Tech Earnings Boost US Stock Futures, S&P 500 Eyes Record High

Tech earnings boost us stock futures sp 500 eyes another record high sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

Recent tech earnings reports have sent shockwaves through the US stock market, pushing the S&P 500 index towards another record high. The positive sentiment in the tech sector, fueled by strong financial performance and a bullish economic outlook, is driving this upward trend.

This surge in optimism is a testament to the resilience of the tech industry and its continued dominance in the global economy.

This upward trajectory is not just about tech giants hitting their stride. It’s a reflection of the broader economic landscape, with investors feeling optimistic about the future. Factors like a robust job market, low interest rates, and increasing consumer spending are contributing to this positive sentiment.

However, it’s not all sunshine and rainbows. There are potential risks on the horizon, including inflation, geopolitical instability, and the ever-present threat of a recession. This makes understanding the current market dynamics crucial for investors seeking to navigate this complex landscape.

Tech Earnings Impact: Tech Earnings Boost Us Stock Futures Sp 500 Eyes Another Record High

The recent tech earnings season has been a boon for the US stock market, with strong performances from major tech companies sending the S&P 500 index soaring towards new record highs. This positive sentiment is driven by a combination of factors, including robust revenue growth, improved profitability, and optimistic outlooks for the future.

Performance of Major Tech Companies

The recent earnings reports have showcased the resilience and growth potential of the tech sector.

- Applereported record revenue for the quarter, driven by strong sales of iPhones, Macs, and services. The company also announced a significant share buyback program, further boosting investor confidence.

- Microsoftexceeded analysts’ expectations, with revenue growth driven by strong demand for cloud computing services like Azure and Office 365. The company also highlighted its strong position in the artificial intelligence (AI) market.

- Amazon, despite facing some headwinds in its e-commerce business, delivered solid earnings, driven by continued growth in its cloud computing segment (AWS) and advertising revenue.

- Alphabet, the parent company of Google, also reported strong earnings, with revenue growth fueled by its search and advertising businesses. The company’s investments in AI and cloud computing continue to drive growth.

Key Financial Metrics

Several key financial metrics have contributed to the earnings boost in the tech sector.

- Revenue growth: Most major tech companies have reported strong revenue growth, driven by increasing demand for their products and services.

- Profitability: Many tech companies have shown improvement in profitability, with margins expanding due to cost optimization and efficient operations.

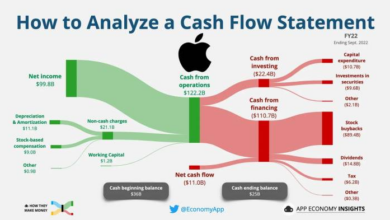

- Strong cash flow: Tech companies have generated strong cash flows, allowing them to invest in research and development, acquisitions, and share buybacks.

S&P 500 Performance

The S&P 500 index is on the cusp of a new record high, fueled by strong corporate earnings, a robust economy, and optimistic investor sentiment. The index has been on an upward trajectory for several months, and its current performance suggests that it is poised to break through previous highs.

Tech earnings are pushing the US stock futures higher, with the S&P 500 poised for another record high. While this positive sentiment is driven by strong corporate performance, global markets are also reacting to rising oil prices, triggered by the US and UK launching strikes on Houthi forces in Yemen, as reported in this article.

It remains to be seen how these geopolitical developments will impact the overall market in the coming days, but for now, the tech sector seems to be driving the bullish momentum.

Factors Influencing S&P 500 Performance

Several factors are contributing to the S&P 500’s impressive performance.

- Tech Earnings:Recent earnings reports from major tech companies have been overwhelmingly positive, demonstrating continued growth and profitability. This strong performance has boosted investor confidence and driven up stock prices across the sector, significantly impacting the S&P 500’s overall performance.

- Economic Indicators:Positive economic indicators, such as low unemployment rates and robust consumer spending, point to a healthy and expanding economy. This strong economic backdrop provides a favorable environment for businesses to thrive and for investors to remain optimistic about the future.

- Investor Sentiment:Investor sentiment remains buoyant, with many expecting continued growth in the stock market. This optimistic outlook is driving increased investment activity and pushing stock prices higher.

Comparison to Previous Record-Breaking Periods, Tech earnings boost us stock futures sp 500 eyes another record high

The current market conditions bear some similarities to previous record-breaking periods.

Tech earnings are powering US stock futures, pushing the S&P 500 towards another record high. The positive sentiment is spilling over into the Canadian market, where stocks are surging on speculation that the Fed might pause its rate hikes soon.

