US Labor Market Adds 209,000 Jobs in June, Reflecting Moderate Growth

Us labor market adds 209000 jobs in june reflecting moderate growth – The US labor market added 209,000 jobs in June, a sign of moderate growth that continues to reflect a resilient economy. While this figure falls short of the robust gains seen earlier in the year, it still signals a healthy pace of job creation.

This positive development comes amidst ongoing concerns about inflation and rising interest rates, making this month’s report particularly noteworthy.

The report reveals a diverse landscape within the labor market. Certain industries, like leisure and hospitality, continue to show strong hiring, while others, like manufacturing, have experienced slower growth. This suggests that the economic recovery is uneven, with some sectors performing better than others.

Job Growth Overview

The US labor market added 209,000 jobs in June, according to the Bureau of Labor Statistics, demonstrating moderate growth and a continued resilient economy. This figure provides insights into the health of the US economy, revealing its ability to sustain job creation despite ongoing challenges.

The US labor market added 209,000 jobs in June, reflecting moderate growth, a positive sign amidst global economic uncertainty. However, the news from Russia, where Wagner leader Yevgeny Prigozhin is defying Putin’s authority, as reported on The Venom Blog , adds another layer of complexity to the global economic landscape.

Despite these geopolitical challenges, the US job market continues to show resilience, indicating a potential for continued economic growth.

Comparison with Previous Months and Year-over-Year Trend

The June job growth figure represents a slight decline from the 306,000 jobs added in May, indicating a potential slowdown in hiring. However, this figure remains above the average monthly job growth of 250,000 observed over the past year. This trend suggests that the labor market continues to grow, albeit at a slightly slower pace.

Industries Contributing to Job Growth

The sectors that contributed most to job growth in June include:

- Leisure and hospitality: This sector added 67,000 jobs, reflecting the continued recovery in the tourism and travel industries.

- Healthcare: This sector added 48,000 jobs, driven by the increasing demand for healthcare services.

- Professional and business services: This sector added 32,000 jobs, reflecting growth in industries like consulting and accounting.

Sectors Experiencing Job Losses or Slower Growth

While several industries experienced job growth, some sectors experienced job losses or slower growth in June:

- Construction: This sector lost 4,000 jobs, potentially reflecting a slowdown in housing starts and infrastructure projects.

- Manufacturing: This sector added only 1,000 jobs, suggesting a continued slowdown in industrial activity.

Unemployment Rate: Us Labor Market Adds 209000 Jobs In June Reflecting Moderate Growth

The unemployment rate remained steady at 3.6% in June, indicating a stable labor market despite the moderate job growth. This suggests that the economy is creating jobs at a pace that is keeping up with the growth in the labor force.

Factors Contributing to the Unemployment Rate Change

The stability of the unemployment rate in June can be attributed to a number of factors.

- The strong labor market continues to attract workers back into the workforce, as evidenced by the continued decline in the labor force participation rate. This suggests that more people are confident in their ability to find jobs, leading to a larger pool of potential workers.

The US labor market added 209,000 jobs in June, reflecting moderate growth. This news comes as the Dow Futures dip in response to Disney reporting losses and ahead of the release of inflation data. You can find live updates on the situation here.

While the job market continues to show resilience, investors are closely watching economic indicators for signs of a potential slowdown.

- The continued growth in the number of job openings suggests that employers are still struggling to find qualified workers. This is likely due to a combination of factors, including the aging workforce, the difficulty of finding workers with the necessary skills, and the ongoing challenges of attracting workers in certain industries.

- The Federal Reserve’s recent interest rate hikes have begun to cool the economy, which could slow job growth in the coming months. However, the impact of these rate hikes is still uncertain, and it is too early to say whether they will have a significant impact on the unemployment rate.

Implications of the Unemployment Rate for the Labor Market

The stable unemployment rate in June is a positive sign for the labor market. It suggests that the economy is creating jobs at a pace that is keeping up with the growth in the labor force. This is good news for workers, who are likely to see continued wage growth and job security.

However, the continued difficulty of employers finding qualified workers suggests that the labor market may be tightening, which could lead to higher wages and more competition for workers.

Comparison of the Current Unemployment Rate to Historical Trends and Projections

The current unemployment rate of 3.6% is near historical lows. The unemployment rate has been steadily declining since the Great Recession, and it is currently at its lowest level since the early 1960s. This suggests that the labor market is in a very strong position.

