Stocks Hold Steady as S&P 500 Nears Record, Streak Continues Amid Limited Trading

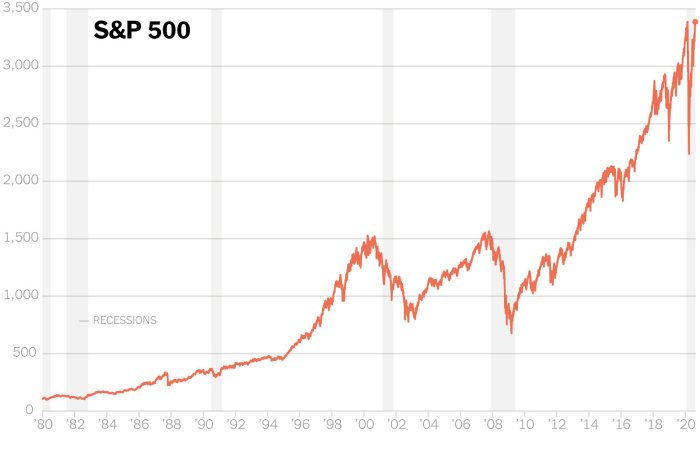

Stocks hold steady as sp 500 nears record positive streak continues amid limited trading week – Stocks Hold Steady as S&P 500 Nears Record, Streak Continues Amid Limited Trading – The stock market has been on a roll lately, with the S&P 500 index approaching a new record high. This week, despite a limited trading volume, the market has remained remarkably stable.

This stability is a testament to the underlying strength of the economy and the investor confidence that fuels it. We’ll delve into the factors driving this positive momentum and explore the potential implications of the S&P 500 reaching a new milestone.

This steady climb is attributed to a confluence of factors, including strong corporate earnings, a robust job market, and continued optimism about the future of the economy. However, it’s important to remember that limited trading can impact market liquidity and potentially lead to more volatile price movements.

We’ll examine the impact of this limited trading on the market’s behavior and assess whether it could disrupt the current positive trend.

Stock Market Stability

The stock market’s resilience in the face of a limited trading week is a testament to its underlying strength and the confidence investors have in the economy. This stability, despite the reduced trading volume, underscores the prevailing sentiment of optimism and the factors driving it.

Factors Contributing to Stock Market Stability

The recent stability in the stock market can be attributed to a confluence of factors.

- Strong Corporate Earnings:Robust corporate earnings continue to fuel investor confidence. Companies across various sectors have reported strong financial results, demonstrating their ability to navigate economic challenges and generate profits. These positive earnings reports have provided a solid foundation for market optimism.

- Low Interest Rates:The Federal Reserve’s accommodative monetary policy, characterized by low interest rates, has made borrowing more affordable for businesses and consumers. This has stimulated economic activity and supported corporate growth, further contributing to the positive market sentiment.

- Government Stimulus Measures:The government’s continued stimulus efforts, aimed at mitigating the economic impact of the pandemic, have provided a cushion for businesses and individuals. These measures have helped to stabilize the economy and boost consumer spending, creating a favorable environment for stock market growth.

The S&P 500 continues its remarkable run, nearing a record-breaking positive streak despite a quiet trading week. While the broader market remains relatively stable, there’s some movement in individual stocks. Check out the live updates on share market movement, with the Nifty crossing 17650, and a focus on HCL Tech and Tata Motors for insights into these specific movers.

This suggests that while the overall market holds steady, there are still opportunities for active traders to capitalize on individual stock performance.

Impact of Limited Trading on Stock Market Volatility

Limited trading volume can impact stock market volatility, but the recent stability suggests that other factors are outweighing this effect.

- Reduced Liquidity:Limited trading volume can lead to reduced liquidity, meaning fewer buyers and sellers are active in the market. This can make it more challenging to execute trades, potentially causing price swings.

- Increased Price Sensitivity:With fewer participants, the market can be more sensitive to news events and economic data releases. This can lead to more pronounced price fluctuations, particularly in the short term.

- Potential for Volatility:While the current market stability is encouraging, it’s important to acknowledge that limited trading volume can increase the potential for volatility in the future. This is especially true if there are unexpected economic developments or geopolitical events.

S&P 500 Nearing Record High

The S&P 500 index, a widely recognized benchmark of the U.S. stock market, is on the verge of achieving a new record high. This remarkable performance reflects a confluence of factors that have fueled investor confidence and propelled the index to unprecedented levels.

Factors Driving the S&P 500’s Ascent, Stocks hold steady as sp 500 nears record positive streak continues amid limited trading week

Several key factors have contributed to the S&P 500’s upward trajectory, driving it closer to a record high.

The stock market enjoyed a quiet week, with the S&P 500 inching closer to a record-breaking positive streak. While the week may have been slow, the upcoming week promises a whirlwind of activity. Investors will be watching closely as critical week ahead stocks brace for trials including nvidia earnings and powells speech and the Federal Reserve Chair’s speech could potentially shake things up.

It’ll be interesting to see how the market reacts to this flurry of events, especially after a week of relative calm.

- Robust Economic Growth:The U.S. economy has shown resilience, with strong GDP growth and a robust labor market. This positive economic backdrop has bolstered corporate earnings, creating a favorable environment for stock valuations.

