Global Markets Update: Dollar Steady, Shares Dip, Eyes on Bank of Japan

Global markets update dollar holds steady shares show slight dip all eyes on bank of japan – Global Markets Update: Dollar Steady, Shares Dip, Eyes on Bank of Japan. This week, global markets are experiencing a mixed bag of emotions, with the US dollar holding its ground despite recent market volatility, while shares show a slight dip.

All eyes are on the Bank of Japan, as investors await their next move on monetary policy. This dynamic interplay of factors is shaping the current economic landscape, prompting investors to carefully analyze market trends and adjust their investment strategies accordingly.

The US dollar’s resilience amidst market fluctuations is largely attributed to the Federal Reserve’s hawkish stance on monetary policy. However, the slight dip in share prices is raising concerns about the impact of rising interest rates on stock valuations.

Meanwhile, the Bank of Japan’s monetary policy remains a key focus, as its decisions could have a significant impact on global markets and the value of the Japanese Yen.

Global Market Overview

Global markets are displaying a mixed performance today, with the dollar holding steady while shares experience a slight dip. The Bank of Japan’s monetary policy decision is the primary focus for investors, as its stance on interest rates will have a significant impact on global financial markets.

Major Indices Performance

The major stock market indices are showing a mixed performance. The S&P 500 is down slightly, while the Nasdaq and the Dow Jones Industrial Average are trading flat. The technology sector is underperforming, with investors cautious about the potential impact of rising interest rates on tech valuations.

Key Sector Performance

The energy sector is performing well, driven by rising oil prices. The financial sector is also performing well, benefiting from the rising interest rate environment. The healthcare sector is lagging behind, with investors concerned about the potential impact of government regulations on drug pricing.

Market Sentiment

Market sentiment is cautious, with investors waiting for further clarity on the Bank of Japan’s monetary policy stance. The recent rise in interest rates has also contributed to the cautious mood, as investors worry about the impact on economic growth.

US Dollar Stability: Global Markets Update Dollar Holds Steady Shares Show Slight Dip All Eyes On Bank Of Japan

The US dollar has shown remarkable resilience in recent weeks, holding steady against a backdrop of global market volatility. This stability is surprising considering the ongoing uncertainty surrounding interest rates, inflation, and geopolitical tensions. Several factors contribute to the dollar’s strength, including its safe-haven status, the Federal Reserve’s hawkish stance, and the relative economic health of the US compared to other major economies.

Impact of the Federal Reserve’s Monetary Policy

The Federal Reserve’s monetary policy plays a crucial role in influencing the value of the US dollar. The Fed’s recent aggressive interest rate hikes have made the dollar more attractive to investors seeking higher returns. This has led to an increase in demand for the dollar, pushing its value higher.

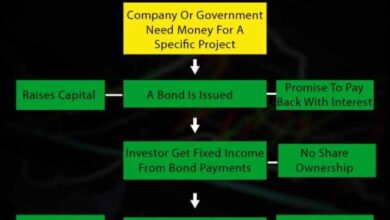

The global markets are holding their breath today, with the dollar remaining steady while shares show a slight dip. All eyes are on the Bank of Japan, whose monetary policy decisions could have a significant impact on global markets. If you’re thinking about getting involved in the stock market, it’s essential to understand the basics first.

Check out tips for beginners to invest in the stock market learn the basics of stock market to get a good foundation. It’s a dynamic world, and even with the current market volatility, there are always opportunities for savvy investors.

The Fed’s commitment to combating inflation through further rate hikes also suggests that the dollar’s strength is likely to persist in the near term.

Relationship with Other Major Currencies

The US dollar’s performance is also influenced by its relationship with other major currencies, such as the euro and the Japanese yen. The euro has been under pressure in recent months due to the ongoing energy crisis in Europe and concerns about the economic outlook.

This weakness has made the US dollar relatively stronger. The Japanese yen has also weakened significantly due to the Bank of Japan’s dovish monetary policy, which has kept interest rates low and made the yen less attractive to investors.

Recent News and Events

Several recent news events have impacted the US dollar’s value. For example, the strong US jobs report released in early August boosted confidence in the US economy, supporting the dollar’s strength. Additionally, the ongoing geopolitical tensions, particularly the war in Ukraine, have also contributed to the dollar’s safe-haven appeal.

Investors tend to flock to the dollar during times of uncertainty, further strengthening its value.

Share Market Dip

A slight dip in share prices has been observed in recent market activity. While the US dollar remains stable, global markets have experienced a minor pullback, primarily attributed to a combination of factors.

