Big Week Ahead: Inflation, Jobs, Chinas Impact on US Wall Street

Big week ahead inflation jobs and chinas impact on us wall street – Big Week Ahead: Inflation, Jobs, China’s Impact on US Wall Street takes center stage this week, as investors brace themselves for a barrage of economic data that could shape the trajectory of markets. From inflation and job reports to China’s economic performance and its impact on the US, this week promises to be a volatile one.

We’ll dive into the key economic indicators to watch, analyze the potential investment strategies, and assess the risk factors that could impact the markets.

This week’s economic calendar is packed with key data releases that will provide insights into the health of the US economy and the global outlook. Inflation remains a top concern, and the upcoming consumer price index (CPI) report will be closely watched for signs of easing price pressures.

The labor market is another key focus, with the release of the nonfarm payrolls report expected to shed light on the strength of the job market and provide clues about the Federal Reserve’s future interest rate decisions.

Economic Outlook

This week, investors will be closely watching key economic indicators that could provide insights into the trajectory of the US economy. Inflation data, job reports, and China’s economic performance are all expected to influence market sentiment and the direction of the stock market.

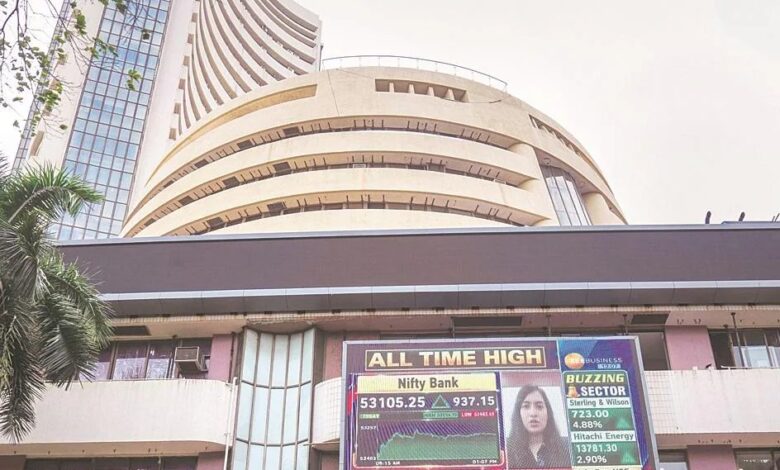

It’s a big week ahead for Wall Street, with inflation, jobs, and China’s impact on the US economy all taking center stage. The market is bracing for a potential decline, with chip stocks already faltering, as investors await Powell’s speech for clues about the Fed’s next move.

This article dives deeper into the market’s anxieties and what to expect in the coming days. With so much at stake, this week will be crucial for determining the direction of the US stock market in the near future.

Inflation’s Impact on the US Economy

The release of inflation data this week will be a crucial event for investors. The Federal Reserve’s (Fed) aggressive monetary policy tightening, aimed at curbing inflation, has raised concerns about the potential for a recession. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, will provide insights into the effectiveness of the Fed’s policies and the persistence of inflation.

If inflation figures show a continued decline, it could ease pressure on the Fed to raise interest rates further, potentially boosting investor confidence. Conversely, persistent or rising inflation could signal a more hawkish Fed stance, leading to increased volatility in the stock market.

Impact of Job Reports on Market Sentiment

The labor market remains a key area of focus for investors, as it provides insights into the health of the US economy. The upcoming job reports, including the Nonfarm Payrolls report, will be scrutinized for signs of a weakening labor market.

This week is shaping up to be a rollercoaster ride for Wall Street. Inflation numbers, job reports, and China’s economic impact are all on the agenda, but there’s another factor adding to the turbulence: Moody’s signals potential credit downgrades for six major US banks.

This news could send shockwaves through the financial system, further impacting investor sentiment and potentially exacerbating existing economic concerns. It’s going to be a wild ride, and keeping a close eye on these developments will be crucial for navigating the week ahead.