However, the unemployment rate is still higher than the pre-pandemic level of 3.5%, indicating that there is still room for improvement.

The US labor market added 209,000 jobs in June, reflecting moderate growth. This steady expansion is likely influenced by a variety of factors, including the overall health of the economy and the demand for skilled workers. As we consider the broader economic landscape, it’s interesting to see how these trends play out in different sectors, such as real estate.

If you’re interested in diving deeper into the intricacies of the real estate market, I recommend checking out this comprehensive guide on exploring real estate in the United States state by state, analyzing both residential and commercial properties.

Understanding these nuances can provide valuable insights into the overall economic picture and help us make informed decisions about our own financial futures.

Different Categories of Unemployment and Their Significance

There are several different categories of unemployment, each with its own implications for the labor market.

- Frictional unemploymentis the unemployment that occurs when people are between jobs. This type of unemployment is typically short-term and is considered a normal part of a healthy economy. It reflects the natural movement of workers from one job to another.

- Structural unemploymentis the unemployment that occurs when there is a mismatch between the skills of workers and the skills required for available jobs. This type of unemployment can be more persistent and may require retraining or education to address. It reflects the changing nature of the economy and the need for workers to adapt to new skills and technologies.

- Cyclical unemploymentis the unemployment that occurs during economic downturns. This type of unemployment is typically short-term and is caused by a decline in aggregate demand. It is often associated with recessions and periods of economic weakness.

Labor Force Participation Rate

The labor force participation rate, a key indicator of economic health, remained steady in June, offering insights into the current state of the labor market.

Labor Force Participation Rate in June

The labor force participation rate in June remained unchanged at 62.6%, indicating that the proportion of the population either working or actively seeking employment remained stable. This figure reflects a slight decrease from the previous month’s rate of 62.7%.

Factors Influencing the Participation Rate

Several factors contribute to the labor force participation rate. These include:

- Demographic Trends:An aging population, with more individuals reaching retirement age, can lead to a decline in the participation rate.

- Economic Conditions:During periods of economic growth, more people tend to enter the workforce, leading to an increase in the participation rate. Conversely, during economic downturns, some individuals may become discouraged and leave the labor force, resulting in a decrease.

- Government Policies:Policies related to retirement, unemployment benefits, and childcare can influence the participation rate. For example, policies that encourage early retirement may lead to a decline, while policies that provide childcare subsidies may encourage more individuals, particularly women, to enter the workforce.

- Education and Skills:The availability of jobs that match the skills and education levels of the population can also impact the participation rate. A mismatch between skills and available jobs may lead to individuals becoming discouraged and leaving the labor force.

Implications of the Participation Rate for the Labor Market

The labor force participation rate provides insights into the overall health of the labor market. A stable or increasing participation rate generally indicates a strong economy with ample job opportunities and a healthy labor force. Conversely, a declining participation rate may signal a weakening economy, potential labor shortages, or a mismatch between available jobs and the skills of the workforce.

Comparison with Historical Trends and Projections

The current participation rate of 62.6% is slightly lower than the pre-pandemic rate of 63.3% in February 2020. While the rate has recovered from its pandemic low of 60.2% in April 2020, it has not yet reached pre-pandemic levels. Projections suggest that the participation rate may continue to rise gradually in the coming years, but it is unlikely to reach pre-pandemic levels in the near future.

Labor Force Participation Rate by Demographics

The labor force participation rate varies significantly across different demographic groups.

| Demographic | Labor Force Participation Rate |

|---|---|

| Men (25-54 years) | 87.1% |

| Women (25-54 years) | 76.8% |

| Black or African American | 61.7% |

| Hispanic or Latino | 64.3% |

| White | 63.9% |

Wage Growth

Wage growth in June remained steady, reflecting a continued, albeit moderate, pace of economic expansion. The average hourly earnings for all employees on private nonfarm payrolls increased by 0.4% in June, following a 0.3% rise in May. This translates to an annualized growth rate of 4.4%, suggesting that workers are still seeing some gains in their purchasing power.

Wage Growth and Its Impact on Inflation and Consumer Spending

The relationship between wage growth and inflation is complex and dynamic. When wages rise faster than inflation, workers have more disposable income, which can lead to increased consumer spending and fuel further economic growth. However, if inflation outpaces wage growth, workers’ purchasing power erodes, potentially dampening consumer demand.