Impact of Rising Interest Rates

Rising interest rates exert a significant influence on stock valuations. As interest rates increase, the cost of borrowing rises for companies, potentially impacting their profitability and future earnings. Investors often reassess the attractiveness of stocks in such scenarios, as the potential returns from holding equities may become less appealing compared to the higher returns offered by fixed-income investments.

Investor Sentiment and Market Volatility

Investor sentiment plays a crucial role in driving market movements. When confidence in the economy or specific sectors weakens, investors may become more risk-averse, leading to selling pressure and market volatility. The recent dip can be partially attributed to concerns about inflation, economic growth, and geopolitical uncertainties, which have contributed to a shift in investor sentiment.

Comparison to Previous Market Corrections

Market corrections are a natural part of the investment cycle. The current dip, while concerning, should be viewed in the context of historical market corrections. Previous corrections have often been followed by periods of recovery and growth. However, it is important to note that the duration and severity of corrections can vary, and the current market environment may present unique challenges.

Focus on the Bank of Japan

The Bank of Japan (BOJ) is the central bank of Japan and plays a crucial role in maintaining price stability and fostering economic growth. It is currently pursuing an unconventional monetary policy stance, aiming to stimulate the economy and combat deflation.

Current Monetary Policy Stance

The BOJ’s current monetary policy is characterized by a commitment to maintaining ultra-low interest rates and large-scale asset purchases. This approach, known as “yield curve control,” aims to keep long-term interest rates at a target level, typically around 0%. The BOJ’s policy is designed to:

- Stimulate borrowing and investment by businesses and consumers.

- Encourage economic activity and inflation.

- Support the Japanese Yen.

Role in Maintaining Price Stability and Economic Growth

The BOJ’s primary mandate is to maintain price stability, which is typically defined as a 2% inflation target. To achieve this, the BOJ uses a range of tools, including:

- Setting interest rates: The BOJ controls the short-term interest rates that banks charge each other for lending. By lowering interest rates, the BOJ encourages borrowing and spending, which can stimulate economic activity and inflation.

- Quantitative easing (QE): This involves the BOJ purchasing large quantities of government bonds and other assets. This increases the money supply and lowers interest rates, providing further stimulus to the economy.

Impact of the Bank of Japan’s Decisions on Global Markets

The BOJ’s monetary policy decisions have significant implications for global markets.

- Impact on Yen: The BOJ’s policies can influence the value of the Japanese Yen. For example, if the BOJ loosens monetary policy, it could lead to a weaker Yen, as investors may seek higher returns in other currencies. Conversely, tightening monetary policy could strengthen the Yen.

While the global markets saw a relatively quiet day with the dollar holding steady and shares experiencing a slight dip, all eyes are on the Bank of Japan’s upcoming policy meeting. Meanwhile, the cryptocurrency world is buzzing with excitement as Bitcoin surged above $30,000, a move fueled by growing interest from Middle Eastern investors and ongoing SEC considerations, as detailed in this article: bitcoin surges above 30000 usd middle east sec considerations.

It will be interesting to see how these developments impact the global markets in the coming days.

- Impact on Global Interest Rates: The BOJ’s actions can also affect interest rates globally. If the BOJ keeps interest rates low for an extended period, it can put downward pressure on global interest rates, potentially influencing the policies of other central banks.

- Impact on Risk Appetite: The BOJ’s policies can also influence investor risk appetite. If the BOJ is perceived as being accommodative, it can encourage investors to take on more risk, potentially leading to higher asset prices in global markets.

Implications of the Bank of Japan’s Policies on the Japanese Yen

The BOJ’s policies have a significant impact on the Japanese Yen.

- Weakening Yen: The BOJ’s ultra-low interest rate policy and quantitative easing have contributed to a weakening Yen in recent years. This is because investors may seek higher returns in other currencies, leading to increased demand for those currencies and a decline in demand for the Yen.

- Impact on Exports: A weaker Yen can benefit Japanese exporters by making their products more competitive in international markets. However, it can also lead to higher import costs for Japanese consumers.

- Impact on Inflation: A weaker Yen can contribute to inflation in Japan by making imported goods more expensive. However, the BOJ’s current focus on stimulating inflation suggests that it is willing to tolerate some currency weakness to achieve its price stability objective.

Global Economic Outlook

The global economic landscape is a complex tapestry woven with threads of geopolitical tensions, inflation, supply chain disruptions, and energy price fluctuations. These factors are shaping the trajectory of economic growth, creating both opportunities and challenges for businesses and investors alike.