This potential shift in monetary policy, as discussed in this article on The Venom Blog , could further fuel investor optimism and propel US markets to new heights.

- Previous Record Highs:The S&P 500 has reached record highs several times in recent years, often fueled by similar factors, such as strong corporate earnings, a robust economy, and favorable investor sentiment. For instance, the index reached a record high in February 2020 before the COVID-19 pandemic triggered a market downturn.

- Key Differences:While there are similarities, there are also some key differences between the current market conditions and previous record-breaking periods. For example, the current economic environment is characterized by high inflation and rising interest rates, which pose potential risks to the market.

Historical Performance of the S&P 500

The S&P 500 has a long and rich history, marked by both periods of significant growth and periods of decline.

| Year | S&P 500 Index Value | Key Events |

|---|---|---|

| 1980 | 107.90 | Interest rates reach 20% |

| 1990 | 330.22 | Start of the dot-com boom |

| 2000 | 1469.25 | Dot-com bubble bursts |

| 2010 | 1115.10 | Financial crisis and recession |

| 2020 | 3756.07 | COVID-19 pandemic |

Investor Sentiment

The recent surge in tech earnings and the prospect of the S&P 500 hitting another record high have fueled a wave of optimism among investors. While some remain cautious, the prevailing sentiment is one of bullishness, driven by a confluence of factors.

The tech earnings bonanza has propelled US stock futures higher, with the S&P 500 poised to break another record. However, the optimism might be tempered as Asian markets are expected to open cautiously, with US futures slipping slightly, as highlighted in this market update.

Despite the slight pullback, the positive sentiment fueled by strong tech earnings suggests a continued upward trajectory for US markets.

Key Drivers of Investor Confidence

The positive outlook for the market is driven by several key factors:

- Strong Corporate Earnings:The recent tech earnings season has exceeded expectations, with many companies reporting robust growth and strong revenue. This has bolstered investor confidence in the underlying health of the economy and corporate profitability.

- Resilient Consumer Spending:Despite inflation, consumer spending has remained relatively strong, indicating continued economic activity and demand for goods and services. This is a positive sign for businesses and the overall economy.

- Federal Reserve’s Policy:While the Federal Reserve has been raising interest rates to combat inflation, the pace of hikes has slowed, suggesting that the central bank is becoming more cautious and potentially nearing the end of its tightening cycle. This has eased concerns about an aggressive monetary policy that could stifle economic growth.

- Technological Advancements:The continued rapid pace of innovation in technology, particularly in areas like artificial intelligence (AI), cloud computing, and electric vehicles, is fueling investor enthusiasm for growth stocks. This sector is seen as a key driver of future economic growth and is attracting significant investment.

Potential Risks and Challenges

While the current market sentiment is optimistic, there are several potential risks and challenges that could impact the market’s trajectory:

- Inflation:Although inflation has begun to moderate, it remains a significant concern for investors. Persistently high inflation could lead to further interest rate hikes, potentially slowing economic growth and impacting corporate earnings.

- Geopolitical Uncertainty:The ongoing war in Ukraine, tensions with China, and other geopolitical risks continue to create uncertainty and volatility in the markets. These events can impact global supply chains, commodity prices, and overall economic sentiment.

- Valuation Concerns:Some analysts believe that the stock market is currently overvalued, particularly in the tech sector. A correction or pullback could occur if investors become concerned about valuations or if interest rates rise more aggressively than expected.

- Recessionary Fears:Despite recent economic data showing resilience, some economists are concerned about the possibility of a recession in the coming months. This could lead to a decline in corporate earnings and a downturn in the stock market.

Investor Perspectives

| Investor Perspective | Market Outlook | Key Considerations |

|---|---|---|

| Bullish | Expect continued market growth, driven by strong corporate earnings, resilient consumer spending, and technological advancements. | Believe that the Federal Reserve will manage interest rates effectively to avoid a recession. |

| Cautious | Concerned about the potential for inflation to persist, leading to further interest rate hikes and economic slowdown. | Monitor geopolitical risks and potential valuation bubbles in certain sectors. |

| Bearish | Anticipate a market correction or downturn, driven by high valuations, potential recession, and rising interest rates. | Focus on defensive sectors and assets that are less vulnerable to economic downturns. |

Economic Outlook

The current economic landscape is a complex mix of positive and negative factors, impacting the stock market’s trajectory. While strong corporate earnings and a resilient consumer have propelled the market to new highs, inflationary pressures, rising interest rates, and geopolitical uncertainties pose challenges.

