Stock Markets Week-Long Surge Pauses: Whats Behind the Numbers?

Stock markets week long surge pauses whats behind the numbers – Stock Markets Week-Long Surge Pauses: What’s Behind the Numbers? The recent surge in stock markets, fueled by a confluence of factors, has taken a sudden pause, leaving investors wondering what’s driving this shift. The market’s upward trajectory, driven by optimism surrounding economic recovery and corporate earnings, has been met with a wave of uncertainty, prompting a period of consolidation.

This week’s pause in the market’s momentum has sparked a wave of analysis, with experts dissecting the underlying forces at play. From shifts in investor sentiment to geopolitical events, the factors contributing to the market’s recent behavior are complex and multifaceted.

Understanding these dynamics is crucial for investors seeking to navigate the current market landscape.

Underlying Market Fundamentals

The recent surge in the stock market, while encouraging, necessitates an examination of the underlying economic fundamentals driving this performance. Understanding these factors is crucial for investors to assess the sustainability of the current market trend and make informed decisions.

Inflation and Interest Rates

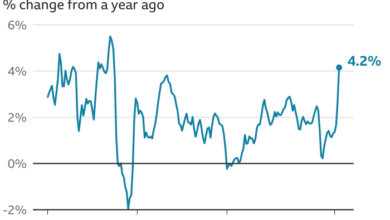

Inflation, a key economic indicator, has been a major concern for investors in recent months. While the rate of inflation has shown signs of cooling, it remains elevated compared to historical levels. The Federal Reserve has responded by aggressively raising interest rates, aiming to curb inflation and stabilize the economy.

This policy, however, can have a dampening effect on economic growth and corporate profits, potentially impacting stock market performance.

Unemployment

The unemployment rate has remained relatively low, indicating a strong labor market. This suggests that consumers have strong spending power, which can contribute to economic growth and corporate earnings. However, it’s important to note that wage growth has not kept pace with inflation, potentially putting pressure on consumer spending in the future.

Outlook for the Broader Economy

The outlook for the broader economy is uncertain, with a number of factors influencing its trajectory. The ongoing war in Ukraine, global supply chain disruptions, and geopolitical tensions all contribute to volatility and uncertainty. Despite these challenges, the US economy remains resilient, supported by strong consumer spending and a robust labor market.

However, the Federal Reserve’s aggressive monetary policy and potential recessionary pressures pose risks to future economic growth.

Investor Sentiment and Market Psychology

The recent surge in the stock market, followed by a pause, highlights the significant role of investor sentiment and market psychology in driving short-term price fluctuations. While underlying market fundamentals are crucial for long-term growth, the prevailing sentiment among investors can have a powerful impact on the market’s direction in the short term.

Investor Sentiment During the Surge and Pause

Investor sentiment during the surge was characterized by optimism and a belief that the market was headed for further gains. This positive sentiment was fueled by several factors, including strong corporate earnings, favorable economic data, and expectations of continued accommodative monetary policy.

As a result, investors were more likely to buy stocks, driving prices higher.However, the subsequent pause in the market’s ascent suggests a shift in investor sentiment. This shift could be attributed to a number of factors, such as concerns about rising inflation, geopolitical tensions, and the potential for tighter monetary policy.

As investors become more cautious, they may be less inclined to buy stocks, leading to a slowdown in price gains.

The Role of Market Psychology in Short-Term Price Fluctuations

Market psychology plays a crucial role in driving short-term price fluctuations. Investors are often influenced by herd mentality, where they follow the actions of others, leading to price movements that are not necessarily justified by fundamentals. For example, if a large number of investors start selling stocks, this can create a downward spiral in prices, even if there is no underlying reason for the sell-off.Another key aspect of market psychology is the tendency for investors to overreact to news and events.

This can lead to excessive price swings, both upward and downward. For example, a positive earnings report from a major company could lead to a significant rally in its stock price, even if the underlying fundamentals of the company have not changed dramatically.

