What to Expect in December: 3 Things Affecting the Stock Market

What to expect in december 3 things that could affect the stock market – December is often a time of anticipation, and this year is no different, especially when it comes to the stock market. With the holiday season approaching, investors are closely watching for key economic indicators, potential geopolitical events, and the upcoming corporate earnings season.

These factors could significantly impact market performance and shape investor sentiment.

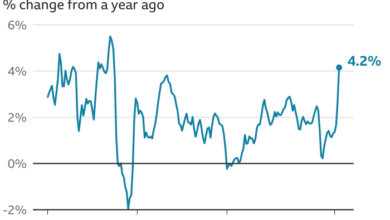

The December economic calendar is packed with important data releases, including the Consumer Price Index (CPI), Producer Price Index (PPI), and retail sales figures. These reports will provide valuable insights into the health of the economy and could influence the Federal Reserve’s monetary policy decisions.

Additionally, geopolitical events, such as trade tensions or international conflicts, can create uncertainty and volatility in the market. Finally, the corporate earnings season is a crucial period for investors, as companies release their financial results for the quarter. Earnings reports can reveal valuable information about a company’s performance and future prospects, which can impact stock prices.

Economic Data Releases: What To Expect In December 3 Things That Could Affect The Stock Market

December is a crucial month for economic data releases, which can significantly influence investor sentiment and market direction. Key data points to watch include the Consumer Price Index (CPI), Producer Price Index (PPI), and retail sales figures. These indicators provide insights into inflation, production costs, and consumer spending, offering valuable clues about the health of the economy.

December is shaping up to be a volatile month for the stock market. We’re likely to see a lot of movement based on interest rate decisions, inflation reports, and consumer spending patterns. For example, news of more cars sold in the US this November with prices dropping a bit could signal a shift in consumer confidence, which could have a ripple effect on the market.

Keep your eyes peeled for these key indicators as they could paint a clearer picture of what to expect in the coming months.

The Consumer Price Index (CPI)

The CPI measures changes in the prices of goods and services purchased by urban consumers. It is a key indicator of inflation, and its movements can influence investor expectations about the Federal Reserve’s monetary policy.

December is shaping up to be an interesting month for the stock market. The Fed’s rate decisions, inflation data, and the upcoming holiday season will all play a role in how things unfold. While Wall Street is anticipating a positive start to the month, the Jackson Hole symposium and Nvidia’s earnings report are likely to be major catalysts for market movement.

Ultimately, December’s performance will hinge on these factors and how investors react to them.

A higher-than-expected CPI reading could signal persistent inflationary pressures, potentially leading to further interest rate hikes by the Fed. Conversely, a lower-than-expected reading might suggest that inflation is easing, potentially prompting the Fed to adopt a less hawkish stance.

December is shaping up to be an interesting month for the stock market. We’re likely to see volatility driven by inflation data, the Fed’s interest rate decisions, and, of course, any surprises from the geopolitical landscape. Speaking of surprises, Elon Musk’s recent announcement of Tesla’s interest in investing in India after meeting with PM Modi elon musk announces teslas interest in investing in india after meeting with pm modi could significantly impact the automotive sector and potentially influence global investor sentiment.

All eyes will be on these factors as we navigate the final stretch of 2023.

The Producer Price Index (PPI)

The PPI tracks changes in the prices of goods and services sold by domestic producers. It provides insights into the cost pressures faced by businesses, which can influence their pricing decisions and profit margins.

A sharp rise in the PPI could indicate that businesses are facing higher input costs, potentially leading to higher prices for consumers. This could contribute to inflationary pressures and affect consumer spending patterns.

Retail Sales Figures

Retail sales data provides insights into consumer spending, a major driver of economic growth. This data point can reveal the health of the consumer sector and its impact on overall economic activity.

Strong retail sales figures could indicate a robust economy with healthy consumer confidence. Conversely, weak retail sales might suggest a slowdown in consumer spending, potentially impacting business growth and employment.

Geopolitical Events

Geopolitical events can significantly influence the stock market, particularly in December, as investors assess the year’s performance and anticipate potential shifts in the global landscape. These events can introduce uncertainty and volatility, impacting investor sentiment and risk appetite.

Global Trade Tensions

The ongoing trade tensions between major economies, such as the United States and China, remain a key geopolitical risk. These tensions can lead to increased tariffs, trade barriers, and disruptions in global supply chains. The impact on the stock market can be significant, as businesses operating in affected sectors may experience reduced profits and growth.

For example, the US-China trade war in 2018 and 2019 led to market volatility and concerns about global economic growth.

International Conflicts

International conflicts, such as the ongoing war in Ukraine, can also have a significant impact on the stock market. These conflicts can disrupt global energy markets, increase geopolitical uncertainty, and lead to economic sanctions. For instance, the war in Ukraine has resulted in higher energy prices and supply chain disruptions, impacting global markets.

Political Instability

Political instability in key regions, such as the Middle East or Latin America, can also influence the stock market. Political unrest, elections, or changes in government can create uncertainty and volatility. For example, the 2011 Arab Spring uprisings led to significant market volatility and economic uncertainty in the region.

Corporate Earnings Season

December marks the start of a crucial period for investors: the fourth-quarter earnings season. This period, where companies publicly release their financial performance for the final quarter of the year, can significantly impact stock market movements.

Impact of Earnings Reports on the Stock Market

Earnings reports are a key indicator of a company’s financial health and future prospects. Positive earnings surprises, where companies exceed analysts’ expectations, can lead to a surge in stock prices. Conversely, negative surprises, where companies fall short of expectations, can trigger sell-offs.

This dynamic can significantly impact the broader market, especially for companies with a large market capitalization or those considered bellwethers in their respective sectors.

Earnings Expectations and Surprises, What to expect in december 3 things that could affect the stock market

Investors closely monitor earnings expectations, which are often compiled by analysts and financial institutions. These expectations serve as a benchmark against which actual earnings are compared. When a company beats expectations, it can signal strong performance and a positive outlook, boosting investor confidence and driving up stock prices.

Conversely, a company falling short of expectations can raise concerns about its financial health and future prospects, leading to a decline in stock prices.

“Earnings season is a time when investors pay close attention to the performance of companies, as it provides valuable insights into their financial health and future prospects.”