US Stocks Rise, Oil Prices Increase: Market Update

Stock market update us stocks rise and oil prices increase – US Stocks Rise, Oil Prices Increase: Market Update – The US stock market is experiencing a surge, with major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all climbing higher. This upward trend is fueled by a combination of factors, including strong economic indicators, positive corporate earnings, and a generally optimistic investor sentiment.

Simultaneously, oil prices are on the rise, driven by global supply and demand dynamics, geopolitical events, and energy policy shifts. This upward trend in oil prices has the potential to impact the global economy, influencing inflation, consumer spending, and corporate profits.

This confluence of rising stock prices and oil prices presents a complex and dynamic market environment. Understanding the underlying factors driving these trends is crucial for investors seeking to navigate this landscape. The historical relationship between stock market performance and oil prices, the potential impact of rising oil prices on various sectors and industries, and the overall market outlook are all critical considerations for making informed investment decisions.

US Stock Market Performance

US stocks have been on a tear lately, with major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all hitting record highs. This rally is driven by a confluence of factors, including a robust economic recovery, strong corporate earnings, and a favorable monetary policy environment.

Factors Driving the Rise in US Stock Prices

The recent rise in US stock prices is fueled by several key factors:

- Strong Economic Recovery:The US economy is showing signs of a robust recovery, with unemployment rates falling and consumer spending increasing. This economic optimism is boosting investor confidence and driving demand for stocks.

- Robust Corporate Earnings:Companies are reporting strong earnings, indicating healthy business conditions and profitability. This positive earnings momentum is further supporting the stock market rally.

- Favorable Monetary Policy:The Federal Reserve has maintained a loose monetary policy, keeping interest rates low and providing ample liquidity to the financial system. This supportive policy environment is encouraging investors to take on more risk and invest in stocks.

Sectors Performing Particularly Well

Several sectors are performing particularly well, benefiting from the strong economic recovery and specific industry trends:

- Technology:The technology sector continues to be a strong performer, driven by the ongoing digital transformation and the increasing adoption of cloud computing, artificial intelligence, and other emerging technologies. Companies like Apple, Microsoft, and Amazon are leading the charge in this sector.

- Energy:The energy sector is benefiting from the rebound in oil prices, driven by increased global demand and supply constraints. Oil and gas producers are seeing improved profitability, and their stock prices are reflecting this positive trend.

- Financials:The financial sector is also performing well, as rising interest rates and a strong economy are boosting lending activity and profitability for banks and other financial institutions.

Oil Price Surge: Stock Market Update Us Stocks Rise And Oil Prices Increase

Oil prices have surged in recent weeks, reaching their highest levels in months. The price of Brent crude, the international benchmark, has climbed above $85 per barrel, while West Texas Intermediate (WTI), the US benchmark, has surpassed $80 per barrel.

This represents a significant increase from earlier this year, when prices were hovering around $70 per barrel.The rise in oil prices can be attributed to a confluence of factors, including tight global supply, robust demand, and geopolitical tensions.

Global Supply and Demand Dynamics, Stock market update us stocks rise and oil prices increase

The global oil market is currently experiencing a supply squeeze, with production struggling to keep pace with growing demand. The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, have announced production cuts, aiming to support prices.

The stock market saw a positive day today, with US stocks rising and oil prices increasing. This positive sentiment might be fueled by news of a major investment in the future of electric vehicles. Ford and SK Innovation, through their joint venture, have secured a whopping $9.2 billion loan from the US government to build battery production facilities.

This move is a significant boost to the EV sector, signaling a growing commitment to clean energy solutions. The rising oil prices, however, could pose a challenge for the EV market in the short term, but the long-term outlook remains positive as the demand for electric vehicles continues to grow.

Meanwhile, sanctions on Russia, a major oil exporter, have disrupted supply chains and reduced global production. At the same time, demand for oil is rebounding as the global economy recovers from the pandemic. This robust demand, particularly in emerging markets, is putting further pressure on oil prices.

Geopolitical Events

Geopolitical tensions, particularly in the Middle East, are also contributing to the rise in oil prices. The ongoing conflict in Yemen, the instability in Libya, and the tensions between Iran and the West have created uncertainty in the oil market, leading to a risk premium being priced into oil prices.

The US stock market saw a surge today, with oil prices also climbing, indicating a positive economic outlook. This upward trend is further fueled by the growing demand for technology, particularly in the Asian market. Apple’s success in China, as highlighted in this insightful article , showcases the vast potential of this region.

As Asian economies continue to grow, we can expect further gains in the stock market, especially in sectors like technology and consumer goods.

Energy Policy Changes

Energy policy changes, particularly in the United States, are also impacting oil prices. The Biden administration’s policies aimed at transitioning to cleaner energy sources have led to reduced investment in oil production, contributing to the supply squeeze.

Impact on the Global Economy

The rise in oil prices is likely to have a significant impact on the global economy. Higher oil prices will lead to increased inflation, as businesses pass on higher energy costs to consumers. This could dampen consumer spending and slow economic growth.

Additionally, rising oil prices will impact corporate profits, particularly for companies in energy-intensive industries.

