US Stock Market Surges: Debt Ceiling Deal & Marvells Rise

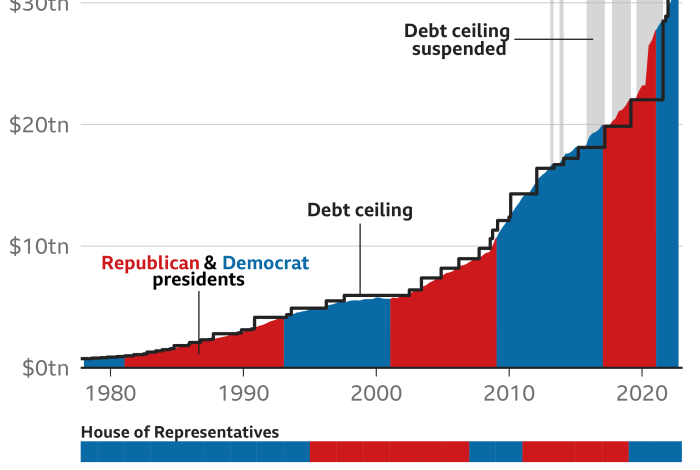

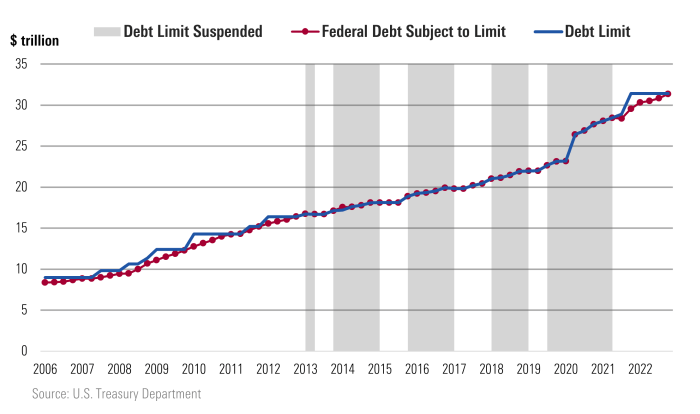

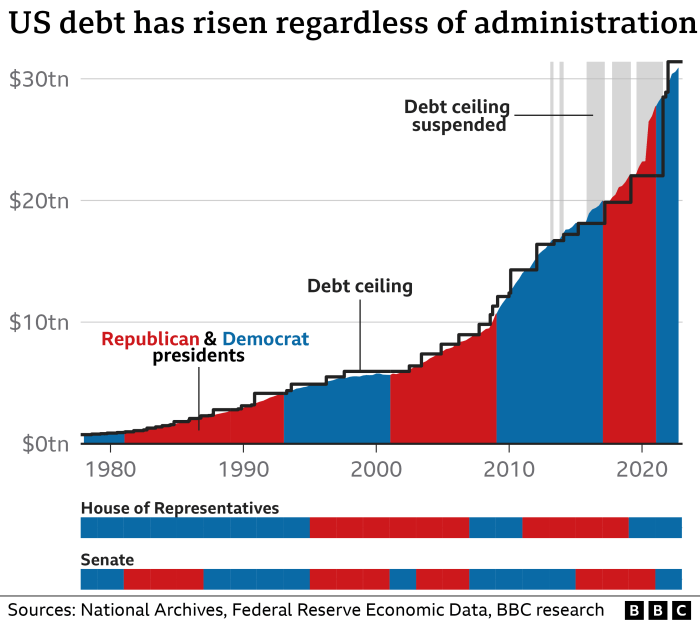

Positive US stock market momentum as debt ceiling agreement takes shape Marvell surges sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The recent agreement to raise the US debt ceiling has injected a wave of optimism into the market, with investors breathing a sigh of relief as the risk of a default was averted.

This positive sentiment has fueled a rally across various sectors, with technology giant Marvell Technology experiencing a particularly impressive surge.

The agreement has not only calmed investor nerves but also provided a much-needed boost to confidence in the US economy. This renewed confidence has translated into increased trading activity and a sense of optimism that is driving market performance.

However, the question remains: how long will this positive momentum last? Will the agreement truly pave the way for sustainable economic growth, or is this just a temporary blip in the market?

