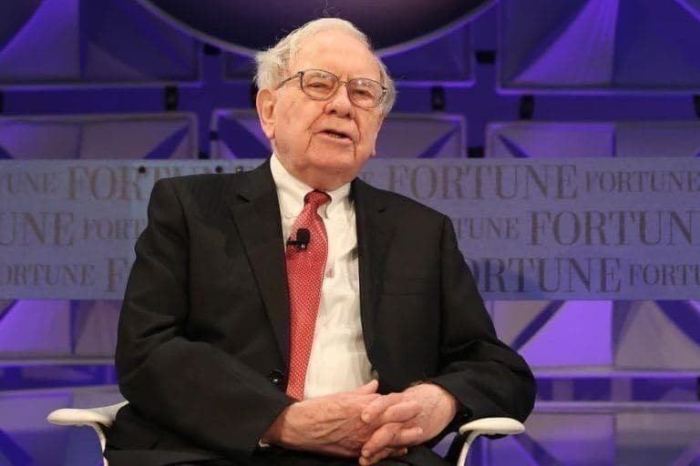

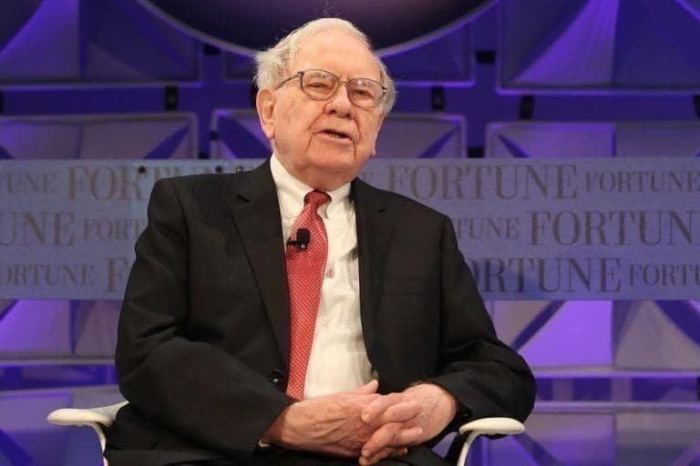

Warren Buffett Earns $2 Billion in Dividends From Two Stocks

Warren buffett rakes in nearly 2 billion in annual dividend income from two stocks – Warren Buffett, the legendary investor, rakes in nearly $2 billion in annual dividend income from two stocks. This staggering sum highlights the power of dividend investing and the strategic brilliance of the Oracle of Omaha. Buffett’s investment strategy, which emphasizes dividend-paying companies, has consistently delivered exceptional returns over decades.

The two companies that contribute the majority of Buffett’s dividend income are Coca-Cola and American Express. Both companies have a long history of paying dividends, and they have consistently grown their payouts over time. This consistent income stream provides Buffett with a steady source of cash flow, which he can reinvest back into his portfolio to generate even more returns.

Warren Buffett’s Dividend Income: Warren Buffett Rakes In Nearly 2 Billion In Annual Dividend Income From Two Stocks

Warren Buffett’s annual dividend income, exceeding $2 billion, is a testament to his long-term investment strategy and the power of compounding. This significant income stream originates from two key investments: Coca-Cola and American Express. These companies represent a substantial portion of Buffett’s portfolio and contribute significantly to his overall returns.

It’s mind-boggling to think that Warren Buffett rakes in nearly $2 billion annually just from dividends on two stocks! While his wealth is impressive, it also highlights the importance of building a solid financial foundation. Managing your own finances, especially credit debt, can be a challenge, but it’s crucial for long-term financial security.

Check out these credit debt management tips, strategies, and examples to learn how to get your finances in order. Just like Buffett’s investments, taking control of your finances can lead to long-term stability and growth.

The Significance of Warren Buffett’s Dividend Income

Warren Buffett’s $2 billion annual dividend income from two stocks highlights the significance of dividend-paying stocks in his investment strategy. It demonstrates the power of compounding and the ability of these companies to generate consistent returns over long periods. This income stream not only provides a steady source of cash flow but also allows Buffett to reinvest dividends back into his portfolio, further accelerating the growth of his investments.

The Companies Contributing to Warren Buffett’s Dividend Income

- Coca-Cola:Buffett’s investment in Coca-Cola dates back to the 1980s, and it remains one of his largest holdings. The company’s consistent dividend payments, coupled with its strong brand recognition and global reach, have made it a cornerstone of Buffett’s portfolio.