The stock market is on a roll, with US stocks rising and oil prices increasing, which is great news for energy companies. But it’s also a reminder of the impact these fluctuations have on our daily lives, especially when it comes to transportation.

To make a smart decision about your next vehicle, it’s worth considering gas vs electric vehicles, and what the experts suggest. Ultimately, the best choice depends on your individual needs and budget, but with oil prices on the rise, it’s a decision worth thinking about.

Higher oil prices can lead to a vicious cycle of inflation, as businesses pass on higher energy costs to consumers, leading to further price increases.

Correlation Between Stock Market and Oil Prices

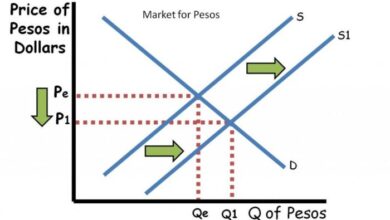

The relationship between the US stock market and oil prices has been a subject of much debate and analysis. While there is no straightforward cause-and-effect relationship, a complex interplay of factors often leads to correlations and patterns in their movements.

Historical Relationship

Historically, the relationship between oil prices and the US stock market has been somewhat volatile and influenced by various economic and geopolitical events. In general, rising oil prices have tended to negatively impact the stock market, particularly for energy-intensive sectors like airlines and transportation.

This is due to increased costs for businesses, which can lead to reduced profits and lower stock prices. However, there have also been periods where rising oil prices have coincided with stock market gains, particularly when these increases are driven by strong economic growth and increased demand for energy.

For instance, the period between 2003 and 2008 saw a surge in oil prices coupled with a bull market in the US stock market, fueled by robust global economic growth. Conversely, during periods of economic uncertainty or recession, such as the 2008 financial crisis, both oil prices and stock markets tend to decline.

Impact of Rising Oil Prices on Stock Market Performance

Rising oil prices can have a significant impact on the US stock market performance, depending on the specific sectors and industries involved. For instance, energy companies, particularly those involved in oil and gas exploration and production, often benefit from higher oil prices.

This is because their revenues increase as the price of their primary product rises. However, for other sectors, like airlines, transportation, and manufacturing, rising oil prices can be detrimental. These sectors rely heavily on oil for fuel and transportation, and higher prices can lead to increased operating costs, reduced profit margins, and potentially lower stock prices.

Furthermore, rising oil prices can also contribute to inflation, which can negatively impact consumer spending and overall economic growth, ultimately impacting the stock market.

Perspectives on the Relationship

The relationship between the stock market and oil prices is complex and influenced by a multitude of factors, including investor sentiment, economic conditions, and market volatility.

- Investor Sentiment:When oil prices rise, investors may become concerned about inflation and its potential impact on corporate profits. This can lead to a sell-off in the stock market, particularly in sectors that are heavily reliant on energy. Conversely, if investors believe that rising oil prices are a sign of a strong economy, they may be more likely to buy stocks, leading to a positive correlation between oil prices and the stock market.

- Economic Conditions:During periods of strong economic growth, demand for oil tends to increase, which can drive up prices. This can lead to higher profits for energy companies and positive stock market performance. However, during economic downturns or recessions, demand for oil typically decreases, leading to lower prices.

This can negatively impact energy companies and contribute to a decline in the stock market.

- Market Volatility:When oil prices are volatile, it can create uncertainty in the market, leading to increased volatility in stock prices. This is because investors may be hesitant to invest in companies that are heavily exposed to oil price fluctuations.

Potential Market Implications

The recent surge in both the stock market and oil prices presents a complex landscape for investors. Understanding the potential implications of these trends is crucial for navigating the current market environment and making informed investment decisions.

Factors Influencing the Market

The rising stock market and oil prices are influenced by a confluence of factors, including:* Economic Recovery:As the global economy recovers from the pandemic, increased consumer spending and business activity are driving demand for goods and services, contributing to stock market gains.

Inflation Rising inflation, driven by supply chain disruptions and strong consumer demand, is prompting investors to seek assets that can hedge against inflation, such as commodities like oil.

Interest Rates The Federal Reserve’s monetary policy, including interest rate hikes, is aimed at controlling inflation. However, rising interest rates can impact the stock market, as they increase borrowing costs for businesses and potentially slow economic growth.

Geopolitical Uncertainty The ongoing conflict in Ukraine and heightened geopolitical tensions in other regions are contributing to market volatility and influencing energy prices.

Potential Investment Strategies

The current market environment presents both risks and opportunities for investors. Here are some potential investment strategies to consider, depending on risk tolerance and investment goals:* Diversification:Spreading investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk and potentially enhance returns.

Value Investing Focusing on undervalued companies with strong fundamentals can provide opportunities for long-term growth.

Growth Investing Investing in companies with high growth potential can potentially deliver significant returns, but also carries higher risk.

Defensive Stocks Investing in companies that are less affected by economic downturns, such as consumer staples and utilities, can provide stability in a volatile market.

Commodity Investments Investing in commodities like oil can provide a hedge against inflation, but also involves significant price volatility.

It is important to remember that investment decisions should be based on individual circumstances, risk tolerance, and investment goals. Consulting with a financial advisor can provide personalized guidance and support.