Wyre: Prominent Crypto Payments Firm Announces Closure

Wyre prominent crypto payments firm announces operational closure – Wyre, a prominent crypto payments firm, has announced its operational closure, leaving a significant impact on the cryptocurrency ecosystem. This unexpected move comes amid a challenging market environment, raising questions about the future of crypto payments and the broader implications for the industry.

Wyre was a key player in facilitating seamless cryptocurrency transactions, providing a bridge between traditional finance and the decentralized world. The company offered a range of services, including fiat-to-crypto on-ramps, merchant processing, and developer tools, all aimed at simplifying the user experience.

Wyre had also established strategic partnerships with major players in the industry, including Coinbase and Kraken, further solidifying its position in the crypto payments landscape.

Wyre’s Background and Operations

Wyre was a prominent player in the cryptocurrency payments space, aiming to bridge the gap between traditional finance and the decentralized world. The company provided a suite of tools and services designed to simplify crypto transactions for both individuals and businesses.

The news of Wyre’s closure is a reminder of the volatile nature of the crypto industry, especially in the face of economic headwinds. While we grapple with the broader impact of these events, it’s also crucial to understand the impact of inflation on our personal finances, and that’s where the inflation guide tips to understand and manage rising prices comes in handy.

By learning to navigate these economic challenges, we can better prepare ourselves for the future, even amidst the uncertainties of the crypto market.

Wyre’s Role in the Cryptocurrency Ecosystem

Wyre’s mission was to make it easier for users to buy, sell, and use cryptocurrencies. It aimed to simplify the process of converting fiat currency into digital assets and vice versa, thereby promoting wider adoption of cryptocurrencies in mainstream applications.

Wyre’s role was essentially to act as a bridge between the traditional financial system and the decentralized world of crypto.

The news of Wyre, a prominent crypto payments firm, shutting down its operations is a reminder of the volatility in the crypto space. This incident highlights the importance of understanding the intricacies of the industry, including concepts like privacy policies.

A privacy policy outlines how a company collects, uses, and protects your personal information, and it’s crucial to understand how these policies work, especially when dealing with financial transactions. What is a privacy policy and why is it important is a question worth exploring, as it directly impacts your security and control over your data.

While Wyre’s closure might be attributed to various factors, it underscores the need for due diligence and awareness when navigating the world of crypto payments.

Key Services Offered by Wyre

Wyre provided a range of services catering to different user needs. Here are some of the key services offered:

- Cryptocurrency On-Ramps and Off-Ramps:Wyre facilitated the seamless conversion of fiat currencies like USD, EUR, and GBP into cryptocurrencies and vice versa. This enabled users to easily enter and exit the crypto market, simplifying the process of buying and selling digital assets.

- Crypto Payment Processing:Wyre offered a payment processing platform that allowed businesses to accept cryptocurrencies as a form of payment. This enabled businesses to expand their customer base and tap into the growing crypto market.

- API Integration:Wyre provided developers with a comprehensive API that enabled them to integrate crypto functionality into their applications. This allowed developers to build custom solutions and leverage Wyre’s infrastructure to offer crypto-related services.

- Crypto Wallets:Wyre offered secure digital wallets for storing and managing cryptocurrencies. These wallets provided users with a convenient way to manage their digital assets.

Partnerships and Integrations

Wyre established partnerships with various companies across the crypto and traditional finance sectors. These partnerships aimed to expand Wyre’s reach and provide its users with access to a wider range of services.

- Coinbase:Wyre partnered with Coinbase, a leading cryptocurrency exchange, to offer users a seamless way to buy and sell cryptocurrencies through Coinbase’s platform.

- Ripple:Wyre integrated with Ripple’s network to facilitate cross-border payments, enabling faster and more cost-effective transfers of funds.

- Stripe:Wyre collaborated with Stripe, a popular payment processing platform, to allow businesses to accept crypto payments through Stripe’s infrastructure.

Factors Contributing to Wyre’s Closure

Wyre’s decision to cease operations was a significant event in the cryptocurrency landscape, prompting many to analyze the contributing factors behind this closure. While the company cited a challenging market environment as a key reason, a closer look reveals a complex interplay of factors that ultimately led to Wyre’s downfall.

The Impact of Market Conditions

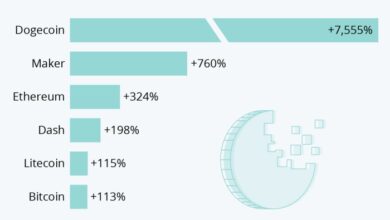

The crypto market has been experiencing a period of volatility and uncertainty, characterized by declining prices and a general sentiment of risk aversion. This has significantly impacted the business models of many crypto companies, including Wyre. The decline in cryptocurrency prices has led to a decrease in trading volume and user activity, impacting revenue streams for companies like Wyre that rely on transaction fees.

The news of Wyre, a prominent crypto payments firm, shutting down operations is a stark reminder of the volatility in the crypto space. While this news might seem isolated, it’s worth considering broader economic trends like the ones highlighted in this article about Chinese realty initiatives boosting base metals and gold surging on a weaker dollar.

These trends, while seemingly unrelated, can ultimately influence the overall sentiment towards crypto and its future. The Wyre situation underscores the importance of staying informed about global economic forces that can impact the crypto market.