- Low Interest Rates:The Federal Reserve’s accommodative monetary policy, characterized by low interest rates, has made borrowing cheaper for businesses and consumers. This has encouraged investment and spending, further supporting economic growth and stock market performance.

- Corporate Profitability:Companies across various sectors have reported strong earnings, fueled by robust demand and efficient operations. This profitability has translated into higher stock prices, driving the S&P 500 higher.

- Investor Sentiment:Positive investor sentiment, driven by factors such as economic optimism and the availability of cheap capital, has contributed to increased demand for stocks, pushing the S&P 500 to new heights.

Implications of a Record High

Reaching a new record high for the S&P 500 carries both potential benefits and risks.

While the S&P 500 continues its impressive run towards a record positive streak, this week’s limited trading volume has kept the markets relatively calm. However, a surprise surge in US employment costs, as reported in this recent article , could potentially impact inflation and, in turn, influence the trajectory of the stock market in the coming weeks.

It’s a reminder that even during periods of relative stability, underlying economic factors can shift the market landscape quickly.

- Market Confidence:A record high can further bolster investor confidence, encouraging more participation in the stock market and potentially leading to continued upward momentum.

- Economic Growth:A strong stock market can be a sign of a healthy economy, as it reflects investor confidence and corporate profitability. This can further stimulate investment and economic activity.

- Valuation Concerns:As the S&P 500 approaches a record high, concerns about overvaluation may arise. This could lead to increased volatility and potential corrections if investor sentiment shifts.

- Market Bubbles:Reaching a record high can raise concerns about the formation of market bubbles, where asset prices are driven by speculation rather than fundamentals. This could lead to a sharp and sudden decline in the market if the bubble bursts.

Positive Streak Continuation

The stock market’s recent positive streak is a notable event, signifying a period of sustained growth and investor optimism. This upward trend has been driven by a confluence of factors, including robust economic indicators, corporate earnings exceeding expectations, and accommodative monetary policy.

However, it is crucial to acknowledge the potential risks and challenges that could disrupt this positive momentum.

Factors Driving Market Momentum

The current positive streak in the stock market is a result of several key factors working in tandem.

- Strong Economic Fundamentals:The US economy has shown resilience, with robust job growth, low unemployment rates, and a steady rise in consumer spending. These indicators suggest a healthy economic environment that supports corporate earnings and investor confidence.

- Corporate Earnings Surprises:Companies across various sectors have consistently exceeded analysts’ earnings expectations. This positive earnings trend reflects strong corporate performance and suggests a healthy economic outlook.

- Accommodative Monetary Policy:The Federal Reserve’s continued commitment to low interest rates and quantitative easing has provided ample liquidity in the financial markets, supporting stock valuations and encouraging investment.

- Investor Sentiment:Positive news flow and strong economic data have boosted investor sentiment, leading to increased risk appetite and a willingness to invest in equities.

Potential Risks and Challenges

While the current positive streak is encouraging, it is essential to acknowledge the potential risks and challenges that could disrupt this upward trend.

- Inflationary Pressures:Rising inflation could erode corporate profits and dampen consumer spending, potentially leading to a slowdown in economic growth and a correction in the stock market.

- Interest Rate Hikes:The Federal Reserve’s eventual shift towards tighter monetary policy, including interest rate hikes, could increase borrowing costs for businesses and consumers, potentially impacting economic growth and stock valuations.

- Geopolitical Uncertainty:Ongoing geopolitical tensions, such as the Russia-Ukraine conflict, could create market volatility and negatively impact investor sentiment.

- Supply Chain Disruptions:Persistent supply chain disruptions and rising input costs could lead to higher prices for consumers and potentially impact corporate profitability.

Limited Trading Week Impact: Stocks Hold Steady As Sp 500 Nears Record Positive Streak Continues Amid Limited Trading Week

The stock market experienced a limited trading week, which is a period characterized by reduced trading activity compared to typical weeks. This can be attributed to various factors, including holidays, scheduled events, or simply a lack of significant market-moving news.

Impact of Limited Trading on Market Liquidity and Price Movements

Limited trading can significantly impact market liquidity and price movements. When trading volume is low, there are fewer buyers and sellers in the market, which can make it harder to execute trades at desired prices. This can lead to wider bid-ask spreads, making it more expensive to buy or sell stocks.

Limited trading volume can create an environment where a small number of trades can have a disproportionate impact on prices, leading to exaggerated price swings.

Additionally, limited trading can make it difficult to assess the true value of stocks, as there is less information available to investors. This can lead to increased volatility, as prices may fluctuate more readily in the absence of substantial trading activity.

Trading Volume Comparison

The trading volume during a limited trading week is typically significantly lower than during typical weeks. For instance, the New York Stock Exchange (NYSE) often sees a reduction in trading volume by as much as 50% during holiday weeks. This can be attributed to investors taking time off or simply choosing not to trade during periods of reduced market activity.

The lower trading volume during a limited trading week can be observed by comparing the average daily trading volume to the volume during the limited trading week.

For example, if the average daily trading volume for the S&P 500 is 10 billion shares, a limited trading week might see an average daily volume of only 5 billion shares. This reduction in trading volume can have a significant impact on market liquidity and price movements.