Bank of America Stays Bullish on Stocks Despite Bearish Market

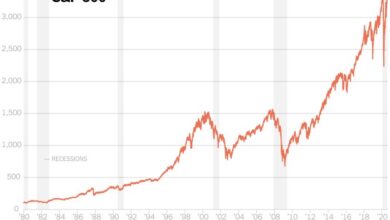

Bank of America maintains bullish outlook for stocks amidst bearish sentiments, a stance that has sparked debate among investors. While many are concerned about rising inflation, interest rates, and geopolitical uncertainties, Bank of America sees a silver lining. Their optimism stems from a combination of factors, including a strong economy, robust corporate earnings, and the potential for continued growth in certain sectors.

This conflicting outlook has created a dynamic market environment, leaving investors wondering which path to take.

This article delves into Bank of America’s reasoning behind their bullish stance, contrasting it with the prevailing bearish sentiment. We’ll explore the economic indicators driving these opposing views, analyze their implications for investors, and discuss the potential long-term outlook for the stock market.

Long-Term Outlook: Bank Of America Maintains Bullish Outlook For Stocks Amidst Bearish Sentiments

Predicting the future of the stock market is a challenging endeavor, even for seasoned investors. However, analyzing historical trends, understanding current economic conditions, and considering potential future events can help us form a reasoned long-term outlook. While the short-term market fluctuations are influenced by a myriad of factors, the long-term trajectory is often driven by fundamental economic drivers and global events.

Factors Shaping the Long-Term Market Trajectory

Understanding the key factors that influence the long-term stock market performance is crucial for investors. These factors provide insights into potential opportunities and risks, guiding investment decisions.

- Economic Growth:A robust and sustainable economic growth rate is a primary driver of stock market performance. Strong economic growth often translates into higher corporate profits, leading to increased stock valuations. Conversely, economic downturns can negatively impact corporate earnings, leading to stock market declines.

- Interest Rates:Interest rates play a crucial role in shaping investment decisions. Lower interest rates encourage borrowing and investment, potentially boosting economic growth and stock market performance. Conversely, higher interest rates can make borrowing more expensive, potentially slowing down economic activity and impacting stock prices.

- Inflation:Inflation erodes the purchasing power of money, potentially impacting corporate profits and stock valuations. High inflation can lead to increased uncertainty, making investors cautious and potentially pushing down stock prices. Conversely, low and stable inflation is generally considered favorable for stock market growth.

- Technological Advancements:Technological innovations can create new industries, drive economic growth, and boost corporate profits. Companies at the forefront of technological advancements often experience significant stock price appreciation. However, technological disruptions can also pose risks to established industries, potentially impacting their stock valuations.

- Geopolitical Events:Global events, such as wars, political instability, and trade disputes, can significantly impact stock market performance. These events can create uncertainty and volatility, leading to market fluctuations. Understanding the potential impact of geopolitical events is crucial for investors in forming their long-term investment strategies.

Key Considerations for Long-Term Investors, Bank of america maintains bullish outlook for stocks amidst bearish sentiments

Formulating a successful long-term investment strategy requires careful consideration of various factors, including risk tolerance, investment horizon, and market outlook.

- Risk Tolerance:Investors with a higher risk tolerance may be willing to invest in more volatile assets, such as growth stocks, with the potential for higher returns. Conversely, investors with a lower risk tolerance may prefer to invest in more stable assets, such as bonds, with lower potential returns.

- Investment Horizon:The length of time an investor plans to hold their investments significantly impacts their investment strategy. Long-term investors with a horizon of several years or more can ride out market fluctuations and benefit from the long-term growth potential of the stock market.

Short-term investors, on the other hand, may be more susceptible to market volatility and need to adjust their strategies accordingly.

- Diversification:Diversifying investments across different asset classes, sectors, and geographies helps mitigate risk and improve portfolio performance. By spreading investments across various assets, investors can reduce the impact of any single asset’s performance on their overall portfolio.

- Dollar-Cost Averaging:Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the impact of market volatility and can potentially lead to higher returns over the long term.

- Rebalancing:Periodically rebalancing the investment portfolio to maintain the desired asset allocation can help manage risk and ensure that investments remain aligned with the investor’s long-term goals.

While Bank of America maintains a bullish outlook for stocks despite widespread bearish sentiment, the global market landscape is far from settled. The cautious start in Asian markets, as highlighted in this recent market update , underscores the ongoing uncertainty.

This suggests that Bank of America’s optimistic stance might be challenged in the coming weeks, especially if the current cautious trend persists.

While Bank of America maintains a bullish outlook for stocks despite bearish sentiment, it’s worth noting that global markets are closely watching the upcoming Fed conference on interest rates. The potential impact on the US economy could ripple through global markets, and it’s interesting to see how the Asian stock market trends amid anticipation of the Fed conference will play out.

Ultimately, this event will be a key factor in determining the trajectory of global markets, including the US stock market, and Bank of America’s bullish outlook may be tested in the coming weeks.

It’s interesting how Bank of America maintains a bullish outlook for stocks even with the current bearish sentiment. Maybe they’re drawing inspiration from the recent mega millions jackpot surge to 1.25 billion , where the chances of winning are slim but the potential reward is huge.

It’s a reminder that even when things seem bleak, there’s always a chance for a big win, and perhaps that’s what Bank of America sees in the stock market.