Comparison of Wage Growth to Inflation

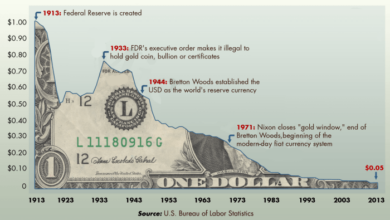

In June, the Consumer Price Index (CPI) increased by 3%, indicating that inflation is still a significant concern for consumers. While wage growth outpaced inflation in June, the gap between the two has narrowed in recent months. This suggests that the Federal Reserve’s efforts to combat inflation are starting to have an impact on wage growth.

Factors Influencing Wage Growth

Several factors influence wage growth, including:* Labor Market Conditions:A tight labor market, characterized by low unemployment and high demand for workers, typically leads to higher wage growth as employers compete for talent.

Productivity Growth Increased productivity, measured as output per worker, can also drive wage growth. When workers are more productive, employers may be willing to pay them more.

Inflation Expectations Workers’ expectations about future inflation can influence their wage demands. If workers anticipate high inflation, they may demand higher wages to maintain their purchasing power.

Government Policies Minimum wage laws, tax policies, and other government regulations can impact wage growth.

Industries with the Highest and Lowest Wage Growth, Us labor market adds 209000 jobs in june reflecting moderate growth

Wage growth varies across different industries. Some industries, such as leisure and hospitality, have seen particularly strong wage growth in recent months, reflecting the tight labor market in these sectors. Other industries, such as manufacturing, have experienced slower wage growth.

Future Outlook

The US labor market is likely to face a complex landscape in the coming months, with various factors influencing its trajectory. Several key economic indicators will play a significant role in shaping the future of job growth, unemployment, and wage trends.

Impact of Inflation, Interest Rates, and Global Economic Conditions

Inflation continues to be a major concern, impacting consumer spending and business investment. The Federal Reserve’s efforts to combat inflation through interest rate hikes could potentially slow economic growth and job creation. Additionally, global economic conditions, such as the ongoing war in Ukraine and supply chain disruptions, can influence US economic performance and the labor market.

- Inflation: High inflation erodes purchasing power, potentially leading to decreased consumer spending and slower economic growth. This could translate into reduced hiring and slower wage growth. For example, the recent surge in gasoline prices has forced consumers to cut back on other expenses, impacting businesses that rely on discretionary spending.

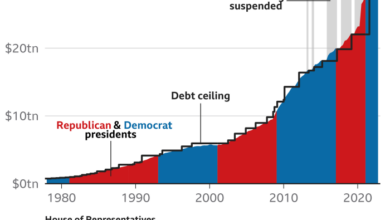

- Interest Rates: Rising interest rates increase borrowing costs for businesses, potentially leading to reduced investment and hiring. Furthermore, higher interest rates can also slow consumer spending as individuals face higher costs for mortgages, loans, and credit cards.

- Global Economic Conditions: Global economic downturns or geopolitical tensions can impact US exports, supply chains, and overall economic activity. For example, the ongoing war in Ukraine has disrupted global energy markets and supply chains, impacting businesses and the labor market.

Long-Term Trends Shaping the Labor Market

The labor market is also influenced by long-term trends, such as technological advancements, demographic shifts, and changes in worker preferences.

- Technological Advancements: Automation and artificial intelligence are transforming industries, potentially displacing some jobs while creating new opportunities in areas like technology and data science. For example, the rise of e-commerce has led to increased demand for warehouse and delivery workers, while also displacing some traditional retail jobs.

- Demographic Shifts: An aging population and declining birth rates could lead to labor shortages in certain sectors. Furthermore, the increasing diversity of the workforce presents both opportunities and challenges for employers in terms of attracting and retaining talent.

- Changes in Worker Preferences: Workers are increasingly seeking flexibility, remote work options, and work-life balance. Employers are adapting to these preferences by offering flexible work arrangements and investing in technology to support remote work.

Job Growth and Unemployment Forecast for the Next Quarter

Based on current economic indicators and trends, a moderate pace of job growth is expected in the next quarter, with the unemployment rate remaining relatively stable. However, the potential impact of inflation, interest rates, and global economic conditions could influence the trajectory of the labor market.