Record Option Expiry: Market Turbulence Looms Amid S&P 500 High

Potential market turbulence as record 5 trillion option expiry approaches amid sp 500s all time high, this is a scenario that has investors on edge. The upcoming expiration of a record-breaking volume of options contracts, coupled with the S&P 500 hitting all-time highs, has created a volatile mix.

This confluence of events raises concerns about potential market upheaval, as the massive options expiry could trigger a surge in volatility and liquidity challenges. It’s a situation that demands careful consideration, as investors navigate a landscape of unprecedented uncertainty.

The sheer size of this option expiry event is unprecedented, exceeding previous records by a significant margin. This massive volume of contracts represents a significant amount of potential buying and selling pressure, which could easily translate into heightened market volatility.

As we’ve seen in the past, large option expiry events can have a dramatic impact on market behavior, often leading to sharp price swings and increased trading activity. The potential for market turbulence is amplified by the fact that the S&P 500 is currently at an all-time high.

This suggests that the market is already stretched, and any significant event could trigger a correction. With investor sentiment riding high, a sudden shift in sentiment could lead to a sell-off, further exacerbating market volatility.

Record Option Expiry

The upcoming record-breaking option expiry event, with over $5 trillion worth of contracts set to expire, is generating significant attention in the financial markets. This event, coinciding with the S&P 500 reaching all-time highs, raises questions about its potential impact on market volatility and liquidity.

Impact on Market Volatility and Liquidity

The sheer size of this option expiry event has the potential to significantly impact market volatility and liquidity. As options contracts expire, their underlying assets are bought or sold, leading to increased trading activity. This surge in trading can create price fluctuations, particularly if a large number of contracts expire simultaneously.

With the S&P 500 hitting all-time highs, the looming record $5 trillion option expiry on Wall Street has investors on edge. This potential market turbulence is amplified by the news of Byju’s, the Indian edtech giant, proposing a staggering $12 billion repayment plan.

Byju’s shocks with 12 billion repayment proposal indian edtech giants swift debt resolution. This swift resolution of debt, while impressive, could further impact market sentiment, especially with the upcoming option expiry. It remains to be seen how these factors will play out, but one thing is certain: the next few weeks will be volatile for investors.

- Increased Trading Volume:The expiration of a massive volume of options contracts will result in a significant increase in trading volume. This surge in activity can overwhelm market makers and create temporary liquidity shortages, leading to wider bid-ask spreads and price volatility.

- Price Fluctuations:The simultaneous buying and selling of underlying assets as options expire can create significant price fluctuations. This is especially true if there is a significant imbalance between calls and puts, or if there are large concentrated positions.

- Market Volatility:The increased trading activity and price fluctuations associated with option expiry can lead to heightened market volatility. This volatility can be amplified if other market factors, such as economic data releases or geopolitical events, are present.

Historical Analysis of Large Option Expiry Events

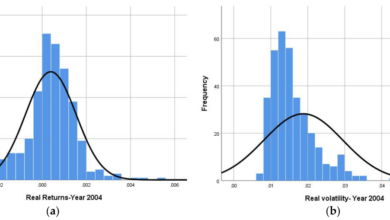

Historical analysis of large option expiry events reveals a mixed impact on market behavior. Some events have resulted in increased volatility and price fluctuations, while others have had little to no noticeable effect.

- January 2023 Option Expiry:This event, with over $4 trillion in options expiring, resulted in a relatively calm market. While there was a noticeable increase in trading volume, the impact on volatility was limited.

- September 2021 Option Expiry:This event, with over $3 trillion in options expiring, coincided with a period of market volatility. The surge in trading activity, combined with other market factors, contributed to significant price fluctuations.

“The impact of option expiry events on market behavior is highly dependent on the specific circumstances surrounding the event, including the size of the expiry, the underlying assets involved, and other market factors.”

[Source

Financial Analyst]

S&P 500 All-Time High

The S&P 500 recently hit an all-time high, a significant milestone that reflects the current state of the stock market and raises questions about its future direction. While this achievement signifies strong investor confidence and economic growth, it also prompts concerns about potential market corrections and the sustainability of this upward trend.

