when making investment decisions.

- Stocks:Capital gains from stock investments are taxed at different rates depending on the holding period. Short-term capital gains (held for less than a year) are taxed at ordinary income tax rates, while long-term capital gains (held for more than a year) are taxed at lower rates.

Dividends received from stocks may also be subject to taxation.

- Real Estate:Real estate investments can offer various tax advantages, including deductions for mortgage interest, property taxes, and depreciation. However, capital gains from selling a property are subject to taxation, and the tax rate can vary depending on the holding period and other factors.

Factors to Consider for Wealth Building

Building wealth through investments requires careful consideration of several factors. Understanding these factors can help you make informed decisions and maximize your chances of achieving your financial goals.

Diversification in Investment Portfolios

Diversification is a key strategy for mitigating risk in investing. It involves spreading your investments across different asset classes, industries, and geographies. By diversifying, you reduce the impact of any single investment performing poorly on your overall portfolio. For example, if you invest solely in real estate and the property market experiences a downturn, your entire investment could be affected.

However, if you diversify your portfolio with stocks, bonds, and other assets, the impact of a real estate downturn would be lessened.

Time Horizon and Investment Goals

Your investment time horizon and goals play a crucial role in determining the appropriate asset allocation between stocks and real estate. Stocks are generally considered more volatile but have the potential for higher returns over the long term. Real estate, on the other hand, tends to be less volatile but offers slower growth potential.

- If you have a long-term investment horizon (10+ years) and are seeking higher returns, stocks may be a suitable option. The longer time horizon allows you to ride out market fluctuations and benefit from the potential for long-term growth.

- If you have a shorter time horizon (5-10 years) or are more risk-averse, real estate might be a more suitable choice. Real estate can provide stable income through rent and appreciation, but it’s important to consider the liquidity of real estate investments, which can be less liquid than stocks.

Risk Tolerance and Financial Situation

Your risk tolerance and financial situation are also important considerations. Risk tolerance refers to your ability and willingness to accept the possibility of losing money in exchange for the potential for higher returns. Your financial situation includes factors like your income, expenses, debt, and savings.

- Investors with a high risk tolerance and a strong financial situation may be comfortable investing a larger portion of their portfolio in stocks, which have the potential for higher returns but also carry higher risk.

- Investors with a lower risk tolerance or a more limited financial situation may prefer to allocate a larger portion of their portfolio to real estate, which offers more stability and potential for income generation.

Managing Investment Risk

Managing investment risk is crucial for protecting your capital and achieving your financial goals. There are several strategies you can employ:

- Diversification: As discussed earlier, diversifying your portfolio across different asset classes, industries, and geographies helps reduce the impact of any single investment performing poorly.

- Dollar-cost averaging: This involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps to reduce the impact of market volatility by averaging your purchase price over time.

- Rebalancing: Rebalancing your portfolio periodically ensures that your asset allocation remains aligned with your risk tolerance and investment goals. As investments grow or decline in value, your asset allocation can shift. Rebalancing helps to bring your portfolio back to your desired allocation.

- Investing in high-quality assets: Investing in high-quality companies with strong fundamentals can help mitigate risk. Before investing, research the company’s financial statements, management team, and industry prospects.

- Seeking professional advice: A financial advisor can help you develop a personalized investment plan and manage your risk based on your individual circumstances.

Case Studies and Examples

To gain a deeper understanding of the potential of both stock market and real estate investment, let’s explore real-world examples of successful investors in each domain. By analyzing their strategies, decisions, and challenges, we can glean valuable insights into the paths to wealth building.

Successful Stock Market Investors

The stock market has produced numerous successful investors who have amassed significant wealth through their investment strategies. Let’s examine a few prominent examples:

- Warren Buffett:Widely regarded as one of the most successful investors of all time, Warren Buffett’s investment philosophy centers around value investing. He focuses on identifying undervalued companies with strong fundamentals and holding them for the long term. His patient and disciplined approach, combined with his ability to analyze businesses deeply, has resulted in phenomenal returns over decades.

- Peter Lynch:Known for his book “One Up On Wall Street,” Peter Lynch emphasizes the importance of understanding the businesses you invest in. He encourages investors to look for companies with strong growth potential, competitive advantages, and sound management. Lynch’s strategy involves investing in companies that are familiar to him and that he believes have a bright future.

- Ray Dalio:Founder of Bridgewater Associates, one of the world’s largest hedge funds, Ray Dalio’s approach is characterized by a focus on risk management and diversification. He employs a systematic and data-driven approach to investing, seeking to identify and capitalize on market trends.

Successful Real Estate Investors

The real estate market offers a diverse range of investment opportunities, from residential properties to commercial buildings. Let’s explore a few successful real estate investors:

- Donald Trump:While controversial, Donald Trump’s success in real estate is undeniable. His approach involves leveraging debt, acquiring properties at favorable prices, and strategically managing them for maximum returns.

- Sam Zell:Known as the “Grave Dancer” of real estate, Sam Zell focuses on distressed properties and turnaround situations.

He has a reputation for acquiring undervalued assets, restructuring them, and then selling them for a profit.

- Barbara Corcoran:A self-made real estate mogul, Barbara Corcoran’s strategy emphasizes networking and building relationships. She emphasizes the importance of understanding the local market, finding undervalued properties, and creating value through renovations and improvements.

Lessons Learned from Successful Investors

The success stories of these investors highlight several common themes:

- Long-term Perspective:Successful investors in both the stock market and real estate have a long-term outlook. They don’t get swayed by short-term market fluctuations and focus on building wealth over time.

- Disciplined Approach:Consistent discipline is crucial for success in both investment arenas.

This includes adhering to a well-defined investment strategy, managing risk effectively, and staying focused on long-term goals.

- Continuous Learning:The investment landscape is constantly evolving. Successful investors stay informed about market trends, new technologies, and economic developments. They continuously learn and adapt their strategies to stay ahead of the curve.

- Diversification:Spreading investments across different asset classes, industries, and geographies can help mitigate risk and enhance returns.

- Risk Management:Understanding and managing risk is essential for successful investing. This involves carefully assessing potential risks, setting appropriate stop-loss orders, and diversifying investments.

Challenges Faced by Investors

While the potential for wealth building is significant, both stock market and real estate investment come with their own set of challenges:

- Market Volatility:Both the stock market and real estate are subject to market volatility. Economic downturns, interest rate changes, and geopolitical events can impact investment values.

- Economic Cycles:Both asset classes are influenced by economic cycles. During periods of economic expansion, asset prices tend to rise, while during recessions, they may decline.

- Liquidity:Real estate can be less liquid than stocks, meaning it can take longer to sell and convert to cash.

- Regulations:Both markets are subject to government regulations and policies that can impact investment decisions.

- Competition:Both investment arenas are highly competitive, with many experienced investors vying for the best opportunities.