Rising Gas Prices: A Challenge for Bidens Reelection?

Rising gas prices and joe bidens reelection a challenge on the horizon – Rising gas prices and Joe Biden’s reelection a challenge on the horizon – a statement that reverberates through the American consciousness. As the cost of filling up our tanks climbs, the economic and political implications are undeniable. The ripple effects of this price surge extend far beyond the pump, impacting our wallets, our communities, and ultimately, the fate of the nation.

The recent spike in gas prices has become a focal point of national conversation, igniting debates about energy policy, economic stability, and the very future of our nation. While the Biden administration grapples with finding solutions, the political landscape is shifting, with voters increasingly scrutinizing the president’s response to this pressing issue.

Economic Impact of Rising Gas Prices

Rising gas prices have a significant impact on the economy, affecting consumers, businesses, and the overall economic landscape. These price increases ripple through various sectors, impacting spending patterns, inflation, and economic growth.

Impact on Consumers

Rising gas prices directly impact consumers’ wallets, reducing their disposable income. This reduction in purchasing power forces consumers to make difficult choices, often prioritizing essential needs like food and housing over discretionary spending. This shift in spending patterns can lead to a decline in consumer demand, impacting businesses across various sectors.

Impact on Businesses

Businesses face a multitude of challenges due to rising gas prices. Increased transportation costs for raw materials and finished goods directly impact production costs. This can lead to higher prices for consumers or reduced profit margins for businesses. Some businesses, particularly those in transportation-dependent industries like trucking and delivery, face significant financial pressure, potentially leading to job losses or reduced service levels.

Impact on Inflation

Rising gas prices contribute to overall inflation. As transportation costs increase, businesses pass on these costs to consumers through higher prices for goods and services. This inflationary pressure can lead to a vicious cycle, with higher prices driving further demand reduction and potentially impacting economic growth.

Impact on Different Sectors

- Transportation:The transportation sector is directly affected by rising gas prices. Airlines, trucking companies, and ride-sharing services experience increased operating costs, potentially leading to higher fares and delivery fees. This can impact the availability and affordability of transportation options for consumers.

- Manufacturing:Manufacturing industries rely heavily on transportation for raw materials and finished goods. Rising gas prices increase production costs, impacting profit margins and potentially leading to job losses or reduced production. This can also contribute to higher prices for manufactured goods, further impacting consumer spending.

- Tourism:The tourism industry is sensitive to rising gas prices. Consumers may choose to stay closer to home or opt for less expensive travel options, impacting travel and accommodation businesses. Rising fuel costs can also impact the cost of airfare and rental cars, making travel more expensive.

Business Adjustments

Businesses are implementing strategies to mitigate the impact of rising gas prices. Some businesses are raising prices to offset increased costs, while others are reducing services or seeking alternative transportation methods.

- Price Increases:Businesses are raising prices for goods and services to cover higher transportation costs. This strategy allows them to maintain profit margins but can lead to decreased consumer demand.

- Reduced Services:Some businesses are reducing services to cut costs. For example, delivery companies may reduce service areas or offer fewer delivery options. This can impact consumer convenience and satisfaction.

- Alternative Transportation:Businesses are exploring alternative transportation methods to reduce fuel consumption. This can include using electric vehicles, optimizing delivery routes, or consolidating shipments. These strategies require significant investment and may not be feasible for all businesses.