Impact of Inflation, Interest Rates, and Geopolitical Events

Inflation remains a key concern, with the Federal Reserve aggressively raising interest rates to tame it. This has a direct impact on businesses and consumers, affecting spending patterns and corporate profitability. Rising interest rates make borrowing more expensive for businesses, potentially slowing down investment and economic growth.

Geopolitical events, particularly the ongoing war in Ukraine, add further volatility to the market, disrupting supply chains and creating uncertainty about global economic prospects.

Economic Forecasts and Their Implications for the Stock Market

Economic forecasts provide insights into the future direction of the economy and its potential impact on the stock market. While some economists predict a recession in the near future, others believe the economy will navigate through the current challenges and maintain moderate growth.

The stock market’s performance will likely be influenced by the actual economic data, investor sentiment, and the Fed’s monetary policy decisions.

Key Economic Indicators and Investor Behavior

The following table illustrates key economic indicators and their influence on investor behavior:

| Economic Indicator | Impact on Investor Behavior |

|---|---|

| Gross Domestic Product (GDP) Growth | Strong GDP growth indicates a healthy economy, boosting investor confidence and potentially leading to higher stock prices. Conversely, a decline in GDP growth raises concerns about economic recession, causing investors to become more cautious. |

| Inflation Rate | High inflation erodes purchasing power and can lead to higher interest rates, potentially impacting corporate profitability and stock prices. Conversely, a decline in inflation can boost consumer spending and corporate earnings, leading to a more favorable stock market environment. |

| Unemployment Rate | A low unemployment rate indicates a strong labor market and healthy consumer spending, supporting economic growth and potentially boosting stock prices. Conversely, a rising unemployment rate signals economic weakness and can lead to investor caution. |

| Interest Rates | Rising interest rates can make borrowing more expensive for businesses, potentially slowing down investment and economic growth. This can lead to lower corporate earnings and potentially impact stock prices. Conversely, lower interest rates can stimulate economic activity and corporate investment, potentially leading to higher stock prices. |

| Consumer Confidence | High consumer confidence indicates strong consumer spending and a healthy economy, potentially boosting stock prices. Conversely, low consumer confidence signals weakness in consumer spending and can lead to investor caution. |

Market Strategies

The recent surge in stock prices, driven by strong tech earnings, presents investors with a compelling opportunity to capitalize on the market’s momentum. However, navigating this dynamic environment requires a well-defined strategy that balances risk and reward. This section delves into various investment approaches, highlighting their benefits, risks, and suitability for different risk appetites.

Investment Strategies and Risk Tolerance

Investors with varying risk tolerances can choose from a range of strategies to align their investments with their financial goals and comfort levels. Here’s a breakdown of some popular strategies and their suitability:

| Strategy | Risk Tolerance | Benefits | Risks |

|---|---|---|---|

| Growth Investing | High | Potential for high returns, exposure to innovative companies | Volatility, potential for losses, concentration risk |

| Value Investing | Moderate | Focus on undervalued companies, potential for long-term growth | Slower returns compared to growth investing, potential for market mispricing |

| Index Investing | Low | Diversification, low fees, passive approach | Limited potential for outperformance, exposure to market fluctuations |

| Dividend Investing | Moderate | Regular income stream, potential for capital appreciation | Lower growth potential compared to growth stocks, dependence on company performance |

Managing Risk and Maximizing Returns

While seeking potential returns, managing risk is crucial. Here are some strategies to mitigate potential losses and enhance overall portfolio performance:

- Diversification:Spreading investments across different asset classes, sectors, and geographies reduces the impact of any single investment’s performance on the overall portfolio.

- Rebalancing:Regularly adjusting portfolio allocations to maintain the desired asset mix, ensuring that risk and return targets remain aligned.

- Dollar-Cost Averaging:Investing a fixed amount at regular intervals, regardless of market fluctuations, helps to average out purchase prices and reduce the impact of market volatility.

- Long-Term Perspective:Maintaining a long-term investment horizon allows investors to ride out market fluctuations and benefit from the power of compounding.

Active vs. Passive Investing

Investors can choose between active and passive investment approaches, each with its own advantages and disadvantages:

- Active Investing:Involves actively managing a portfolio by buying and selling securities based on market research and analysis. This approach aims to outperform the market, but requires significant time, effort, and expertise.

- Passive Investing:Involves tracking a specific market index, such as the S&P 500, through index funds or exchange-traded funds (ETFs). This approach offers diversification, low fees, and a hands-off approach, making it suitable for investors with limited time or experience.