US Dollar Strengthens Amid Fitchs Downgrade Warning

Us dollar strengthens as fitch signals possible rating downgrade sparking default concerns – US Dollar Strengthens Amid Fitch’s Downgrade Warning, a headline that’s sent ripples through global markets, is a stark reminder of the delicate balance of economic power. Fitch’s recent signal of a potential US credit rating downgrade, a move that could significantly impact the country’s borrowing costs and debt sustainability, has sparked concerns about a potential default, sending the US dollar soaring.

The move, which comes at a time when the US Federal Reserve is battling inflation with aggressive interest rate hikes, has triggered a wave of speculation about the future of the US economy and its global influence.

This development raises questions about the factors contributing to the US dollar’s recent strength, the potential impact of a stronger dollar on US exports, imports, and inflation, and the implications for global financial markets. Moreover, the prospect of a US debt default, a scenario that could have catastrophic consequences for the global economy, has added another layer of complexity to the situation.

Fitch’s Rating Downgrade Signal

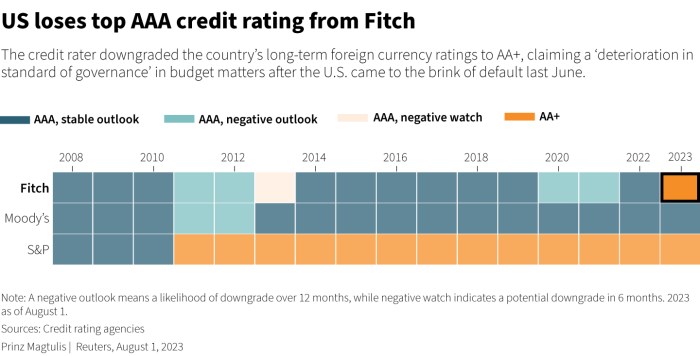

Fitch Ratings, one of the world’s leading credit rating agencies, recently signaled a potential downgrade of the United States’ sovereign credit rating. This move has sent shockwaves through global financial markets, raising concerns about the potential impact on the US economy and its ability to manage its debt burden.

Implications of a Downgrade

A downgrade of the US credit rating would have significant implications for the US economy, potentially leading to increased borrowing costs, reduced investor confidence, and a weakening dollar. The move could also exacerbate existing economic challenges, including inflation and rising interest rates.

Historical Context

This is not the first time the US has faced a potential downgrade. In 2011, Standard & Poor’s downgraded the US credit rating from AAA to AA+, citing concerns about the country’s political gridlock and debt levels. This downgrade triggered a significant sell-off in US Treasury bonds, leading to a spike in interest rates and increased borrowing costs for the US government.

Fitch’s Rationale

Fitch cited several factors in its rationale for a potential downgrade, including:

- Persistent budget deficits and a projected increase in the government’s debt burden.

- Political gridlock in Washington, D.C., making it difficult to address fiscal challenges.

- Weakening governance standards, as evidenced by the debt ceiling standoff in 2023.

Impact on US Government Borrowing Costs

A downgrade would likely increase borrowing costs for the US government, making it more expensive to finance its debt. This could lead to higher interest rates on Treasury bonds, potentially impacting the overall cost of borrowing for businesses and consumers.

Debt Sustainability

The potential downgrade also raises concerns about the sustainability of the US debt. With a growing debt burden and rising interest rates, the US government may face increasing difficulty in managing its debt obligations. This could lead to a vicious cycle of higher borrowing costs, further increasing the debt burden, and potentially putting the US economy at risk.

US Dollar Strengthening

The US dollar has been on a strengthening trajectory in recent months, driven by a confluence of factors. This surge in the dollar’s value has significant implications for the global economy, impacting trade, inflation, and financial markets.

