Crypto Queen Unveils Bitcoin Bill: A New Era for Regulation?

The senates most prominent advocate for cryptocurrency known as the crypto queen has unveiled a far reaching new bill focused on bitcoin – The Senate’s most prominent advocate for cryptocurrency, known as the Crypto Queen, has unveiled a far-reaching new bill focused on Bitcoin, sending shockwaves through the industry. This proposed legislation, which has been met with both enthusiasm and apprehension, aims to bring much-needed clarity and regulation to the burgeoning world of digital assets.

The bill, spearheaded by Senator [Senator’s Name], who has long championed the potential of blockchain technology and cryptocurrency, aims to establish a framework for Bitcoin specifically. It addresses concerns about consumer protection, financial stability, and the potential for market manipulation, while also promoting innovation and economic growth within the cryptocurrency space.

The Crypto Queen: The Senates Most Prominent Advocate For Cryptocurrency Known As The Crypto Queen Has Unveiled A Far Reaching New Bill Focused On Bitcoin

Senator [Senator’s Name] has emerged as a leading voice for cryptocurrency in the Senate, earning the moniker “The Crypto Queen.” Her unwavering advocacy has made her a prominent figure in the ongoing debate surrounding digital assets and their regulation.

The Crypto Queen’s Background and Advocacy

Senator [Senator’s Name] first became involved in cryptocurrency in [year], driven by [reason for initial involvement]. Her early involvement in the space led to her becoming a vocal advocate for its potential, particularly its role in [specific benefits].Senator [Senator’s Name]’s advocacy has taken various forms, including:

- Introducing legislation aimed at fostering cryptocurrency adoption and innovation.

- Participating in numerous hearings and debates on cryptocurrency regulation.

- Engaging with industry stakeholders and experts to understand the nuances of the cryptocurrency ecosystem.

Previous Stances and Actions Related to Cryptocurrency Regulation

Senator [Senator’s Name]’s past actions regarding cryptocurrency regulation reflect her commitment to [her regulatory stance]. She has consistently advocated for [specific regulatory approach], believing that it will foster responsible innovation while protecting consumers.Some notable examples of her actions include:

- Supporting [specific legislation or policy] aimed at [specific regulatory objective].

- Opposing [specific legislation or policy] due to concerns about [specific regulatory impact].

Key Arguments for Promoting Cryptocurrency Adoption

Senator [Senator’s Name]’s advocacy for cryptocurrency adoption is rooted in her belief in its potential to [specific benefits]. She frequently emphasizes the following key arguments:

- Financial Inclusion:Cryptocurrency can provide access to financial services for individuals and communities currently underserved by traditional banking systems.

- Innovation:Cryptocurrency technology has the potential to revolutionize various sectors, from finance to healthcare.

- Economic Growth:Cryptocurrency can stimulate economic growth by fostering new businesses and investment opportunities.

Reputation and Influence within the Senate

Senator [Senator’s Name]’s unwavering advocacy has earned her a reputation as a strong and knowledgeable voice on cryptocurrency issues. Her influence within the Senate is evident in her ability to [specific examples of influence].Senator [Senator’s Name]’s work has also garnered attention beyond the halls of Congress, with her insights frequently sought by [specific media outlets, industry groups, etc.].

Her dedication to promoting cryptocurrency adoption has positioned her as a key figure in shaping the future of this rapidly evolving industry.

It’s been a whirlwind week in the world of crypto, with the Senate’s most prominent advocate, dubbed the “Crypto Queen,” unveiling a far-reaching new bill focused on Bitcoin. While the future of this legislation remains uncertain, it’s got everyone talking, even those who typically focus on more traditional financial strategies, like, say, understanding Mega Millions tips to increase your chances of winning.

understanding mega millions tips to increase your chances of winning But with the crypto market booming, it’s clear that the future of finance is being reshaped, and the “Crypto Queen” is at the forefront of this revolution.

The New Bitcoin Bill

The Crypto Queen, the Senate’s most prominent advocate for cryptocurrency, has unveiled a far-reaching new bill focused on Bitcoin. This legislation, which has already garnered significant attention, aims to provide a regulatory framework for Bitcoin in the United States.