Current State of the S&P 500

The S&P 500’s all-time high reflects a confluence of factors driving its performance, including robust corporate earnings, accommodative monetary policy, and strong consumer spending. These factors have contributed to a favorable environment for stock market growth, pushing the index to unprecedented levels.

However, it is crucial to recognize that this bull market has been fueled by both fundamental and technical factors, making it imperative to analyze the potential for future market fluctuations.

Potential for Market Correction

The record high in the S&P 500 does not necessarily imply continued upward momentum. Historically, periods of extended market gains are often followed by corrections, reflecting a natural cycle of market adjustments. Several factors could contribute to a market correction, including rising interest rates, inflation concerns, and geopolitical uncertainties.

The current economic environment, characterized by elevated inflation and tightening monetary policy, could potentially trigger a shift in investor sentiment and lead to a market correction.

Potential for Continued Growth

Despite the potential for market corrections, several factors support the continued growth of the S&P 500. Strong corporate earnings, coupled with a healthy economic outlook, could continue to drive investor confidence and support market valuations. Moreover, ongoing technological advancements and innovation, particularly in sectors like artificial intelligence and renewable energy, present significant growth opportunities for companies listed on the S&P 500.

Historical Comparisons

Comparing current market conditions to historical periods of high valuations provides valuable insights. During the dot-com bubble of the late 1990s, the Nasdaq Composite Index experienced an unprecedented surge, fueled by the rapid growth of internet companies. However, this bubble eventually burst, leading to a significant market correction.

Similarly, the housing bubble of the mid-2000s resulted in a financial crisis and a prolonged recession. These historical events highlight the importance of considering valuations and market sentiment when evaluating potential risks and opportunities.

Market Turbulence Potential: Potential Market Turbulence As Record 5 Trillion Option Expiry Approaches Amid Sp 500s All Time High

The confluence of a record $5 trillion option expiry and the S&P 500’s all-time high creates a unique market landscape. While the current bull run might seem unstoppable, several factors could contribute to market turbulence in the coming weeks.

Geopolitical Events

Geopolitical events are a significant source of market volatility. The ongoing conflict in Ukraine, heightened tensions with China, and potential escalations in other regions could create uncertainty and risk aversion among investors.

The market’s on a knife’s edge right now. With the S&P 500 hitting all-time highs, a record $5 trillion in options set to expire, and whispers of potential market turbulence, things are getting interesting. It’s almost ironic, then, that global stock markets rallied after Powell signaled a potential adjustment to interest rates.

This could be a sign of investor confidence, or it could just be a temporary lull before the storm. Only time will tell how this record-breaking expiry will play out.

- Ukraine War:The war’s impact on global energy markets, supply chains, and inflation is a constant concern. Any escalation or prolonged conflict could further disrupt markets and trigger sell-offs.

- China-US Relations:Tensions between the two economic giants, particularly around trade, technology, and Taiwan, could lead to market instability. Any unforeseen escalation or policy change could trigger market reactions.

- Other Geopolitical Risks:Other conflicts or geopolitical developments, such as tensions in the Middle East, North Korea’s nuclear program, or political instability in emerging markets, could also contribute to market turbulence.

Economic Data Releases

Economic data releases provide insights into the health of the economy and can significantly influence market sentiment. Unexpectedly weak economic data could raise concerns about growth prospects, leading to market sell-offs.

- Inflation Data:Inflation remains a key concern for investors and central banks. Higher-than-expected inflation readings could fuel fears of aggressive interest rate hikes, impacting growth and corporate profits.

- Employment Data:Strong employment data is generally positive for the market, indicating a healthy economy. However, a decline in employment numbers could signal a slowdown, triggering market sell-offs.

- Economic Growth Reports:Reports on GDP growth, manufacturing activity, and consumer spending provide valuable insights into the economy’s direction. Negative surprises in these reports could lead to market uncertainty.

Investor Sentiment and Risk Appetite

Investor sentiment and risk appetite play a crucial role in driving market volatility. Shifts in investor psychology can quickly translate into market movements.

- Fear and Greed:Extreme fear or greed can lead to irrational market behavior. During periods of high fear, investors tend to sell assets, driving prices down. Conversely, excessive greed can fuel speculative bubbles, making markets vulnerable to crashes.

- Market Volatility:High volatility can make investors nervous, leading them to reduce their risk exposure. This can trigger sell-offs, further amplifying market fluctuations.

