Forex US Dollar Strengthens as Consumer Prices Surprise

Forex US Dollar Strengthens as Consumer Prices Show Surprising Increase: The US dollar has been on a tear lately, strengthening against most major currencies. This unexpected rise is largely attributed to a surprising increase in consumer prices, indicating a potentially more persistent inflationary environment.

This development has significant implications for global markets, investors, and businesses alike.

The recent surge in inflation has caught many by surprise, as it deviates from the expected trajectory of price increases. This unexpected turn of events has prompted a reassessment of economic forecasts and sparked concerns about the potential for more aggressive interest rate hikes by the Federal Reserve.

The stronger dollar is a direct consequence of these concerns, as investors seek safe haven assets in a volatile economic landscape.

US Dollar Strengthens

The US dollar has been on a tear lately, strengthening against most major currencies. This move is driven by a combination of factors, including rising interest rates, a robust US economy, and safe-haven demand.

Impact of a Strong US Dollar

A strong US dollar has significant implications for global markets. It can make US exports more expensive and imports cheaper, impacting trade balances and competitiveness. For example, a stronger dollar can make US agricultural products less attractive to foreign buyers, potentially hurting farmers.

On the other hand, it can make imported goods, such as electronics or clothing, more affordable for US consumers.

Impact on Different Sectors of the Economy

A strong US dollar can affect different sectors of the economy in various ways:

- Manufacturing:A strong dollar can hurt US manufacturers who export their goods, as it makes their products more expensive in foreign markets. Conversely, it can benefit manufacturers who import raw materials or components, as these become cheaper.

- Tourism:A strong dollar can make the US a more expensive destination for foreign tourists, potentially reducing tourism revenue. On the other hand, it can make travel abroad more affordable for US residents.

- Finance:A strong dollar can attract foreign investment into the US, as investors seek to capitalize on the higher returns offered by US assets. This can lead to lower borrowing costs for US companies and consumers.

Consumer Price Increase

The recent surge in consumer prices has sent shockwaves through the global economy, raising concerns about inflation and its potential impact on businesses and consumers alike. The increase in prices is a complex phenomenon driven by a confluence of factors, including supply chain disruptions, strong consumer demand, and rising energy costs.

The US dollar is strengthening as consumer prices continue to climb, a trend that could have a ripple effect across global markets. This rise in inflation is causing investors to seek out safe haven assets, driving up demand for the dollar.

On a more positive note, the EU and New Zealand’s new free trade deal is projected to boost bilateral trade by 30%, potentially offsetting some of the negative economic impacts of inflation. The agreement aims to eliminate tariffs and streamline trade procedures, offering a glimmer of hope for businesses and consumers alike.

Whether this new deal will be enough to counter the strengthening dollar remains to be seen, but it’s a positive development in an otherwise turbulent economic landscape.

Key Drivers of Consumer Price Increase

The recent surge in consumer prices is a result of several key drivers, including:

- Supply Chain Disruptions:The COVID-19 pandemic has caused widespread disruptions to global supply chains, leading to shortages of goods and materials. This has driven up prices for manufacturers and retailers, who have passed these costs on to consumers.

- Strong Consumer Demand:As economies have reopened, consumer demand has rebounded strongly, leading to increased spending on goods and services. This has put upward pressure on prices, as businesses have sought to capitalize on the surge in demand.

- Rising Energy Costs:Energy prices have surged in recent months, driven by factors such as increased demand, geopolitical tensions, and supply chain disruptions. This has contributed to higher prices for goods and services, as businesses have had to pass on these higher costs to consumers.

- Government Stimulus Measures:Government stimulus measures, such as cash payments and expanded unemployment benefits, have increased consumer spending and contributed to inflationary pressures.

Comparison with Historical Trends

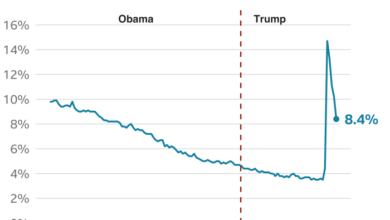

The current inflation rate is significantly higher than it has been in recent years. The Consumer Price Index (CPI) has been rising steadily since the beginning of 2021, and reached a 40-year high in 2022. This is a significant departure from the low inflation environment that prevailed in the years leading up to the pandemic.

