Rising Oil Prices Push August Inflation Higher

Rising oil prices drive anticipated increase in august inflation figures, a trend that is likely to impact consumers and businesses alike. The rising cost of fuel has a ripple effect throughout the economy, affecting the price of goods and services across various sectors.

From transportation to manufacturing, industries heavily reliant on fuel are facing increased costs, which they may pass on to consumers in the form of higher prices.

The impact of rising oil prices on inflation is a complex issue with far-reaching consequences. As we delve into the details, we’ll explore how these price increases are expected to manifest in August’s inflation data, examining key indicators like consumer prices and producer prices.

We’ll also analyze potential factors beyond oil prices that could influence inflation, such as supply chain disruptions and global demand.

The Impact of Rising Oil Prices on Inflation

The recent surge in oil prices is a significant factor contributing to the anticipated increase in inflation figures for August. This upward trend in oil prices has a far-reaching impact on the cost of goods and services across various sectors, ultimately affecting consumer spending and economic activity.

With rising oil prices driving anticipated increases in August inflation figures, the US stock market displayed mixed results as investors grapple with economic uncertainty. While energy stocks surged, fueled by the rising price of oil, electric vehicle stocks rallied, reflecting a growing focus on sustainable transportation.

This rally in EV stocks suggests that investors are looking beyond the immediate inflationary pressures and toward a future where clean energy solutions will play a significant role. This shift in investor sentiment could signal a long-term trend toward greener investments, even as the short-term outlook for inflation remains challenging.

Impact on the Cost of Goods and Services

Rising oil prices directly impact the cost of transportation, which is a key input for many industries. This increased cost of transportation is passed on to consumers in the form of higher prices for goods and services. For instance, the transportation of raw materials, finished products, and agricultural produce becomes more expensive, leading to higher prices for consumers.

Industries Heavily Impacted by Increased Fuel Costs

Several industries are particularly vulnerable to rising oil prices due to their reliance on fuel for operations. The transportation sector, including airlines, trucking companies, and shipping lines, faces substantial increases in fuel costs, which are often reflected in ticket prices, freight charges, and delivery fees.

The anticipated rise in August inflation figures is largely driven by the surge in oil prices. While this might be concerning for consumers, the stock market seems to be taking it in stride. The US stock market opened higher today amid steady yields , indicating a sense of resilience despite the inflationary pressures.

It remains to be seen how the market will react in the long run as rising oil prices continue to impact the economy.

The agricultural sector, which relies on fuel for machinery and transportation, also experiences higher input costs, ultimately leading to higher food prices.

Potential Ripple Effect on Consumer Spending and Economic Activity

Higher oil prices can have a significant ripple effect on consumer spending and economic activity. When consumers face higher prices for essential goods and services, their discretionary income decreases, leading to reduced spending on non-essential items. This decline in consumer spending can impact businesses across various sectors, leading to slower economic growth.

Moreover, rising oil prices can also contribute to higher inflation, potentially leading to a cycle of rising prices and reduced purchasing power.

Analyzing August Inflation Data: Rising Oil Prices Drive Anticipated Increase In August Inflation Figures

The upcoming release of August inflation figures is highly anticipated, particularly given the recent surge in oil prices. This data will provide valuable insights into the broader inflationary pressures facing the economy.

Key Inflation Indicators Affected by Rising Oil Prices

Rising oil prices have a significant impact on various inflation indicators. Here’s a breakdown of some key areas expected to be affected:

- Energy Prices:This is the most direct impact of rising oil prices. The Consumer Price Index (CPI) energy component, which measures changes in the cost of gasoline, heating oil, and electricity, is likely to show a substantial increase.

- Transportation Costs:Higher oil prices directly translate to higher transportation costs, impacting both consumer and producer prices. This can be seen in increased prices for goods and services that rely on transportation, such as food, manufactured goods, and even services like delivery.

- Inflation Expectations:Rising oil prices can also fuel inflation expectations. Consumers and businesses may anticipate further price increases, leading to a self-fulfilling prophecy as they adjust their spending and pricing decisions accordingly.

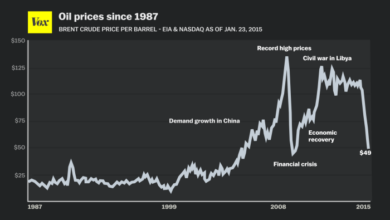

Comparison to Previous Months and Historical Trends

To assess the impact of rising oil prices on August inflation, it’s crucial to compare the figures to previous months and historical trends.

With rising oil prices driving anticipated increases in August inflation figures, it seems like the world is in a state of constant flux. And while we’re grappling with economic uncertainty, Elon Musk has been busy shaking things up in the tech world by unveiling dramatic changes to Twitter’s logo and announcing the demise of the iconic bird.

Whether these changes will lead to a brighter future for Twitter remains to be seen, but one thing is certain: the impact of rising oil prices on our wallets is a far more immediate concern than the fate of a blue bird.

- Month-Over-Month Changes:Comparing August inflation to July’s figures will highlight the immediate impact of rising oil prices. If energy prices surged significantly in August, we would expect to see a notable increase in the month-over-month inflation rate.