- Central Bank Actions:Central bank decisions on interest rates and monetary policy significantly influence investor sentiment. Unexpectedly hawkish policies could lead to market sell-offs, while dovish policies could support market rallies.

Strategies for Managing Risk

With the S&P 500 reaching all-time highs and a record-breaking option expiry approaching, it’s crucial to consider strategies for managing risk in your investment portfolio. The potential for market turbulence, especially during such significant events, makes it essential to implement measures that can help mitigate potential losses and protect your capital.

Hedging Strategies

Hedging involves using financial instruments to offset potential losses in your investment portfolio. These strategies can be particularly valuable during periods of market volatility.

- Put Options:These options give you the right, but not the obligation, to sell an asset at a predetermined price. If the market drops, put options can help limit your losses by providing a floor for your investment.

- Short Selling:This involves borrowing an asset and immediately selling it in the market, with the intention of buying it back later at a lower price.

Short selling can be profitable in a declining market, but it carries significant risk.

- Inverse ETFs:These exchange-traded funds (ETFs) move in the opposite direction of their underlying index. For example, an inverse S&P 500 ETF would rise in value when the S&P 500 falls.

While hedging strategies can help reduce risk, they also come with their own costs and limitations. Put options expire, and short selling can result in significant losses if the market moves against you.

The stock market is riding a wave of optimism, fueled by the Federal Reserve’s recent dovish stance. This positive momentum, however, could be tested as we approach a record $5 trillion options expiry, coinciding with the S&P 500’s all-time high.

This confluence of events could create volatility, particularly if traders are looking to capitalize on the current market sentiment, as outlined in this recent article stock market gains federal reserve optimism sparks positive market momentum. It’s a delicate balance, and it will be interesting to see how the market navigates this potential turbulence.

Portfolio Diversification

Diversification is a fundamental principle of risk management. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of any single investment’s performance on your overall portfolio.

- Asset Allocation:This involves determining the percentage of your portfolio allocated to different asset classes, such as stocks, bonds, real estate, and commodities.

- Sector Diversification:Investing in companies across various sectors, such as technology, healthcare, and energy, can help mitigate sector-specific risks.

- Geographic Diversification:Investing in companies or assets in different countries can help reduce exposure to economic or political risks in any single region.

Diversification does not guarantee profits, but it can help reduce the overall volatility of your portfolio and protect your capital in times of market uncertainty.

Active Trading

Active trading involves frequent buying and selling of securities in an attempt to outperform the market. While it can potentially generate higher returns, active trading also carries higher risk and requires significant time and expertise.

- Technical Analysis:This involves using historical price data and charting patterns to identify potential trading opportunities.

- Fundamental Analysis:This focuses on analyzing a company’s financial statements, industry trends, and management quality to make investment decisions.

- Market Timing:This involves trying to buy low and sell high by predicting market movements.

Active trading strategies can be complex and require careful planning and execution. It’s important to have a clear understanding of your risk tolerance and investment goals before engaging in active trading.

Adjusting Investment Strategies

Your investment strategy should be tailored to your individual risk tolerance and market outlook.

- Risk Tolerance:Consider your ability and willingness to withstand potential losses. If you have a low risk tolerance, you may prefer to invest in less volatile assets like bonds.

- Market Outlook:Your investment strategy should reflect your expectations for the market. If you anticipate a bull market, you may allocate a larger portion of your portfolio to stocks.

- Time Horizon:Your investment time horizon also plays a crucial role. If you are investing for the long term, you may be able to tolerate more risk than someone with a shorter time horizon.

Regularly review and adjust your investment strategy as needed, taking into account changes in your risk tolerance, market conditions, and financial goals.

Example:

For example, an investor with a high risk tolerance and a long-term investment horizon might choose to allocate a significant portion of their portfolio to stocks, potentially including a small allocation to high-growth technology companies. Conversely, an investor with a low risk tolerance and a short-term investment horizon might prefer to allocate a larger portion of their portfolio to bonds, seeking lower volatility and more predictable returns.

Technical Analysis

Technical analysis provides valuable insights into potential market movements by studying historical price data and trading patterns. It can help identify key support and resistance levels, assess the strength of trends, and identify potential turning points in the market.