Implications of Rising Inflation

Rising inflation can have a significant impact on consumer spending and business activity.

The US dollar is surging on the back of higher-than-expected inflation data, indicating a more hawkish stance from the Federal Reserve. This strengthens the greenback against other currencies, including the Pakistani Rupee. However, a glimmer of hope for Pakistan’s economy emerges as the IMF approves a $3 billion loan program , potentially stabilizing the Rupee and boosting economic prospects.

It’s a complex interplay of global economic forces, and it’s crucial to monitor both the strengthening dollar and Pakistan’s economic response to this new IMF support.

- Reduced Consumer Spending:Rising inflation erodes purchasing power, as consumers have to pay more for the same goods and services. This can lead to a decrease in consumer spending, as households adjust their budgets to account for higher prices.

- Increased Business Costs:Businesses are also affected by rising inflation, as they face higher costs for raw materials, labor, and other inputs. This can lead to higher prices for consumers, as businesses pass on these increased costs to stay profitable.

- Uncertainty and Volatility:Rising inflation can create uncertainty and volatility in the economy, as businesses and consumers adjust to changing price levels. This can make it difficult for businesses to plan for the future and can discourage investment.

Impact of Inflation on Forex

Inflation, a persistent increase in the general price level of goods and services, has a significant impact on currency values in the foreign exchange (forex) market. Understanding this relationship is crucial for investors and traders seeking to navigate the complexities of global currency markets.

Impact of Inflation on Currency Value

Inflation erodes the purchasing power of a currency. When prices rise, the same amount of money buys fewer goods and services. This decline in purchasing power can lead to a depreciation of the currency’s value.

The US dollar is getting a boost as inflation figures came in hotter than expected, but that doesn’t seem to be impacting oil prices much. Despite OPEC’s efforts to restrain supply, oil prices are dipping , suggesting that traders are more focused on the global economic outlook than the immediate supply squeeze.

This could mean that the dollar’s strength is more about a flight to safety than a reflection of a robust US economy.

“A higher inflation rate in a country typically leads to a weaker currency.”

For example, if the United States experiences higher inflation than other major economies, the US dollar may weaken against those currencies. This is because investors and traders anticipate that the dollar’s purchasing power will decline faster than other currencies, making them less attractive to hold.

Impact of Inflation Data on Forex Market

Inflation data, such as the Consumer Price Index (CPI), is closely watched by forex market participants. When inflation data surprises to the upside, as in the recent case of the US CPI report, it can trigger a strengthening of the US dollar.

This is because the data suggests that inflation pressures are more persistent than expected, potentially leading to more aggressive monetary tightening by the Federal Reserve.

“A surprise increase in inflation data can lead to a strengthening of the currency as investors anticipate higher interest rates.”

Conversely, if inflation data comes in lower than expected, it can lead to a weakening of the currency. This is because investors may anticipate less aggressive monetary policy tightening, potentially leading to lower interest rates.

US Dollar Performance Against Other Major Currencies

The following table shows the performance of the US dollar against other major currencies in recent months:| Currency | 3-Month Change | 6-Month Change ||—|—|—|| Euro (EUR) | +2.5% | +5.0% || Japanese Yen (JPY) | +10.0% | +15.0% || British Pound (GBP) | +3.0% | +6.0% || Canadian Dollar (CAD) | +1.0% | +2.0% || Australian Dollar (AUD) |

- 2.0% |

- 4.0% |

As the table shows, the US dollar has generally strengthened against other major currencies in recent months, driven by higher inflation and expectations of continued monetary tightening by the Federal Reserve.

Outlook for the US Dollar

The recent surge in inflation has injected uncertainty into the future trajectory of the US dollar. Economists and analysts are divided on whether the greenback will continue its upward climb or experience a correction in the coming months.

Potential Risks and Opportunities

The strength of the US dollar presents both risks and opportunities for investors and businesses. A strong dollar can make US exports more expensive, potentially harming American businesses operating in global markets. However, it can also make foreign investments in the US more attractive, potentially boosting capital inflows.

