Stocks Mixed After JPMorgan Chase Buys First Republic Assets

Stocks Mixed After JPMorgan Chase Buys First Republic Assets live news updates sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The recent acquisition of First Republic Bank by JPMorgan Chase has sent shockwaves through the financial world, sparking discussions about the health of the banking industry and the potential ramifications for both investors and everyday consumers.

This move comes amidst a period of heightened anxiety surrounding the stability of the banking sector, with several high-profile failures shaking investor confidence. As we delve into the intricacies of this landmark deal, we’ll explore the factors that led to First Republic’s downfall, the potential impact on the broader economy, and the implications for depositors and customers of both institutions.

The acquisition of First Republic Bank by JPMorgan Chase is a significant event in the ongoing saga of the banking crisis. This move has far-reaching consequences for the industry, the economy, and individual investors. It’s crucial to understand the underlying factors that led to First Republic’s troubles and the potential impact of this acquisition on the future of the banking sector.

JPMorgan Chase Acquisition of First Republic Bank

The acquisition of First Republic Bank by JPMorgan Chase is a significant event in the current banking crisis. This move comes after several regional banks faced financial difficulties and prompted concerns about the stability of the banking system. This acquisition is a testament to the resilience of the banking industry and the ability of larger institutions to absorb smaller, struggling banks.

Impact of the Acquisition

The acquisition of First Republic Bank by JPMorgan Chase is expected to have a significant impact on the banking industry and the overall economy. Here are some of the potential consequences:

- Increased Market Share:This acquisition will significantly increase JPMorgan Chase’s market share, making it one of the largest banks in the United States. This will give the bank greater influence in the financial markets and potentially lead to changes in lending practices and interest rates.

- Stability in the Banking System:The acquisition helps stabilize the banking system by removing a troubled institution from the market. It also provides reassurance to depositors and investors about the overall health of the financial sector. However, it’s important to note that this acquisition doesn’t address the underlying issues that led to the crisis, such as rising interest rates and the potential for further bank failures.

- Potential Job Losses:While JPMorgan Chase has pledged to retain some of First Republic’s employees, there is a possibility of job losses as the two banks integrate their operations. This could have a negative impact on the local economies where First Republic had a presence.

The stock market was a bit of a mixed bag today, with some investors unsure about the future after JPMorgan Chase bought First Republic’s assets. It’s clear that the recent banking turmoil has had a major impact, with First Republic losing a staggering $72 billion in deposits, as reported in this article.

Despite the uncertainty, the market seems to be cautiously optimistic about the future of the banking sector, with JPMorgan Chase’s acquisition of First Republic being seen as a positive step towards stability.

Factors Leading to First Republic’s Financial Difficulties

First Republic’s financial difficulties stemmed from several factors, including:

- High Concentration of Deposits:First Republic Bank had a significant concentration of deposits from wealthy individuals and families. When these depositors began withdrawing their funds in the wake of the Silicon Valley Bank and Signature Bank failures, the bank faced a liquidity crisis.

- Exposure to Commercial Real Estate:First Republic had a significant exposure to commercial real estate loans, which have become riskier in recent years due to rising interest rates and concerns about a potential recession. This exposure contributed to the bank’s financial vulnerabilities.

- Aggressive Lending Practices:First Republic was known for its aggressive lending practices, which involved offering low interest rates and favorable terms to borrowers. While this strategy helped the bank grow its loan portfolio, it also increased its exposure to risk.

JPMorgan Chase’s Acquisition Strategy

JPMorgan Chase’s acquisition of First Republic Bank is a strategic move to strengthen its position in the banking industry. The acquisition allows JPMorgan Chase to expand its customer base, increase its market share, and acquire valuable assets, such as First Republic’s branch network and customer relationships.

This acquisition is also an opportunity for JPMorgan Chase to demonstrate its financial strength and stability in a time of uncertainty in the banking sector.