Key Support and Resistance Levels, Potential market turbulence as record 5 trillion option expiry approaches amid sp 500s all time high

Support and resistance levels are crucial price points where the market has historically found buying or selling pressure. These levels can act as potential barriers to price movements.

- Support Levels:These are price levels where buying pressure is expected to be strong enough to prevent further price declines. The S&P 500 has several key support levels, including the 200-day moving average, the 50-day moving average, and previous lows.

- Resistance Levels:These are price levels where selling pressure is expected to be strong enough to prevent further price increases. The S&P 500 has several key resistance levels, including previous highs, psychological levels (e.g., 4,500), and trendline resistance.

Technical Indicators

Technical indicators are mathematical calculations based on price and volume data that provide insights into market sentiment and potential price movements.

- Moving Averages:Moving averages are widely used technical indicators that smooth out price fluctuations and highlight trends. The 50-day and 200-day moving averages are often used to identify short-term and long-term trends, respectively. A crossover of the 50-day moving average above the 200-day moving average can signal a bullish trend, while a crossover below can indicate a bearish trend.

- Relative Strength Index (RSI):The RSI is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. Readings above 70 are considered overbought, while readings below 30 are considered oversold.

- MACD (Moving Average Convergence Divergence):The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. A bullish signal is generated when the MACD line crosses above the signal line, while a bearish signal is generated when the MACD line crosses below the signal line.

Technical Signals and Market Sentiment

| Technical Signal | Implications for Market Sentiment |

|---|---|

| S&P 500 breaking above key resistance levels | Strong bullish signal, indicating potential for further price increases. |

| S&P 500 breaking below key support levels | Bearish signal, indicating potential for further price declines. |

| RSI above 70 | Overbought condition, suggesting potential for a price correction. |

| RSI below 30 | Oversold condition, suggesting potential for a price rebound. |

| MACD line crossing above the signal line | Bullish signal, indicating potential for an upward trend. |

| MACD line crossing below the signal line | Bearish signal, indicating potential for a downward trend. |

Market Sentiment Analysis

Gauging market sentiment is crucial for understanding the prevailing mood among investors and its potential impact on market movements. This analysis delves into the current market sentiment, compares it to historical periods of turbulence, and explores the potential influence of sentiment shifts on investor behavior and trading activity.

Current Market Sentiment

Analyzing market sentiment involves examining various indicators, including investor surveys, news reports, and social media trends. The current market sentiment can be assessed by considering the following:

- Investor Surveys:Recent investor surveys indicate a cautious optimism, with investors remaining optimistic about the long-term outlook but expressing concerns about short-term volatility. For example, the American Association of Individual Investors (AAII) Sentiment Survey shows a bull-bear spread that is slightly positive, suggesting a mild degree of optimism.

- News Reports:News reports often reflect a mixed bag of sentiment, with some highlighting economic strength and positive corporate earnings while others focus on geopolitical tensions and rising inflation. For instance, the recent surge in oil prices and the ongoing conflict in Ukraine have raised concerns about global economic growth and fueled market volatility.

- Social Media Trends:Social media platforms can provide valuable insights into market sentiment. Sentiment analysis tools can analyze the tone and content of social media posts to gauge investor sentiment. For example, an increase in negative posts about a particular stock or sector might indicate a bearish sentiment.

Comparison to Historical Periods of Market Turbulence

Comparing the current market sentiment to historical periods of turbulence can provide valuable context. For instance, the current market sentiment is reminiscent of the period leading up to the 2008 financial crisis, where investors were initially optimistic about the economy but later became increasingly concerned about the potential for a recession.

However, it is important to note that the current economic landscape is different from the pre-2008 environment, with factors such as low interest rates and robust corporate earnings offering some support to the market.

Impact of Changing Market Sentiment on Investor Behavior

Changes in market sentiment can significantly impact investor behavior and trading activity. When sentiment is positive, investors are more likely to be bullish, leading to increased buying activity and rising stock prices. Conversely, when sentiment is negative, investors tend to become more cautious, leading to increased selling activity and declining stock prices.

“Market sentiment is a powerful force that can drive asset prices higher or lower. It is essential for investors to understand the prevailing sentiment and its potential impact on their investment decisions.”