A strong job report, characterized by robust job growth and low unemployment, could support the view that the economy is resilient and able to withstand higher interest rates. However, a weak job report, with declining job growth or rising unemployment, could raise concerns about a potential recession and lead to a sell-off in the stock market.

US Stock Market Outlook

The US stock market has been experiencing volatility in recent months, driven by concerns about inflation, interest rates, and the global economic outlook. The S&P 500, a broad market index, has shown resilience, but it remains susceptible to shifts in investor sentiment.

The market’s performance this week will depend on the interplay of various factors, including the inflation data, job reports, and global economic conditions.

If economic indicators point to a moderation in inflation and a resilient labor market, the stock market could experience a rebound. However, if data suggests persistent inflation or a weakening economy, the market could face further downward pressure.

China’s Influence: Big Week Ahead Inflation Jobs And Chinas Impact On Us Wall Street

China’s economic trajectory is intrinsically linked to the US, creating a complex web of interdependence that shapes global markets. Understanding China’s current economic landscape and its potential impact on the US is crucial for investors and policymakers alike.

China’s Economic Situation and Its Impact on the US

China’s economic growth has slowed in recent years, facing headwinds from the pandemic, a property market slowdown, and a weakening global economy. This slowdown could impact the US in several ways. * Reduced Demand for US Exports:China is a major market for US goods and services.

A slower Chinese economy could lead to reduced demand for US exports, potentially impacting US manufacturing and employment.

Supply Chain Disruptions China plays a vital role in global supply chains. Any disruptions in Chinese production could ripple through the US economy, leading to shortages and higher prices.

Impact on Global Markets China’s economic performance influences global market sentiment. A slowdown in China could trigger a broader market correction, impacting US stocks and other investments.

China’s Trade Policies and Geopolitical Maneuvers

China’s trade policies and geopolitical maneuvers have significant implications for Wall Street. * Trade Tensions:The US-China trade war has created uncertainty for businesses and investors. Tariffs and other trade barriers have disrupted supply chains and raised costs for consumers.

Currency Manipulation China’s currency policy can impact the value of the US dollar, affecting the competitiveness of US exports and potentially influencing US monetary policy.

Investment Restrictions China’s restrictions on foreign investment in certain sectors can limit US companies’ access to the Chinese market, impacting their growth and profitability.

China’s Economic Performance and Global Markets

China’s economic performance is a key driver of global markets. * Global Growth:China’s economic growth has been a major factor in global economic expansion. A slowdown in China could weaken global growth prospects, impacting investor confidence and asset prices.

Commodity Prices China’s demand for commodities like oil and copper has a significant impact on global prices. A decline in Chinese demand could lead to lower commodity prices, affecting energy and mining companies.

It’s a big week ahead, with inflation, jobs, and China’s impact on US Wall Street dominating the headlines. But while we’re glued to the global economic rollercoaster, it’s worth remembering that the money game is alive and well elsewhere, like in the booming world of Indian cricket.

The IPL is a massive financial force, showcasing the power of sports to generate revenue and attract global investment, even amidst economic uncertainties. So, while we navigate the complex world of Wall Street, let’s not forget the exciting financial plays happening in the world of sports.

Investment Flows China’s economic performance influences investment flows across the globe. A slowdown in China could lead to a decrease in investment in emerging markets, including those in the US.

Key Economic Indicators

This week, investors will be closely watching a handful of key economic indicators that could provide insights into the health of the U.S. economy and the trajectory of inflation. These indicators will offer valuable clues about the Federal Reserve’s future monetary policy decisions and their potential impact on financial markets.

Inflation Data

The Consumer Price Index (CPI) and the Producer Price Index (PPI) are two of the most closely watched inflation indicators. The CPI measures changes in the prices of goods and services purchased by urban consumers, while the PPI tracks changes in the prices of goods and services produced by domestic producers.

