February 2, 2025

Optus Sports Streaming A Potential Deal

Optus sports streaming service potential deal discussion explores the exciting possibility of Optus entering the Australian sports streaming market. This…

March 7, 2024

French Apple Store Employees Strike on iPhone 15 Launch Day

French apple store employees stage strike on iphone 15 launch day – French Apple Store employees staged a strike on…

February 6, 2023

Texas Businessman Linked to Paxton Impeachment Faces Federal Court

Texas businessman linked to impeachment of attorney general Ken Paxton faces federal court appearance following FBI arrest 202991. This case,…

August 29, 2022

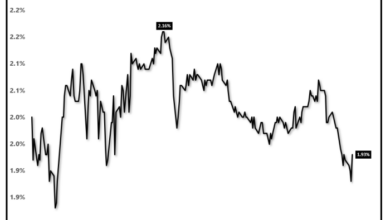

Stocks Mixed After JPMorgan Chase Buys First Republic Assets

Stocks Mixed After JPMorgan Chase Buys First Republic Assets live news updates sets the stage for this enthralling narrative, offering…

April 29, 2023

McDonalds Grimace Shake Takes TikTok By Storm, Inspiring Bizarre Faux Death Trend

Mcdonalds grimace shake takes tiktok by storm inspiring bizarre faux death trend – McDonald’s Grimace Shake Takes TikTok By Storm,…

August 6, 2022

How Ethereum is Different from Bitcoin: A Deep Dive

How Ethereum is different from Bitcoin takes center stage as we explore these two prominent cryptocurrencies. While both are built…

July 11, 2024

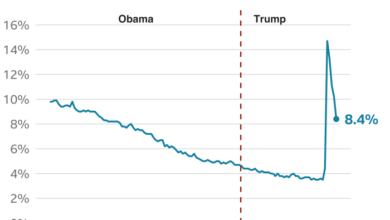

Trumps Testimony: A High-Stakes Battle for His Empire

Donald trump faces high stakes testimony in legal battle to protect real estate empire – Donald Trump faces high stakes…

April 20, 2023

Cineworld Debt Restructuring Plan Approved by US Court

Cineworld debt restructuring plan gets approval from US court, marking a crucial step for the struggling cinema chain. The company,…