Wall Street Prepares for Subdued Start Amid Middle East Tensions

Wall street prepares for subdued start amid escalating middle east tensions – Wall Street prepares for a subdued start amid escalating Middle East tensions, a situation that has investors on edge. The recent spike in geopolitical uncertainty has cast a shadow over global markets, with traders and analysts bracing for a period of volatility.

The ongoing conflict in the Middle East has raised concerns about potential disruptions to energy supplies, supply chains, and global trade, all of which could have significant economic repercussions.

The current situation is reminiscent of past crises, where similar geopolitical events have triggered market turbulence. Investors are carefully weighing the risks and potential rewards as they navigate this uncertain landscape. While some are taking a cautious approach, others see opportunities for profit amidst the volatility.

The key for investors will be to remain informed, assess the evolving situation, and make well-informed decisions based on a comprehensive understanding of the geopolitical and economic factors at play.

Market Sentiment and Volatility: Wall Street Prepares For Subdued Start Amid Escalating Middle East Tensions

Wall Street is poised for a subdued start to the trading week, reflecting a cautious investor sentiment driven by a confluence of factors, including escalating tensions in the Middle East and concerns about the global economic outlook.

Factors Contributing to Subdued Market Sentiment, Wall street prepares for subdued start amid escalating middle east tensions

Several factors are contributing to the subdued market sentiment, leading investors to adopt a more cautious approach. These include:

- Escalating Tensions in the Middle East:The recent escalation of tensions in the Middle East, particularly the conflict between Israel and Hamas, has injected uncertainty into global markets. The potential for wider regional conflict and disruptions to energy supplies is a major concern for investors, prompting them to seek safe haven assets and reduce risk exposure.

- Economic Concerns:Global economic growth remains a concern, with persistent inflation and rising interest rates weighing on businesses and consumers. Recent economic data from major economies, such as the United States and China, has shown signs of weakness, further dampening investor optimism.

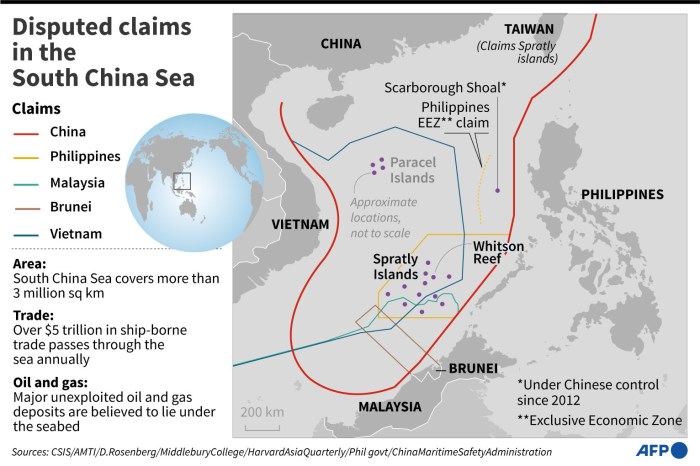

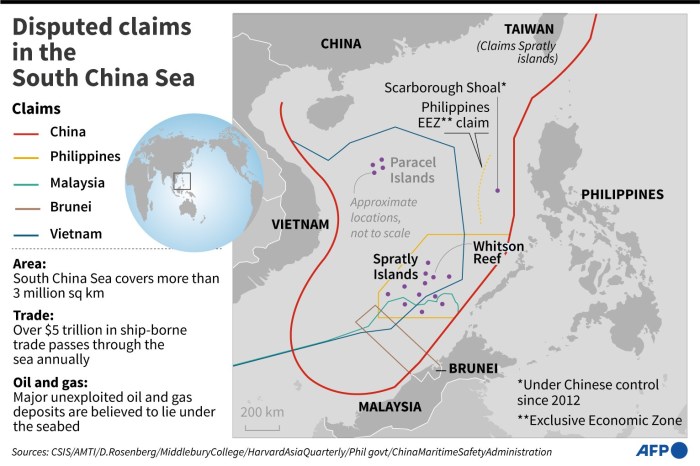

- Geopolitical Uncertainties:The ongoing war in Ukraine, coupled with heightened tensions between the United States and China, has created a complex geopolitical landscape that adds to market volatility. The potential for further escalation or unexpected events adds to the uncertainty that investors are navigating.

Market Trends Reflecting Investor Caution

Recent market trends indicate that investors are exercising caution and seeking safety in the face of these challenges:

- Flight to Safety:Investors are moving towards safe haven assets, such as gold and US Treasury bonds, which are perceived as less risky in times of uncertainty. The price of gold has risen recently, reflecting this shift in investor sentiment.

- Volatility in Equity Markets:Equity markets have been characterized by increased volatility, with sharp swings in stock prices reflecting the uncertainty surrounding the economic outlook and geopolitical risks. The VIX index, a measure of market volatility, has risen in recent weeks, indicating heightened investor anxiety.

- Cautious Corporate Spending:Companies are becoming more cautious about their spending plans, as they navigate economic uncertainty and potential disruptions to supply chains. This is evident in recent earnings reports, where some companies have expressed concerns about the outlook for the remainder of the year.

Potential Impact of Escalating Middle East Tensions on Market Volatility

Escalating tensions in the Middle East have the potential to significantly impact market volatility. The potential for wider regional conflict, disruptions to energy supplies, and geopolitical instability could trigger a sharp sell-off in global markets.

- Energy Prices:A major concern is the potential impact on energy prices. Any disruptions to oil production or supply routes could lead to a surge in oil prices, which would have a ripple effect throughout the global economy. Higher energy costs could further exacerbate inflationary pressures and weigh on economic growth.

- Global Supply Chains:The Middle East is a crucial region for global supply chains, particularly for energy and commodities. A protracted conflict could disrupt these supply chains, leading to shortages and price increases for essential goods. This could further disrupt global economic activity and add to inflationary pressures.

- Investor Sentiment:Escalating tensions in the Middle East could significantly impact investor sentiment. The uncertainty and potential for wider conflict could lead to a flight to safety, with investors moving out of riskier assets and seeking refuge in safe havens like gold and US Treasury bonds.

This could lead to a sharp decline in equity markets and further increase market volatility.

Wall Street is bracing for a muted start to the week as tensions in the Middle East escalate, creating a sense of uncertainty in the market. It’s a reminder that global events can have a profound impact on the economy, and businesses need to be agile and adaptable to navigate these challenges.

A recent article on netflix success in adapting to social and political issues insights from a corporate board veteran highlights the importance of being sensitive to current affairs and reflecting these in content, which can be a valuable lesson for companies across all sectors.

While the immediate focus remains on the Middle East situation, the broader implications for business are clear – adaptability and foresight are key to weathering the storm.

Wall Street is bracing for a subdued start to the week, with escalating tensions in the Middle East casting a shadow over investor sentiment. However, a recent surge in Treasury yields, driven by positive US economic data, wall street experiences mixed performance as positive us economic data drives treasury yields up , might offer some counterbalance.

The market is navigating a complex landscape of geopolitical risks and economic uncertainties, making it difficult to predict a clear direction for the week ahead.

Wall Street is bracing for a subdued start to the week, with investors keeping a close eye on the escalating tensions in the Middle East. While geopolitical risks are weighing on sentiment, a glimmer of hope comes from the retail sector, as Overstock transforms Bed Bath & Beyond’s revival with a digital relaunch.

This strategic move could inject some much-needed optimism into the market, but the overall mood remains cautious as the geopolitical landscape continues to shift.