Political Implications of Rising Gas Prices

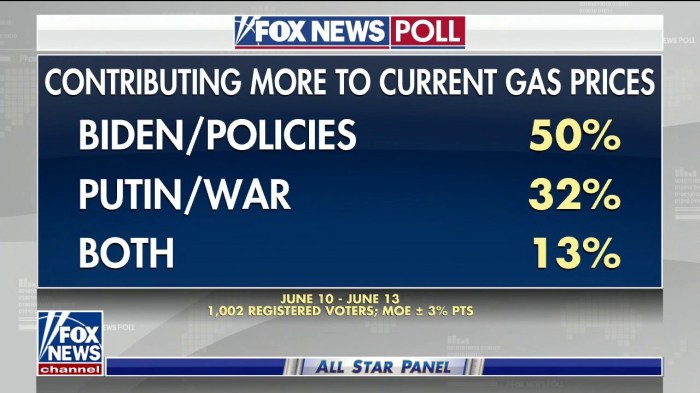

Rising gas prices have a significant impact on voter sentiment and public opinion, potentially influencing election outcomes. Voters often associate rising gas prices with economic hardship and may hold the incumbent government accountable for failing to address the issue. This can lead to decreased support for the ruling party and increased support for opposition candidates who promise solutions.

Rising Gas Prices as a Political Issue

Rising gas prices have historically been a major political issue, particularly during election years. Voters are sensitive to fluctuations in gas prices, as they directly impact their household budgets and overall cost of living. This sensitivity can translate into political pressure on policymakers to address the issue.

Rising gas prices are a hot-button issue, and with the 2024 election looming, it’s a major challenge for President Biden. While the stock market seems to be holding its own, as seen in the recent news that the US stock market opened higher amid steady yields , the economic anxieties surrounding inflation and high gas prices are likely to play a significant role in the upcoming election.

- Increased Scrutiny of Government Policies:Rising gas prices can lead to increased scrutiny of government policies related to energy production, regulation, and taxation. Voters may demand action from policymakers to address the issue, leading to policy debates and potential changes in government priorities.

- Shift in Public Opinion:Rising gas prices can shift public opinion towards policies that are perceived to address the issue, such as increased domestic energy production, reduced dependence on foreign oil, or tax breaks for consumers. This shift in public opinion can influence the political landscape and impact the outcome of elections.

- Impact on Election Outcomes:In some cases, rising gas prices have been directly linked to election outcomes. For instance, in the 1970s, the energy crisis and high gas prices contributed to the defeat of President Gerald Ford. Similarly, in 2008, high gas prices played a role in the election of Barack Obama, as voters were looking for a change in leadership and a solution to the economic crisis.

Historical Relationship Between Gas Prices and Presidential Elections

Throughout history, there has been a correlation between gas prices and presidential election outcomes. While other factors also influence election results, rising gas prices have often been associated with decreased support for incumbent presidents and increased support for challengers.

- 1970s Energy Crisis:The 1970s energy crisis, marked by high gas prices and oil shortages, significantly impacted the 1976 presidential election. President Gerald Ford, who was running for re-election, was blamed for the economic hardships caused by the energy crisis. This contributed to his defeat by Jimmy Carter.

- 2008 Election:The 2008 election saw record-high gas prices, which played a role in the defeat of incumbent President George W. Bush. Voters were frustrated with the high cost of gas and the perceived lack of progress in addressing the issue.

Rising gas prices are a major concern for many Americans, and it’s a challenge that could significantly impact President Biden’s reelection chances. The economic fallout of the pandemic, coupled with global events, has created a complex situation, and the impact of cryptocurrencies like Bitcoin, as discussed in this insightful article on bitcoins impact on the global economy dissecting the influence of cryptocurrency , adds another layer to the economic puzzle.

Ultimately, voters will be looking for solutions, and the ability to address these challenges will be crucial for President Biden’s reelection bid.

This contributed to the election of Barack Obama, who promised to address the economic crisis and promote energy independence.

- 2012 Election:While gas prices were lower in 2012 than in 2008, they still remained a concern for voters. The issue of gas prices was a significant talking point during the presidential campaign, with both candidates, Barack Obama and Mitt Romney, proposing solutions to address the issue.

Examples of Politicians Addressing Rising Gas Prices

Politicians have employed various strategies to address rising gas prices in the past. These strategies often focus on increasing domestic energy production, reducing dependence on foreign oil, or providing tax relief to consumers.

