Dollar Heading for Biggest Weekly Rise Since May Before Jobs Report

Dollar Heading for Biggest Weekly Rise Since May Before Jobs Report – the US dollar has experienced its most significant weekly surge since May, setting the stage for a potentially volatile week ahead. This rise comes in anticipation of the upcoming jobs report, which could further influence the dollar’s trajectory.

The recent strength of the dollar is attributed to a combination of factors, including rising interest rate expectations, positive economic data, and a generally optimistic global market sentiment.

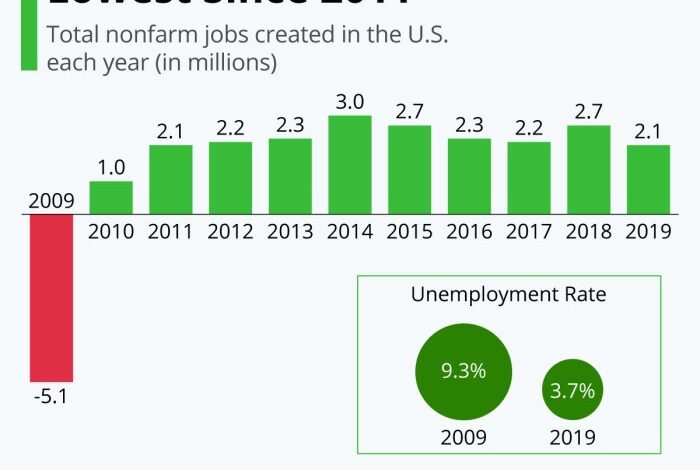

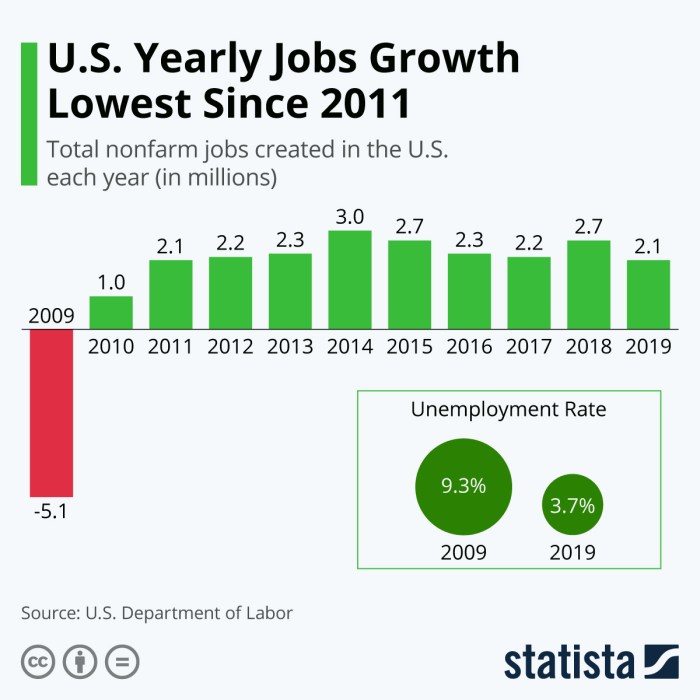

The upcoming jobs report is expected to be a key driver of the dollar’s future performance. Economists and market analysts are closely watching the report’s key indicators, such as the unemployment rate and wage growth, to gauge the health of the US labor market.

A strong jobs report could solidify the dollar’s recent gains, while a weak report could lead to a correction. The potential impact of the jobs report on the dollar is a major talking point among investors and traders, as it could shape the overall market sentiment and influence investment decisions.

Dollar Strength

The dollar’s recent surge, marking its biggest weekly rise since May, has sent ripples through global markets. This dramatic strengthening reflects a confluence of factors, including heightened expectations for interest rate hikes, robust economic data, and a shift in global market sentiment.

The dollar is heading for its biggest weekly rise since May, even before the jobs report hits. This kind of volatility can be exciting for seasoned investors, but if you’re just starting out, it’s important to learn the basics of the stock market.

Check out tips for beginners to invest in the stock market learn the basics of stock market to get a solid foundation. Understanding how the market works will help you navigate these ups and downs and make informed decisions about your investments, even when the dollar is making big moves.

Potential Factors Contributing to Dollar Strength

The dollar’s recent surge can be attributed to a combination of factors:

- Interest Rate Expectations:The Federal Reserve’s hawkish stance on interest rates has been a major driver of the dollar’s strength. The market anticipates further rate hikes, potentially pushing the federal funds rate to its highest level in over two decades. This aggressive monetary policy stance attracts foreign investors seeking higher returns, increasing demand for the dollar.