Key Economic Events

Several key economic events in the coming months could significantly impact the US dollar.

- The Federal Reserve’s monetary policy decisions will be crucial. If the Fed continues to raise interest rates aggressively to combat inflation, the dollar could strengthen further. However, if the Fed signals a more dovish stance, the dollar could weaken.

- The US economic growth outlook is another critical factor. If the US economy shows signs of slowing down, the dollar could weaken as investors seek safer havens in other currencies. Conversely, if the US economy continues to grow, the dollar could remain strong.

- Geopolitical developments, particularly the ongoing war in Ukraine, could also influence the US dollar. If the conflict escalates, the dollar could benefit from its safe-haven status. However, if the conflict de-escalates, the dollar could weaken.

Implications for Investors: Forex Us Dollar Strengthens As Consumer Prices Show Surprising Increase

A strengthening US dollar can have significant implications for investors, particularly those with international investments or exposure to foreign currencies. The rise in the US dollar can impact portfolio returns and create currency risk. Understanding these implications and adopting appropriate strategies can help investors navigate the changing market dynamics and protect their investments.

Investment Strategies to Mitigate the Impact of a Strong US Dollar

Investors can employ several strategies to mitigate the impact of a strong US dollar on their portfolios. These strategies aim to reduce currency risk and potentially enhance returns.

- Diversify Investments:Diversifying investments across different asset classes and geographies can help reduce the impact of a strong US dollar. Investors can consider allocating a portion of their portfolio to non-US dollar assets, such as international stocks, bonds, or real estate.

This can help offset potential losses from a weakening foreign currency.

- Currency Hedging:Currency hedging involves using financial instruments, such as forward contracts or options, to lock in an exchange rate for a future transaction. This can help protect against adverse currency movements and mitigate potential losses. For example, an investor with a foreign stock portfolio can use forward contracts to lock in a favorable exchange rate when selling the stocks back into US dollars.

- Invest in US Dollar-Denominated Assets:Investing in assets denominated in US dollars, such as US Treasury bonds or US real estate, can provide a natural hedge against a strengthening US dollar. As the US dollar strengthens, these assets tend to appreciate in value, potentially offsetting losses in other investments.

Potential Opportunities for Investors in Different Asset Classes, Forex us dollar strengthens as consumer prices show surprising increase

A strong US dollar can create both challenges and opportunities for investors in different asset classes.

- International Stocks:A strengthening US dollar can make foreign stocks less attractive to US investors as their value declines when converted back to US dollars. However, investors may find opportunities in undervalued foreign stocks, particularly in emerging markets where currencies may be weaker than the US dollar.

- Commodities:Commodities, such as oil and gold, are often priced in US dollars. A strong US dollar can make commodities more expensive for foreign buyers, potentially leading to lower demand and lower prices. However, investors can consider hedging strategies to mitigate this risk or look for opportunities in commodities that are priced in currencies other than the US dollar.

- Bonds:US dollar-denominated bonds may offer higher returns as the US dollar strengthens, but foreign bonds can be more volatile and may suffer from currency depreciation. Investors can consider diversifying their bond portfolio across different currencies to manage risk.

Examples of How Investors Can Hedge Against Currency Risk

Investors can employ various strategies to hedge against currency risk, including:

- Forward Contracts:Forward contracts are agreements to buy or sell a currency at a predetermined exchange rate on a future date. This can help lock in a favorable exchange rate and protect against potential losses. For example, an investor with a foreign stock portfolio can enter into a forward contract to sell the foreign currency at a specific rate when selling the stocks back into US dollars.

- Options:Options contracts give the holder the right, but not the obligation, to buy or sell a currency at a specific price on or before a certain date. This can provide downside protection against adverse currency movements while still allowing for potential upside gains.

For example, an investor with a foreign stock portfolio can buy put options on the foreign currency, which would give them the right to sell the currency at a specific price if it weakens.

- Currency ETFs:Currency exchange-traded funds (ETFs) track the performance of specific currencies or currency pairs. Investors can use ETFs to gain exposure to foreign currencies without directly investing in them. For example, an investor can invest in a US dollar-denominated ETF that tracks the euro to benefit from a potential rise in the euro against the US dollar.