- Tax Breaks:Presidents have often implemented tax breaks or rebates to provide temporary relief to consumers facing high gas prices. For example, President George W. Bush signed the Energy Policy Act of 2005, which included tax breaks for oil and gas exploration and production.

- Increased Domestic Production:Presidents have also encouraged increased domestic energy production to reduce dependence on foreign oil and lower gas prices. For example, President Donald Trump signed an executive order promoting American energy independence and reducing regulations on oil and gas production.

- Alternative Energy Investments:Presidents have also invested in alternative energy sources, such as solar and wind power, to diversify the energy mix and reduce reliance on fossil fuels. For example, President Barack Obama signed the American Recovery and Reinvestment Act of 2009, which included funding for renewable energy projects.

Biden Administration’s Response to Rising Gas Prices

The Biden administration has faced a significant challenge in tackling rising gas prices, a factor that has contributed to inflation and impacted the economy. The administration has implemented various policies and initiatives to address this issue, drawing both praise and criticism.

Policies and Initiatives to Address Rising Gas Prices

The Biden administration has taken a multifaceted approach to addressing rising gas prices. Key initiatives include:

- Release of Strategic Petroleum Reserve (SPR):The administration has authorized the release of millions of barrels of oil from the SPR, a national emergency reserve, to increase supply and reduce prices. This action was taken in coordination with other countries, including Japan, South Korea, and India.

- Promoting Domestic Energy Production:The administration has emphasized the need to increase domestic oil production, particularly in the United States. This includes streamlining the permitting process for new oil and gas projects and encouraging investment in renewable energy sources.

- Promoting Alternative Fuels:The administration has focused on promoting alternative fuels, such as biofuels and electric vehicles, to reduce reliance on gasoline and diversify the energy mix.

- Addressing Market Speculation:The administration has investigated potential market manipulation and price gouging by oil companies, aiming to ensure fair pricing practices.

- Encouraging Fuel Efficiency:The administration has promoted fuel-efficient vehicles and technologies, aiming to reduce fuel consumption and dependence on fossil fuels.

Comparison with Previous Administrations

The Biden administration’s response to rising gas prices has been compared to previous administrations’ approaches. Some key differences include:

- Focus on Renewable Energy:The Biden administration has placed a greater emphasis on renewable energy sources and reducing reliance on fossil fuels compared to previous administrations.

- International Cooperation:The Biden administration has actively engaged in international cooperation to address energy supply issues, including coordinating oil releases from the SPR with other countries.

- Market Regulation:The Biden administration has shown a greater willingness to investigate potential market manipulation and price gouging by oil companies.

Effectiveness of the Biden Administration’s Policies

The effectiveness of the Biden administration’s policies in mitigating the impact of rising gas prices is a subject of ongoing debate. While some argue that the administration’s actions have helped to stabilize prices, others contend that these measures have had a limited impact.

- Short-Term Relief:The release of oil from the SPR and other measures have provided some short-term relief from rising prices, but the long-term impact remains uncertain.

- Increased Domestic Production:The administration’s efforts to increase domestic oil production have faced challenges, including regulatory hurdles and environmental concerns.

- Shift to Renewable Energy:The transition to renewable energy sources is a long-term process that may not provide immediate relief from rising gas prices.

Political Consequences of the Biden Administration’s Response

The Biden administration’s response to rising gas prices has had significant political implications.

- Public Perception:Rising gas prices have contributed to public dissatisfaction with the administration’s economic policies.

- Political Opposition:Republican lawmakers have criticized the administration’s policies, arguing that they have exacerbated the problem of rising gas prices.

- Impact on Elections:The issue of rising gas prices is likely to be a significant factor in the 2024 presidential election.

Alternative Energy and its Role in Addressing Gas Price Volatility

The global dependence on fossil fuels, particularly oil, has created a precarious situation where gas prices are susceptible to volatility driven by geopolitical events, supply chain disruptions, and global demand fluctuations. This dependence on a finite resource with a volatile market has prompted a global shift towards alternative energy sources, aiming to reduce our reliance on fossil fuels and mitigate the impact of price swings.

