Retail Investors: Shaping the US Stock Market

The rise of retail investors how individuals are shaping the us stock market – Retail Investors: Shaping the US Stock Market sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The rise of retail investors, fueled by the accessibility of online trading platforms and a growing interest in financial markets, has dramatically reshaped the landscape of US stock market investing.

This shift has brought a new wave of participants to the table, influencing market dynamics, driving innovation, and raising crucial questions about regulation and investor protection.

From the emergence of meme stocks to the growing popularity of options trading, retail investors are not only participating in the market but actively shaping its trajectory. This blog delves into the fascinating world of retail investors, exploring their motivations, strategies, and impact on the US stock market.

The Rise of Retail Investors

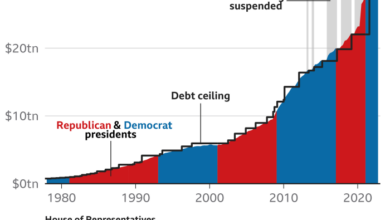

The US stock market has long been dominated by institutional investors, but in recent years, a new breed of investor has emerged: the retail investor. Driven by a confluence of factors, retail investors are playing an increasingly significant role in shaping the market, challenging traditional investment paradigms and influencing stock prices in unprecedented ways.

The rise of retail investors is a fascinating phenomenon, with individuals now wielding significant power in shaping the US stock market. It’s not just about meme stocks anymore; we’re seeing a growing interest in blockchain technology and cryptocurrencies. This is evident in the recent interview of Ethereum co-founder Vitalik Buterin on Bloomberg’s Studio 10, where he discussed the future of decentralized finance.

This shift in focus highlights the growing influence of retail investors on the financial landscape, as they actively seek out new and innovative investment opportunities.

Historical Context

Retail investor participation in the US stock market has a long history, dating back to the early 20th century. The rise of the middle class and the increasing availability of investment products, such as mutual funds, fueled the growth of retail investing.

The rise of retail investors is undeniably shaping the US stock market, with individuals increasingly driving the trends. This shift is evident in the growing popularity of meme stocks and the increased focus on social media for investment insights. This same spirit of individual investment is also playing out on a global scale, as seen in the apples prosperity in china and the promising future in asian markets.

This dynamic suggests that retail investors are not just influencing US markets, but are becoming a global force, driving growth and innovation across the world.

However, for much of the 20th century, retail investors were primarily passive participants, relying on brokers and financial advisors to manage their investments.

Factors Driving the Surge in Retail Investor Activity

The recent surge in retail investor activity is a result of several key factors:

- Technological advancements: The rise of online brokerages, mobile trading apps, and social media platforms has made it easier than ever for individuals to access the stock market. Platforms like Robinhood, TD Ameritrade, and E*TRADE have democratized investing, lowering barriers to entry and attracting a new generation of investors.

- Increased financial literacy: The growing awareness of financial concepts and the availability of educational resources have empowered individuals to take control of their investments. Online courses, personal finance blogs, and YouTube channels have made financial information more accessible than ever before.

The rise of retail investors has undoubtedly shaken up the US stock market, with individual investors playing a more significant role than ever before. While many are focused on building their portfolios, others are looking for alternative ways to generate income, especially students who may not have the capital for traditional investments.

There are plenty of passive income ideas for students without investment , from online surveys to freelance writing, that can provide a steady stream of cash. These side hustles not only offer financial independence but also valuable experience and skills that can be applied to future endeavors, whether in the stock market or beyond.

- Economic uncertainty: The COVID-19 pandemic and subsequent economic downturn have prompted many individuals to seek alternative investment opportunities beyond traditional savings accounts. The stock market, with its potential for higher returns, has become an attractive option for those seeking to grow their wealth.

- Social media influence: Social media platforms like Reddit and Twitter have become hubs for retail investors to share investment ideas, discuss market trends, and coordinate their trading activities. This collective action has led to significant price movements in certain stocks, demonstrating the power of retail investors to influence the market.