The Senate’s most prominent advocate for cryptocurrency, dubbed the “Crypto Queen,” has just unveiled a far-reaching new bill focused on Bitcoin. While the bill aims to regulate the crypto industry, it also sparks interesting discussions about the potential impact on real estate markets, especially when considering factors like property valuations and investment strategies.

To delve deeper into the complexities of real estate across the US, check out this comprehensive analysis of residential and commercial properties state by state, exploring real estate in united states state by state analysis residential commercial properties.

Ultimately, the Crypto Queen’s bill could reshape the landscape of both finance and real estate, making it crucial to stay informed about these developments.

Key Provisions and Scope

The bill proposes a comprehensive approach to regulating Bitcoin, addressing various aspects of its usage and development.

The Major Components of the Proposed Bill

The bill Artikels several key provisions, including:

- Establishing a regulatory framework for Bitcoin exchanges and trading platforms: The bill proposes the creation of a new regulatory body specifically for Bitcoin exchanges, which would oversee their operations, including anti-money laundering and know-your-customer (KYC) compliance.

- Defining Bitcoin as a digital commodity: The bill seeks to clarify Bitcoin’s legal status, recognizing it as a digital commodity rather than a security or currency. This classification could have significant implications for taxation and other regulatory aspects.

- Promoting innovation and research in Bitcoin technology: The bill includes provisions to encourage research and development in Bitcoin technology, potentially fostering innovation in the sector.

- Addressing consumer protection concerns: The bill aims to safeguard consumers by establishing guidelines for Bitcoin-related products and services, including disclosure requirements and anti-fraud measures.

Regulation of Bitcoin

The bill proposes to regulate Bitcoin by establishing a framework that balances innovation with consumer protection. It aims to create a clear regulatory environment for Bitcoin exchanges, while also ensuring that consumers are adequately protected from potential risks associated with the cryptocurrency.

Impact on the Cryptocurrency Industry

The bill’s passage could have a significant impact on the cryptocurrency industry. It could:

- Increase investor confidence: By providing a clear regulatory framework, the bill could increase investor confidence in Bitcoin, potentially leading to greater adoption and investment.

- Attract new businesses and investment: A regulated environment could encourage new businesses and investments in the cryptocurrency sector, leading to growth and innovation.

- Promote responsible development: The bill’s focus on consumer protection and responsible development could help ensure the long-term sustainability of the cryptocurrency industry.

Implications for Individual Investors and Businesses

The bill’s provisions could have various implications for individual investors and businesses:

- Increased transparency and accountability: The bill’s proposed regulations could lead to increased transparency and accountability within the Bitcoin ecosystem, benefiting both investors and businesses.

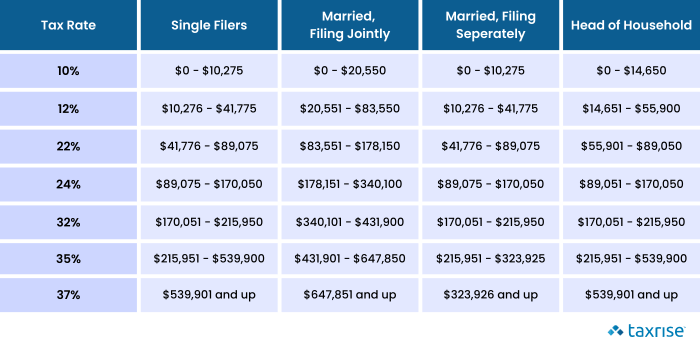

- Simplified tax reporting: The bill’s definition of Bitcoin as a digital commodity could simplify tax reporting for individuals and businesses involved in Bitcoin transactions.

- Enhanced security and fraud prevention: The bill’s consumer protection measures could enhance security and fraud prevention, providing greater peace of mind for investors and businesses.

Potential Benefits and Drawbacks of the Bill

The Crypto Queen’s new Bitcoin bill has sparked intense debate, with proponents touting its potential to boost the economy and critics raising concerns about its implications. This bill, if enacted, could have a profound impact on the US financial landscape.

Potential Economic Benefits

The bill’s proponents argue that it could unleash a wave of innovation and economic growth. They point to the potential of Bitcoin and other cryptocurrencies to revolutionize financial services, reduce transaction costs, and provide access to financial tools for underserved populations.