Both indices are important indicators of inflation, and their movements can have a significant impact on investor sentiment.

A sustained rise in inflation can erode purchasing power, leading to higher interest rates and slower economic growth. Conversely, a decline in inflation can boost consumer confidence and lead to increased spending.

Employment Data

The weekly jobless claims report and the monthly nonfarm payrolls report are two key indicators of the health of the labor market. The jobless claims report provides a snapshot of the number of Americans filing for unemployment benefits. A decline in jobless claims typically indicates a strong labor market, while an increase suggests weakness.

The nonfarm payrolls report provides a broader picture of job creation in the U.S. economy. A strong jobs report can boost investor confidence and support economic growth, while a weak report can signal concerns about the economy’s health.

The Federal Reserve closely monitors employment data as it considers interest rate adjustments. A strong labor market can support higher interest rates, while a weak labor market can push for lower rates.

Manufacturing Data

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) is a key indicator of the health of the manufacturing sector. The PMI is a composite index based on surveys of purchasing managers at manufacturing companies. A reading above 50 indicates expansion in the manufacturing sector, while a reading below 50 indicates contraction.

The PMI can provide insights into the overall health of the U.S. economy, as manufacturing is a significant component of GDP.

A strong manufacturing sector can boost economic growth and support investment in the stock market. Conversely, a weak manufacturing sector can signal economic weakness and lead to lower stock prices.

Table of Key Economic Releases

| Indicator | Release Date | Expected Impact | Potential Market Reaction |

|---|---|---|---|

| Consumer Price Index (CPI) | [Release Date] | Inflation data will provide insights into the pace of price increases. | Higher-than-expected inflation could lead to increased volatility in the stock market and a rise in bond yields. Lower-than-expected inflation could lead to a decline in bond yields and support stock prices. |

| Producer Price Index (PPI) | [Release Date] | PPI data will provide insights into inflationary pressures at the wholesale level. | Similar to CPI, a higher-than-expected PPI could lead to increased volatility in the stock market and a rise in bond yields. A lower-than-expected PPI could lead to a decline in bond yields and support stock prices. |

| Weekly Jobless Claims | [Release Date] | Jobless claims data will provide insights into the health of the labor market. | A decline in jobless claims could boost investor confidence and support stock prices. An increase in jobless claims could signal concerns about the economy’s health and lead to lower stock prices. |

| Nonfarm Payrolls | [Release Date] | Nonfarm payrolls data will provide insights into job creation in the U.S. economy. | A strong jobs report could boost investor confidence and support stock prices. A weak jobs report could signal concerns about the economy’s health and lead to lower stock prices. |

| ISM Manufacturing PMI | [Release Date] | Manufacturing PMI data will provide insights into the health of the manufacturing sector. | A strong manufacturing PMI could boost investor confidence and support stock prices. A weak manufacturing PMI could signal concerns about the economy’s health and lead to lower stock prices. |

Investor Strategies

Navigating the current market environment requires a thoughtful approach to investment strategies. Investors must consider the interplay of inflation, potential job market shifts, and China’s influence on the US economy while weighing the risks and potential rewards of various investment options.

Strategies for Market Volatility

Understanding the market volatility and its drivers is crucial for developing an effective investment strategy. This volatility is influenced by various factors, including inflation, interest rate changes, and geopolitical events.

- Diversification:A diversified portfolio can help mitigate risk by spreading investments across different asset classes, such as stocks, bonds, real estate, and commodities. This strategy aims to reduce the impact of any single asset class underperforming.

- Defensive Investments:In times of economic uncertainty, investors may consider allocating a portion of their portfolio to defensive investments. These investments are less susceptible to economic downturns and often provide a stable return. Examples include high-quality bonds, dividend-paying stocks, and gold.

- Active Management:Active management involves actively trading securities to capitalize on market opportunities and mitigate risks. This approach requires in-depth market analysis and expertise. However, it can be beneficial in volatile markets, where timing and selection are crucial.