Key Platforms and Tools

Retail investors utilize a range of platforms and tools to navigate the stock market:

- Online brokerages: Platforms like Robinhood, TD Ameritrade, and E*TRADE offer commission-free trading, real-time market data, and investment research tools, making it easy for individuals to buy and sell stocks.

- Mobile trading apps: Mobile trading apps like Robinhood and Fidelity Go allow investors to manage their portfolios on the go, making it convenient to track their investments and execute trades.

- Social media platforms: Reddit, Twitter, and StockTwits have become popular forums for retail investors to discuss investment strategies, share market insights, and coordinate trading activities.

- Investment research tools: Platforms like Morningstar and Seeking Alpha provide in-depth analysis of companies and their financial performance, helping investors make informed investment decisions.

Impact on Market Dynamics

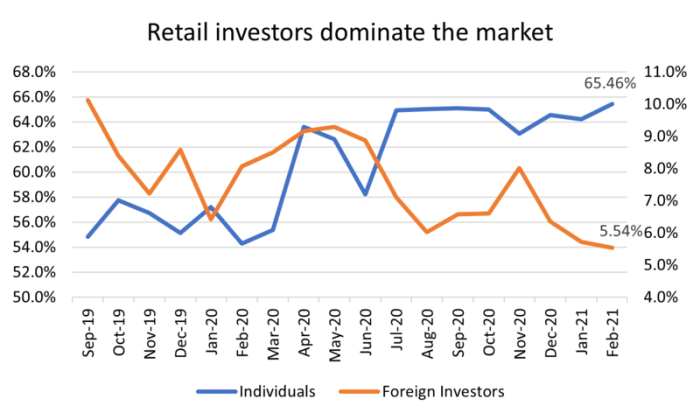

The rise of retail investors has significantly impacted market dynamics, altering the traditional power balance and introducing new forces that influence stock prices and market trends. This shift is driven by increased accessibility to financial markets, fueled by online trading platforms and mobile applications.

Influence on Stock Prices and Market Trends

The influx of retail investors has the potential to drive stock prices higher, particularly in companies that are popular among retail investors, often referred to as “meme stocks.” This surge in demand can create a positive feedback loop, as increased stock prices attract even more retail investors, further driving prices up.

However, the same phenomenon can also lead to rapid price declines when sentiment shifts. For example, the rapid rise and fall of GameStop in 2021 demonstrates the impact of retail investor sentiment on stock prices.

Investment Strategies of Retail and Institutional Investors

Retail investors often adopt a more speculative approach to investing, focusing on short-term gains and momentum trading. They are often drawn to companies with high growth potential or those that are generating significant social media buzz. Conversely, institutional investors, such as hedge funds and mutual funds, typically employ a more fundamental approach, focusing on long-term value creation and analyzing a company’s financial performance and industry prospects.

They tend to invest in companies with a proven track record and a strong balance sheet.

Risks and Opportunities Associated with the Rise of Retail Investors

The rise of retail investors presents both risks and opportunities for the market. On the one hand, the increased participation can lead to greater market volatility, as retail investors are often more susceptible to emotional decision-making and herd behavior. This can result in market bubbles and crashes, as witnessed during the “dot-com bubble” of the late 1990s and the recent meme stock frenzy.On the other hand, retail investors can bring fresh perspectives and innovative ideas to the market, potentially identifying undervalued companies or emerging trends that institutional investors may overlook.

They can also exert pressure on companies to improve their corporate governance and transparency, as they are more likely to engage with management and demand accountability.

New Investment Approaches

The rise of retail investors has not only reshaped market dynamics but also introduced new investment approaches. Driven by accessibility, technology, and the desire to participate in market gains, retail investors are embracing innovative strategies that were previously considered the domain of institutional players.

These new approaches, while offering opportunities for individual investors, also present challenges and risks that require careful consideration.

The Rise of Meme Stocks

The emergence of meme stocks, driven by social media trends and online communities, has significantly impacted the stock market. Meme stocks are typically companies with a strong online following, often characterized by volatile price swings and high trading volume.

“Meme stocks are often characterized by a disconnect between their fundamental value and their market price, driven by social media hype and sentiment.”