Geopolitical Tensions and Global Inflation

Geopolitical tensions, such as the ongoing conflict in Ukraine, have significant implications for the global economy. These conflicts disrupt supply chains, increase energy prices, and create uncertainty for businesses, leading to reduced investment and slower economic growth. Additionally, rising inflation, fueled by supply chain disruptions and strong consumer demand, puts pressure on central banks to raise interest rates, which can slow economic activity.

The global markets are holding their breath today, with the dollar remaining steady and shares showing a slight dip. All eyes are on the Bank of Japan, but the real buzz is coming from across the Pacific. Slower job growth in the US has fueled speculation that the Federal Reserve might pause its rate hike cycle, a development that could have significant implications for global markets.

This shift in sentiment is likely to be a major factor in the coming weeks, as investors weigh the potential impact on the US economy and its ripple effects around the world.

Supply Chain Disruptions and Energy Prices

The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to shortages and price increases. The war in Ukraine has further exacerbated these disruptions, particularly in the energy sector. Rising energy prices impact both businesses and consumers, leading to higher input costs and reduced purchasing power.

Outlook for Major Economies

- United States:The US economy is facing headwinds from inflation and rising interest rates. However, strong consumer spending and a robust labor market provide some support. The Federal Reserve is expected to continue raising interest rates to combat inflation, which could slow economic growth.

- China:China’s economy is facing challenges from the “zero-COVID” policy and a property market slowdown. However, government stimulus measures and ongoing infrastructure investment could help to support growth.

- Eurozone:The Eurozone is grappling with the energy crisis and the war in Ukraine. Rising energy prices and supply chain disruptions are weighing on economic activity. The European Central Bank is expected to raise interest rates to combat inflation, which could further slow growth.

Investment Strategies

The current market environment presents both opportunities and challenges for investors. With the US dollar holding steady, global shares showing a slight dip, and all eyes on the Bank of Japan, investors need to carefully consider their investment strategies. Here are four different approaches that investors can consider, each with its own potential benefits and risks.

Investment Strategies Based on Current Market Conditions, Global markets update dollar holds steady shares show slight dip all eyes on bank of japan

The following table Artikels four distinct investment strategies, each tailored to navigate the current market landscape. It examines their potential benefits, risks, and suitable asset classes, providing investors with a framework for making informed decisions.

| Strategy | Potential Benefits | Potential Risks | Suitable Assets |

|---|---|---|---|

| Value Investing |

|

|

|

| Growth Investing |

|

|

|

| Defensive Investing |

|

|

|

| Alternative Investments |

|

|

|

Market Risks and Opportunities

The current market landscape presents both significant risks and potential opportunities for investors. Navigating this complex environment requires a careful assessment of the various factors at play, including geopolitical uncertainties, inflation, and interest rate hikes. While these factors pose challenges, they also create opportunities for astute investors to capitalize on undervalued assets and sectors with growth potential.

Geopolitical Uncertainties

Geopolitical tensions remain a major source of market volatility. The ongoing conflict in Ukraine, tensions between the US and China, and regional conflicts in the Middle East continue to create uncertainty and disrupt global supply chains. These disruptions can lead to higher commodity prices, inflation, and economic instability.

- Impact on Energy Markets:The conflict in Ukraine has significantly impacted global energy markets, leading to higher oil and gas prices. This has implications for energy-intensive industries and consumer spending.

- Supply Chain Disruptions:Geopolitical tensions can disrupt global supply chains, leading to shortages of essential goods and materials. This can impact manufacturing, production, and overall economic growth.

- Investment Uncertainty:Geopolitical risks can deter investment, as businesses and investors become hesitant to commit capital in uncertain environments.

Inflation and Interest Rate Hikes

Inflation remains a significant concern for investors. Central banks around the world are raising interest rates to combat rising prices, which can slow economic growth and impact corporate earnings.

- Impact on Corporate Profits:Higher interest rates increase borrowing costs for businesses, potentially reducing their profitability. This can lead to lower stock prices and reduced investment.

- Impact on Consumer Spending:Rising interest rates can make it more expensive for consumers to borrow money, potentially leading to reduced spending and slower economic growth.

- Impact on Bond Yields:Higher interest rates can lead to higher bond yields, which can negatively impact the value of existing bonds.

Opportunities Arising from Market Conditions

Despite the risks, the current market conditions also present opportunities for investors.

- Undervalued Assets:The market volatility created by geopolitical uncertainties and inflation can lead to undervalued assets, particularly in sectors that are less sensitive to economic fluctuations.

- Growth Potential in Emerging Markets:Emerging markets may offer attractive growth opportunities, as they are less affected by developed market volatility and have higher growth potential.

- Innovation and Disruptive Technologies:Companies developing innovative technologies and solutions to address global challenges, such as climate change and energy security, may present significant growth potential.