Stock Market Gains Ahead of Powells Speech: Market News Today

Stock market gains ahead of powells speech market news today – Stock Market Gains Ahead of Powell’s Speech: Market News Today – Wall Street is on edge, with investors eagerly awaiting Federal Reserve Chair Jerome Powell’s speech today. The market has been on a recent upswing, fueled by a combination of factors, including positive economic data and hopes for a soft landing.

However, the speech is expected to shed light on the Fed’s future plans regarding interest rates, and this could significantly impact the market’s trajectory.

The anticipation surrounding Powell’s speech is palpable. Many analysts believe his comments will provide crucial insights into the Fed’s stance on inflation and the potential for further rate hikes. The market’s recent gains could be jeopardized if Powell signals a more hawkish approach, leading to increased volatility and potentially even a correction.

Conversely, a dovish tone could bolster investor confidence and propel the market higher.

Market Overview

The stock market has been experiencing a period of volatility in recent weeks, with investors grappling with concerns about inflation, interest rate hikes, and the ongoing geopolitical tensions. While major indices have shown some resilience, the overall sentiment remains cautious, with investors seeking clarity on the path forward.

Recent Market Trends

Recent market movements have been influenced by a number of factors, including:

- Inflation:The Federal Reserve’s aggressive interest rate hikes have been aimed at taming inflation, but the impact on the economy remains uncertain. Higher interest rates can slow economic growth and potentially lead to a recession, weighing on corporate earnings and investor confidence.

- Geopolitical Tensions:The ongoing conflict in Ukraine has created global uncertainty and volatility, disrupting supply chains and driving up energy prices. The war’s impact on the global economy and financial markets is still unfolding.

- Earnings Season:Corporate earnings reports have been mixed, with some companies exceeding expectations while others have fallen short. Investors are closely scrutinizing earnings calls for insights into future growth prospects and the impact of inflation and rising interest rates.

Investor Sentiment

Investor sentiment is currently characterized by a mix of caution and optimism. While some investors remain concerned about the economic outlook, others are finding opportunities in the market’s recent pullback. The ongoing volatility has led to increased trading activity, with investors seeking to navigate the uncertain environment.

Key Indices

- S&P 500:The S&P 500, a broad market index, has been volatile in recent weeks, but has shown some resilience, holding above key support levels. The index has been influenced by a combination of factors, including strong earnings reports from some companies and the anticipation of a potential shift in the Federal Reserve’s monetary policy stance.

- Nasdaq Composite:The Nasdaq Composite, which is heavily weighted towards technology stocks, has been more volatile than the S&P 500, reflecting investor concerns about the impact of rising interest rates on growth companies. The index has experienced a pullback in recent weeks, but some investors believe that the long-term growth prospects for technology remain strong.

- Dow Jones Industrial Average:The Dow Jones Industrial Average, a price-weighted index of 30 large-cap stocks, has been relatively stable in recent weeks, reflecting the resilience of some sectors, such as energy and financials. The index has benefited from the recent surge in oil prices and the strong performance of banks.

Powell’s Speech and Market Expectations: Stock Market Gains Ahead Of Powells Speech Market News Today

All eyes are on Federal Reserve Chair Jerome Powell’s speech today, as investors eagerly await clues about the future direction of monetary policy. This speech holds significant weight, given its potential to influence interest rates, inflation, and economic growth.

Interest Rate Outlook

The market is particularly focused on any hints about the Fed’s stance on interest rates. Investors are trying to decipher whether the Fed will maintain its current aggressive rate hike path or signal a potential pivot towards a more accommodative approach.

“Powell’s speech will be closely scrutinized for any signs of a shift in the Fed’s thinking on interest rates,” says Michael Wilson, chief investment strategist at Morgan Stanley.