- American Express:Buffett began investing in American Express in the 1960s, recognizing its potential as a premium financial services company. The company’s focus on customer service and its ability to generate consistent profits have made it a reliable source of dividend income for Buffett.

The Historical Context of These Investments

Buffett’s investments in Coca-Cola and American Express represent a long-term commitment to quality businesses with strong track records of growth and profitability. He has often emphasized the importance of investing in companies with enduring competitive advantages and a history of paying consistent dividends.

These investments have not only generated substantial dividend income but have also appreciated significantly in value over the years, contributing to the growth of Buffett’s portfolio.

The Strategic Reasons Behind Buffett’s Preference for Dividend-Paying Stocks

Buffett’s preference for dividend-paying stocks stems from several strategic reasons:

- Consistent Cash Flow:Dividends provide a steady stream of income, allowing investors to reinvest the proceeds or use them for other purposes. This predictability is particularly valuable for long-term investors seeking to generate consistent returns.

- Sign of Profitability:Companies that pay dividends are generally profitable and have a strong track record of generating cash flow. This signals financial health and stability, which are essential for long-term investment success.

- Compounding:Reinvesting dividends back into the portfolio allows investors to benefit from the power of compounding. This means that earnings generate more earnings over time, leading to exponential growth in the long run.

- Alignment with Management:Companies that pay dividends often have management teams that are aligned with the interests of shareholders. This alignment encourages a focus on long-term value creation and a commitment to returning value to investors.

The Power of Dividend Investing

Dividend investing is a popular strategy among investors seeking to generate consistent income and build long-term wealth. By investing in companies that pay dividends, investors receive regular cash payments, often quarterly, that can be reinvested or used for other purposes.

This approach offers a unique combination of income generation and potential capital appreciation, making it an attractive option for a wide range of investors.

It’s fascinating to see how Warren Buffett’s investment strategy, focused on long-term dividends, generates such massive income. While he’s reaping nearly $2 billion annually from just two stocks, it’s a different kind of game when it comes to lottery wins like Mega Millions.

If you’re looking to increase your chances of striking it rich, you might want to check out some understanding mega millions tips to increase your chances of winning. But, let’s be realistic, even with the best strategy, winning the lottery is a long shot.

Meanwhile, Buffett’s steady dividend income provides a much more predictable and sustainable financial foundation.

Understanding Dividend Investing

Dividend investing involves selecting companies that have a history of paying dividends and are expected to continue doing so in the future. These companies typically operate in stable industries with predictable earnings and a strong track record of profitability. Dividends are paid out of a company’s profits, and they represent a share of the company’s earnings distributed to shareholders.

Benefits of Dividend Investing

Dividend investing offers several potential benefits, including:

- Regular Income Stream:Dividend payments provide a consistent stream of income, which can be particularly valuable for retirees or individuals seeking to supplement their income.

- Potential for Capital Appreciation:Dividend-paying companies often experience strong growth, as they are typically established businesses with a solid track record. This growth can lead to capital appreciation, further enhancing the investor’s returns.

- Reduced Portfolio Volatility:Dividend-paying stocks tend to be less volatile than growth stocks, as they are typically mature companies with a stable earnings stream. This can help to mitigate portfolio risk and provide a more consistent return.

- Tax Advantages:Dividend income is often taxed at a lower rate than other forms of income, such as interest or capital gains.

Dividend Investing vs. Other Investment Strategies

Dividend investing can be compared to other investment strategies, such as growth investing and value investing.

- Growth Investing:Focuses on companies with high growth potential, often sacrificing current income for the potential for future capital appreciation.

- Value Investing:Seeks out undervalued companies with strong fundamentals, aiming to capitalize on market inefficiencies.

Dividend investing offers a balance between income generation and potential capital appreciation, making it a suitable strategy for investors with varying risk tolerances and investment goals.

Risks Associated with Dividend Investing

While dividend investing offers numerous benefits, it’s important to be aware of the associated risks.

- Dividend Cuts:Companies can reduce or eliminate dividends if their earnings decline or if they face financial difficulties.

- Company Performance:The value of dividend-paying stocks can fluctuate based on the company’s performance, which can impact both the dividend payments and the overall investment return.

- Inflation:Inflation can erode the purchasing power of dividend payments, making them less valuable over time.

Mitigating Risks in Dividend Investing

Investors can mitigate the risks associated with dividend investing by:

- Diversifying Portfolio:Spreading investments across a range of companies and industries can help to reduce the impact of any single company’s performance.