- Robust Economic Data:Recent economic data releases, including a resilient labor market and strong consumer spending, have reinforced the perception of a robust US economy. This positive economic outlook further supports the dollar’s strength, as investors anticipate continued growth and potential for higher inflation, bolstering the Fed’s commitment to raising rates.

- Global Market Sentiment:The dollar often serves as a safe-haven currency during times of global uncertainty. The recent geopolitical tensions, including the war in Ukraine and heightened inflation globally, have pushed investors toward the dollar as a safe haven, driving up demand for the currency.

Impact on Global Markets

The dollar’s strength has significant implications for global markets, particularly for emerging economies.

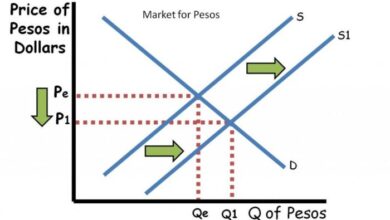

- Emerging Market Currencies:A strong dollar typically puts downward pressure on emerging market currencies. This is because a stronger dollar makes it more expensive for emerging economies to service their dollar-denominated debt. This can lead to currency depreciation and potentially exacerbate inflation in these countries.

- Commodity Prices:The dollar’s strength tends to weigh on commodity prices, which are typically priced in dollars. This is because a stronger dollar makes commodities more expensive for buyers using other currencies. This can impact the economies of countries that rely heavily on commodity exports.

Impact of Jobs Report

The upcoming jobs report, scheduled for release on [date], is poised to be a significant event for the dollar. Investors will be keenly focused on the report’s insights into the health of the US labor market, as it can offer valuable clues about the future direction of monetary policy and, consequently, the dollar’s trajectory.

The dollar is heading for its biggest weekly rise since May ahead of the crucial jobs report, and investors are clearly seeking out opportunities in the life sciences sector. Goldman Sachs Asset Management has successfully raised $650 million for its innovative life sciences fund, a testament to the growing interest in this area.

This suggests that the market is looking beyond the immediate economic uncertainty and towards the long-term potential of the life sciences sector, which could further fuel the dollar’s rise.

Impact of Unemployment Rate

The unemployment rate is a key indicator of labor market health. A lower unemployment rate generally signals a strong economy, which can boost demand for the dollar. Conversely, a higher unemployment rate suggests a weaker economy, potentially leading to a decline in the dollar’s value.

For instance, in [year], when the unemployment rate fell to [percentage], the dollar experienced a significant surge. This was attributed to investor confidence in the US economy’s strength, leading to increased demand for the dollar as a safe-haven asset.

Impact of Wage Growth

Wage growth is another critical factor to watch. Robust wage growth indicates a strong economy with rising consumer spending, which can bolster the dollar. Conversely, weak wage growth could suggest a slowdown in economic activity, potentially weakening the dollar. For example, in [year], when wage growth unexpectedly slowed to [percentage], the dollar experienced a dip.

The dollar is on track for its biggest weekly rise since May, a surge that’s likely driven by anticipation for the upcoming jobs report. It’s interesting to note how market sentiment can be influenced by a combination of factors, like the news that Newell Brands and its former CEO are facing SEC charges for misleading investors, as reported by The Venom Blog.

This kind of news can shake investor confidence, leading to a flight towards perceived safer assets like the US dollar.

This was attributed to concerns about the sustainability of economic growth, leading to a decrease in demand for the dollar.

Potential Outcomes of Strong vs. Weak Jobs Report

A strong jobs report, characterized by low unemployment and robust wage growth, could further bolster the dollar. This is because it would reinforce the perception of a healthy US economy, potentially prompting the Federal Reserve to maintain or even tighten monetary policy, which could lead to higher interest rates and increased demand for the dollar.On the other hand, a weak jobs report, featuring a higher unemployment rate and sluggish wage growth, could weaken the dollar.

This is because it would suggest a weakening US economy, potentially prompting the Federal Reserve to ease monetary policy, which could lead to lower interest rates and decreased demand for the dollar.

Market Volatility: Dollar Heading For Biggest Weekly Rise Since May Before Jobs Report

The recent surge in the dollar, driven by the anticipation of a strong jobs report, has injected a significant dose of volatility into global markets. This heightened volatility stems from a confluence of factors, including uncertainty surrounding interest rate hikes, global economic headwinds, and the potential for unexpected shifts in market sentiment.

Market Volatility and its Impact on Investors and Traders

The increased volatility presents both risks and opportunities for investors and traders.

- Increased Risk of Losses:Volatile markets can lead to sudden and unpredictable price swings, increasing the risk of losses for investors and traders. This is particularly true for those holding positions with high leverage or those who rely on short-term trading strategies.

For example, a sudden drop in the stock market due to unexpected economic news could result in significant losses for investors who have heavily invested in equities.

