Wall Street Shifts Focus From Recession to Hot Economy

Wall Street shifts focus from recession to hot economy, signaling a dramatic change in sentiment among investors. This shift, driven by a confluence of economic indicators and events, has triggered a reevaluation of market forecasts and investment strategies. The recent economic data paints a more optimistic picture, with strong growth indicators and a robust labor market pushing Wall Street to re-evaluate its previously cautious stance.

The shift in sentiment is evident in the performance of financial markets. Stock prices have surged, reflecting investor confidence in the economic outlook. Bond yields have also risen, reflecting expectations of higher interest rates as the Federal Reserve seeks to manage inflation.

This change in market dynamics has led to a renewed focus on sectors and industries that are expected to thrive in a hot economy, including technology, consumer discretionary, and energy.

Wall Street’s Shifting Sentiment

Wall Street, known for its volatility and quick shifts in sentiment, has recently undergone a dramatic change in its outlook on the US economy. After months of fretting over a looming recession, the financial markets are now buzzing with optimism, embracing a narrative of a “hot” economy.

This shift in sentiment is fueled by a confluence of economic indicators and events that have challenged the earlier recessionary forecasts.

Key Economic Indicators and Events

The recent shift in Wall Street’s outlook is largely attributed to a series of positive economic indicators and events that have challenged the prevailing narrative of an impending recession.

- Robust Labor Market:The US labor market has defied expectations, exhibiting remarkable resilience. The unemployment rate remains low, and job growth has been consistently strong, indicating a healthy economy with ample demand for labor.

- Strong Consumer Spending:Consumer spending, which accounts for a significant portion of the US economy, has remained surprisingly resilient. Consumers have continued to spend, supported by a healthy labor market and pent-up demand.

- Resilient Corporate Earnings:Corporate earnings have generally been strong, with many companies exceeding analysts’ expectations. This suggests that businesses are navigating the current economic environment effectively and maintaining profitability.

- Inflation Cooling:Inflation has begun to moderate, albeit at a slower pace than initially anticipated. This cooling of inflation, coupled with the Federal Reserve’s commitment to combating it, has instilled confidence in the markets that the US economy is on a path to a soft landing.

Wall Street is buzzing with optimism as the focus shifts from recession fears to a burgeoning hot economy. Amidst this wave of positive sentiment, news of the passing of renowned actor Ray Stevenson at the age of 58, known for his roles in films like “Punisher: War Zone,” “RRR,” and the “Thor” franchise, renowned actor ray stevenson passes away at 58 known for punisher war zone rrr and thor films , serves as a stark reminder of the fragility of life.

However, the economic optimism on Wall Street remains, suggesting a brighter future for the markets and the economy as a whole.

- Government Spending:The Biden administration’s infrastructure spending program has injected billions of dollars into the economy, stimulating economic activity and creating jobs.

Shifting Economic Forecasts and Investment Strategies

The shift in Wall Street’s sentiment has led to a corresponding change in economic forecasts and investment strategies.

- Recession Fears Subsided:The initial recessionary fears that gripped Wall Street have largely subsided, with many analysts now forecasting a period of sustained economic growth.

- Growth Expectations Elevated:Growth expectations have been revised upwards, with many analysts now projecting a stronger economic performance in the coming quarters.

- Investment Strategies Adjusted:Investment strategies have shifted to reflect the new optimistic outlook. Investors are now more likely to favor growth stocks and sectors that are expected to benefit from a robust economy.

Impact on Markets and Investments

The shift from recession fears to a hot economy has had a significant impact on financial markets, causing a surge in asset prices and a reassessment of investment strategies. This change in sentiment has influenced various financial instruments, including stocks, bonds, and commodities, as investors adjust their portfolios to reflect the new economic outlook.

Impact on Stock Markets

The prospect of a robust economy has led to a rally in stock markets globally. As businesses anticipate increased demand and higher profits, investors are pouring money into equities, driving up prices. This is particularly evident in sectors that are expected to benefit most from a hot economy, such as technology, consumer discretionary, and industrials.

Wall Street’s focus has shifted from recession fears to a hot economy, and investors are looking for growth opportunities. This shift is reflected in the recent surge in Domino’s shares, driven by a surprise partnership that marks a significant shift in their delivery strategy.

This move suggests a confidence in the future of the economy and the potential for Domino’s to capitalize on a growing demand for convenient food options. Read more about Domino’s new strategy here. This partnership, along with the broader economic optimism, is likely to continue to fuel Domino’s success in the months to come.