Market Reactions to the Acquisition: Stocks Mixed After Jpmorgan Chase Buys First Republic Assets Live News Updates

The news of JPMorgan Chase’s acquisition of First Republic Bank sent shockwaves through the financial markets, triggering a flurry of activity and raising concerns about the broader banking sector. While the deal aimed to stabilize the banking system and prevent further contagion, it also highlighted the fragility of the industry and the potential for future challenges.

Stock Price Movements

The acquisition announcement immediately impacted the stock prices of the involved companies and other major banks. JPMorgan Chase’s stock initially rose on the news, indicating investor confidence in the bank’s ability to manage the acquisition and its potential for future growth.

However, the stock price later experienced a slight decline, reflecting concerns about the potential costs and risks associated with integrating First Republic’s operations. First Republic’s stock surged dramatically after the announcement, as investors anticipated a quick resolution to the bank’s financial difficulties.

However, the stock price remained volatile, reflecting uncertainty about the future of the bank under JPMorgan Chase’s ownership. Other major banks, such as Bank of America, Wells Fargo, and Citigroup, also experienced fluctuations in their stock prices. While some investors saw the acquisition as a sign of strength and stability in the banking sector, others remained cautious about the potential for further turmoil.

The markets are in a bit of a tizzy today, with stocks mixed after JPMorgan Chase snagged First Republic’s assets. It’s a big deal, and I’m sure it’ll be making headlines for a while. Speaking of big deals, it’s also a good time to remind ourselves about the importance of privacy policies – you know, those documents that tell us how our information is being used.

It’s always a good idea to check out the what is a privacy policy and why is it important before signing up for anything online, especially when it comes to financial services. Back to the markets, I’m curious to see how things shake out in the coming days, and how this acquisition will impact the banking landscape.

Factors Influencing Market Reactions

Several key factors influenced the market’s response to the JPMorgan Chase acquisition of First Republic Bank. These factors include:

- Investor Confidence: The acquisition announcement initially boosted investor confidence, as it signaled a potential solution to the banking crisis and a sign of stability in the financial system. However, concerns about the potential costs and risks associated with the acquisition, as well as the broader economic outlook, dampened investor enthusiasm in the days following the announcement.

The market seems to be digesting the news of JPMorgan Chase acquiring First Republic Bank’s assets, with stocks trading mixed. It’s a reminder of the ongoing turbulence in the banking sector, and the recent federal reserve report on svb collapse highlights mismanagement and supervisory failures only adds to the uncertainty.

While the JPMorgan deal is a positive step towards stability, investors are still cautious about the broader economic outlook.

- Concerns About the Banking Sector: The acquisition further heightened concerns about the health of the banking sector, particularly in the wake of the recent failures of Silicon Valley Bank and Signature Bank. Investors remained apprehensive about the potential for further bank failures and the implications for the broader economy.

- Potential Regulatory Implications: The acquisition also raised questions about potential regulatory implications, as regulators are likely to scrutinize the deal to ensure it does not create a monopoly or hinder competition in the banking industry. The possibility of regulatory scrutiny and potential fines could weigh on investor sentiment and impact the stock prices of involved companies.

Stock Performance Comparison

In the days following the acquisition announcement, JPMorgan Chase’s stock performance was generally positive, indicating investor confidence in the bank’s ability to manage the acquisition and its future growth prospects. However, the stock price remained volatile, reflecting concerns about the potential costs and risks associated with integrating First Republic’s operations.Other major banks, such as Bank of America, Wells Fargo, and Citigroup, experienced mixed stock performance in the days following the acquisition announcement.

While some investors saw the acquisition as a sign of strength and stability in the banking sector, others remained cautious about the potential for further turmoil.

Impact on Depositors and Customers

The acquisition of First Republic Bank by JPMorgan Chase has significant implications for depositors and customers of the former. While the deal aims to stabilize the banking sector and reassure depositors, it’s crucial to understand the transition process and potential concerns for customers.