- Opportunities for Profit:While volatility can be a source of risk, it also creates opportunities for skilled investors and traders to profit from market fluctuations. For instance, experienced traders can employ strategies like short-selling or buying options to capitalize on downward price movements during periods of heightened volatility.

Risk and Opportunities

Here is a table comparing the potential risks and opportunities associated with the current market conditions:

| Risk | Opportunity |

|---|---|

| Increased risk of losses due to sudden price swings. | Potential for higher returns from short-term trading strategies. |

| Uncertainty surrounding future economic conditions. | Opportunity to invest in undervalued assets during market corrections. |

| Potential for market corrections or crashes. | Opportunity to buy low and sell high during periods of volatility. |

Economic Outlook

The dollar’s recent surge is a reflection of the complex interplay of economic forces, with the upcoming jobs report adding another layer of uncertainty. Understanding the broader economic landscape is crucial for deciphering the dollar’s potential trajectory.

Inflation and Consumer Spending

Inflation remains a key driver of the dollar’s value. As the Federal Reserve continues to combat inflation through interest rate hikes, the dollar’s attractiveness to investors seeking higher returns increases. However, elevated inflation can also dampen consumer spending, potentially impacting economic growth and the dollar’s strength.

Global Trade Dynamics

The global trade environment also plays a significant role in the dollar’s performance. A strong dollar can make U.S. exports more expensive, potentially hurting trade balances. Conversely, a weaker dollar can boost exports, but also increase the cost of imported goods.

The dollar’s value can be influenced by geopolitical events, such as trade wars or global economic shocks, which can impact trade flows and currency valuations.

Key Economic Events and their Potential Impact

- Jobs Report (July 7):This report will provide insights into the health of the U.S. labor market. A strong jobs report could reinforce expectations of continued interest rate hikes, supporting the dollar. However, a weak report could raise concerns about economic growth and potentially weaken the dollar.

- Inflation Data (July 12):The Consumer Price Index (CPI) report will provide updates on inflation trends. A decline in inflation could signal that the Fed might slow its rate hikes, potentially putting downward pressure on the dollar. Conversely, persistent inflation could fuel further rate increases, bolstering the dollar.

- Federal Reserve Meeting (July 25-26):The Fed’s monetary policy decisions will be closely watched. Any indications of a more hawkish stance on interest rates could strengthen the dollar. However, a more dovish approach, suggesting a pause or slowdown in rate hikes, could weaken the dollar.

Global Currency Dynamics

The dollar’s recent surge has impacted global currency markets, causing significant shifts in exchange rates. Understanding these dynamics is crucial for investors, traders, and businesses operating in a globalized world.

Currency Pair Performance and Drivers, Dollar heading for biggest weekly rise since may before jobs report

The recent performance of the dollar against other major currencies reflects a complex interplay of economic, geopolitical, and market sentiment factors. The dollar’s strength has been fueled by a combination of factors, including the Federal Reserve’s hawkish monetary policy, a resilient US economy, and safe-haven demand during periods of global uncertainty.Here’s a table summarizing the key currency pairs and their recent performance, highlighting the underlying reasons for their movements:

| Currency Pair | Recent Performance | Underlying Drivers |

|---|---|---|

| USD/EUR | Dollar appreciation | Widening interest rate differentials between the US and Eurozone, concerns about the European economy, and geopolitical tensions in Europe. |

| USD/JPY | Dollar appreciation | Safe-haven demand for the dollar during periods of global uncertainty, widening interest rate differentials between the US and Japan, and a weaker Japanese yen due to the Bank of Japan’s accommodative monetary policy. |

| USD/GBP | Dollar appreciation | Concerns about the UK economy, political uncertainty in the UK, and a weaker British pound due to the Bank of England’s cautious monetary policy. |

| USD/CHF | Dollar appreciation | Safe-haven demand for the dollar during periods of global uncertainty, and a weaker Swiss franc due to the Swiss National Bank’s accommodative monetary policy. |

Implications for Global Trade and Investment

The dollar’s strength has significant implications for global trade and investment. For US exporters, a strong dollar makes their goods more expensive in foreign markets, potentially reducing demand and hurting their competitiveness. Conversely, US importers benefit from a strong dollar, as they can purchase foreign goods at lower prices.For investors, a strong dollar can make foreign investments less attractive, as the returns from those investments are likely to be lower when converted back into US dollars.

Conversely, US investors may find it more attractive to invest in foreign assets, as their value will increase when converted back into US dollars.The impact of the dollar’s strength on global trade and investment is complex and can vary depending on the specific sector and country.

However, it is clear that the dollar’s recent surge has created a challenging environment for businesses and investors operating in a globalized world.