Wall Street Eyes Positive Start: Data & Fed Influence

Wall street eyes positive start as investors anticipate key economic data and feds influence – Wall Street Eyes Positive Start: Data & Fed Influence sets the stage for an intriguing week on the markets. Investors are anticipating key economic data releases, which will offer valuable insights into the health of the economy. The Federal Reserve’s recent actions and future plans are also weighing heavily on investor sentiment, as their decisions can significantly impact interest rates and overall market direction.

This week’s economic calendar is packed with crucial data points, including inflation figures, unemployment rates, and GDP growth. These releases will provide a clearer picture of the economy’s trajectory and influence investor decisions. The Fed’s influence, however, remains a key factor, as their communication and future plans on interest rate adjustments will likely shape investor strategies and market volatility.

Wall Street’s Outlook

Wall Street is poised for a positive start to the week, driven by a confluence of factors that have ignited investor optimism. The recent economic data releases, coupled with the Federal Reserve’s stance on interest rates, have fueled expectations of a robust market performance.

Investor Sentiment and Market Expectations

The current sentiment among investors is cautiously optimistic, reflecting a balance between the potential for economic growth and the ongoing uncertainties. The recent positive economic data, including strong job creation and resilient consumer spending, has boosted investor confidence. However, concerns about inflation and the potential for aggressive interest rate hikes by the Federal Reserve continue to weigh on market sentiment.

Key Economic Data Releases

Investors are keenly awaiting the release of several key economic data points this week, which are expected to provide further insights into the health of the US economy and the Federal Reserve’s future course of action.

Wall Street is cautiously optimistic, with investors watching closely for the release of key economic data and the Federal Reserve’s upcoming decisions. Meanwhile, the crypto market continues to evolve, and former crypto traders are analyzing the shifting trends to understand the future of digital assets.

Ultimately, both Wall Street and the crypto world are intertwined, and the performance of one sector could impact the other in unexpected ways.

- The Consumer Price Index (CPI) report, scheduled for release on Tuesday, will offer a snapshot of inflation in July. A decline in inflation would likely be welcomed by investors, as it could signal that the Federal Reserve may be nearing the end of its interest rate hike cycle.

Wall Street is poised for a positive start, fueled by anticipation of key economic data releases and the Federal Reserve’s influence on interest rates. However, the optimism is tempered by a cautious start in Asian markets, where US futures have slipped, as seen in this recent market update.

The global market landscape is a delicate dance of optimism and caution, with investors carefully weighing the potential for growth against the looming uncertainties.

- The Producer Price Index (PPI) report, also scheduled for release on Tuesday, will provide insights into inflation pressures at the wholesale level. A slowdown in PPI inflation would further support expectations of a cooling inflation environment.

- The Retail Sales report, scheduled for release on Wednesday, will provide an update on consumer spending in July. Strong retail sales figures would indicate continued resilience in consumer demand and a healthy economy.

The Federal Reserve’s Influence: Wall Street Eyes Positive Start As Investors Anticipate Key Economic Data And Feds Influence

The Federal Reserve, often referred to as the Fed, plays a pivotal role in shaping the American economy and, consequently, the trajectory of Wall Street. Its actions, particularly interest rate decisions and monetary policy adjustments, can have a profound impact on investor sentiment and market performance.

The Fed’s Recent Actions and Implications for Wall Street

The Fed’s recent actions have been driven by the need to combat inflation while supporting economic growth. In 2022, the Fed embarked on an aggressive series of interest rate hikes, aiming to cool down the economy and bring inflation under control.

These hikes have increased borrowing costs for businesses and consumers, potentially slowing down economic activity. The implications for Wall Street are multifaceted. Rising interest rates can make it more expensive for companies to borrow money, potentially impacting their profitability and growth prospects.

This, in turn, can lead to a decline in stock prices. However, the Fed’s actions also aim to create a more stable and predictable economic environment, which could benefit investors in the long run.

Wall Street is bracing for a potentially volatile week, with investors eagerly awaiting key economic data releases and the Federal Reserve’s next move. The market is already showing signs of nervousness, as seen in the recent dip in Dow futures following Disney’s disappointing earnings report.

The news highlights the growing concerns surrounding inflation and its impact on corporate profits. This article provides a detailed breakdown of the current market dynamics and the factors influencing investor sentiment. Despite the initial dip, Wall Street remains hopeful that strong economic indicators and the Fed’s potential pivot could pave the way for a positive start to the week.