For example, the Nasdaq Composite Index, which is heavily weighted towards technology stocks, has seen significant gains, reflecting investor confidence in the sector’s growth potential.

Impact on Bond Yields

A hot economy typically leads to rising interest rates, as the Federal Reserve (or other central banks) may tighten monetary policy to curb inflation. This, in turn, causes bond yields to rise. As yields go up, the value of existing bonds declines, as they offer a lower return compared to newly issued bonds with higher yields.

The rise in bond yields can also impact the attractiveness of equities, as investors may shift their investments from stocks to bonds, seeking a more conservative approach.

Sectors Benefiting from a Hot Economy

Several sectors are expected to thrive in a hot economy, as they stand to benefit from increased consumer spending, business investment, and overall economic activity.

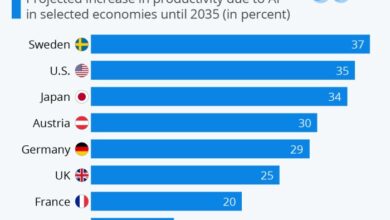

- Technology:The tech sector is well-positioned to benefit from the growth in e-commerce, digital services, and artificial intelligence. Companies in this sector are expected to see strong demand for their products and services, driving revenue growth and higher stock valuations.

- Consumer Discretionary:With rising consumer confidence and disposable income, the consumer discretionary sector, which includes companies that sell non-essential goods and services, is poised for growth. This includes retailers, restaurants, travel companies, and entertainment providers.

- Industrials:As businesses invest in new equipment and expand their operations, the industrial sector is expected to see a surge in demand. This includes companies that manufacture machinery, construction materials, and transportation equipment.

Potential Risks and Challenges

While a hot economy offers opportunities for growth and investment, it also presents potential risks and challenges that could hinder economic progress.

- Inflation:A hot economy can lead to higher inflation, eroding purchasing power and putting pressure on businesses to raise prices. This can lead to a cycle of rising inflation, which can be difficult to control.

- Interest Rate Hikes:To combat inflation, central banks may raise interest rates, making it more expensive for businesses to borrow money and potentially slowing down economic growth.

- Supply Chain Disruptions:Global supply chain disruptions, exacerbated by geopolitical tensions, could continue to impact businesses, leading to higher prices and shortages. This could dampen economic growth and create uncertainty for investors.

- Geopolitical Risks:The ongoing war in Ukraine, tensions between the US and China, and other geopolitical risks can create volatility in financial markets and hinder economic growth.

The Federal Reserve’s Role

The Federal Reserve, the central bank of the United States, plays a crucial role in shaping the economic landscape. Its monetary policy decisions, particularly interest rate adjustments, have a profound impact on Wall Street’s sentiment, investment strategies, and ultimately, the overall health of the economy.

The Federal Reserve’s Current Monetary Policy Stance

The Federal Reserve’s current monetary policy stance is characterized by a series of interest rate hikes aimed at curbing inflation. These hikes are intended to cool down the economy by making borrowing more expensive, thereby reducing consumer spending and business investment.

The Fed’s actions are driven by the need to control inflation, which has been running at elevated levels for several months.

The Potential Implications of Interest Rate Hikes

Interest rate hikes can have both positive and negative implications for the economy. On the one hand, they can help to control inflation by slowing down economic growth. However, they can also lead to a recession if they are too aggressive or if they are implemented during a period of economic weakness.

Impact on Economic Growth

Higher interest rates make it more expensive for businesses to borrow money, which can lead to a reduction in investment and economic growth. This can also lead to a slowdown in job creation and a decline in consumer spending.

Impact on Inflation

Interest rate hikes can help to control inflation by reducing demand for goods and services. This can lead to a decrease in prices, which can help to stabilize the economy.

The Potential Impact of the Federal Reserve’s Actions on Wall Street’s Sentiment and Investment Decisions

The Federal Reserve’s actions can have a significant impact on Wall Street’s sentiment and investment decisions. When the Fed raises interest rates, it can lead to a decline in stock prices as investors become more cautious about the economic outlook.

This is because higher interest rates make it more expensive for companies to borrow money, which can lead to slower growth and lower profits.

Impact on Investment Decisions

Investors may shift their investment strategies in response to the Fed’s actions. For example, they may invest in bonds rather than stocks if they believe that interest rates will continue to rise. This is because bonds tend to perform well when interest rates are rising, while stocks may suffer.

