Bitcoin ETFs: Pros, Cons, and Investment Insights

Bitcoin etfs pros cons and investment insights – Bitcoin ETFs: Pros, Cons, and Investment Insights have taken the financial world by storm, offering a new avenue for investors to access the volatile yet potentially rewarding world of cryptocurrencies. These exchange-traded funds (ETFs) provide a way to invest in Bitcoin without directly purchasing the digital asset, offering a level of accessibility and diversification that has attracted a wide range of investors.

This exploration delves into the intricacies of Bitcoin ETFs, examining the advantages and disadvantages they present. We’ll uncover the potential benefits of investing in Bitcoin through ETFs, including enhanced diversification and risk management, along with the ease of access and convenience they offer compared to direct Bitcoin investments.

However, we’ll also analyze the potential drawbacks, such as higher fees, regulatory uncertainty, and market volatility. This analysis will provide a comprehensive understanding of the Bitcoin ETF landscape, empowering investors to make informed decisions about their investment strategies.

Bitcoin ETFs

Bitcoin ETFs, or Bitcoin Exchange-Traded Funds, are investment funds that track the price of Bitcoin. They allow investors to gain exposure to Bitcoin without directly buying and holding the cryptocurrency.Bitcoin ETFs function similarly to traditional ETFs, offering a convenient and regulated way to invest in a specific asset class.

These funds pool money from multiple investors to purchase Bitcoin, and the fund’s shares are then traded on an exchange like stocks.

A Brief History of Bitcoin ETFs, Bitcoin etfs pros cons and investment insights

The concept of Bitcoin ETFs has been around for several years, with proponents arguing for their benefits in providing a regulated and accessible way to invest in Bitcoin. However, regulatory hurdles and concerns about Bitcoin’s volatility have slowed their adoption.

- Early Attempts:In 2013, the Winklevoss twins, known for their involvement with Facebook, filed an application with the Securities and Exchange Commission (SEC) for a Bitcoin ETF. However, their application was rejected, citing concerns about market manipulation and the lack of a regulated Bitcoin market.

Bitcoin ETFs offer a convenient way to gain exposure to the cryptocurrency market, but investors should consider the pros and cons before diving in. While they provide diversification and potential for growth, the volatility of Bitcoin can lead to significant losses.

Speaking of unexpected moves, it’s interesting to see how the political landscape is being influenced by platforms like TikTok, as exemplified by US Republican presidential candidate Vivek Ramaswamy joining TikTok amid controversy. Ultimately, understanding the risks and rewards is crucial for any investment, whether it’s Bitcoin ETFs or exploring the political ramifications of social media platforms.

- Continued Efforts:Despite early setbacks, numerous other companies continued to pursue Bitcoin ETFs, facing similar challenges and delays. The SEC remained cautious, expressing concerns about the potential for market manipulation, investor protection, and the overall maturity of the Bitcoin market.

- First Approvals:In 2021, the SEC finally approved the first Bitcoin futures ETFs, which track Bitcoin futures contracts rather than the underlying cryptocurrency itself.

These ETFs, like the ProShares Bitcoin Strategy ETF (BITO), allowed investors to gain indirect exposure to Bitcoin through futures contracts.

Advantages of Bitcoin ETFs: Bitcoin Etfs Pros Cons And Investment Insights

Bitcoin exchange-traded funds (ETFs) offer investors a convenient and regulated way to gain exposure to the volatile cryptocurrency market. While direct Bitcoin investments provide full ownership, ETFs offer advantages in terms of accessibility, diversification, and risk management.

Diversification and Risk Management

Bitcoin ETFs allow investors to diversify their portfolios by including a portion of their holdings in Bitcoin, without the need for direct cryptocurrency trading. This diversification helps mitigate risk, as the performance of Bitcoin is not directly correlated with traditional assets like stocks and bonds.

Bitcoin ETFs offer a convenient way to invest in the digital asset, but they come with their own set of pros and cons. One factor to consider is the broader macroeconomic environment, like the recent surge in Canadian stocks, fueled by speculation about a potential pause in the Fed’s rate hikes, as highlighted in this article canadian stocks surge as speculation grows of fed rate hike pause.

This kind of market volatility can impact the price of Bitcoin, and in turn, the performance of Bitcoin ETFs. Ultimately, understanding the risks and potential rewards associated with these ETFs is crucial for making informed investment decisions.

By spreading investments across different asset classes, investors can potentially reduce overall portfolio volatility and enhance risk-adjusted returns.

“Diversification is key to managing risk in any investment portfolio. Bitcoin ETFs allow investors to diversify their portfolios without having to directly buy and store Bitcoin.”

Disadvantages of Bitcoin ETFs

While Bitcoin ETFs offer a convenient way to gain exposure to the cryptocurrency market, they also come with certain disadvantages. It’s crucial to understand these potential drawbacks before investing in a Bitcoin ETF.

Higher Fees and Expense Ratios

Bitcoin ETFs typically charge higher fees compared to traditional ETFs. These fees include management fees, trading expenses, and custody costs associated with holding and securing Bitcoin. High fees can significantly impact your returns over time, especially for long-term investments.

For example, the ProShares Bitcoin Strategy ETF (BITO) charges an expense ratio of 0.95%, which is considerably higher than many traditional ETFs.

Higher fees and expense ratios can eat into your profits, so it’s essential to compare the fees of different Bitcoin ETFs before making a decision.

Regulatory Uncertainty and Market Volatility

The cryptocurrency market is known for its volatility, and Bitcoin is no exception. The price of Bitcoin can fluctuate significantly, even within a single day. This volatility can make it challenging to time your investments and can lead to significant losses.