Inflation Expectations

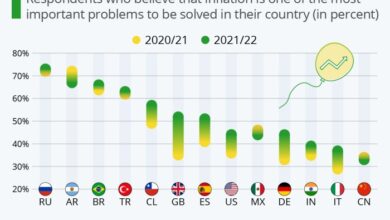

Inflation remains a key concern for investors and policymakers alike. The market is looking for Powell to provide an update on the Fed’s assessment of inflation and its trajectory.

The stock market showed some gains today ahead of Powell’s speech, with tech stocks leading the charge. This rally was fueled by strong earnings from Nvidia, which is powering a broader tech rally and boosting the Nasdaq. Investors are eagerly awaiting Powell’s comments on interest rates, hoping for clues about the future direction of monetary policy, which could significantly impact the market’s trajectory.

“The Fed’s commitment to bringing inflation down to its 2% target will be a major focus of Powell’s speech,” says Ellen Zentner, chief US economist at Morgan Stanley.

Investor Positioning

Ahead of Powell’s speech, investors are taking a cautious approach. Some are holding back on making significant investments, waiting for clarity from the Fed. Others are adjusting their portfolios to reflect potential interest rate scenarios.

The stock market saw gains today ahead of Powell’s speech, but I can’t help but be distracted by the incredible news coming from India – their Chandrayaan-3 rover has begun its lunar surface exploration! Check out this article to see the amazing images.

It’s amazing to think about the scientific advancements happening right now, while the financial world waits with bated breath for Powell’s words.

“The market is in a wait-and-see mode,” says Peter Boockvar, chief investment strategist at Bleakley Advisory Group. “Investors are hesitant to make major moves until they hear what Powell has to say.”

Factors Influencing Market Gains

The recent surge in stock market indices, particularly ahead of Powell’s speech, can be attributed to a confluence of factors. These factors, acting in concert, have provided a positive backdrop for market performance. However, the relative significance and sustainability of these factors remain subject to ongoing evaluation.

Economic Data and Sentiment, Stock market gains ahead of powells speech market news today

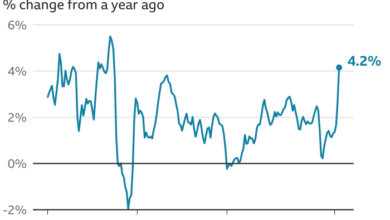

Recent economic data releases have painted a more optimistic picture of the US economy. Notably, the unemployment rate has remained low, consumer spending has remained resilient, and inflation appears to be moderating. This positive economic backdrop has boosted investor confidence, leading to increased risk appetite and a willingness to invest in equities.

Interest Rate Expectations

The market’s expectations regarding the Federal Reserve’s future interest rate decisions have also played a significant role. The Fed has signaled a potential pause in its rate-hiking cycle, suggesting that interest rates may remain at current levels for a longer period.

The stock market saw gains today ahead of Powell’s speech, likely fueled by hopes that the Fed might be nearing the end of its rate-hiking cycle. This anticipation is understandable, as the Federal Reserve’s September rate decision will be a pivotal moment, with implications for the entire market.

For a deeper dive into the significance of this decision and its potential impact on the market, check out this insightful article: federal reserves september rate decision significance and market outlook. Whether the Fed chooses to hold rates steady or increase them further, the decision will undoubtedly shape the trajectory of the stock market in the coming months.

This prospect has been welcomed by investors, as it implies lower borrowing costs for businesses and households, potentially stimulating economic growth.

Corporate Earnings

Strong corporate earnings reports have provided further support for the stock market. Many companies have exceeded analysts’ expectations, demonstrating resilience and continued profitability in a challenging economic environment. This positive earnings momentum has bolstered investor confidence and reinforced the view that the US economy remains relatively healthy.

Geopolitical Developments

Geopolitical developments, particularly the ongoing conflict in Ukraine, have also influenced market sentiment. While the war continues to pose risks and uncertainties, recent developments, including the potential for peace negotiations, have offered some hope for a de-escalation of the conflict.

This prospect has contributed to a reduction in risk aversion and a greater willingness among investors to take on equity exposure.

