Stock Market Reacts to Shifting Inflation Signals: Insights from Latest Movements

Stock market reacts to shifting inflation signals insights from latest market movements – The stock market is constantly in motion, reacting to a myriad of factors, and inflation is one of the most powerful forces shaping investor sentiment. As inflation signals shift, so too does the market, with investors adjusting their strategies and portfolios in response.

This dynamic interplay between inflation and the stock market is a fascinating subject, with implications for both individual investors and the broader economy.

Understanding how inflation impacts the market is crucial for making informed investment decisions. By analyzing key inflation indicators, market reactions, and recent trends, we can gain valuable insights into the current state of the market and its potential trajectory.

In this blog post, we’ll delve into the intricate relationship between inflation and the stock market, exploring how recent inflation signals have shaped market movements and what this means for investors.

Latest Market Movements: Stock Market Reacts To Shifting Inflation Signals Insights From Latest Market Movements

The stock market is a complex system that is constantly in flux, influenced by a myriad of factors. Recent market movements have been particularly volatile, reflecting the uncertainty surrounding inflation and the Federal Reserve’s response. Understanding these dynamics is crucial for investors seeking to navigate the market effectively.

Inflation-Sensitive Sectors

Inflation has a significant impact on certain sectors and industries, making them more susceptible to its fluctuations. Here are some of the key sectors that are particularly sensitive to inflation:

- Consumer Discretionary:Companies in this sector, such as retailers and restaurants, are vulnerable to inflation as rising prices can erode consumer spending power, impacting their sales and profitability.

- Energy:The energy sector is directly impacted by inflation, as higher energy prices can drive up production costs and impact consumer demand.

- Materials:The materials sector, which includes producers of raw materials like metals and chemicals, is also susceptible to inflation, as rising input costs can affect their margins.

Asset Class Performance, Stock market reacts to shifting inflation signals insights from latest market movements

The performance of different asset classes varies significantly in response to inflation signals.

- Stocks:Stocks generally tend to perform well in periods of low inflation, as companies can pass on higher costs to consumers. However, high inflation can erode corporate profits and lead to a decline in stock prices.

- Bonds:Bonds are traditionally considered a safe haven asset, but their performance can be negatively impacted by rising inflation. As interest rates rise to combat inflation, bond prices tend to fall, leading to capital losses.

- Commodities:Commodities, such as oil and gold, often benefit from inflation. As prices rise, the value of commodities tends to increase, making them a potential hedge against inflation.

Factors Driving Market Movements

Recent market movements have been driven by a combination of factors, including:

- Investor Sentiment:Investor sentiment plays a crucial role in shaping market direction. Rising inflation and concerns about the Fed’s monetary policy tightening have led to increased market volatility and uncertainty, impacting investor sentiment.

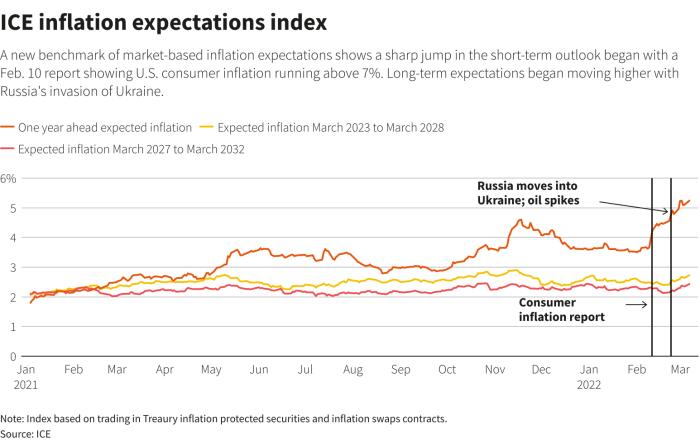

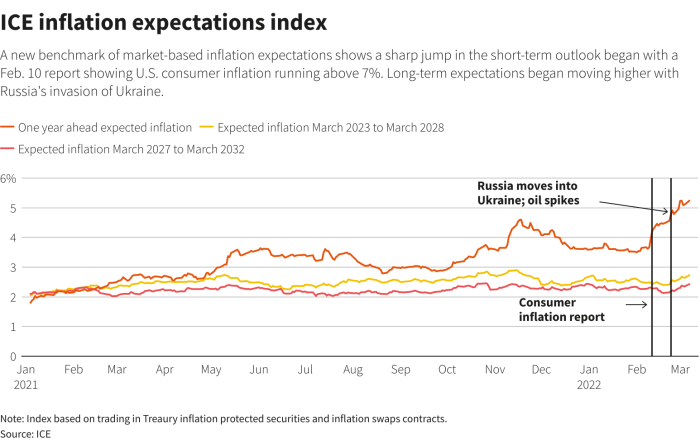

- Economic Data:Economic data releases, such as inflation reports, employment figures, and GDP growth data, provide insights into the health of the economy and influence market sentiment. Strong economic data tends to support stock prices, while weak data can lead to market declines.

- Monetary Policy Decisions:The Federal Reserve’s monetary policy decisions are a key driver of market movements. As the Fed raises interest rates to combat inflation, it can impact borrowing costs for businesses and consumers, potentially slowing economic growth and affecting stock prices.

The stock market is a sensitive beast, constantly reacting to the shifting winds of economic data. Lately, inflation signals have been a major focus, with investors trying to decipher the latest whispers from the Fed and the broader market. It’s a complex landscape, but understanding the underlying drivers of inflation is crucial.

For a deeper dive into navigating these turbulent waters, check out the inflation guide tips to understand and manage rising prices. Armed with this knowledge, you can better interpret the market’s reaction to inflation, making informed decisions about your own investments.

The stock market is a wild beast, constantly reacting to the latest economic news. Today, we’re seeing a lot of volatility as investors grapple with shifting inflation signals. It’s a stark reminder that even in times of economic uncertainty, there are other important things in life, like remembering the contributions of talented actors like Ray Stevenson, who sadly passed away at 58.

He’ll be remembered for his roles in films like Punisher: War Zone, RRR, and Thor. But back to the market, it’s going to be a bumpy ride for a while, so buckle up and keep an eye on those inflation numbers.

The stock market’s recent volatility reflects the ongoing tug-of-war between inflation and growth, making it crucial for investors to stay informed. This uncertainty underscores the importance of long-term financial planning, especially for women who often face a wider retirement savings gap.

A strong foundation for retirement security can be built by taking control of your financial future and making informed investment decisions. Empowering women’s retirement and closing the savings gap for a bright financial future is a vital step towards securing a comfortable and fulfilling retirement.

Understanding the latest market movements and implementing a solid financial plan can help navigate the challenges of inflation and ensure a secure future.