US Homebuyers Remain Willing Despite High Rates: Bank of America Study

Shift in us home buyer behavior increasing willingness despite high interest rates bank of america study – Despite soaring interest rates, a recent Bank of America study reveals a surprising shift in US homebuyer behavior – an increasing willingness to purchase despite the higher costs. This unexpected trend raises questions about the resilience of the housing market and the motivations driving these buyers.

The study delves into the current state of the housing market, analyzing factors like inventory levels, price trends, and affordability. It then explores the changing priorities of homebuyers, identifying the reasons behind their continued interest in purchasing despite the financial challenges posed by rising interest rates.

The Current Housing Market Landscape

The US housing market is currently navigating a complex landscape shaped by a confluence of factors, including rising interest rates, shifting buyer preferences, and lingering supply chain issues. Understanding these dynamics is crucial for both potential homebuyers and investors seeking to make informed decisions.

Inventory Levels and Price Trends

Inventory levels remain relatively low, although some signs of easing are emerging in certain markets. This limited supply continues to exert upward pressure on prices, but the pace of appreciation has slowed in recent months. While the market is not experiencing a dramatic downturn, it is transitioning from a seller’s market to a more balanced one, where buyers have slightly more negotiating power.

Impact of Rising Interest Rates

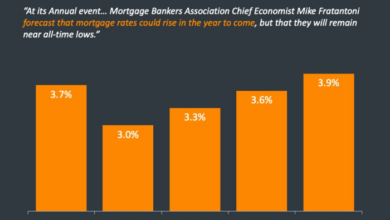

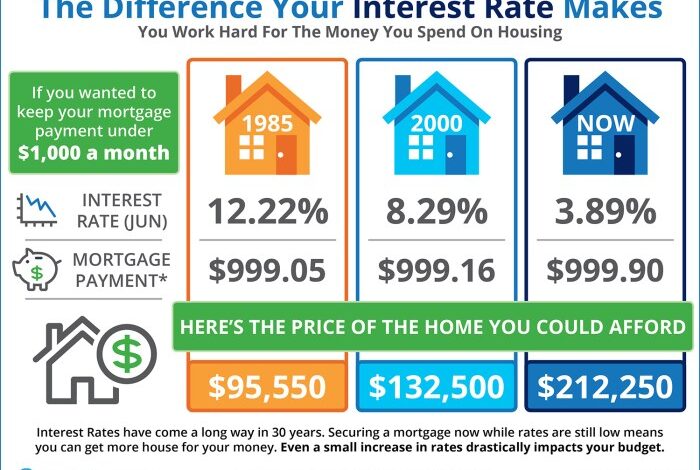

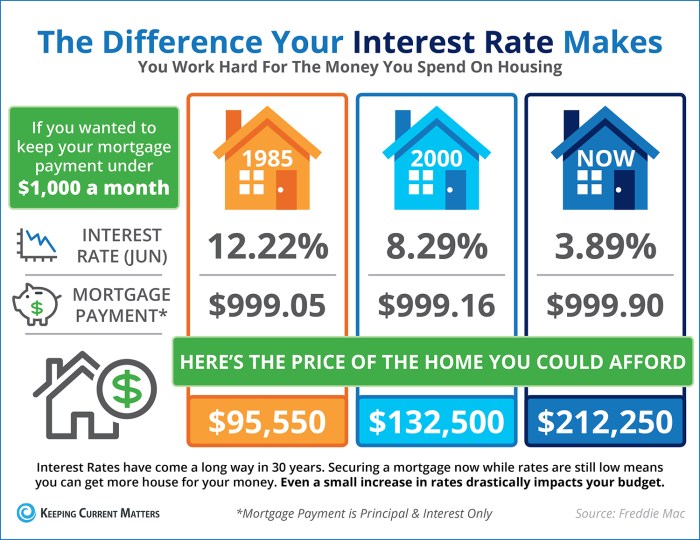

The Federal Reserve’s aggressive interest rate hikes have significantly impacted mortgage costs. Higher interest rates translate into higher monthly mortgage payments, making homeownership less affordable for many. This affordability squeeze has cooled demand in some segments of the market, particularly among first-time homebuyers who are most sensitive to interest rate fluctuations.