- Year-Over-Year Changes:Looking at the year-over-year inflation rate will provide a broader perspective on the impact of rising oil prices. Comparing August 2023 inflation to August 2022 will reveal the cumulative effect of oil price fluctuations over the past year.

- Historical Trends:Analyzing historical trends in inflation and oil prices can provide valuable context. Examining periods when oil prices experienced significant increases can offer insights into how inflation responded in the past, helping to understand the potential impact of current oil price rises.

Potential Factors Beyond Oil Prices

While rising oil prices are a significant factor, other economic forces can also influence inflation in August.

- Supply Chain Disruptions:Ongoing supply chain disruptions, particularly in sectors like semiconductors and agricultural products, can continue to contribute to price pressures.

- Strong Consumer Demand:Robust consumer spending can drive demand-pull inflation, pushing prices higher as businesses respond to increased demand.

- Labor Market Conditions:Tight labor markets, characterized by low unemployment and wage growth, can lead to higher labor costs for businesses, potentially contributing to inflation.

Government and Consumer Responses

Rising oil prices pose a significant challenge to both governments and consumers. Governments must balance economic growth with inflation control, while consumers need to adapt their spending habits to navigate the rising cost of living. This section explores potential policy measures governments can implement to mitigate the impact of rising oil prices and strategies consumers can adopt to manage rising inflation and fuel costs.

Government Policy Measures

Governments have various policy tools at their disposal to address the economic consequences of rising oil prices. These measures can be broadly categorized into direct and indirect interventions.

- Direct Interventions:

- Price Controls:Imposing price caps on gasoline and other fuel products can temporarily curb inflation but may lead to shortages and black markets.

- Subsidies:Providing direct subsidies to consumers to offset rising fuel costs can help alleviate the burden but may be expensive and distort market signals.

- Tax Relief:Reducing taxes on gasoline or providing tax credits to consumers can provide temporary relief but may not address the underlying issue of rising oil prices.

- Indirect Interventions:

- Monetary Policy:Central banks can raise interest rates to curb inflation, but this may slow economic growth.

- Fiscal Policy:Governments can increase spending on public transportation or invest in renewable energy sources to reduce dependence on oil.

- Strategic Petroleum Reserve:Releasing oil from strategic reserves can temporarily increase supply and lower prices but is a short-term solution.

Consumer Strategies, Rising oil prices drive anticipated increase in august inflation figures

Consumers can adopt various strategies to manage rising inflation and fuel costs, focusing on reducing consumption, increasing efficiency, and seeking alternative transportation options.

- Reduce Consumption:

- Consolidate Trips:Combining errands into fewer trips can reduce fuel consumption.

- Carpooling:Sharing rides with colleagues or neighbors can reduce individual fuel costs.

- Public Transportation:Utilizing public transportation whenever feasible can significantly reduce reliance on personal vehicles.

- Increase Efficiency:

- Maintain Vehicle:Regular vehicle maintenance, including tire inflation and engine tune-ups, can improve fuel efficiency.

- Driving Habits:Avoiding aggressive acceleration and braking can improve fuel economy.

- Fuel-Efficient Vehicles:Consider purchasing fuel-efficient vehicles or hybrid models to reduce long-term fuel costs.

- Alternative Transportation:

- Cycling:Biking for short distances can be a healthy and cost-effective alternative to driving.

- Walking:Walking is a free and beneficial way to get around, especially for shorter trips.

- Electric Vehicles:Exploring electric vehicles can reduce reliance on gasoline but requires considering charging infrastructure and costs.

Impact on Different Income Groups

Rising oil prices disproportionately affect lower-income households, as they spend a larger percentage of their income on transportation and essential goods.

| Income Group | Impact of Rising Oil Prices |

|---|---|

| Low-Income | Higher proportion of income spent on fuel, potentially leading to reduced access to essential goods and services. |

| Middle-Income | Moderate impact on household budgets, with increased fuel costs affecting discretionary spending. |

| High-Income | Minimal impact on household budgets, as fuel costs represent a smaller percentage of their overall spending. |

Long-Term Implications

Persistent high oil prices pose a significant challenge to global economic stability and growth. While the immediate impact is felt through increased inflation, the long-term effects could be far-reaching, influencing energy policy, the transition to renewable energy, and the overall global economic landscape.

Impact on Economic Growth and Stability

The long-term implications of high oil prices on economic growth and stability are multifaceted and interconnected.

- Reduced Consumer Spending:Higher oil prices translate to higher transportation costs, leading to reduced consumer spending power. This can stifle economic growth by dampening demand for goods and services. For instance, the 2008 oil price spike contributed to the global financial crisis by significantly impacting consumer spending.

- Increased Business Costs:Businesses rely on oil for transportation and production, so higher oil prices translate to increased operating costs. This can lead to reduced profits, lower investment, and potential job losses, ultimately impacting economic growth.

- Inflationary Pressures:Rising oil prices contribute to overall inflation, eroding purchasing power and leading to economic instability. This can create a vicious cycle, where higher inflation leads to higher interest rates, further dampening economic activity.