Build Wealth in Your 20s: Secure Your Financial Future Today

The ultimate guide to building wealth in your 20s secure your financial future today – Build Wealth in Your 20s: Secure Your Financial Future Today is a comprehensive guide designed to empower young adults to take control of their finances and build a solid foundation for a prosperous future. This guide will equip you with the knowledge and tools necessary to navigate the world of money, from understanding your financial situation to making smart investments and building healthy financial habits.

This guide will cover essential topics such as budgeting, saving, investing, debt management, side hustles, and protecting your future. We will delve into practical strategies and actionable steps that you can implement right away to start building wealth and securing your financial future.

Whether you’re just starting out or have already begun your financial journey, this guide will provide valuable insights and guidance to help you achieve your financial goals.

Understanding Your Financial Situation

Before you can start building wealth, you need to understand where you stand financially. This involves taking a close look at your income, expenses, and overall financial health. The 20s are a crucial time for establishing solid financial habits that will benefit you in the long run.

Building wealth in your 20s is all about smart choices, and one of the biggest financial decisions you’ll make is buying a home. Understanding how to maximize home loan repayment can make a huge difference in your long-term financial picture.

Check out this article on maximizing home loan repayment exploring the pros and cons of various approaches to find out how you can pay off your mortgage faster and save thousands in interest. This strategy can free up cash flow, allowing you to invest more aggressively and build wealth faster, making your 20s the foundation for a secure financial future.

Tracking your income and expenses is the foundation of effective financial management, and it’s a habit that will serve you well throughout your life.

Tracking Income and Expenses

The first step towards understanding your financial situation is to meticulously track your income and expenses. This practice provides a clear picture of your financial inflow and outflow, enabling you to identify areas where you can save more and invest wisely.

- Income:This includes your salary, any additional income from side hustles, investments, or other sources.

- Expenses:These encompass all your expenditures, from essential necessities like rent and groceries to discretionary spending on entertainment and travel.

There are several methods for tracking your income and expenses, each with its own advantages and disadvantages. Here are some popular methods:

Budgeting Methods

Budgeting methods are essential tools for managing your finances effectively. They provide a framework for allocating your income to different categories, ensuring you have enough funds for your needs and goals. Here are some popular budgeting methods:

- 50/30/20 Method:This method allocates 50% of your after-tax income to needs (housing, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Zero-Based Budgeting:This method involves meticulously planning how every dollar of your income will be spent, leaving no room for unplanned spending.

- Envelope Budgeting:This method involves allocating cash to different spending categories and using physical envelopes to track your spending.

The best budgeting method for you will depend on your individual needs and preferences. Experiment with different methods to find one that works best for you.

Identifying and Reducing Unnecessary Expenses

Once you have a clear understanding of your income and expenses, you can start identifying areas where you can cut back on unnecessary spending. This process can help you free up more money for savings and investments.

- Review Your Subscriptions:Cancel subscriptions you don’t use or that you can find cheaper alternatives for.

- Shop Around for Better Deals:Compare prices on essential items like groceries, utilities, and insurance to find better deals.

- Reduce Eating Out:Cooking at home can save you a significant amount of money compared to eating out regularly.

- Cut Down on Entertainment Costs:Explore free or low-cost entertainment options instead of spending a lot on movies, concerts, and other activities.

Identifying and reducing unnecessary expenses can significantly improve your financial health and free up more resources for your financial goals.

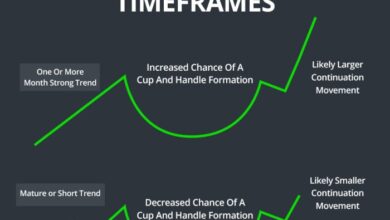

Building wealth in your 20s is all about taking control of your financial future. A key part of that is understanding how the stock market works. Keep an eye on the latest market trends, like the live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors , to make informed decisions about your investments.

It’s all about learning, growing, and building a solid financial foundation for your future.