Buyer Behavior and Demand

The rising cost of borrowing has led to a shift in buyer behavior. Some potential buyers are delaying their purchase decisions, waiting for interest rates to stabilize or prices to soften. Others are adjusting their search criteria, focusing on more affordable properties or locations.

It’s fascinating to see how homebuyers are navigating the current market, with a Bank of America study revealing an increased willingness to buy despite high interest rates. This resilience could be linked to the recent surge in consumer sentiment, as reflected in the University of Michigan survey which highlighted a positive shift amid slowing inflation.

This suggests that consumers are feeling more optimistic about the economy, potentially driving their confidence in making major purchases like homes.

The demand for homes in desirable areas with strong amenities and schools remains robust, but the overall pace of sales has slowed.

Shifting Buyer Priorities

The recent Bank of America study reveals a surprising trend: homebuyers are increasingly willing to enter the market despite high interest rates. This shift in behavior raises questions about the underlying factors driving this willingness. Understanding these motivations is crucial for navigating the current housing market landscape.

It’s fascinating to see how the US home buyer market is navigating these high interest rates. The Bank of America study highlights a surprising willingness to buy despite the financial headwinds. Meanwhile, the cryptocurrency world is buzzing with the news that bitcoin has surged above $30,000 USD, prompting discussions about SEC considerations in the Middle East.

Perhaps this surge in Bitcoin is a sign of the shifting financial landscape that’s influencing even the housing market, as investors look for alternative assets and opportunities.

Factors Driving Buyer Willingness

Several key factors are driving the increased willingness of homebuyers to purchase despite high interest rates. These include:

- Desire for Homeownership:The dream of owning a home remains a powerful motivator for many, even in the face of economic challenges. The perception of homeownership as a long-term investment, coupled with the potential for future appreciation, continues to drive demand.

- Changing Lifestyle Needs:The pandemic accelerated the shift towards remote work and flexible living arrangements. This has led to a surge in demand for larger homes with dedicated office spaces and outdoor areas, particularly in suburban and rural locations.

- Perception of Long-Term Value:Despite rising interest rates, many buyers believe that real estate remains a sound investment in the long term. The historical trend of home appreciation, coupled with limited housing supply, fuels this perception.

- Low Inventory:The limited inventory of available homes has created a competitive market, pushing buyers to act quickly. This scarcity, combined with the fear of missing out, is contributing to the willingness to purchase even with higher interest rates.

Buyer Priorities: A Comparative Analysis

The priorities of homebuyers vary depending on their stage in the homeownership journey.

- First-time buyers:This segment is primarily driven by affordability and location. They often prioritize access to amenities, public transportation, and good schools. While interest rates impact their affordability, the desire to enter the market outweighs the financial burden for many.

- Move-up buyers:This group seeks more space, amenities, and features that align with their changing lifestyle needs. They often prioritize quality of life, neighborhood safety, and proximity to desired amenities. Move-up buyers are more sensitive to interest rate fluctuations, as they are typically financing larger mortgages.

- Investors:This segment is primarily driven by potential return on investment. They focus on properties with high rental yields, appreciation potential, and strong cash flow. Investors are often less affected by interest rate fluctuations, as they can adjust their strategies based on market conditions.

Bank of America Study Findings

The Bank of America study, titled “Homebuyer Sentiment Survey,” provides valuable insights into the evolving dynamics of the housing market. The survey, conducted in the second quarter of 2023, delves into the motivations, priorities, and behaviors of homebuyers in the face of rising interest rates and a complex economic landscape.

Key Findings

The study reveals several significant trends shaping the current housing market.