Factors Contributing to the Dollar’s Strength

The recent strengthening of the US dollar can be attributed to several key factors:

- Rising Interest Rates:The Federal Reserve’s aggressive interest rate hikes have made US assets more attractive to foreign investors, leading to increased demand for the dollar. Higher interest rates incentivize investors to park their money in US assets, boosting the dollar’s value.

This is a classic example of how monetary policy can influence exchange rates.

- Safe-Haven Demand:Amidst global economic uncertainties, the US dollar is often perceived as a safe-haven currency. During periods of market volatility, investors tend to flock towards assets deemed less risky, including the US dollar. This increased demand further strengthens the dollar’s value.

- Stronger US Economic Outlook:While global growth concerns linger, the US economy has demonstrated resilience, with relatively robust consumer spending and a strong labor market. This positive economic outlook makes the dollar more appealing to investors.

- Weakening of Other Currencies:The dollar’s strength is also partly due to the weakness of other major currencies, such as the euro and the Japanese yen. The euro, for example, has been weighed down by the energy crisis and the war in Ukraine, while the yen has been impacted by Japan’s ultra-loose monetary policy.

Comparison to Previous Instances of Dollar Appreciation, Us dollar strengthens as fitch signals possible rating downgrade sparking default concerns

The current dollar appreciation resembles previous periods of dollar strength, such as the early 2000s and the mid-2010s. These episodes were also characterized by rising US interest rates, a strong US economy, and global economic uncertainties. However, there are some key differences.

- Magnitude:The current dollar appreciation is arguably more pronounced than in previous periods, particularly in relation to the euro. This has implications for trade and inflation.

- Global Context:The current global landscape is more complex, with geopolitical tensions and supply chain disruptions adding to economic uncertainty. This could amplify the impact of a stronger dollar.

- Policy Response:Central banks around the world are grappling with inflation and slowing growth, making it difficult to coordinate policy responses to a stronger dollar.

Impact on US Exports, Imports, and Inflation

A stronger dollar has both positive and negative consequences for the US economy.

- Exports:A stronger dollar makes US exports more expensive for foreign buyers, potentially leading to a decline in demand. This could hurt US businesses that rely heavily on exports, particularly in sectors like manufacturing and agriculture.

- Imports:Conversely, a stronger dollar makes imported goods cheaper for US consumers. This can lead to lower prices for consumers and potentially reduce inflationary pressures. However, it could also harm domestic industries that compete with imports.

- Inflation:The impact of a stronger dollar on inflation is complex and depends on various factors. While cheaper imports can help to contain inflation, a decline in exports could lead to job losses and reduced economic activity, potentially pushing prices higher in the long run.

Influence on Global Financial Markets

A stronger dollar can have significant ripple effects on global financial markets.

- Emerging Markets:Emerging market economies are often particularly vulnerable to a strong dollar, as it can increase their borrowing costs and make it more difficult to service their debts. This can lead to financial instability and currency crises.

- Commodity Prices:A stronger dollar can depress commodity prices, as they are typically priced in dollars. This can have a negative impact on commodity-producing countries, particularly those that rely heavily on exports.

- Asset Prices:A strong dollar can lead to volatility in global asset markets. For example, it can make US stocks more expensive for foreign investors, potentially leading to capital outflows and a decline in equity prices.

Default Concerns

The possibility of a US debt default, while seemingly far-fetched, carries significant implications for the global economy. A default would signal a severe crisis of confidence in the US financial system, potentially triggering a cascade of negative consequences.

Historical Examples of Sovereign Debt Defaults and Their Consequences

Understanding the potential consequences of a US debt default requires examining historical precedents. Throughout history, numerous countries have defaulted on their sovereign debt obligations, leading to a range of negative outcomes. For instance, the 1998 Russian financial crisis, triggered by a sovereign debt default, led to a global financial meltdown.

The crisis highlighted the interconnectedness of global markets and the potential for contagion effects from sovereign debt defaults. Similarly, the 2010 Greek debt crisis, characterized by multiple debt restructurings and bailouts, underscored the potential for protracted economic hardship and political instability in the face of sovereign debt defaults.

