US Stock Market: Inflation Data and Earnings Reports Drive Caution

The US stock market awaits inflation data and earnings reports as sentiment remains cautious. Investors are navigating a complex landscape, balancing potential growth opportunities with persistent economic uncertainties. The upcoming inflation data release is a critical focal point, as it will provide insights into the Federal Reserve’s future monetary policy decisions and their impact on the market.

Additionally, a wave of earnings reports from major companies will offer crucial information about corporate profitability and future prospects, further shaping investor sentiment.

This cautious approach is driven by several factors, including rising interest rates, ongoing geopolitical tensions, and lingering concerns about inflation. The market has witnessed some volatility in recent weeks, reflecting this cautious sentiment. The upcoming weeks will be crucial for understanding how the market will respond to these key data points and their implications for the broader economic outlook.

Current Market Sentiment

The US stock market is currently navigating a period of cautious sentiment, marked by a combination of economic uncertainties and corporate earnings concerns. Investors are closely monitoring various factors, including inflation, interest rates, and geopolitical tensions, as they weigh the potential impact on corporate profits and overall economic growth.

Factors Contributing to Cautious Sentiment

The current cautious sentiment in the US stock market is driven by a confluence of factors, including:

- Persistent Inflation:While inflation has shown signs of moderating, it remains elevated, prompting concerns about the Federal Reserve’s continued interest rate hikes. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings.

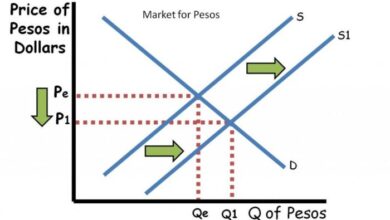

- Interest Rate Hikes:The Federal Reserve’s aggressive interest rate hikes are aimed at curbing inflation, but they also raise concerns about the potential for a recession. As interest rates rise, the cost of borrowing increases, potentially leading to a slowdown in economic activity.

The US stock market is currently in a holding pattern, awaiting crucial inflation data and earnings reports. Sentiment remains cautious, with investors seeking clarity on the economic outlook. While navigating the traditional market, it’s also worth exploring alternative investment strategies, like those outlined in this cryptocurrency investment strategies profitable guide for maximum returns.

Diversifying your portfolio with cryptocurrencies can offer potential for growth, even amidst market uncertainty.

- Geopolitical Uncertainties:Ongoing geopolitical tensions, including the war in Ukraine and rising tensions between the US and China, create uncertainty and volatility in the market. These conflicts disrupt global supply chains, increase energy prices, and impact global economic growth.

- Earnings Season:The upcoming earnings season is a key factor influencing market sentiment. Investors will be closely scrutinizing corporate earnings reports for signs of slowing growth and the impact of inflation and interest rate hikes on profitability.

Examples of Recent Market Activity

Recent market activity reflects the cautious sentiment, with investors seeking safety and hedging against potential market downturns:

- Defensive Sectors:Investors have been rotating into defensive sectors, such as consumer staples and healthcare, which are considered less sensitive to economic fluctuations. These sectors are expected to provide stable earnings and dividends during periods of economic uncertainty.

- Volatility in Growth Stocks:Growth stocks, particularly those in the technology sector, have been experiencing heightened volatility as investors assess the impact of rising interest rates and slowing economic growth on their valuations.

- Increased Volatility:The market has witnessed increased volatility, as investors adjust their positions based on economic data, corporate earnings, and geopolitical events. This volatility reflects the heightened uncertainty and caution among market participants.

Inflation Data

The upcoming release of inflation data is a pivotal event for the stock market, as it will provide crucial insights into the trajectory of prices and the Federal Reserve’s potential response. Investors are closely watching this data to gauge the health of the economy and the likelihood of further interest rate hikes.

Impact of Inflation Readings on Investor Sentiment

The impact of inflation data on investor sentiment is multifaceted and hinges on the relationship between the reported figures and market expectations.

- Higher-than-expected inflation: A reading that surpasses market expectations could trigger a negative reaction from investors. This is because it suggests that inflation is more persistent and might necessitate more aggressive rate hikes from the Federal Reserve, potentially leading to slower economic growth and lower corporate earnings.

In this scenario, investors might sell off stocks, leading to market declines.

- Lower-than-expected inflation: Conversely, a reading below market expectations could be viewed positively by investors. This indicates that inflation is easing, potentially allowing the Federal Reserve to adopt a less hawkish stance on interest rates. This could boost investor confidence and lead to stock market gains, as investors anticipate a more favorable economic environment for businesses.

- Inflation within expectations: If the inflation data aligns with market expectations, the market’s reaction might be muted. Investors might not react strongly to the data, as it confirms existing market sentiment. However, even within expectations, the specific components of the inflation data, such as core inflation (excluding volatile food and energy prices), could still influence investor sentiment.

The US stock market is bracing for a week of crucial economic data releases, with inflation figures and earnings reports set to provide insights into the health of the economy. While investors remain cautious, a recent development in the crypto world might be catching their attention.