Impact on Wall Street Sentiment

The Fed’s actions can also influence Wall Street’s overall sentiment. If investors believe that the Fed is taking the right steps to control inflation, it can lead to a more positive outlook for the economy and financial markets. However, if investors believe that the Fed is making mistakes, it can lead to a more negative outlook and increased volatility in the markets.

Wall Street’s focus has shifted dramatically from recession worries to a “hot economy” narrative, fueled by resilient consumer spending and a surprisingly strong labor market. This optimism, however, is tempered by the ongoing global economic headwinds, including the critical IMF talks Argentina is facing to resolve its looming debt crisis.

The outcome of these talks could have ripple effects on global markets and potentially impact the trajectory of the US economy, reminding us that even amidst bullish sentiment, vulnerabilities remain.

Consumer and Business Confidence: Wall Street Shifts Focus From Recession To Hot Economy

Consumer and business confidence are crucial indicators of economic health. These sentiments reflect how optimistic or pessimistic individuals and businesses are about the future economic prospects. They play a significant role in shaping spending patterns, investment decisions, and overall economic growth.

Current Levels of Consumer and Business Confidence

Consumer and business confidence levels are influenced by various economic factors, including employment, inflation, interest rates, and overall economic growth. The Conference Board’s Consumer Confidence Index and the Institute for Supply Management’s Manufacturing Index are two prominent indicators that track these sentiments.

- The Conference Board’s Consumer Confidence Index has been fluctuating in recent months, reflecting concerns about inflation and rising interest rates. While consumer spending remains robust, there are signs of weakening confidence due to rising prices and economic uncertainty.

- The Institute for Supply Management’s Manufacturing Index has also shown some signs of softening, indicating that businesses are becoming more cautious about future growth prospects.

Factors Driving Consumer Spending and Business Investment Decisions

Consumer spending is the largest component of economic activity, and it is driven by factors such as disposable income, employment levels, and consumer confidence. Business investment decisions are influenced by factors such as interest rates, profit expectations, and the overall economic climate.

- Rising wages and low unemployment rates have boosted consumer spending, although inflation has eroded some of these gains. Consumers are still spending on goods and services, but they are becoming more price-sensitive.

- Businesses are investing in new equipment, technology, and expansion projects, driven by strong demand and low borrowing costs. However, rising inflation and interest rates are creating some uncertainty about future investment prospects.

Impact of Rising Inflation and Interest Rates on Consumer and Business Confidence, Wall street shifts focus from recession to hot economy

Rising inflation and interest rates can have a significant impact on consumer and business confidence. Inflation erodes purchasing power and reduces disposable income, while higher interest rates increase borrowing costs for both consumers and businesses.

- Consumers may become more cautious about spending if they perceive that inflation is eroding their purchasing power. This could lead to a decline in consumer confidence and spending.

- Businesses may become more hesitant to invest if they believe that rising interest rates will make borrowing more expensive. This could lead to a slowdown in business investment and economic growth.

Global Economic Landscape

The shift in Wall Street’s sentiment from recession fears to a hot economy is influenced by a complex web of global economic conditions and geopolitical events. While the US economy is showing resilience, the global landscape presents both risks and opportunities that Wall Street needs to navigate.

Impact of Global Economic Conditions

Global economic conditions significantly impact Wall Street’s outlook. The health of major economies, particularly in Europe and Asia, influences US markets through trade, investment, and consumer spending. For instance, a slowdown in China’s growth could negatively impact US companies with significant exports to China.

Similarly, a recession in Europe could reduce demand for US goods and services.

Geopolitical Events and Their Impact

Geopolitical events, such as wars, trade disputes, and political instability, can also significantly impact Wall Street’s sentiment. The ongoing war in Ukraine, for example, has disrupted global supply chains, driven up energy prices, and created uncertainty in the global economy.

These events can lead to market volatility and affect investor confidence.

International Trade and Currency Fluctuations

International trade and currency fluctuations are key factors in the global economic landscape. A strengthening US dollar can make US exports more expensive, potentially harming US companies. Conversely, a weakening dollar can make imports cheaper, potentially benefiting consumers but also increasing inflation.

Navigating Global Economic Complexities

Wall Street is constantly adapting to the complexities of the global economic landscape. Investors are increasingly looking for diversification and hedging strategies to mitigate risks. For example, investors may allocate a portion of their portfolios to emerging markets, which are often less correlated with developed markets.

Opportunities in the Global Landscape

Despite the challenges, the global landscape also presents opportunities for Wall Street. Emerging markets, particularly in Asia, are experiencing rapid economic growth, creating potential for investment. Technological advancements, such as artificial intelligence and renewable energy, are driving innovation and creating new industries.