- Thorough Research:Carefully analyze the financial health of companies before investing in them. Look for companies with a strong track record of profitability, consistent dividend payments, and a sustainable business model.

- Considering Dividend Yield:Dividend yield is the annual dividend payment divided by the stock’s current price. A high dividend yield can be an indicator of a high payout, but it can also signal that the company is facing financial difficulties.

The Companies Behind the Dividends

Warren Buffett’s massive dividend income stems primarily from two companies: Coca-Cola and American Express. These companies, with their long histories of consistent profitability and shareholder-friendly policies, have been cornerstones of Berkshire Hathaway’s portfolio for decades.

Coca-Cola’s Business and Dividend Appeal

Coca-Cola is a global beverage giant, renowned for its iconic brands like Coca-Cola, Sprite, and Fanta. The company’s business model is built on a vast distribution network and a portfolio of recognizable brands that have enjoyed enduring popularity worldwide. This strong brand recognition and widespread reach provide a solid foundation for consistent revenue generation and profitability.

For dividend investors, Coca-Cola offers several attractive features:

- Long History of Dividend Payments:Coca-Cola has a long and consistent history of paying dividends, a testament to its commitment to shareholder value.

- Dividend Growth:The company has a track record of increasing its dividend payments annually, providing investors with a steady stream of growing income.

- Strong Financial Position:Coca-Cola maintains a robust financial position, characterized by low debt and ample cash flow, which supports its dividend payments and future growth prospects.

American Express’s Business and Dividend Appeal

American Express is a leading provider of financial services, including credit cards, charge cards, and travel-related services. The company’s premium brand positioning and focus on affluent customers contribute to its high-quality earnings and profitability. American Express, similar to Coca-Cola, offers several compelling features for dividend investors:

- Strong Brand Reputation:American Express enjoys a strong brand reputation, associated with high-quality service and exclusivity, which translates into customer loyalty and consistent revenue generation.

- Profitable Business Model:The company’s premium pricing strategy and focus on affluent customers lead to high profit margins and strong cash flow generation.

- Consistent Dividend Payments:American Express has a history of consistently paying dividends to shareholders, reflecting its commitment to shareholder value creation.

Financial Health and Future Prospects

Both Coca-Cola and American Express have proven their ability to navigate economic cycles and maintain strong financial health.

- Coca-Cola:Despite facing challenges in recent years, including evolving consumer preferences and competition in the beverage market, Coca-Cola has continued to generate consistent profits and grow its dividend. The company is actively investing in innovation and expanding into new markets, demonstrating its commitment to long-term growth.

Warren Buffett’s massive dividend income from Apple and Coca-Cola is a testament to the power of passive income. While you might not be able to match his billions, there are still plenty of ways to generate passive income, even without investing.

Check out these passive income ideas for students without investment to get started. Whether it’s through online surveys, freelance writing, or selling digital products, there are opportunities for everyone to build a stream of income that works for them.

And who knows, maybe one day you’ll be raking in millions from your own portfolio of passive income streams, just like Warren Buffett.

- American Express:American Express has benefited from the strong performance of the global economy and the growth of consumer spending. The company’s focus on affluent customers and its premium brand positioning have shielded it from some of the challenges faced by other financial institutions.

American Express is well-positioned to continue benefiting from the growth of the global economy and the increasing demand for premium financial services.

Dividend Yields Compared to Industry Peers

Coca-Cola and American Express consistently offer dividend yields that are higher than the average for their respective industries. This reflects their strong financial performance and commitment to shareholder value.

- Coca-Cola:The company’s dividend yield is typically higher than the average for the beverage industry, reflecting its strong cash flow generation and its commitment to returning value to shareholders.

- American Express:American Express’s dividend yield is typically higher than the average for the financial services industry, reflecting its high profitability and its commitment to shareholder value creation.

Buffett’s Investment Philosophy

Warren Buffett’s investment philosophy, often referred to as value investing, has been instrumental in his success. His approach focuses on identifying undervalued companies with strong fundamentals and holding them for the long term.

The Core Principles of Value Investing

Value investing emphasizes identifying companies that are trading below their intrinsic value. This intrinsic value is determined by analyzing the company’s financial health, its competitive position, and its future earning potential. Buffett’s investment philosophy rests on these key principles:

- Focus on intrinsic value:Buffett believes that the true value of a company lies in its ability to generate future cash flows. He analyzes companies’ financial statements, competitive advantages, and management quality to estimate their intrinsic value.