The internet has become a breeding ground for these trends, with platforms like Reddit’s WallStreetBets forum playing a crucial role in coordinating trading activities. The surge in popularity of meme stocks like GameStop and AMC Entertainment, fueled by online discussions and coordinated buying sprees, has demonstrated the power of social media in influencing market behavior.

Options Trading, The rise of retail investors how individuals are shaping the us stock market

Options trading, a complex investment strategy that involves the right to buy or sell an underlying asset at a specific price within a certain timeframe, has seen a surge in popularity among retail investors.

“Options trading offers the potential for amplified returns, but also carries higher risks compared to traditional stock investments.”

The accessibility of online brokerage platforms has lowered the barrier to entry for options trading, making it more accessible to a wider range of investors. However, the complexity of options strategies and the potential for significant losses make it crucial for retail investors to understand the risks involved before engaging in such activities.

Fractional Shares and Alternative Investment Products

The growth of fractional shares and other alternative investment products is another significant development driven by retail investors. Fractional shares allow investors to buy portions of a stock, making it easier to diversify their portfolios with limited capital.

“Fractional shares provide greater accessibility to investment opportunities, particularly for those with smaller investment amounts.”

This trend has been fueled by platforms that offer fractional share trading, catering to a growing demand for investment products that cater to smaller investment amounts and a wider range of investors.

Regulatory Considerations

The rise of retail investors has significantly impacted the US stock market, prompting regulatory scrutiny and a reassessment of existing frameworks. This section explores the regulatory landscape surrounding retail investor activity, analyzes potential implications for market stability and investor protection, and identifies potential areas for future regulation and oversight.

Market Stability and Investor Protection

The increased participation of retail investors has raised concerns about market stability and investor protection.

- Increased Volatility:The influx of retail investors, often driven by social media trends and short-term investment strategies, can amplify market volatility. This can lead to sudden price swings, making it difficult for institutional investors to manage their portfolios effectively.

- Market Manipulation:The use of social media and online forums by retail investors has raised concerns about market manipulation. Coordinated efforts to pump up or short specific stocks, known as “pump-and-dump” schemes, can harm unsuspecting investors.

- Risk Management:Retail investors may not have the same level of risk management expertise as institutional investors. They may be more susceptible to speculative trading, potentially leading to significant losses.

Potential Areas for Future Regulation and Oversight

In response to these challenges, regulators are considering several areas for future regulation and oversight.

- Social Media Regulation:Regulators are exploring ways to regulate the use of social media platforms for financial information and investment recommendations. This could include requiring disclosures of potential conflicts of interest or limiting the spread of misinformation.

- Investor Education:Efforts to improve investor education are crucial. Regulators can work with financial institutions to provide retail investors with better resources and tools to make informed investment decisions.

- Enhanced Risk Management:Regulators may consider imposing stricter risk management requirements on platforms that facilitate retail trading. This could include measures to prevent excessive leverage or limit the frequency of trades.

- Protection Against Market Manipulation:Regulators are actively investigating instances of market manipulation involving retail investors. This could involve stricter enforcement of existing rules or developing new regulations to address the unique challenges posed by social media and online trading platforms.

Future of Retail Investing: The Rise Of Retail Investors How Individuals Are Shaping The Us Stock Market

The rise of retail investors has undeniably reshaped the US stock market, but what does the future hold for this growing segment? Predicting the future is inherently challenging, but several factors suggest that retail investor participation will continue to grow and evolve in fascinating ways.

Technological Advancements

Technological advancements have been a driving force behind the rise of retail investing. The proliferation of mobile trading apps, online platforms, and data-driven tools has made investing more accessible and user-friendly than ever before. This trend is expected to continue, with further innovation in areas like artificial intelligence (AI) and robo-advisors likely to further democratize investing.

AI-powered investment tools can provide personalized recommendations, automate portfolio management, and even offer real-time market insights. Robo-advisors, which use algorithms to manage investments based on risk tolerance and financial goals, are also gaining traction, particularly among younger investors who value convenience and cost-effectiveness.