Cynthia Lummis, the Senate’s most prominent advocate for cryptocurrency, known as the “Crypto Queen,” has unveiled a far-reaching new bill focused on Bitcoin, potentially shaping the future of digital assets in the US. This move could influence investor sentiment, adding another layer of complexity to an already uncertain market landscape.

Comparison of Expectations with Recent Trends

Market expectations for inflation data are constantly evolving based on economic indicators, consumer spending patterns, and the Federal Reserve’s communication.

- Recent trends: Recent data suggests that inflation has been gradually easing, although it remains above the Federal Reserve’s target of 2%. This has led to some optimism among investors that inflation is on a downward trajectory.

- Expectations: Market expectations for the upcoming inflation data reflect this recent trend, with analysts generally forecasting a continued moderation in inflation. However, there are still concerns about the persistence of underlying inflationary pressures, particularly related to labor costs and supply chain disruptions.

Earnings Reports

The upcoming earnings season will be closely watched by investors, as companies across various sectors release their financial results for the second quarter of 2023. These reports will provide insights into the health of the economy and the impact of inflation and interest rate hikes on corporate profits.

The US stock market is holding its breath, waiting for inflation data and earnings reports to paint a clearer picture of the economic landscape. Sentiment remains cautious, with investors grappling with rising interest rates and the ongoing war in Ukraine.

Meanwhile, across the globe, Argentina faces critical IMF talks to resolve a looming debt crisis , highlighting the interconnected nature of global markets and the potential for ripple effects on investor confidence. It’s a reminder that even as we focus on domestic economic indicators, events on the world stage can significantly impact market sentiment.

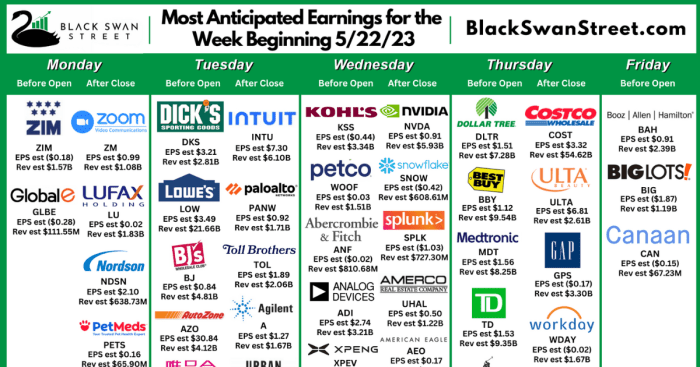

Key Companies Releasing Earnings Reports, Us stock market awaits inflation data and earnings reports as sentiment remains cautious

The earnings season will feature a mix of large-cap and small-cap companies across various sectors. Some of the key companies releasing earnings reports in the coming weeks include:

- Technology:Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, Netflix, and Adobe.

- Financials:JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs, and Morgan Stanley.

- Consumer Discretionary:Walmart, Target, Home Depot, Lowe’s, Costco, and Nike.

- Energy:ExxonMobil, Chevron, ConocoPhillips, and Schlumberger.

- Healthcare:Johnson & Johnson, UnitedHealth Group, Pfizer, and Moderna.

Potential Impact of Earnings Reports on the Stock Market

Earnings reports can have a significant impact on stock prices, both for individual companies and the broader market. Strong earnings reports can boost investor confidence and lead to stock price gains, while weak earnings reports can trigger sell-offs.

- Positive Earnings Surprises:When companies exceed analysts’ expectations, their stock prices tend to rise. This is because investors interpret strong earnings as a sign of good financial health and future growth potential. For example, if Apple announces a higher-than-expected iPhone sales figure, its stock price could rise as investors anticipate continued strong demand for the company’s products.

- Negative Earnings Surprises:When companies fall short of analysts’ expectations, their stock prices tend to decline. This is because investors view weak earnings as a sign of potential problems and future challenges. For example, if Tesla reports lower-than-expected vehicle deliveries, its stock price could fall as investors question the company’s growth prospects.

Emerging Trends in Earnings Reports

The earnings reports for the second quarter of 2023 will likely reveal several emerging trends, including:

- Inflation:Companies will likely highlight the impact of inflation on their operations, including rising costs for raw materials, labor, and transportation. Investors will be looking for signs of how companies are managing inflation and whether they are able to pass on price increases to consumers.

- Interest Rates:The Federal Reserve’s aggressive interest rate hikes are putting pressure on companies’ borrowing costs and potentially slowing economic growth. Earnings reports will provide insights into how companies are adapting to this changing environment.

- Supply Chain Disruptions:The global supply chain continues to face disruptions, leading to higher costs and delays. Companies will likely discuss their efforts to mitigate these challenges and their impact on their operations.

Investor Strategies: Us Stock Market Awaits Inflation Data And Earnings Reports As Sentiment Remains Cautious

The current market landscape presents both challenges and opportunities for investors. Navigating this environment requires a thoughtful approach that considers the potential impact of inflation, earnings reports, and overall market sentiment. Here are some strategies that investors can employ to mitigate risk and potentially capitalize on opportunities:

Portfolio Diversification

Diversification is a fundamental principle of investing that aims to reduce risk by spreading investments across different asset classes, sectors, and geographies. A diversified portfolio can help cushion the impact of adverse market movements in one specific area. For instance, a portfolio might include a mix of stocks, bonds, real estate, and commodities.