The Potential Impact of the Fed’s Interest Rate Decisions and Monetary Policy on Investor Confidence

The Fed’s interest rate decisions and monetary policy have a significant impact on investor confidence. When the Fed raises interest rates, it can create uncertainty in the market as investors try to assess the implications for economic growth and corporate earnings.

This uncertainty can lead to a decline in investor confidence, potentially resulting in a sell-off in the stock market.On the other hand, if the Fed signals a more accommodative monetary policy, such as keeping interest rates low or even cutting them, it can boost investor confidence and lead to a rise in stock prices.

This is because a lower interest rate environment makes it cheaper for companies to borrow money, potentially leading to increased investment and economic growth.

The Fed’s Communication and Future Plans Influence Market Sentiment and Trading Strategies

The Fed’s communication plays a crucial role in shaping market sentiment and influencing trading strategies. The Fed’s statements and press conferences are closely scrutinized by investors for clues about the future direction of monetary policy. For example, if the Fed signals that it plans to continue raising interest rates, it can lead to a sell-off in the stock market as investors anticipate a potential slowdown in economic growth.

Conversely, if the Fed suggests that it is nearing the end of its rate-hiking cycle, it can boost investor confidence and lead to a rally in the stock market. The Fed’s communication can also influence the allocation of assets by investors.

If the Fed is expected to maintain a tight monetary policy, investors may shift their investments towards bonds, which are considered less risky than stocks in a high-interest rate environment. In conclusion, the Fed’s influence on Wall Street is undeniable.

Its actions, particularly interest rate decisions and monetary policy adjustments, can have a profound impact on investor confidence and market performance.

Key Economic Data Releases

Wall Street’s eyes are glued to a handful of key economic data releases, as these numbers can significantly impact investor sentiment and market direction. These releases offer valuable insights into the health of the US economy, influencing the Federal Reserve’s monetary policy decisions and ultimately shaping investor strategies.

Impact of Data Releases on Market Performance

Positive economic data releases generally boost investor confidence, leading to a rise in stock prices. Conversely, negative data can trigger sell-offs as investors become more cautious. The magnitude of the impact depends on the specific data point, the market’s expectations, and the overall economic climate.

Inflation Data

Inflation is a key concern for investors, as it erodes the purchasing power of money and can lead to higher interest rates. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index are the most closely watched inflation indicators.

- A higher-than-expected inflation reading could indicate that the Fed might need to raise interest rates more aggressively, which could slow economic growth and hurt corporate profits.

- Conversely, a lower-than-expected inflation reading could suggest that the Fed might be able to ease its tightening stance, potentially supporting stock prices.

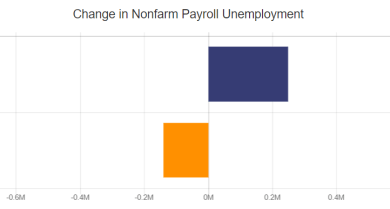

Unemployment Rate

The unemployment rate is a measure of the percentage of the labor force that is unemployed and actively seeking work.

- A declining unemployment rate signals a strong economy with robust job creation. This typically leads to increased consumer spending and corporate profits, boosting stock prices.

- Conversely, a rising unemployment rate suggests a weakening economy and could prompt investors to sell stocks.

Gross Domestic Product (GDP) Growth

GDP growth measures the total value of goods and services produced in an economy over a specific period.

- Strong GDP growth indicates a healthy economy and can support stock prices.

- Conversely, weak GDP growth signals a slowing economy and could lead to a decline in stock prices.

Other Key Data Releases

In addition to inflation, unemployment, and GDP growth, investors also closely monitor data releases on retail sales, manufacturing activity, and housing starts. These indicators provide insights into various sectors of the economy and can influence investor decisions.

Investor Strategies and Sentiment

The anticipation of key economic data releases and the Federal Reserve’s monetary policy decisions heavily influence investor strategies and market sentiment. Understanding how investors react to these factors is crucial for navigating the complexities of the financial markets.

Investor Strategies in Response to Economic Data and Fed Influence, Wall street eyes positive start as investors anticipate key economic data and feds influence

Investors employ various strategies to position themselves in the market based on their outlook on economic data and the Fed’s actions.

- Buy and Hold:Investors who believe in the long-term growth potential of the market might adopt a buy-and-hold strategy, regardless of short-term fluctuations. This approach is often favored by those with a long-term investment horizon and a belief in the underlying strength of the economy.

- Active Trading:Active traders engage in frequent buying and selling of securities, seeking to capitalize on short-term market movements. They often employ technical analysis and fundamental research to identify trading opportunities, aiming to profit from price fluctuations driven by economic data or Fed announcements.