- Despite rising interest rates, homebuyer demand remains robust. The survey found that 70% of respondents are still actively looking to purchase a home, highlighting their unwavering commitment to homeownership.

- The study underscores the resilience of the housing market, demonstrating that buyers are adapting to the new realities of higher interest rates. This suggests a strong underlying demand for housing, driven by factors like demographic shifts and the desire for stability.

- The survey highlights the evolving priorities of homebuyers. While affordability remains a crucial concern, factors like location, amenities, and community are gaining prominence. Buyers are seeking homes that meet their lifestyle needs and offer long-term value.

Demographics of Buyers

The study sheds light on the demographics of active homebuyers.

It’s fascinating to see how US home buyer behavior is shifting, with many still willing to enter the market despite high interest rates, as a recent Bank of America study reveals. This resilience might be fueled by a growing sense of urgency, perhaps spurred by news like the record-breaking billion-euro fine the EU just imposed on Meta for data privacy violations.

This could make people think twice about relying on big tech companies and instead focus on securing a tangible asset like a home.

- Millennials continue to be the dominant force in the housing market, accounting for the largest share of homebuyers. Their desire for homeownership and their strong financial position contribute to their significant presence in the market.

- First-time homebuyers are facing challenges due to higher interest rates and limited inventory, but they remain determined to enter the market. Their entry into the market is crucial for sustaining housing demand and fostering market stability.

- The study also reveals a growing number of older buyers seeking to downsize or relocate to more desirable locations. Their presence adds complexity to the market, influencing demand in specific areas and contributing to the overall housing dynamics.

Purchase Motivations, Shift in us home buyer behavior increasing willingness despite high interest rates bank of america study

The study provides insights into the motivations driving homebuyer decisions.

- The desire for homeownership remains a primary motivator, with buyers seeking stability, security, and a sense of belonging. The enduring appeal of homeownership underscores its importance in the American dream.

- The need for more space is another key driver, as families grow and lifestyle needs evolve. The desire for larger homes and outdoor living spaces reflects changing priorities and the importance of comfortable living environments.

- The pursuit of a better location is gaining momentum, as buyers seek neighborhoods that offer amenities, access to services, and a strong sense of community. This trend highlights the importance of lifestyle factors in homebuying decisions.

Market Trends

The study identifies several market trends that are shaping the current housing landscape.

- The inventory shortage continues to be a significant challenge, impacting affordability and driving competition among buyers. This shortage underscores the need for increased housing construction and policy initiatives to address supply constraints.

- The shift towards remote work is influencing housing demand, with buyers seeking homes in desirable locations that offer a good quality of life and a strong sense of community. This trend is driving growth in suburban and rural areas.

- The rise of online real estate platforms is transforming the homebuying process, offering greater transparency and accessibility. These platforms empower buyers with more information and tools to navigate the complex world of real estate.

Implications for the Housing Market

The Bank of America study reveals a fascinating shift in buyer behavior, with many remaining undeterred by rising interest rates. This trend has significant implications for the future of the housing market, potentially influencing pricing, inventory levels, and overall market stability.

Impact on Pricing

The continued willingness of buyers to purchase despite higher interest rates could have a stabilizing effect on home prices. While rising rates typically lead to a decrease in demand and a slowdown in price growth, the current scenario suggests that demand remains strong, potentially preventing a significant price correction.

This is particularly relevant in areas with limited inventory, where competition for available homes remains fierce.

Impact on Inventory Levels

The study findings suggest that inventory levels may remain constrained in the near future. The sustained demand from buyers could limit the number of homes available for sale, further intensifying competition and potentially pushing prices upwards. The combination of high demand and limited supply could lead to a continuation of the seller’s market conditions experienced in recent years.

Market Stability

The persistence of buyer demand, even with elevated interest rates, indicates a level of resilience in the housing market. However, it is crucial to acknowledge that this trend does not guarantee continued stability. Factors such as economic uncertainties, job market fluctuations, and potential shifts in monetary policy could still influence market dynamics.