- Invest in businesses you understand:Buffett prefers to invest in companies whose businesses he understands. This allows him to make informed decisions and avoid investing in areas where he lacks expertise.

- Look for a margin of safety:Buffett emphasizes buying companies at a price significantly lower than their intrinsic value. This creates a “margin of safety” that protects against potential mistakes in valuation and unforeseen events.

- Long-term perspective:Buffett advocates for a long-term investment horizon. He believes that markets are inherently unpredictable in the short term, and he focuses on holding investments for years, if not decades.

- Focus on quality businesses:Buffett prioritizes investing in companies with strong competitive advantages, sustainable earnings, and a history of profitable growth.

Alignment with Dividend-Paying Stocks, Warren buffett rakes in nearly 2 billion in annual dividend income from two stocks

Buffett’s investment philosophy aligns well with his focus on dividend-paying stocks. Dividend payments are a tangible sign of a company’s profitability and its commitment to returning value to shareholders. Companies that consistently pay dividends are often well-established and have a proven track record of generating profits.

These factors are crucial for value investors who seek long-term growth and sustainable returns.

Patience and Long-Term Perspective

Patience is a cornerstone of Buffett’s investment approach. He believes that the market can be irrational in the short term, but it eventually corrects itself. He is willing to wait for the right opportunities, even if it takes years. This long-term perspective allows him to ride out market fluctuations and focus on the long-term value creation of his investments.

Characteristics Buffett Looks for in Companies

Buffett seeks companies that exhibit the following characteristics:

- Strong competitive advantage:Companies with a sustainable competitive advantage, such as a strong brand, low costs, or a unique product or service, are more likely to generate consistent profits over the long term.

- Proven track record of profitability:Buffett prefers companies with a history of consistent profitability and earnings growth. This indicates that the company has a solid business model and is well-managed.

- Strong management team:A competent and ethical management team is essential for a company’s long-term success. Buffett seeks leaders who are honest, capable, and committed to shareholder value creation.

- Favorable industry outlook:Buffett invests in industries with a favorable long-term outlook, such as healthcare, consumer staples, and technology. These industries are less likely to be disrupted by economic downturns or technological changes.

Implications for Investors

Warren Buffett’s extraordinary dividend income, fueled by his strategic investments, offers invaluable insights for individual investors. His approach, characterized by patience, value investing, and a long-term perspective, can be adapted to build a robust portfolio that generates consistent passive income.

Investing in Dividend-Paying Stocks

Investing in dividend-paying stocks is a key pillar of Buffett’s strategy. He seeks companies with a proven track record of profitability, strong cash flow, and a commitment to returning value to shareholders through dividends. This approach allows investors to benefit from both capital appreciation and regular income streams.

Building a Hypothetical Portfolio

A hypothetical portfolio inspired by Buffett’s principles could include:* Coca-Cola (KO):A global beverage giant with a long history of dividend payments.

Johnson & Johnson (JNJ) A diversified healthcare conglomerate with a strong track record of growth and dividend consistency.

Procter & Gamble (PG) A consumer staples company with a wide range of household products and a solid dividend track record.

Apple (AAPL) A technology giant with a growing dividend and strong future prospects.

Berkshire Hathaway (BRK.B) Buffett’s own company, which offers a unique opportunity to invest in a diversified portfolio of businesses.

Top Dividend-Paying Stocks by Sector

| Sector | Ticker | Dividend Yield |

|---|---|---|

| Financials | JPM (JPMorgan Chase) | 3.2% |

| Energy | XOM (ExxonMobil) | 4.0% |

| Utilities | NEE (NextEra Energy) | 2.8% |

| Consumer Staples | PG (Procter & Gamble) | 2.5% |

| Healthcare | JNJ (Johnson & Johnson) | 2.7% |

The Power of Dividend Reinvestment

Dividend reinvestment is a powerful tool for long-term portfolio growth. By reinvesting dividends back into the same stocks or other dividend-paying investments, investors can compound their returns over time. This strategy allows them to benefit from the snowball effect of earning dividends on their original investment and subsequent reinvestments.

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you’ve got the power to raise prices significantly, you’ve got an exceptional business.”

Warren Buffett

Potential Impact of Dividend Income on Portfolio Growth

Consider a hypothetical portfolio of $100,000 invested in a basket of dividend-paying stocks with an average annual dividend yield of 3%. Over 10 years, with dividends reinvested, the portfolio could grow to approximately $134,000, assuming a modest annual growth rate of 3%.

This demonstrates the potential impact of dividend income on portfolio growth over time.