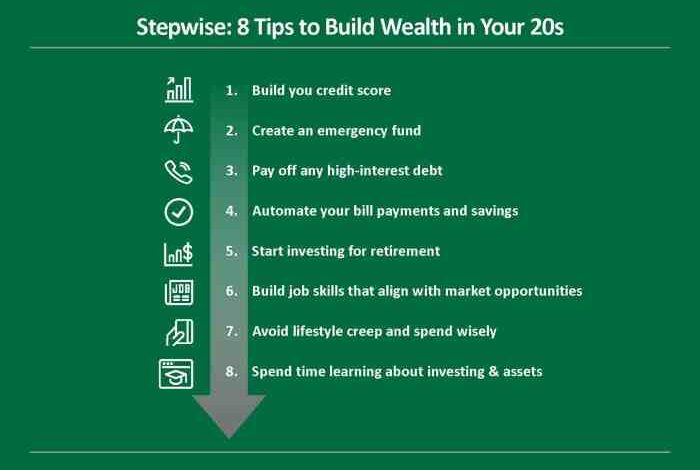

Building a Solid Financial Foundation: The Ultimate Guide To Building Wealth In Your 20s Secure Your Financial Future Today

In your 20s, you’re laying the groundwork for a financially secure future. This means establishing habits and practices that will serve you well for years to come. Building a solid financial foundation involves several key components, including creating an emergency fund, saving for retirement, and understanding different investment options.

Creating an Emergency Fund

Having an emergency fund is crucial for navigating unexpected life events. This fund acts as a safety net, preventing you from accumulating debt when faced with unforeseen expenses. A good rule of thumb is to aim for three to six months’ worth of living expenses in your emergency fund.

Saving for Retirement Early

Retirement might seem far off in your 20s, but starting early offers significant advantages. The power of compound interest works wonders over time, allowing your investments to grow exponentially. Even small contributions made early can lead to substantial savings later.

Understanding Different Investment Accounts

There are several investment accounts available, each with its own advantages.

Retirement Accounts

- 401(k):Offered by employers, 401(k) plans allow you to contribute pre-tax dollars to a retirement account. Your contributions are typically matched by your employer, making it a highly beneficial option.

- Roth IRA:A Roth IRA allows you to contribute after-tax dollars, which grow tax-free. This means you won’t have to pay taxes on your withdrawals in retirement.

Managing Debt Effectively

Debt can be a significant obstacle to building wealth, especially in your 20s. It’s crucial to understand different types of debt, their associated interest rates, and effective strategies for repayment. By managing your debt effectively, you can free up more of your income for saving and investing.

Building wealth in your 20s isn’t just about saving – it’s about smart investing. While traditional stocks and bonds are a good start, consider exploring the world of cryptocurrencies. Understanding the difference between established players like Bitcoin and newer platforms like Ethereum is crucial.

How Ethereum is different from Bitcoin can provide valuable insights for making informed investment decisions, helping you build a secure financial future.

Types of Debt and Interest Rates

Debt can be categorized into different types, each with its own interest rate and repayment terms. Here’s a breakdown of common types of debt:

- Student Loans:These loans are typically used to finance higher education. They often have lower interest rates than credit cards, but can still accumulate significant interest over time.

- Credit Card Debt:This is a form of revolving debt, where you can borrow money repeatedly up to a certain limit. Credit cards usually have the highest interest rates among common debt types.

- Personal Loans:These are unsecured loans that can be used for various purposes, such as debt consolidation or home improvements. Interest rates for personal loans vary depending on your credit score and the lender.

- Auto Loans:These loans are used to finance the purchase of a vehicle. Interest rates for auto loans can be influenced by the vehicle’s make, model, and loan term.

- Mortgages:These are loans used to purchase a home. Mortgages typically have the lowest interest rates among common debt types, but also involve significant principal amounts.

It’s essential to be aware of the interest rates associated with each type of debt, as they can significantly impact the overall cost of borrowing.

Debt Repayment Strategies

Once you’ve identified your debts and their interest rates, you can develop a strategy for repayment. Two popular approaches are the snowball and avalanche methods:

- Snowball Method:This method involves paying off your smallest debt first, regardless of its interest rate. The idea is to gain momentum by making small wins and feeling a sense of accomplishment. Once the smallest debt is paid off, you roll the payment amount into the next smallest debt, and so on.

- Avalanche Method:This method focuses on paying off the debt with the highest interest rate first, even if it’s the largest debt. This approach minimizes the total interest paid over time, leading to faster debt reduction.