The Role of Alternative Energy in Reducing Dependence on Fossil Fuels, Rising gas prices and joe bidens reelection a challenge on the horizon

The transition to alternative energy sources, such as solar, wind, hydro, and geothermal power, offers a path to lessen our reliance on fossil fuels and create a more sustainable energy future. These renewable sources provide a consistent and reliable energy supply, reducing our vulnerability to the unpredictable nature of the fossil fuel market.

Rising gas prices are a major concern for voters, and they could pose a significant challenge to President Biden’s reelection bid. With inflation already a hot-button issue, Americans are feeling the pinch at the pump, and many are struggling to make ends meet.

Managing credit debt effectively can be a crucial part of weathering these economic storms. Check out these credit debt management tips, strategies, and examples to help you stay on top of your finances. While the economy is uncertain, understanding your financial situation and taking proactive steps to manage your debt can provide a sense of control and stability during these turbulent times.

As we increase our investment in renewable energy infrastructure, the demand for oil and gas decreases, potentially leading to a more stable and less volatile market.

Potential Impact of Renewable Energy on Gas Prices

The increasing adoption of renewable energy sources has the potential to significantly impact gas prices in the long term. As renewable energy technologies continue to advance and become more cost-effective, they are increasingly competitive with fossil fuels. This competition drives down the demand for oil and gas, ultimately impacting the price of gasoline.

Successful Initiatives to Transition to Alternative Energy Sources

Numerous initiatives around the world demonstrate the successful transition to alternative energy sources and their impact on gas prices.

- Germany’s Energiewende:Germany’s ambitious plan to transition to renewable energy has significantly reduced its dependence on fossil fuels. This initiative has led to a decrease in the country’s reliance on imported oil and gas, contributing to a more stable energy market and potentially lower gas prices.

- China’s Solar Power Expansion:China’s rapid expansion of solar power has made it the world’s largest producer of solar energy. This initiative has significantly reduced the country’s reliance on fossil fuels, contributing to a more sustainable energy future and potentially lowering gas prices.

- California’s Zero-Emission Vehicle Mandate:California’s mandate requiring the sale of zero-emission vehicles has spurred innovation and investment in electric vehicle technology. The increased adoption of electric vehicles directly reduces the demand for gasoline, potentially impacting gas prices.

Challenges and Opportunities of Transitioning to a Sustainable Energy Future

While transitioning to a sustainable energy future offers numerous benefits, it also presents challenges.

- Infrastructure Investment:The transition requires significant investment in renewable energy infrastructure, including solar panels, wind turbines, and energy storage systems.

- Grid Integration:Integrating renewable energy sources into existing power grids can be complex and requires careful planning to ensure stability and reliability.

- Intermittency of Renewable Sources:Solar and wind energy are intermittent sources, meaning their availability fluctuates depending on weather conditions. This requires developing energy storage solutions and integrating them into the grid to ensure a consistent energy supply.

Despite these challenges, the transition to a sustainable energy future presents numerous opportunities:

- Economic Growth:The renewable energy sector is a growing industry, creating new jobs and stimulating economic growth.

- Energy Security:Reducing reliance on fossil fuels enhances energy security, making countries less vulnerable to geopolitical events and supply chain disruptions.

- Environmental Sustainability:Transitioning to renewable energy sources reduces greenhouse gas emissions and contributes to mitigating climate change.

The Impact of Global Events on Gas Prices

The price of gasoline is influenced by a complex web of factors, including global events that can significantly impact supply and demand. Geopolitical instability, international conflicts, and global economic fluctuations all play a role in shaping the price we pay at the pump.