Key Sectors and Stocks to Watch

The recent market gains have been driven by a combination of factors, including strong corporate earnings, easing inflation concerns, and positive economic data. However, the market is likely to remain volatile in the near term as investors await further guidance from the Federal Reserve.

Sector Performance and Outlook

The recent market gains have been broad-based, with most sectors participating in the rally. However, some sectors have outperformed others, driven by specific factors.

| Sector | Key Stocks | Performance | Outlook |

|---|---|---|---|

| Technology | Apple (AAPL), Microsoft (MSFT), Amazon (AMZN) | The technology sector has been a strong performer in recent months, driven by optimism around artificial intelligence (AI) and cloud computing. | The outlook for the technology sector remains positive, with AI and cloud computing expected to continue driving growth. However, investors should be aware of the potential for increased regulation in the sector. |

| Energy | ExxonMobil (XOM), Chevron (CVX), ConocoPhillips (COP) | The energy sector has benefited from higher oil prices, driven by strong demand and supply constraints. | The outlook for the energy sector is mixed, with some analysts predicting continued high oil prices, while others expect prices to moderate. |

| Consumer Discretionary | Tesla (TSLA), Nike (NKE), Home Depot (HD) | The consumer discretionary sector has seen mixed performance, with some companies benefiting from strong consumer spending, while others have been impacted by inflation and rising interest rates. | The outlook for the consumer discretionary sector is uncertain, with consumer spending expected to slow in the coming months. |

| Healthcare | Johnson & Johnson (JNJ), UnitedHealth Group (UNH), Pfizer (PFE) | The healthcare sector has been a steady performer, driven by aging demographics and rising healthcare costs. | The outlook for the healthcare sector is positive, with continued growth expected in areas such as pharmaceuticals and medical devices. |

Risks and Challenges

While the market is currently enjoying a surge, it’s crucial to acknowledge that several risks and challenges could potentially impact the upward trajectory. These factors could influence investor sentiment and potentially lead to a correction in the market. Understanding these risks and developing strategies to mitigate them is essential for investors looking to navigate the market effectively.

Potential Risks and Challenges

Several potential risks and challenges could impact the market, including:

- Inflation and Interest Rates:The Federal Reserve’s aggressive interest rate hikes aim to curb inflation. However, these hikes could slow economic growth and potentially lead to a recession. A recession could negatively impact corporate earnings, leading to a decline in stock prices.

- Geopolitical Uncertainty:The ongoing war in Ukraine, tensions between the US and China, and other geopolitical events create uncertainty and volatility in the market. These events can disrupt supply chains, impact energy prices, and lead to investor caution.

- Valuation Concerns:Some sectors, such as technology, have experienced significant growth in recent years, leading to high valuations. If growth slows down, these valuations could become unsustainable, potentially leading to a correction.

- Earnings Expectations:The market’s performance is closely tied to corporate earnings. If companies fail to meet earnings expectations, it could lead to a sell-off in the market.

- Market Sentiment:Investor sentiment plays a crucial role in driving market direction. If investor confidence wanes due to economic concerns or other factors, it could lead to a decline in stock prices.

Impact on Market Gains

These risks could significantly impact the current market gains. For example, if inflation remains high and the Fed continues to raise interest rates, it could lead to a slowdown in economic growth and a decline in corporate earnings. This could result in a correction in the stock market as investors become more cautious.

Mitigation Strategies

Investors can employ several strategies to mitigate these risks:

- Diversification:Spreading investments across different asset classes, sectors, and geographic regions can help reduce risk.

- Value Investing:Focusing on undervalued companies with strong fundamentals can provide a buffer against market volatility.

- Risk Management:Setting stop-loss orders and other risk management strategies can help limit potential losses.

- Long-Term Perspective:Maintaining a long-term investment horizon can help weather short-term market fluctuations.

- Staying Informed:Staying informed about economic data, geopolitical events, and company news can help investors make informed decisions.