For instance, in 2022, the price of Bitcoin experienced a sharp decline, dropping from its all-time high of nearly $69,000 to below $20,000 within a few months.

Furthermore, the regulatory landscape surrounding cryptocurrencies is still evolving. This uncertainty can create challenges for Bitcoin ETFs and may lead to potential legal and regulatory risks.

Bitcoin ETFs offer a way to gain exposure to the cryptocurrency market without directly holding Bitcoin. While they offer convenience and potential for growth, they also come with fees and potential regulatory risks. All of this is happening as the stock market is roiled by a shocking September jobs report, putting the Federal Reserve in a tough spot as they weigh interest rate hikes.

This broader economic uncertainty could also impact the future of Bitcoin ETFs, making it crucial to carefully consider your investment goals and risk tolerance before diving in.

Tracking Errors and Price Discrepancies

Bitcoin ETFs aim to track the price of Bitcoin, but there can be discrepancies between the ETF’s price and the actual Bitcoin price. These tracking errors can arise due to factors like trading costs, fund management fees, and the ETF’s trading strategy.

For example, the price of a Bitcoin ETF might be slightly higher or lower than the actual Bitcoin price due to these factors.

Tracking errors can impact your returns and might not reflect the true performance of Bitcoin. It’s important to research the ETF’s tracking record and understand how it manages tracking errors before investing.

Investment Insights

The Bitcoin ETF market is evolving rapidly, offering investors diverse options to gain exposure to the digital asset. Understanding the landscape and comparing different ETFs is crucial for making informed investment decisions.

Bitcoin ETF Market Landscape

The Bitcoin ETF market is characterized by a growing number of products with varying features and strategies. This diversity provides investors with a range of choices to align with their risk tolerance and investment goals.

Comparison of Bitcoin ETFs

- Spot Bitcoin ETFs: These ETFs track the price of Bitcoin directly, offering a straightforward way to invest in the digital asset. Examples include the Purpose Bitcoin ETF (BTCC) and the ProShares Bitcoin Strategy ETF (BITO).

- Futures-Based Bitcoin ETFs: These ETFs invest in Bitcoin futures contracts, which are agreements to buy or sell Bitcoin at a predetermined price and date. They provide exposure to Bitcoin but may not perfectly track its spot price due to the roll-over process.

Examples include the ProShares Bitcoin Strategy ETF (BITO) and the VanEck Bitcoin Strategy ETF (XBTF).

- Bitcoin Mining ETFs: These ETFs invest in companies involved in Bitcoin mining, offering indirect exposure to the digital asset. Examples include the Global X Bitcoin Miners ETF (BIMI) and the Amplify Transformational Data Sharing ETF (BLOK).

Key Characteristics of Prominent Bitcoin ETFs

| ETF | Type | Underlying Asset | Expense Ratio | Trading Symbol |

|---|---|---|---|---|

| Purpose Bitcoin ETF (BTCC) | Spot Bitcoin ETF | Bitcoin | 1.00% | BTCC |

| ProShares Bitcoin Strategy ETF (BITO) | Futures-Based Bitcoin ETF | Bitcoin Futures Contracts | 0.95% | BITO |

| VanEck Bitcoin Strategy ETF (XBTF) | Futures-Based Bitcoin ETF | Bitcoin Futures Contracts | 0.65% | XBTF |

| Global X Bitcoin Miners ETF (BIMI) | Bitcoin Mining ETF | Shares of Bitcoin Mining Companies | 0.50% | BIMI |

Investment Strategies and Considerations

- Risk Tolerance: Consider your risk tolerance before investing in Bitcoin ETFs. Bitcoin is a volatile asset, and its price can fluctuate significantly.

- Investment Horizon: Bitcoin ETFs are suitable for long-term investors who believe in the future of Bitcoin. Short-term traders may find the volatility of Bitcoin ETFs challenging.

- Fees and Expenses: Compare the expense ratios of different Bitcoin ETFs to find the most cost-effective option.

- Regulatory Landscape: The regulatory environment for Bitcoin ETFs is evolving, and it’s important to stay informed about any changes that could impact your investment.

Future of Bitcoin ETFs

The Bitcoin ETF market is still relatively young, but it has shown tremendous growth potential. As regulatory frameworks evolve and investor interest in Bitcoin continues to grow, we can expect to see further expansion and innovation in this space.

Regulatory Changes and Investor Sentiment

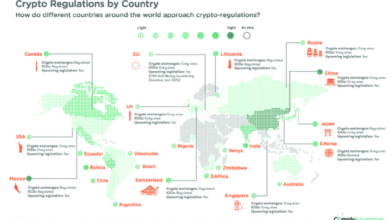

Regulatory clarity is crucial for the growth of any financial product, and Bitcoin ETFs are no exception. As regulatory bodies around the world become more comfortable with cryptocurrencies, we can expect to see more approvals for Bitcoin ETFs, which will likely lead to increased investor confidence and participation.

Potential for New and Innovative Bitcoin ETF Products

The Bitcoin ETF market is constantly evolving, with new and innovative products emerging all the time. For example, some ETFs are designed to track the performance of Bitcoin futures contracts, while others track the performance of Bitcoin mining companies. This diversity of product offerings provides investors with a wider range of options to choose from, based on their individual investment goals and risk tolerance.

Long-Term Outlook for Bitcoin ETFs

Bitcoin ETFs have the potential to play a significant role in the future of the cryptocurrency ecosystem. By providing investors with a regulated and accessible way to invest in Bitcoin, ETFs can help to increase the adoption and mainstream acceptance of cryptocurrencies.