Stock Market Calms After Volatility: Feds Next Move in Focus

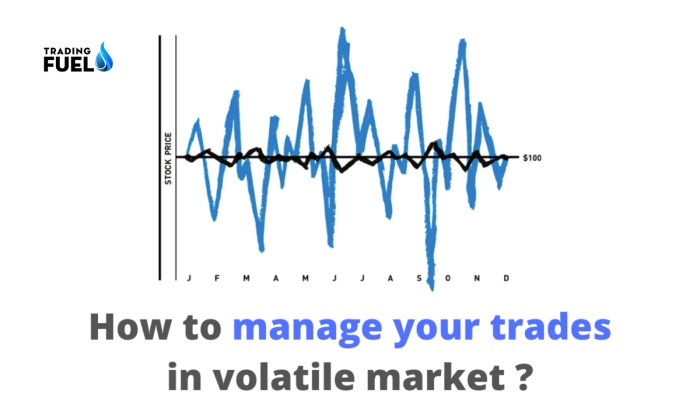

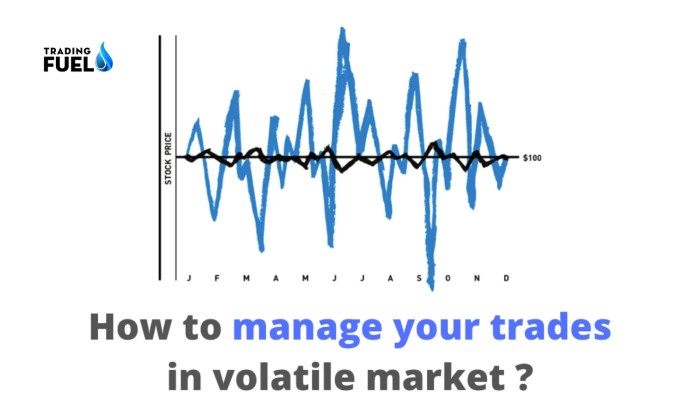

Stock market calms after recent volatility heres what traders are awaiting from the fed – Stock Market Calms After Volatility: Fed’s Next Move in Focus – The stock market, after a period of intense volatility, seems to be finding its footing. While recent events have shaken investor confidence, the market has shown signs of stabilization.

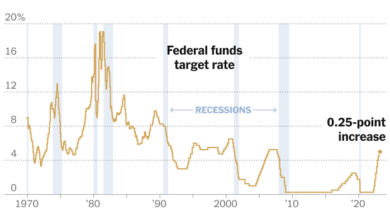

But the question on everyone’s mind is what will the Federal Reserve do next? The Fed’s decisions have a profound impact on the market, and traders are eagerly awaiting their next move.

This period of volatility was driven by a confluence of factors, including rising inflation, concerns about economic growth, and the ongoing war in Ukraine. These events sent shockwaves through different sectors, with some industries faring better than others. The tech sector, for example, was particularly hard hit as investors grew wary of growth stocks in a rising interest rate environment.

However, the market has shown resilience, with many indices now trading above their recent lows.

Recent Market Volatility: Stock Market Calms After Recent Volatility Heres What Traders Are Awaiting From The Fed

The stock market has experienced a period of significant volatility in recent months. This volatility has been driven by a confluence of factors, including rising inflation, concerns about a potential recession, and the ongoing war in Ukraine.

Factors Contributing to Market Volatility

The recent market volatility can be attributed to a number of factors, including:

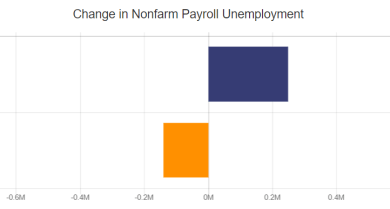

- Rising Inflation:Inflation has been rising at its fastest pace in decades, eroding consumer purchasing power and forcing businesses to raise prices. This has led to concerns about a potential recession, as consumers may start to cut back on spending.

- Concerns About a Potential Recession:The Federal Reserve has been raising interest rates in an effort to combat inflation, which could slow economic growth and lead to a recession. These concerns have weighed heavily on the stock market, as investors worry about the impact on corporate profits.

- The War in Ukraine:The war in Ukraine has disrupted global supply chains and created uncertainty about the future of the global economy. This has led to increased volatility in energy and commodity prices, which has had a ripple effect on other sectors of the market.

Impact on Different Sectors of the Market, Stock market calms after recent volatility heres what traders are awaiting from the fed

The recent market volatility has had a significant impact on different sectors of the market. For example, the energy sector has benefited from the surge in oil and gas prices, while the technology sector has been hit hard by rising interest rates.

- Energy Sector:The energy sector has been one of the best performers in the market, as oil and gas prices have soared due to the war in Ukraine and supply chain disruptions. Companies in the energy sector have seen their stock prices rise significantly, as investors bet on continued high energy prices.

- Technology Sector:The technology sector has been one of the worst performers in the market, as investors have been selling off shares of tech companies due to concerns about rising interest rates. Tech companies are often seen as growth stocks, and their valuations are sensitive to changes in interest rates.

Rising interest rates make it more expensive for companies to borrow money, which can hurt their profitability.

The stock market has calmed down after a period of intense volatility, and traders are now looking to the Fed for guidance on interest rates. If you’re new to investing, this kind of news might seem overwhelming, but don’t worry! There are plenty of resources available to help you understand the basics of the stock market.

Check out this great article on tips for beginners to invest in the stock market learn the basics of stock market , which can help you get started. Once you have a solid understanding of the fundamentals, you’ll be better equipped to navigate the ups and downs of the market and make informed decisions about your investments.

The stock market seems to be finding its footing after the recent volatility, but traders are keeping a close eye on the Fed’s next move. Adding to the mix, Moody’s has signaled potential credit downgrades for six major US banks, which could further impact market sentiment.

With the Fed’s interest rate decisions and potential banking sector instability in the spotlight, investors are bracing for another turbulent week.

The stock market’s recent volatility has investors on edge, with many looking to the Fed for guidance on interest rates. But while the financial world is focused on the future of the markets, there’s a whole other world out there – the world of real estate.

For those looking to diversify their portfolio or simply find a stable investment, exploring the real estate market state-by-state can be a great way to gain insights, whether you’re interested in residential or commercial properties. This comprehensive guide provides valuable information to help you navigate the intricacies of the US real estate market.

Ultimately, the Fed’s decisions will have a significant impact on both the stock market and the real estate sector, making it essential to stay informed about both areas.