The best strategy for you will depend on your individual circumstances and financial goals. If you’re motivated by quick wins and building momentum, the snowball method might be more appealing. If you prioritize minimizing interest charges, the avalanche method could be more suitable.

Creating a Personalized Debt Repayment Plan

To effectively manage your debt, it’s essential to create a personalized debt repayment plan. This plan should prioritize high-interest debt and Artikel specific steps for achieving your debt-free goals. Here’s a step-by-step guide:

- List all your debts:Include the name of each creditor, the outstanding balance, and the interest rate.

- Calculate your monthly debt payments:Determine how much you can afford to allocate towards debt repayment each month.

- Prioritize high-interest debt:Focus on paying down debts with the highest interest rates first, as these will cost you the most in the long run.

- Set realistic goals:Break down your debt repayment journey into smaller, achievable goals. For example, you could aim to reduce your credit card balance by 10% each month.

- Track your progress:Regularly monitor your debt balances and payments to ensure you’re staying on track.

- Seek professional advice:If you’re struggling to manage your debt, consider seeking advice from a financial advisor or credit counselor. They can provide personalized guidance and support.

By following a structured debt repayment plan, you can take control of your finances and work towards a debt-free future.

Investing for Growth

Investing is crucial for building wealth in your 20s. It allows your money to work for you, generating returns over time and helping you reach your financial goals. By investing early, you benefit from the power of compounding, where your earnings generate more earnings, leading to exponential growth.

Understanding Investment Options

It’s essential to understand the different investment options available to you before making any decisions. Here are some popular options suitable for young adults:

- Stocks: Stocks represent ownership in publicly traded companies. Investing in stocks offers the potential for high returns, but it also comes with higher risk.

- Bonds: Bonds are loans you make to companies or governments. They typically offer lower returns than stocks but are considered less risky.

- Real Estate: Investing in real estate can provide a steady stream of income through rent and potential appreciation in value. However, it requires significant capital and can be illiquid.

- Mutual Funds and Exchange-Traded Funds (ETFs): These investment vehicles allow you to diversify your portfolio by investing in a basket of stocks, bonds, or other assets. They offer a convenient and cost-effective way to invest in a diversified portfolio.

- Cryptocurrencies: Cryptocurrencies, like Bitcoin and Ethereum, are digital assets that have gained popularity in recent years. However, they are highly volatile and carry significant risks.

Understanding Investment Strategies

Different investment strategies can be employed based on your risk tolerance, time horizon, and financial goals. Two common strategies are:

- Value Investing: Value investors seek out undervalued companies with strong fundamentals. They believe that the market has mispriced these companies and that their value will eventually be recognized, leading to capital appreciation.

- Growth Investing: Growth investors focus on companies with high growth potential, often in emerging industries. They aim to capture the potential for rapid earnings growth and stock price appreciation.

The Importance of Diversification

Diversification is a crucial investment principle that involves spreading your investments across different asset classes, industries, and geographical regions. It helps mitigate risk by reducing the impact of any single investment’s performance on your overall portfolio.

“Don’t put all your eggs in one basket.”

A popular proverb that emphasizes the importance of diversification.

For example, investing in a mix of stocks, bonds, and real estate can help reduce your overall risk. If the stock market experiences a downturn, your bond holdings may provide some stability. Similarly, if the real estate market softens, your stock investments may offer some protection.

Building Wealth Through Side Hustles

In your 20s, you have the energy, flexibility, and time to explore new opportunities and build wealth. Side hustles offer a fantastic way to supplement your income, gain valuable experience, and even discover a new passion that could turn into a full-time career.Side hustles can be a great way to boost your income, gain new skills, and even discover a new career path.

They allow you to be your own boss, set your own hours, and work on something you’re passionate about.

Examples of Side Hustles, The ultimate guide to building wealth in your 20s secure your financial future today

Side hustles come in many forms, ranging from online gigs to creative pursuits. Here are a few popular examples:

- Freelancing:If you have skills in writing, graphic design, web development, or other areas, you can offer your services on freelance platforms like Upwork, Fiverr, or Freelancer.com.

- Tutoring or Teaching:If you excel in a particular subject, you can tutor students online or in person.