This downward trend has also made it more difficult for crypto firms to raise capital, putting pressure on their financial stability.

“The crypto market has been in a prolonged bear market, and we’ve seen a significant decrease in trading volume and user activity. This has made it difficult for us to generate the revenue needed to sustain our operations.”

Wyre CEO, Michael Dunworth

Wyre’s situation is not unique, as many other crypto companies have faced similar challenges in the current market. Platforms like BlockFi, Celsius, and Voyager Digital have all been forced to make significant adjustments or even declare bankruptcy due to the downturn in the crypto market.

Implications of Wyre’s Closure

Wyre’s closure signifies a significant event in the crypto payments landscape, with implications for both the industry and its stakeholders. The company’s exit raises questions about the future of crypto payments and the challenges faced by businesses operating in this evolving space.

Impact on the Crypto Payments Landscape, Wyre prominent crypto payments firm announces operational closure

Wyre’s closure is a stark reminder of the volatility and uncertainty inherent in the cryptocurrency industry. While crypto payments have gained traction in recent years, challenges such as regulatory scrutiny, market fluctuations, and competition from established players continue to pose hurdles.

Wyre’s exit could lead to:

- Reduced Competition:With Wyre out of the picture, the crypto payments landscape becomes less competitive. This could potentially benefit existing players, but it also raises concerns about potential market consolidation and reduced innovation.

- Increased Regulatory Scrutiny:Wyre’s closure may further prompt regulators to intensify their scrutiny of the crypto payments sector. This could lead to stricter regulations and compliance requirements, potentially hindering the growth of the industry.

- Shifts in Market Dynamics:The closure could influence the adoption of crypto payments, potentially discouraging some businesses from integrating these solutions due to perceived risks and uncertainties.

Implications for Wyre’s Customers and Partners

Wyre’s closure has immediate and direct implications for its customers and partners:

- Disruption of Services:Customers and partners relying on Wyre’s services will need to find alternative solutions. This could involve transitioning to new platforms, potentially leading to disruptions and additional costs.

- Loss of Access to Funds:Customers with funds held in Wyre accounts will need to withdraw their assets. The process of accessing these funds may be complex and time-consuming, depending on the specific circumstances.

- Impact on Business Operations:Businesses that integrated Wyre’s services into their operations will need to adjust their payment processing systems and find alternative solutions, potentially affecting their efficiency and customer experience.

Implications for the Cryptocurrency Industry

Wyre’s closure highlights the challenges and risks associated with operating in the cryptocurrency space. The broader implications for the industry include:

- Increased Volatility and Uncertainty:The closure underscores the volatility and uncertainty inherent in the cryptocurrency market. It reinforces the need for robust risk management practices and careful consideration of potential risks before investing in or relying on crypto-related services.

- Importance of Regulatory Clarity:The closure emphasizes the need for clear and consistent regulations in the crypto space. A lack of regulatory clarity can create uncertainty and hinder the growth of the industry.

- Focus on Sustainability and Adoption:The closure highlights the importance of focusing on sustainable business models and promoting wider adoption of cryptocurrencies. This involves addressing concerns about security, scalability, and regulatory compliance.

Future of Crypto Payments: Wyre Prominent Crypto Payments Firm Announces Operational Closure

Wyre’s closure, while a significant event, doesn’t signal the end of crypto payments. The demand for fast, secure, and borderless transactions remains strong, and the industry is adapting to meet this need. While Wyre’s absence creates a void, it also presents an opportunity for other players to step up and innovate.

Alternative Crypto Payment Solutions

With Wyre out of the picture, several other solutions are available for individuals and businesses looking to integrate crypto payments. These alternatives offer various features and cater to different needs, providing a diverse landscape for crypto adoption.

- Coinbase Commerce: A user-friendly platform for accepting crypto payments, ideal for small businesses and individuals. It allows users to create invoices, accept payments in various cryptocurrencies, and easily integrate with e-commerce platforms.

- BitPay: A widely recognized platform with a strong focus on enterprise solutions. It provides businesses with tools for accepting crypto payments, managing invoices, and handling payouts. It also offers a dedicated point-of-sale solution for physical stores.

- Mercuryo: This platform focuses on providing a seamless experience for buying and selling crypto, making it suitable for individuals and businesses looking for a straightforward solution. It offers a range of payment methods, including bank transfers and credit cards, and supports various cryptocurrencies.

- NOWPayments: A versatile platform designed for businesses of all sizes. It supports a wide range of cryptocurrencies and offers customizable payment widgets that can be integrated into websites and applications.

- Simplex: A reputable platform known for its focus on security and compliance. It offers a reliable solution for businesses looking to accept payments from credit cards and debit cards in cryptocurrencies.

Hypothetical Scenario for the Future of Crypto Payments

Imagine a future where crypto payments are seamlessly integrated into our daily lives. We use our digital wallets to pay for groceries, travel tickets, and even utilities, all in a matter of seconds. Transactions are instant, secure, and transparent, with minimal fees.

This scenario, while still evolving, is not far-fetched.The rise of decentralized finance (DeFi) and stablecoins is paving the way for a more inclusive and accessible financial system. With the development of faster and more scalable blockchains, crypto payments can become faster and more cost-effective than traditional methods.