Transition Process for First Republic Customers, Stocks mixed after jpmorgan chase buys first republic assets live news updates

The acquisition involves the transfer of First Republic’s assets and liabilities to JPMorgan Chase. This means that First Republic customers will become JPMorgan Chase customers. The transition process will involve:

- Account Consolidation:First Republic accounts will be consolidated into JPMorgan Chase accounts. Customers will receive detailed information about the process, including new account numbers and access details.

- Branch Access:First Republic branches will be rebranded as JPMorgan Chase branches. Customers will have access to a wider network of branches and ATMs.

- Services and Products:JPMorgan Chase will offer a comprehensive range of banking products and services to former First Republic customers. This could include checking and savings accounts, loans, credit cards, and investment services.

Potential Concerns for Depositors and Customers

While the acquisition aims to ensure the safety of deposits and continuity of services, some concerns remain for depositors and customers:

- Potential Changes to Services:Customers might experience changes to banking services, including fees, interest rates, and product offerings. JPMorgan Chase may have different policies and procedures compared to First Republic.

- Privacy and Security:Customers might have concerns about the privacy and security of their financial information as it transitions to a new banking system. JPMorgan Chase will need to assure customers about the robust security measures in place.

- Customer Support:The transition process could lead to delays or disruptions in customer support. Customers may face difficulties reaching support representatives or accessing online services during the transition period.

Regulatory and Financial Implications

The acquisition of First Republic Bank by JPMorgan Chase has significant regulatory and financial implications, impacting both the participating institutions and the broader banking landscape. The transaction underwent rigorous scrutiny by federal regulators, including the Federal Deposit Insurance Corporation (FDIC), to ensure its compliance with banking regulations and protect the interests of depositors and the financial system.

Role of Regulatory Bodies

The FDIC played a pivotal role in overseeing the acquisition process, ensuring that the transaction met its regulatory standards and minimized potential risks to the financial system. The FDIC’s involvement included assessing the financial health of First Republic Bank, reviewing JPMorgan Chase’s acquisition proposal, and ensuring that the transaction protected depositors’ funds.

The FDIC’s primary objectives were to:

- Safeguard depositors’ funds:The FDIC’s top priority was to ensure that depositors’ funds were protected and that the acquisition process did not result in any losses for depositors. This involved assessing the financial health of First Republic Bank and ensuring that JPMorgan Chase had the financial resources to absorb any potential losses.

- Maintain financial stability:The FDIC also aimed to maintain financial stability by preventing a potential systemic risk from the failure of First Republic Bank. The acquisition of First Republic Bank by a large and financially sound institution like JPMorgan Chase helped to mitigate this risk and maintain confidence in the banking system.

- Ensure compliance with regulations:The FDIC reviewed the acquisition proposal to ensure compliance with relevant banking regulations, including those related to capital adequacy, risk management, and consumer protection.

Other regulatory bodies, such as the Federal Reserve and the Office of the Comptroller of the Currency (OCC), also played a role in overseeing the acquisition process, focusing on aspects related to their respective areas of expertise. For example, the Federal Reserve would have assessed the impact of the acquisition on the overall financial system and monetary policy, while the OCC would have reviewed JPMorgan Chase’s capital adequacy and risk management practices.

Impact on Capital Requirements and Regulatory Oversight

The acquisition of First Republic Bank by JPMorgan Chase has implications for the banking industry’s capital requirements and regulatory oversight. The transaction is likely to increase the regulatory scrutiny of large banks, particularly in terms of their capital adequacy and risk management practices.

This increased scrutiny is expected to result in:

- Higher capital requirements:Regulators may consider raising capital requirements for large banks, particularly those with significant deposit bases, to enhance their resilience against future financial shocks. This could involve requiring banks to hold a larger percentage of their assets as capital, which would reduce their ability to lend and potentially slow economic growth.

- Enhanced risk management oversight:Regulators are likely to increase their oversight of risk management practices at large banks, particularly in areas such as stress testing and liquidity management. This increased oversight could involve more frequent and rigorous reviews of banks’ risk management systems and practices.