Potential Risks and Challenges

While the current buyer behavior suggests a strong market, it is essential to recognize potential risks and challenges:

- Overvaluation:Continued demand in the face of high interest rates could lead to an overvaluation of homes, creating a bubble that may burst if market conditions change.

- Affordability Concerns:While many buyers remain willing to purchase, affordability is a growing concern. Rising interest rates increase monthly mortgage payments, potentially stretching budgets and limiting access to homeownership for some segments of the population.

- Economic Volatility:The current economic climate is characterized by inflation and potential recessionary pressures. These factors could impact job security, consumer confidence, and ultimately, housing market stability.

Strategies for Homebuyers and Sellers: Shift In Us Home Buyer Behavior Increasing Willingness Despite High Interest Rates Bank Of America Study

The current housing market presents unique challenges for both buyers and sellers. While interest rates remain elevated, the demand for homes remains strong. Understanding the dynamics of this market is crucial for making informed decisions and achieving success.

Strategies for Homebuyers

Navigating the current market with high interest rates requires a strategic approach. Here are some key strategies for homebuyers:

- Get pre-approved for a mortgage: This step is essential for understanding your buying power and demonstrating your financial readiness to sellers. It also helps you avoid surprises during the negotiation process.

- Be flexible with your search criteria: Consider expanding your search radius or exploring properties that may not be your first choice, but still meet your essential needs. This approach can increase your chances of finding a suitable home within your budget.

- Consider a smaller down payment: If you are struggling with affordability, consider a smaller down payment. This can lower your monthly payments but may increase your overall interest costs. However, it can help you enter the market sooner.

- Offer a competitive offer: In a competitive market, you may need to offer a higher price than the asking price. Consider offering a strong offer that includes a larger down payment or a shorter closing period.

- Be prepared for bidding wars: It is not uncommon for multiple offers to be submitted on a desirable property. Be prepared to negotiate and be ready to move quickly.

- Negotiate with the seller: While the market is competitive, there is still room for negotiation. Explore options such as seller concessions or a lower price.

Strategies for Sellers

Positioning your property effectively in a competitive environment is crucial for a successful sale. Here are some strategies for sellers:

- Price your property realistically: Overpricing your home can deter potential buyers and make it harder to sell. Consult with a real estate agent to determine a fair market value based on recent comparable sales.

- Stage your home professionally: Staging can enhance the appeal of your property and make it more attractive to potential buyers. Consider hiring a professional stager to create a welcoming and inviting atmosphere.

- Make necessary repairs and upgrades: Addressing minor repairs and updating outdated features can increase the value of your home and make it more competitive.

- Offer incentives to buyers: Consider offering buyer incentives such as closing cost assistance or a home warranty to sweeten the deal.

- Be flexible with showings: Make your home available for showings at convenient times to accommodate potential buyers.

- Respond to offers promptly: Promptly respond to offers and be prepared to negotiate.

Importance of Working with Experienced Real Estate Professionals

In a complex and dynamic market, working with an experienced real estate professional can be invaluable.

- Market Expertise: Real estate agents have a deep understanding of local market conditions, trends, and pricing strategies. They can provide insights and guidance to help you make informed decisions.

- Negotiation Skills: Real estate agents are skilled negotiators who can help you secure the best possible price and terms. They can also navigate complex negotiations and protect your interests.

- Access to Resources: Real estate agents have access to a network of professionals, including lenders, appraisers, and inspectors, who can assist with the home buying or selling process.

- Marketing and Promotion: Real estate agents can effectively market your property to potential buyers through various channels, including online listings, open houses, and targeted advertising.

- Legal and Contractual Expertise: Real estate agents are familiar with the legal and contractual aspects of real estate transactions. They can help you navigate complex paperwork and ensure that your interests are protected.