- Defensive Strategies:During periods of economic uncertainty or market volatility, investors might opt for defensive strategies. These strategies focus on preserving capital by investing in low-risk assets like bonds or cash. This approach aims to minimize potential losses during periods of market decline.

- Sector Rotation:Investors may choose to rotate their investments between different sectors of the economy based on their expectations of economic performance. For example, if economic growth is expected to slow, investors might shift their investments from cyclical sectors (e.g., consumer discretionary) to defensive sectors (e.g., healthcare) that are less sensitive to economic downturns.

Investor Sentiment and Market Behavior

Investor sentiment is a broad gauge of how optimistic or pessimistic investors are about the market’s future performance. It can be influenced by a variety of factors, including economic data, geopolitical events, and market trends.

Investor sentiment is a powerful force that can drive market movements.

Visual Representation of Investor Sentiment:[Image: A visual representation of investor sentiment levels and their corresponding market behavior. This could be a simple graph with a horizontal axis representing different sentiment levels (e.g., bullish, neutral, bearish) and a vertical axis representing market behavior (e.g., rising prices, stable prices, falling prices). The graph could show a positive correlation between bullish sentiment and rising prices, neutral sentiment and stable prices, and bearish sentiment and falling prices.]

Impact of Investor Confidence on Market Volatility and Trading Activity

Investor confidence plays a significant role in determining market volatility and trading activity. When investor confidence is high, markets tend to be more volatile and trading activity increases. This is because investors are more willing to take risks and invest in assets that are perceived to have higher growth potential.

Conversely, when investor confidence is low, markets tend to be less volatile and trading activity decreases. Investors become more risk-averse and may prefer to hold cash or invest in safer assets, leading to reduced market activity.

Market Volatility and Risk Assessment

The stock market is a dynamic and unpredictable environment, influenced by a myriad of factors that can lead to significant fluctuations in asset prices. Understanding and managing these fluctuations is crucial for investors seeking to protect their capital and achieve their financial goals.

Factors Contributing to Market Volatility

Market volatility can be attributed to various factors, including economic uncertainty and geopolitical events.

- Economic Uncertainty: Fluctuations in economic indicators, such as inflation, interest rates, and employment data, can create uncertainty among investors, leading to shifts in market sentiment and volatility. For instance, rising inflation can lead to concerns about corporate profitability and consumer spending, potentially causing stock prices to decline.

Conversely, a strong employment report can boost investor confidence and drive markets higher.

- Geopolitical Events: Global events, such as wars, political instability, and trade disputes, can also contribute to market volatility. These events can disrupt global supply chains, increase uncertainty about future economic prospects, and create risk aversion among investors. The ongoing Russia-Ukraine conflict, for example, has significantly impacted energy markets and global economic outlook, leading to increased market volatility.

Risk Assessment Tools and Methods

Investors employ a variety of tools and methods to assess and manage risk in light of current market conditions.

- Risk Tolerance Assessment: This process helps investors understand their ability and willingness to accept potential losses in pursuit of higher returns. It involves evaluating factors such as financial goals, investment horizon, and personal circumstances. A risk tolerance assessment can guide investors towards investment strategies that align with their individual risk profiles.

- Portfolio Diversification: Spreading investments across different asset classes, sectors, and geographies can help reduce portfolio volatility and mitigate risk. A diversified portfolio can help investors weather market downturns as losses in one asset class may be offset by gains in another.

- Quantitative Analysis: This involves using statistical models and historical data to identify and assess potential risks. Techniques such as beta, standard deviation, and correlation analysis can help investors quantify the risk associated with individual investments and portfolios.

- Qualitative Analysis: This involves evaluating non-quantifiable factors, such as management quality, competitive landscape, and regulatory environment. Qualitative analysis can provide insights into the potential risks and opportunities associated with specific investments.

Investor Strategies and Portfolio Adjustments

Investors often adjust their portfolios and trading strategies to mitigate potential risks.

- Shifting Asset Allocation: In periods of heightened market volatility, investors may choose to reduce their exposure to riskier assets, such as stocks, and increase their allocation to more conservative investments, such as bonds. This strategy can help preserve capital during market downturns.

- Short-Selling: Investors can also use short-selling strategies to profit from declining asset prices. This involves borrowing securities and selling them in the market, with the hope of buying them back at a lower price later. Short-selling can be a risky strategy, as potential losses are unlimited.

- Hedging: Hedging strategies involve using financial instruments to offset potential losses from adverse price movements. For example, investors may buy put options to protect their stock holdings from declines. Hedging can help reduce risk but also comes with associated costs.