Within each asset class, investors can further diversify by investing in a variety of companies or sectors. For example, within the stock market, an investor might choose to allocate funds across different sectors such as technology, healthcare, and energy.

Strategic Asset Allocation

Strategic asset allocation involves determining the proportion of an investment portfolio that should be allocated to each asset class. This decision is based on factors such as the investor’s risk tolerance, investment goals, and time horizon.

- Conservative investors, who prioritize preserving capital and minimizing risk, might allocate a larger portion of their portfolio to bonds and other fixed-income securities. Bonds are generally considered less volatile than stocks and offer a more predictable stream of income.

- Growth-oriented investors, who are willing to take on more risk in pursuit of higher returns, might allocate a larger portion of their portfolio to stocks. Stocks have the potential for higher growth but also carry a greater risk of losses.

Value Investing

Value investing involves identifying undervalued securities that have the potential to appreciate in value over time. Value investors typically focus on companies with strong fundamentals, such as solid earnings, low debt levels, and a history of profitability.

- Value investorsoften seek out companies that are trading at a discount to their intrinsic value, which is the actual worth of the company based on its assets, earnings, and future prospects. They believe that the market has mispriced these companies and that their share prices will eventually rise to reflect their true value.

- Value investorsoften use financial ratios, such as the price-to-earnings ratio (P/E) and the price-to-book ratio (P/B), to identify undervalued companies.

Growth Investing

Growth investing involves identifying companies with high growth potential. Growth investors typically focus on companies with strong revenue growth, expanding market share, and innovative products or services.

- Growth investorsare often willing to pay a premium for these companies, as they believe that their future growth prospects justify the higher price.

- Growth investorsoften use metrics such as revenue growth, earnings per share growth, and return on equity to identify high-growth companies.

Active vs. Passive Investing

Active investing involves actively managing a portfolio by selecting individual securities and making buy and sell decisions. Passive investing involves investing in a diversified portfolio of securities, such as index funds or exchange-traded funds (ETFs), and holding them for the long term.

- Active investorsbelieve that they can outperform the market by making informed investment decisions. However, active investing can be time-consuming and expensive, as it requires ongoing research, analysis, and trading.

- Passive investorsbelieve that it is difficult to consistently outperform the market, and they prefer to let their investments grow over time without active management. Passive investing is typically less expensive than active investing, as it does not involve ongoing trading or research.

Hypothetical Portfolio Allocation

As an example, consider a hypothetical portfolio allocation for an investor with a moderate risk tolerance and a long-term investment horizon:

| Asset Class | Allocation |

|---|---|

| Large-cap U.S. stocks | 30% |

| International stocks | 20% |

| Bonds | 30% |

| Real Estate | 10% |

| Commodities | 10% |

This allocation reflects a balance between growth potential and risk mitigation. The large-cap U.S. stocks and international stocks provide exposure to growth, while the bonds and real estate offer more stability and income. The commodities allocation provides diversification and potential inflation protection.

Risk Mitigation Strategies

- Dollar-cost averaging:This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. This helps to reduce the impact of market volatility and can lead to lower average purchase prices over time.

- Stop-loss orders:Stop-loss orders are designed to limit potential losses on an investment. These orders automatically sell a security if it falls below a predetermined price level. This can help to protect investors from significant losses if the market takes a downturn.

- Rebalancing:Rebalancing involves periodically adjusting the asset allocation of a portfolio to ensure that it remains consistent with the investor’s risk tolerance and investment goals. This can help to prevent the portfolio from becoming too heavily weighted in one asset class and can help to maintain a balanced approach to investing.

Economic Outlook

The current economic outlook is a mixed bag, with a delicate balance between growth and inflation concerns. While the economy continues to show signs of resilience, rising interest rates, persistent inflation, and geopolitical uncertainties pose significant challenges.

Economic Growth and Inflation

The global economy is navigating a complex landscape. The International Monetary Fund (IMF) forecasts global growth of 2.9% in 2023, down from 3.4% in 2022. This slowdown is attributed to factors such as persistent inflation, rising interest rates, and the ongoing war in Ukraine.

Inflation, although easing, remains elevated in many countries, with the US Federal Reserve and other central banks continuing to raise interest rates to combat it.

Key Economic Events and their Potential Impact

The stock market will be closely watching several key economic events in the coming months. These include:

- Inflation Data:The Federal Reserve’s decisions on interest rate hikes are heavily influenced by inflation data. Higher-than-expected inflation readings could lead to more aggressive rate hikes, potentially weighing on economic growth and stock market performance.

- Earnings Reports:Corporate earnings reports will provide insights into the health of individual companies and the broader economy. Strong earnings growth can boost investor confidence and drive stock prices higher, while weak earnings could trigger sell-offs.

- Geopolitical Developments:The ongoing war in Ukraine and other geopolitical tensions continue to create uncertainty and volatility in the global economy. Escalations in these conflicts could negatively impact energy prices, supply chains, and global growth.