The stock market’s week-long surge has paused, leaving investors wondering what’s driving the numbers. While the economic landscape remains complex, it’s worth considering the broader picture. Understanding the real estate market is crucial, and a comprehensive analysis of the US market, state by state, can offer valuable insights, especially when exploring both residential and commercial properties, like you’ll find in this detailed breakdown exploring real estate in united states state by state analysis residential commercial properties.

This deeper understanding of the real estate sector can help shed light on the stock market’s recent volatility and potential future trends.

Behavioral Biases that Influence Market Behavior

Several behavioral biases can influence market behavior, including:

- Confirmation bias:Investors tend to seek out information that confirms their existing beliefs, even if that information is inaccurate or incomplete. This can lead to irrational investment decisions.

- Anchoring bias:Investors often over-rely on the first piece of information they receive, even if it is irrelevant or outdated. This can lead to them setting unrealistic price targets or making poor investment decisions.

- Herd mentality:As mentioned earlier, investors often follow the actions of others, even if it is not in their best interest. This can lead to market bubbles and crashes.

These biases can amplify market volatility and contribute to short-term price fluctuations. Understanding these biases is crucial for investors to make rational decisions and avoid falling prey to emotional reactions.

Technical Analysis of Market Trends

The recent surge in the stock market has prompted investors to examine the technical aspects of this rally. Technical analysis uses historical price and volume data to identify patterns and trends, providing insights into potential future price movements. This approach complements fundamental analysis by providing a different perspective on market sentiment and momentum.

Chart Patterns, Stock markets week long surge pauses whats behind the numbers

Chart patterns are visual representations of price movements over time. They can help identify potential support and resistance levels, as well as potential trend reversals. The recent surge has been characterized by several bullish chart patterns, suggesting continued upward momentum.

The stock market’s week-long surge finally paused, leaving investors wondering what’s driving the numbers. While some point to improving economic indicators, others cite a growing sense of caution, particularly after news of Peloton recalling 2.2 million bikes over injury and fall concerns highlighted the potential for unexpected risks.

This uncertainty, combined with the recent volatility in the tech sector, suggests a period of consolidation may be in order before the market resumes its upward trajectory.

- Breakout:The market has broken through previous resistance levels, indicating a shift in sentiment and potential for further gains.

- Cup and Handle:This pattern forms a rounded base followed by a downward correction, resembling a cup with a handle. It often signals a continuation of an uptrend.

- Bullish Flag:A consolidation pattern where prices trade within a narrow range after a strong upward move. This pattern suggests a pause before a resumption of the uptrend.

Trading Volume

Trading volume reflects the number of shares traded in a given period. It can provide insights into the strength of a trend and potential changes in market sentiment. High trading volume during the recent surge suggests strong demand and a conviction in the uptrend.

The stock market’s week-long surge has finally paused, leaving investors wondering what’s behind the numbers. While recent economic data suggests a slowdown in inflation, the Federal Reserve’s battle against rising prices continues, with discussions of potential rate cuts swirling.

The Fed’s strategy is a major factor in the market’s volatility, and investors are closely watching for any signs of a shift in policy.

Momentum Indicators

Momentum indicators measure the speed and strength of price movements. They can help identify overbought or oversold conditions, as well as potential trend reversals. Some commonly used momentum indicators include:

- Relative Strength Index (RSI):A measure of price momentum that ranges from 0 to 100. Readings above 70 are considered overbought, while readings below 30 are considered oversold.

- Moving Average Convergence Divergence (MACD):A trend-following momentum indicator that compares two moving averages. Crossovers between the two lines can signal potential trend changes.

Support and Resistance Levels

Support levels represent price levels where buying pressure is expected to outweigh selling pressure, preventing further declines. Resistance levels are price levels where selling pressure is expected to outweigh buying pressure, preventing further advances. The recent surge has seen several key support and resistance levels emerge:

- Previous Highs:Previous highs act as resistance levels, as investors may take profits at these levels.

- Moving Averages:Moving averages can act as support or resistance levels, depending on their position relative to the current price.