These historical examples illustrate the significant economic and political ramifications of sovereign debt defaults, underscoring the potential severity of a US debt default.

The US dollar’s recent surge, fueled by Fitch’s potential rating downgrade and growing default concerns, is a stark reminder of the ongoing economic uncertainty. Navigating this volatile landscape requires a keen understanding of inflation and its impact on our finances.

For practical tips and strategies to manage rising prices, check out the inflation guide tips to understand and manage rising prices. Armed with this knowledge, we can make informed decisions and mitigate the effects of inflation on our daily lives, even as the dollar’s strength continues to be a point of discussion.

Political and Economic Factors Contributing to a Default

Several political and economic factors could contribute to a US debt default. Political gridlock, particularly between the executive and legislative branches, could hinder the timely passage of legislation to raise the debt ceiling. Ideological divisions and partisan polarization could further exacerbate this issue, potentially leading to a stalemate and a default.

The US dollar has been strengthening recently, but the potential for a Fitch rating downgrade is causing some jitters. While the US economy seems to be holding its own, with surprise job gains in April , the possibility of a default on US debt could undermine the dollar’s strength.

It’s a delicate balancing act between economic growth and financial stability, and the market is keeping a close eye on how the US navigates this uncertain path.

Furthermore, economic challenges, such as rising inflation, high interest rates, and a slowing economy, could further complicate the situation. These challenges could lead to a decline in tax revenues and an increase in government spending, potentially pushing the US closer to the debt ceiling.

Additionally, external factors, such as global economic uncertainty and geopolitical tensions, could further amplify these challenges, increasing the risk of a default.

Impact of a Default on US Financial Institutions and Markets

A US debt default would have a profound impact on US financial institutions and markets. Investors could lose confidence in US assets, leading to a sharp decline in the value of US Treasury securities. This could trigger a sell-off in other asset classes, such as stocks and corporate bonds, causing a significant market correction.

Furthermore, a default could disrupt the functioning of financial markets, leading to a credit crunch and a reduction in lending activity. This could severely impact businesses and consumers, leading to a recession. Additionally, a default could damage the reputation of the US dollar as a global reserve currency, potentially weakening its status and undermining its role in international trade and finance.

The news of the US dollar strengthening while Fitch signals a possible rating downgrade, sparking default concerns, is a stark reminder of the importance of securing your finances. It’s a good time to review your bank account security measures and ensure your money is safe.

A recent survey by Gallup, highlighted in this article on bank account security tips protecting finances recent survey of gallup , offers valuable insights into common vulnerabilities and provides practical advice on how to protect your accounts. In a volatile economic climate, taking proactive steps to safeguard your finances is more important than ever.

Market Reactions: Us Dollar Strengthens As Fitch Signals Possible Rating Downgrade Sparking Default Concerns

Fitch’s rating downgrade signal sent shockwaves through global financial markets, triggering immediate and widespread reactions. The potential for a US default, a scenario previously deemed highly unlikely, sent investors scrambling to reassess their risk profiles and adjust their portfolios accordingly.

Impact on Financial Instruments

The potential downgrade had a significant impact on various financial instruments.

- Stock Markets:Global stock markets experienced a sharp decline in response to Fitch’s announcement. The Dow Jones Industrial Average, for instance, fell by over 300 points, reflecting investor concerns about the potential economic fallout from a US default. The broader market selloff highlighted the heightened risk aversion among investors.

- Bond Yields:Bond yields, which move inversely to prices, surged as investors sought safe-haven assets. The yield on the 10-year US Treasury bond, a benchmark for borrowing costs, climbed to its highest level in months, indicating increased demand for government debt.

- US Dollar:The US dollar, typically considered a safe-haven currency, initially strengthened against other major currencies. However, as concerns about the potential economic impact of a downgrade mounted, the dollar’s gains moderated.