- Increased Financial Inclusion:Cryptocurrencies can provide access to financial services for individuals and businesses currently excluded from the traditional banking system, especially in developing countries. This can promote financial inclusion and economic empowerment.

- Reduced Transaction Costs:Cryptocurrencies can facilitate faster and cheaper cross-border transactions, reducing the costs associated with traditional banking systems and promoting international trade.

- Enhanced Innovation:The bill could foster innovation in the financial sector, leading to the development of new financial products and services based on blockchain technology.

Potential Risks and Challenges, The senates most prominent advocate for cryptocurrency known as the crypto queen has unveiled a far reaching new bill focused on bitcoin

However, the bill also faces criticism from those concerned about its potential impact on financial stability, consumer protection, and national security.

The Senate’s most prominent advocate for cryptocurrency, known as the “Crypto Queen,” has unveiled a far-reaching new bill focused on Bitcoin. This comes at a time when the Federal Reserve’s report on the collapse of Silicon Valley Bank ( federal reserve report on svb collapse highlights mismanagement and supervisory failures ) highlights significant mismanagement and supervisory failures, raising questions about the regulatory landscape for financial institutions, including those dealing with digital assets.

The new bill aims to address these concerns by providing a clearer regulatory framework for Bitcoin, potentially fostering greater confidence and stability within the cryptocurrency market.

- Financial Stability Concerns:The bill’s provisions could expose the financial system to volatility and risk associated with cryptocurrencies, potentially leading to systemic instability.

- Consumer Protection Issues:The bill may not adequately address the risks of fraud, scams, and market manipulation associated with cryptocurrencies, leaving consumers vulnerable.

- National Security Implications:The bill could create opportunities for illicit activities, such as money laundering and terrorist financing, if appropriate safeguards are not implemented.

Impact on Financial Stability and Consumer Protection

The bill’s potential impact on financial stability and consumer protection is a major concern. While proponents argue that the bill will foster innovation and growth, critics worry that it could expose the financial system to new risks.

- Volatility and Risk:Cryptocurrencies are known for their price volatility, which can pose significant risks to investors and the broader financial system. The bill’s provisions could exacerbate this volatility and increase systemic risk.

- Lack of Consumer Protection:The cryptocurrency market is currently unregulated, leaving consumers vulnerable to fraud, scams, and market manipulation. The bill’s provisions may not adequately address these risks, potentially leading to consumer harm.

- Need for Robust Regulation:To mitigate these risks, robust regulation is crucial. The bill must establish clear rules and safeguards to protect consumers and ensure financial stability.

Public and Industry Reactions to the Bill

The Crypto Queen’s Bitcoin bill has sparked a wave of reactions from various stakeholders, each with their own perspectives and interests. The bill, which aims to establish a comprehensive regulatory framework for Bitcoin in the country, has been met with a mixture of enthusiasm, skepticism, and outright opposition.

Reactions from Different Stakeholders

The bill has generated diverse reactions from various stakeholders, including:

- Financial institutionshave expressed mixed sentiments. Some see the bill as an opportunity to enter the burgeoning cryptocurrency market, potentially offering new avenues for investment and financial services. However, others are concerned about the regulatory uncertainties and potential risks associated with Bitcoin, particularly regarding money laundering and financial stability.

- Cryptocurrency businesses, on the other hand, have largely welcomed the bill. They view it as a step towards legitimizing the industry and providing much-needed clarity on regulatory requirements. The bill’s provisions could foster innovation and attract more investment in the cryptocurrency sector.

- Consumer advocacy groupshave raised concerns about the bill’s potential impact on consumers. They argue that the bill may not adequately protect consumers from scams and fraud, especially in the unregulated and volatile cryptocurrency market. There are concerns about the lack of clear consumer protection provisions and the potential for predatory practices.

- Economic expertshave offered a range of opinions on the bill’s potential economic impact. Some believe that Bitcoin adoption could boost economic growth, create new jobs, and attract foreign investment. However, others caution that the bill’s implementation could have unintended consequences, such as increased volatility in the financial markets and potential inflation.

Arguments for and Against the Bill

The debate surrounding the Crypto Queen’s Bitcoin bill centers on several key arguments:

- Arguments in favor of the bill:

- Legal certainty and regulatory clarity: Supporters argue that the bill provides much-needed regulatory clarity and legal certainty for Bitcoin, creating a more stable and predictable environment for businesses and investors.