The Role of Geopolitical Events

Global events, particularly those impacting oil production or transportation, can have a profound influence on gas prices. International conflicts, such as wars or political unrest in oil-producing regions, can disrupt supply chains and lead to price increases. For instance, the 2003 invasion of Iraq, a major oil producer, significantly impacted global oil markets and contributed to rising gas prices.

Similarly, the ongoing conflict in Ukraine, a key exporter of wheat and sunflower oil, has caused disruptions in global commodity markets, including oil.

The Role of Supply and Demand in Gas Price Fluctuations: Rising Gas Prices And Joe Bidens Reelection A Challenge On The Horizon

The price of gasoline, like any other commodity, is determined by the fundamental economic forces of supply and demand. When supply exceeds demand, prices tend to fall, and when demand outpaces supply, prices rise. This dynamic interplay between supply and demand is the primary driver of gas price fluctuations.

Factors Influencing Supply and Demand

Supply and demand in the oil market are influenced by a complex interplay of factors. Production levels, refining capacity, and consumer demand are key elements that shape the balance between supply and demand, ultimately impacting gas prices.

Production Levels

The amount of crude oil extracted and produced globally significantly influences gas prices. When oil production levels are high, supply increases, putting downward pressure on prices. Conversely, when production declines, supply shrinks, leading to higher prices. Several factors can affect production levels, including:

- Geopolitical Events:Conflicts or political instability in major oil-producing regions, such as the Middle East, can disrupt production and lead to supply shortages, pushing prices higher.

- Technological Advancements:Innovations in oil extraction technologies, such as fracking, can increase production and potentially lower prices.

- Government Policies:Government regulations and policies, such as production quotas or subsidies, can influence oil production levels and impact gas prices.

Refining Capacity

The capacity of refineries to process crude oil into gasoline and other petroleum products also plays a crucial role in determining gas prices. When refining capacity is limited, it can create a bottleneck, leading to higher prices. Factors affecting refining capacity include:

- Maintenance and Upgrading:Periodic maintenance and upgrades of refineries can temporarily reduce refining capacity, leading to price increases.

- Investment in New Refineries:Investment in new refineries can increase capacity, potentially putting downward pressure on prices.

- Environmental Regulations:Stringent environmental regulations can increase the cost of refining, potentially leading to higher gas prices.

Consumer Demand

Consumer demand for gasoline is a significant driver of gas prices. When demand is high, prices tend to rise, and when demand is low, prices tend to fall. Factors influencing consumer demand include:

- Economic Growth:Strong economic growth often leads to increased driving and higher gasoline demand, pushing prices upward.

- Fuel Efficiency:Improvements in vehicle fuel efficiency can reduce gasoline demand, potentially leading to lower prices.

- Alternative Fuels:The adoption of alternative fuels, such as electric vehicles, can decrease demand for gasoline, potentially impacting prices.

Historical Examples of Supply and Demand Impacts

Throughout history, changes in supply and demand have had a significant impact on gas prices. For instance:

- The 1973 Oil Crisis:The Arab oil embargo of 1973 significantly reduced oil production, leading to a sharp increase in gas prices. This event highlighted the vulnerability of the global economy to oil supply disruptions.

- The 2008 Financial Crisis:The global financial crisis of 2008 led to a decrease in demand for gasoline, resulting in a significant drop in prices.

- The Shale Oil Revolution:The development of shale oil extraction technologies in the United States increased oil production and contributed to lower gas prices in the 2010s.

Future Factors Influencing Supply and Demand

Looking ahead, several factors could potentially influence supply and demand dynamics in the oil market and impact gas prices:

- Global Economic Growth:Continued global economic growth is expected to increase demand for oil, potentially putting upward pressure on prices.

- Climate Change Policies:Governments worldwide are increasingly implementing policies to reduce greenhouse gas emissions, which could impact oil production and consumption, potentially leading to higher gas prices.

- Technological Advancements:Advancements in renewable energy technologies, such as solar and wind power, could reduce reliance on fossil fuels, potentially impacting oil demand and gas prices.