You can also teach classes or workshops in your area of expertise.

- Virtual Assistant:Many businesses need help with administrative tasks, social media management, or customer service. You can work as a virtual assistant from anywhere with an internet connection.

- Delivery Services:Platforms like DoorDash, Uber Eats, and Grubhub allow you to earn money by delivering food or groceries.

- E-commerce:Sell products online through platforms like Etsy, Amazon, or your own website. You can create and sell handmade goods, resell items, or offer digital products like ebooks or online courses.

- Blogging or Content Creation:If you enjoy writing, you can start a blog or create content for social media. You can monetize your content through advertising, affiliate marketing, or selling products or services.

Finding and Starting a Successful Side Hustle

Finding the right side hustle for you involves understanding your skills, interests, and available time.

- Identify Your Skills and Interests:What are you good at? What do you enjoy doing? Consider your hobbies, past work experiences, and any skills you’ve learned.

- Research Potential Side Hustles:Explore different options based on your skills and interests. Read articles, watch videos, and talk to people who have experience with side hustles.

- Create a Business Plan:Even for a side hustle, it’s important to have a basic plan. Define your target audience, Artikel your services or products, and set realistic goals.

- Market Your Services:Once you’re ready to launch, promote your side hustle through social media, networking, or online platforms.

- Stay Organized and Consistent:Manage your time effectively, track your income and expenses, and stay consistent with your efforts to build momentum and success.

Tax Implications of Side Hustle Income

It’s crucial to understand the tax implications of side hustle income.

- Reporting Income:You’ll need to report your side hustle income on your tax return. The specific form you’ll use will depend on your type of side hustle.

- Taxes and Deductions:You may be able to deduct certain business expenses related to your side hustle, such as supplies, equipment, and travel.

- Self-Employment Taxes:If you’re self-employed, you’ll need to pay self-employment taxes, which include Social Security and Medicare taxes.

- Consult with a Tax Professional:It’s always a good idea to consult with a tax professional to ensure you’re complying with all tax laws and maximizing your deductions.

Protecting Your Future

Securing your financial future isn’t just about accumulating wealth; it’s also about safeguarding your well-being and protecting your loved ones. While you’re focused on building your financial foundation, it’s crucial to consider the potential risks that could derail your progress and plan accordingly.

This involves taking steps to protect yourself from unforeseen events, ensuring your health, and safeguarding your legacy.

Health Insurance

Health insurance is essential for young adults, especially during a time when you’re likely to be more active and susceptible to unexpected health issues. It provides financial protection against high medical expenses, ensuring you can access necessary healthcare without incurring overwhelming debt.

Here’s why health insurance is important:* Financial Protection:Medical emergencies can be financially devastating. Health insurance covers a significant portion of your medical costs, reducing the burden on your savings.

Access to Care Having health insurance grants you access to a wider range of healthcare providers and services, including preventive care, screenings, and specialized treatments.

Peace of Mind Knowing you have health insurance provides peace of mind, allowing you to focus on your health and well-being without worrying about the financial consequences of an unexpected illness or injury.

Disability Insurance

Disability insurance protects your income in case of an unexpected illness or injury that prevents you from working. While you may think you’re invincible in your 20s, accidents and illnesses can happen to anyone. Disability insurance provides a safety net, ensuring you can continue to meet your financial obligations if you become unable to work.Here’s why disability insurance is important:* Income Replacement:Disability insurance provides a portion of your lost income, helping you cover essential expenses like rent, utilities, and debt payments.

Financial Stability It prevents you from depleting your savings or accumulating debt due to lost income, allowing you to maintain financial stability during a challenging time.

Peace of Mind Knowing you have disability insurance provides peace of mind, allowing you to focus on your recovery without the added stress of financial worries.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It ensures they have the financial resources to cover expenses, pay off debts, and maintain their lifestyle without facing financial hardship. Here’s why life insurance is important:* Financial Security:Life insurance provides a lump sum payment to your beneficiaries, helping them cover expenses like funeral costs, mortgage payments, outstanding debts, and living expenses.

Debt Protection It can help pay off debts like mortgages, student loans, and credit card balances, relieving your loved ones of the financial burden.