- Economic growth and innovation: Proponents believe that the bill will foster innovation and attract investment in the cryptocurrency sector, potentially boosting economic growth and creating new jobs.

- Financial inclusion: Some argue that Bitcoin could provide financial services to underserved populations who lack access to traditional banking.

- Arguments against the bill:

- Risk of financial instability: Critics argue that Bitcoin’s volatility and lack of intrinsic value could pose a significant risk to financial stability, potentially leading to market crashes and systemic failures.

- Money laundering and illicit activities: Concerns have been raised about the potential for Bitcoin to facilitate money laundering and other illicit activities due to its pseudonymous nature.

- Lack of consumer protection: Critics argue that the bill may not adequately protect consumers from scams, fraud, and other risks associated with the cryptocurrency market.

Potential for Amendments or Revisions to the Bill

Given the diverse range of opinions and concerns surrounding the bill, it is highly likely that amendments or revisions will be proposed before it is finalized. The legislative process provides opportunities for stakeholders to voice their concerns and contribute to shaping the final legislation.

- Consumer protection: Amendments could focus on strengthening consumer protection provisions, including mandatory disclosures, investor education, and mechanisms for resolving disputes.

- Financial stability: Revisions could address concerns about financial stability by incorporating measures to mitigate risks associated with Bitcoin’s volatility and potential for systemic impact.

- Money laundering and illicit activities: Amendments could focus on strengthening anti-money laundering and counter-terrorism financing provisions, including requirements for Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance.

The Future of Cryptocurrency Regulation in the Senate

The Crypto Queen’s Bitcoin bill, while ambitious, is only the beginning of the Senate’s journey towards regulating the cryptocurrency landscape. The bill’s fate and the future of cryptocurrency regulation in the Senate depend on a complex interplay of political forces, public opinion, and the evolving nature of the crypto industry itself.

The Likelihood of the Bill’s Passage

The bill’s passage hinges on several factors. Firstly, it faces the challenge of navigating a politically divided Senate. The bill’s provisions, particularly those concerning consumer protection and financial stability, are likely to spark debate among senators representing different ideological viewpoints.

Secondly, the bill’s impact on the existing financial system, including its potential disruption to traditional banking and investment practices, will be a major consideration. The bill’s proponents will need to effectively address concerns from stakeholders who may perceive the bill as a threat to their interests.

Finally, the bill’s passage is contingent on the level of public support it receives. The public’s understanding and acceptance of cryptocurrency regulation will play a significant role in shaping the bill’s trajectory.

Future Legislation Related to Cryptocurrency

The Crypto Queen’s bill is likely to be just the first step in a series of legislative initiatives aimed at shaping the cryptocurrency landscape. The ongoing evolution of the cryptocurrency industry, including the emergence of new technologies and business models, will necessitate further legislative action.

Future legislation may address areas such as decentralized finance (DeFi), stablecoins, and the regulation of cryptocurrency exchanges. The Senate will need to remain agile in adapting its regulatory framework to keep pace with the rapidly evolving nature of the cryptocurrency ecosystem.

The Ongoing Debate and Political Landscape

The debate surrounding cryptocurrency regulation is multifaceted, reflecting the diverse perspectives of different stakeholders. Proponents of stricter regulation argue that it is necessary to protect consumers from fraud and manipulation, while opponents contend that excessive regulation could stifle innovation and stifle the growth of the cryptocurrency industry.

The political landscape surrounding cryptocurrency regulation is also dynamic, with varying levels of support for different regulatory approaches across different political parties and regions.

Impact of the Bill on Future Cryptocurrency Development and Adoption

The Crypto Queen’s bill, if passed, could have a significant impact on the future of cryptocurrency development and adoption. The bill’s provisions, particularly those concerning consumer protection and financial stability, could create a more predictable and secure environment for cryptocurrency businesses, attracting more investment and driving innovation.

However, the bill’s regulatory requirements could also pose challenges for smaller cryptocurrency startups, potentially slowing down their growth and limiting their ability to compete with established players. The bill’s impact on cryptocurrency adoption will depend on how effectively it balances the need for regulation with the need to foster innovation and growth.