- Greater scrutiny of mergers and acquisitions:The acquisition of First Republic Bank could lead to greater scrutiny of future mergers and acquisitions in the banking industry. Regulators may pay closer attention to the potential systemic risks posed by such transactions and the impact on competition and consumer protection.

The acquisition also raises questions about the effectiveness of current regulatory frameworks in preventing future bank failures. The FDIC’s handling of the First Republic Bank situation has been praised by some for its swift action and for preventing a systemic crisis.

However, others have argued that the regulatory framework needs to be strengthened to address the growing risks posed by large banks and their interconnectedness.

Future Outlook for the Banking Sector

The acquisition of First Republic Bank by JPMorgan Chase marks a significant turning point in the ongoing banking crisis. This event has raised concerns about the future stability of the banking sector and its potential impact on the broader economy.

Understanding the timeline of events leading up to this acquisition and the responses of major banks provides valuable insights into the current state of the banking sector and its future trajectory.

Timeline of Key Events

The banking crisis unfolded in a series of events, culminating in the acquisition of First Republic Bank. Here is a timeline highlighting the key events:

- March 2023:Silicon Valley Bank (SVB) collapses, triggering concerns about the financial health of other regional banks.

- March 2023:Signature Bank fails, further escalating the crisis and raising concerns about the vulnerability of the banking system.

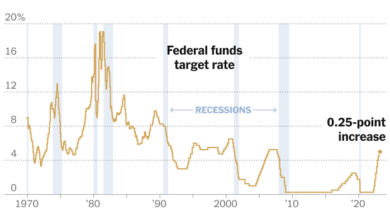

- March 2023:The Federal Reserve, FDIC, and Treasury Department intervene to stabilize the banking system, including providing emergency lending facilities and guaranteeing deposits.

- March 2023:First Republic Bank faces significant deposit outflows, raising concerns about its solvency.

- May 2023:JPMorgan Chase acquires First Republic Bank, ending weeks of uncertainty and speculation about the bank’s future.

Major Banks Involved in the Banking Crisis and Their Responses

The banking crisis has involved several major banks, each with its own response to the unfolding situation. The table below summarizes the key banks and their actions:

| Bank | Response |

|---|---|

| Silicon Valley Bank (SVB) | Collapsed due to significant losses on its investment portfolio and deposit outflows. |

| Signature Bank | Failed due to concerns about its exposure to commercial real estate and cryptocurrency. |

| First Republic Bank | Acquired by JPMorgan Chase after experiencing significant deposit outflows and concerns about its financial stability. |

| JPMorgan Chase | Acquired First Republic Bank, demonstrating its financial strength and its willingness to step in during a crisis. |

| Bank of America | Increased its lending to small and medium-sized businesses, aiming to provide stability and support to the economy. |

| Wells Fargo | Strengthened its capital position and increased its focus on risk management to address concerns about potential losses. |

Impact of JPMorgan Chase Acquisition on the Banking Sector

The acquisition of First Republic Bank by JPMorgan Chase has significant implications for the future of the banking sector. Here are some key potential impacts:

- Consolidation in the Banking Sector:The acquisition could lead to further consolidation in the banking sector, as larger institutions may seek to acquire smaller banks facing financial difficulties.

- Increased Regulatory Scrutiny:The banking crisis has highlighted the need for increased regulatory scrutiny of banks, particularly those with significant exposure to riskier assets.

- Shift in Lending Practices:Banks may become more cautious in their lending practices, potentially leading to tighter credit conditions for businesses and consumers.

- Impact on Depositors and Customers:The acquisition of First Republic Bank has provided reassurance to depositors and customers, as JPMorgan Chase is a large and financially stable institution. However, there may be some disruptions in services and customer relationships during the transition process.

- Potential for Increased Competition:The acquisition could lead to increased competition among the remaining large banks, as they seek to attract depositors and customers from the acquired institutions.