Long-Term Effects on Investor Confidence and Risk Appetite

Fitch’s downgrade signal could have far-reaching consequences for investor confidence and risk appetite.

- Eroding Confidence:A downgrade from a major credit rating agency like Fitch can erode investor confidence in the US economy and its ability to repay its debts. This could lead to a decline in foreign investment, as investors become more hesitant to hold US assets.

- Increased Risk Aversion:The potential for a US default could trigger a wave of risk aversion among investors, prompting them to shift their investments towards safer assets, such as government bonds, and away from riskier assets like stocks.

- Higher Borrowing Costs:A downgrade could lead to higher borrowing costs for the US government and businesses, as lenders demand a higher risk premium to compensate for the increased perceived risk. This could further dampen economic growth.

Investor Strategies for Navigating Market Volatility

Investors are facing increased uncertainty and volatility in the wake of Fitch’s downgrade signal.

- Diversification:Diversifying investments across different asset classes, sectors, and geographies can help mitigate risk and protect portfolios from market downturns. A well-diversified portfolio can absorb potential losses in one area while benefiting from gains in another.

- Risk Management:Investors should carefully assess their risk tolerance and adjust their portfolios accordingly. This may involve reducing exposure to riskier assets, such as stocks, and increasing exposure to safer assets, such as bonds.

- Long-Term Perspective:It’s crucial to maintain a long-term investment perspective and avoid making hasty decisions based on short-term market fluctuations. The US economy has historically shown resilience, and a downgrade may not necessarily signal a prolonged economic downturn.

Economic Outlook

The strengthening of the US dollar and the potential for a credit rating downgrade, coupled with the growing possibility of a US default, have significant implications for the global economy. These developments raise concerns about the potential for economic instability and disruption to financial markets.

Impact on Global Economic Growth and Trade

The strengthening US dollar makes US exports more expensive and imports cheaper, potentially impacting global trade patterns. A stronger dollar can also make it more difficult for emerging market economies to service their dollar-denominated debt, potentially leading to financial instability and slowing economic growth in these regions.

- Trade Imbalances:A stronger dollar can exacerbate existing trade imbalances, potentially leading to increased protectionist measures and further disruptions to global trade flows.

- Emerging Market Debt:Emerging market economies with significant dollar-denominated debt could face higher borrowing costs and increased pressure on their currencies, potentially leading to financial crises and economic slowdowns.

Central Bank Policy Decisions and Inflation Expectations

Central banks around the world are closely monitoring the situation and may adjust their monetary policies in response to the evolving economic landscape. A strengthening dollar could lead to deflationary pressures in the US, potentially pushing the Federal Reserve to maintain or even lower interest rates.

Conversely, if inflation remains elevated, the Fed may need to continue raising interest rates, despite the potential economic risks.

- Monetary Policy Adjustments:Central banks may adjust their monetary policies to mitigate the potential impact of a stronger dollar and the risk of default. This could involve lowering interest rates, easing credit conditions, or intervening in currency markets to support their own currencies.

- Inflation Expectations:The strengthening dollar and potential default concerns could lead to lower inflation expectations in the US, potentially reducing pressure on the Federal Reserve to raise interest rates. However, if inflation remains high, the Fed may need to continue tightening monetary policy, even in the face of these economic risks.

Economic Scenarios

The economic outlook is uncertain and depends on the severity of the US dollar strengthening and the likelihood of a credit rating downgrade and default.

- Scenario 1: Moderate Strengthening and No Default:The US dollar strengthens modestly, but the US avoids a credit rating downgrade and default. In this scenario, the economic impact is likely to be relatively limited, with some potential for trade imbalances and pressure on emerging market economies.

- Scenario 2: Significant Strengthening and Default:The US dollar strengthens significantly, and the US experiences a credit rating downgrade and default. This scenario could lead to a global economic slowdown, financial market turmoil, and a potential recession in the US.