- Passive Investing:Passive investing involves investing in index funds or exchange-traded funds (ETFs) that track a specific market index. This approach aims to match the performance of the underlying index, offering a low-cost and diversified way to invest.

Investment Portfolio Design, Big week ahead inflation jobs and chinas impact on us wall street

A hypothetical investment portfolio designed for the current market conditions could incorporate a balanced approach, considering the potential for inflation, interest rate hikes, and global economic uncertainties.

- Core Holdings:A significant portion of the portfolio could be allocated to core holdings, such as index funds or ETFs that track broad market indices like the S&P 500 or the Nasdaq 100. This provides a diversified exposure to the overall market.

- Fixed Income:A portion of the portfolio could be allocated to fixed income investments, such as bonds. These investments provide stability and income, particularly in a rising interest rate environment. Investors can choose from different bond maturities and credit ratings to manage risk and potential returns.

- Growth Stocks:Growth stocks, typically associated with companies expected to experience rapid growth, can offer potential for higher returns. However, they can also be more volatile. Investors may consider allocating a portion of their portfolio to growth stocks, particularly in sectors expected to benefit from long-term trends, such as technology or healthcare.

- Alternative Investments:Alternative investments, such as real estate, commodities, or private equity, can provide diversification and potential for higher returns. However, they often come with higher risks and liquidity challenges.

Risk Factors

This week, investors will be closely watching a number of potential risk factors that could impact market performance. These risks, ranging from geopolitical tensions to economic data releases, could influence investor sentiment and lead to market volatility. Understanding these risks is crucial for investors to make informed decisions and manage their portfolios effectively.

Potential Risk Factors

This section Artikels potential risk factors that could impact the markets this week, along with their likelihood and potential impact.

-

Geopolitical Tensions

The ongoing geopolitical tensions, particularly those related to the Russia-Ukraine conflict and the situation in the Middle East, remain a significant risk factor for global markets. Escalation of these conflicts could lead to increased uncertainty, disruptions in energy supplies, and higher inflation, impacting investor confidence and potentially leading to market declines.

- Likelihood: Moderate to High

- Potential Impact: Increased market volatility, potential decline in equity prices, and a surge in safe-haven assets like gold.

-

Inflation

Inflation remains a key concern for investors and central banks. The recent rise in inflation, driven by supply chain disruptions, strong consumer demand, and the war in Ukraine, has forced central banks to raise interest rates aggressively. Further unexpected increases in inflation could lead to more aggressive rate hikes, potentially slowing economic growth and impacting corporate earnings.

- Likelihood: Moderate

- Potential Impact: Increased market volatility, potential decline in equity prices, and a shift towards value stocks.

-

Economic Data Releases

The release of key economic data, such as the Consumer Price Index (CPI), Producer Price Index (PPI), and employment reports, can significantly influence market sentiment. Unexpectedly weak economic data could raise concerns about a potential recession, leading to market declines.

Conversely, strong data could boost investor confidence and support market gains.

- Likelihood: High

- Potential Impact: Increased market volatility, potential gains or declines in equity prices, and changes in interest rate expectations.

-

China’s Economic Slowdown

China’s economic slowdown, driven by strict Covid-19 lockdowns and a real estate crisis, poses a significant risk to global markets. A further deterioration in China’s economic performance could disrupt global supply chains, reduce demand for commodities, and negatively impact global growth.

- Likelihood: Moderate

- Potential Impact: Increased market volatility, potential decline in equity prices, and a decline in commodity prices.

-

Interest Rate Hikes

The Federal Reserve’s aggressive interest rate hikes are aimed at controlling inflation but could also slow economic growth. Further unexpected rate hikes could lead to a sharp decline in corporate earnings, impacting equity valuations and potentially triggering a market correction.

- Likelihood: Moderate

- Potential Impact: Increased market volatility, potential decline in equity prices, and a shift towards fixed income investments.