Legacy Planning Life insurance can be used to fund college tuition, provide for dependents, or establish a trust for charitable purposes, ensuring your legacy lives on.There are different types of life insurance, each with its own features and benefits:* Term Life Insurance:This is the most affordable type, providing coverage for a specific period (e.g., 10, 20, or 30 years).

It’s ideal for temporary needs like covering a mortgage or providing income replacement for young families.

Whole Life Insurance This type offers permanent coverage throughout your lifetime, as long as you pay the premiums. It also builds cash value that can be borrowed against or withdrawn.

Universal Life Insurance This flexible type allows you to adjust your premiums and death benefit, offering more control over your policy. It also accumulates cash value, but the growth rate is not guaranteed.

Estate Planning

Estate planning involves preparing for the distribution of your assets after your death. It’s a crucial aspect of protecting your future and ensuring your wishes are carried out. Here’s why estate planning is important:* Protecting Your Assets:A well-structured estate plan ensures your assets are distributed according to your wishes, preventing disputes among family members or unintended consequences.

Minimizing Taxes Estate planning can help reduce estate taxes, maximizing the amount of wealth passed on to your beneficiaries.

Protecting Your Loved Ones It provides peace of mind knowing your loved ones will be financially secure and supported after your death.Estate planning typically involves creating a will and a power of attorney:* Will:A will Artikels how your assets will be distributed among your beneficiaries after your death.

It designates who will inherit your property, money, and other possessions.

Power of Attorney A power of attorney designates someone you trust to make financial and legal decisions on your behalf if you become incapacitated.Creating an estate plan can be a complex process. It’s recommended to consult with an estate planning attorney to ensure your plan meets your specific needs and complies with applicable laws.

Building Healthy Financial Habits

Building healthy financial habits in your 20s sets the stage for a secure and prosperous future. By developing a strong financial foundation, you can avoid common pitfalls, achieve your financial goals, and ultimately build wealth.

The Importance of Financial Literacy

Financial literacy is the foundation of sound financial decision-making. It involves understanding basic financial concepts, such as budgeting, saving, investing, and debt management. The more you understand about money, the better equipped you are to make informed choices that benefit your financial well-being.

- Continuous Learning:Financial literacy is not a one-time event. The financial landscape is constantly evolving, so it’s crucial to stay updated on new trends, products, and regulations. This can be achieved through reading books and articles, attending workshops, listening to podcasts, and following reputable financial experts on social media.

- Seek Professional Guidance:Don’t hesitate to seek professional advice from a financial advisor. They can provide personalized guidance based on your specific situation and help you navigate complex financial decisions.

Staying Motivated and Avoiding Common Pitfalls

Maintaining financial discipline can be challenging, especially in your 20s when you’re likely facing new financial responsibilities and temptations. Here are some tips to stay motivated and avoid common financial pitfalls:

- Set Realistic Goals:Start with small, achievable goals. Breaking down large financial goals into smaller, manageable steps can make the journey less daunting. For example, instead of aiming to save $10,000 in a year, aim to save $1,000 every three months.

- Track Your Spending:Use a budgeting app or a spreadsheet to track your income and expenses. This will help you identify areas where you can cut back and prioritize your spending.

- Avoid Impulse Purchases:Before making a purchase, ask yourself if it’s a need or a want. Consider the long-term implications of your spending decisions and avoid making impulsive purchases that you may regret later.

- Embrace the Power of Compounding:Start investing early and take advantage of the power of compounding. Even small, regular investments can grow significantly over time due to the snowball effect of earning interest on interest.

- Seek Support and Accountability:Share your financial goals with friends, family, or a financial mentor. Having a support system can help you stay motivated and accountable.

Resources for Finding Financial Advice and Support

There are many resources available to help you build healthy financial habits.

- Financial Literacy Websites:Websites like Investopedia, NerdWallet, and The Balance offer comprehensive information on personal finance topics.

- Financial Education Organizations:Organizations like the National Endowment for Financial Education (NEFE) and the JumpStart Coalition for Personal Financial Literacy offer educational resources and programs.

- Local Libraries and Community Centers:Many libraries and community centers offer free financial literacy workshops and programs.

- Financial Advisors:A financial advisor can provide personalized guidance and support based on your individual needs.