- Fibonacci Retracement Levels:These levels are calculated based on the Fibonacci sequence and can identify potential support and resistance areas.

Implications for Market Trends

The technical indicators suggest that the current uptrend in the stock market may continue in the short term. However, it is important to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Impact on Different Asset Classes

The recent surge in stock markets has had a ripple effect across different asset classes, with varying degrees of impact. While stocks enjoyed a significant rally, other assets, such as bonds, have exhibited a more subdued performance, reflecting the complex interplay of market forces.

Performance Comparison

The surge in stock markets has been driven by a combination of factors, including improving economic data, easing inflation concerns, and expectations of continued monetary policy support. This positive sentiment has led to strong gains in equities, particularly in sectors like technology and consumer discretionary.

However, the bond market has reacted differently, with yields rising as investors anticipate higher interest rates in the future. This rise in yields has led to a decline in bond prices, resulting in negative returns for bondholders.Other asset classes, such as commodities and real estate, have also experienced mixed performance.

Commodities, particularly energy, have benefited from the global economic recovery and geopolitical tensions. Real estate, however, has shown more muted growth, reflecting concerns about rising interest rates and potential economic slowdown.

Impact on Investment Strategies

The market volatility experienced during the surge and subsequent pause has highlighted the importance of carefully considering investment strategies. Investors with a higher risk tolerance and a longer-term horizon may have benefited from the stock market rally. However, those with a more conservative approach or a shorter-term investment horizon may have chosen to allocate a larger portion of their portfolio to bonds or other less volatile assets.

Implications for Portfolio Diversification and Risk Management

The recent market movements underscore the significance of portfolio diversification and risk management. Diversification across different asset classes helps to mitigate the impact of market volatility on overall portfolio returns. For example, a portfolio with a mix of stocks, bonds, and other assets can help to cushion losses during market downturns and capitalize on opportunities during market rallies.Risk management involves identifying and assessing potential risks and developing strategies to mitigate their impact.

This can include setting appropriate investment goals, choosing suitable investment vehicles, and regularly monitoring portfolio performance.

Looking Ahead: Stock Markets Week Long Surge Pauses Whats Behind The Numbers

The recent surge in the stock market has left many investors wondering what lies ahead. While the market’s momentum has been impressive, it’s crucial to consider the factors that could influence its trajectory in the coming weeks and months.

Expert Opinions and Forecasts

A range of expert opinions exists regarding the future direction of the stock market. Some analysts remain optimistic, citing factors such as strong corporate earnings, a robust economy, and accommodative monetary policy. Others, however, express caution, highlighting potential headwinds like rising inflation, geopolitical tensions, and the possibility of a recession.

“The market is always looking ahead,” says [Expert Name], Chief Investment Strategist at [Financial Institution]. “While the current economic environment appears favorable, investors need to be mindful of the uncertainties that lie ahead.”

Potential Risks and Opportunities

The market’s upward trend presents both risks and opportunities for investors. On the one hand, investors who missed out on the recent rally may be tempted to chase returns, potentially entering the market at inflated valuations. On the other hand, the market’s volatility could provide opportunities for those with a long-term investment horizon.

Key Events and Data Releases

Several key events and data releases in the coming weeks and months could significantly impact market sentiment. These include:

- Federal Reserve Interest Rate Decisions:The Federal Reserve’s decisions on interest rate hikes will continue to be closely watched by investors. Higher interest rates could dampen economic growth and potentially lead to a decline in stock prices.

- Inflation Data:Inflation remains a major concern for investors. Data releases on consumer price index (CPI) and producer price index (PPI) will provide insights into the pace of inflation and the Fed’s potential response.

- Earnings Season:Corporate earnings reports will provide valuable information about the health of the economy and individual companies. Strong earnings could fuel further market gains, while disappointing results could lead to sell-offs.

- Geopolitical Developments:The ongoing conflict in Ukraine and tensions between the US and China could continue to weigh on market sentiment. Any escalation in these conflicts could lead to increased market volatility.