Market Response to Debt Ceiling Agreement: Positive Us Stock Market Momentum As Debt Ceiling Agreement Takes Shape Marvell Surges

The US stock market exhibited a positive response to the debt ceiling agreement, demonstrating a sense of relief and optimism among investors. The agreement, which averted a potential default on US debt obligations, provided much-needed certainty and stability for the financial markets.

The US stock market is riding high on the wave of optimism surrounding the debt ceiling agreement, with tech giants like Marvel surging. However, amidst this positive momentum, news of the passing of renowned actor Ray Stevenson at the age of 58 has cast a shadow of sadness.

Known for his roles in films like “Punisher: War Zone,” “RRR,” and the “Thor” franchise, renowned actor ray stevenson passes away at 58 known for punisher war zone rrr and thor films , Stevenson’s talent and presence will be sorely missed.

Despite this tragic loss, the stock market continues its upward trajectory, fueled by the confidence of a resolution to the debt crisis.

Investor Sentiment and Confidence

The agreement significantly boosted investor confidence, as it eliminated the immediate threat of a US default. Investors, who had been cautiously watching the negotiations, were reassured by the resolution, leading to a surge in risk appetite. This sentiment was reflected in the broad-based gains across various sectors, particularly those considered more sensitive to economic uncertainty, such as technology and consumer discretionary.

Marvell Technology’s Surge

Marvell Technology’s stock price has surged recently, capturing the attention of investors. This surge can be attributed to a confluence of factors, including strong financial performance, positive market sentiment, and promising growth prospects.

Recent Financial Performance and Market Position

Marvell’s recent financial performance has been impressive, demonstrating its strong market position and growth potential. The company has consistently exceeded analysts’ expectations, driven by robust demand for its semiconductor products. Marvell’s key product segments, including networking, storage, and connectivity, are experiencing significant growth, fueled by the increasing adoption of cloud computing, 5G, and artificial intelligence.

In the first quarter of 2023, Marvell reported revenue of $1.4 billion, exceeding analyst estimates and representing a year-over-year increase of 13%. The company also reported a strong profit margin, reflecting its efficient operations and ability to navigate the challenging semiconductor supply chain environment.

Catalysts Driving the Stock’s Upward Momentum

Several catalysts have contributed to the upward momentum of Marvell’s stock price. These include:

- Strong Demand for Semiconductors:The global semiconductor market is experiencing robust growth, driven by the increasing adoption of technology across various industries. This has created a favorable environment for semiconductor companies like Marvell, which are well-positioned to benefit from this trend.

- Growth in Cloud Computing and 5G:Marvell’s products are essential components in cloud computing and 5G infrastructure. The rapid expansion of these markets is expected to drive strong demand for Marvell’s semiconductors in the coming years.

- Strategic Acquisitions:Marvell has been actively pursuing strategic acquisitions to expand its product portfolio and market reach. These acquisitions have enabled the company to enter new markets and enhance its competitive position.

- Focus on Innovation:Marvell is a leader in semiconductor innovation, developing cutting-edge technologies that address the evolving needs of its customers. This commitment to innovation has enabled the company to maintain its technological edge and attract new customers.

Positive Momentum and Economic Outlook

The recent agreement on raising the debt ceiling has instilled a sense of relief in the markets, injecting a much-needed dose of confidence and contributing to the positive momentum observed in the US stock market. This agreement eliminates the immediate threat of a default, which would have had catastrophic consequences for the US economy and global markets.

The US stock market is buzzing with optimism as the debt ceiling agreement takes shape, with tech giants like Marvell leading the charge. It’s a reminder that even amidst global economic uncertainties, investors are always on the lookout for opportunities.

And speaking of opportunities, the world of cricket offers a fascinating parallel, as the Indian Premier League (IPL) has become a financial powerhouse, as you can read in this article on the money game of Indian cricket how IPL scores big in finances.

Just like the US stock market, the IPL has successfully leveraged its popularity to attract massive investments and create a thriving ecosystem. It’s inspiring to see how both sectors, despite their differences, are driven by a common thread: the pursuit of growth and success.

The market’s response to the agreement reflects a renewed optimism about the future direction of the US economy.

The US stock market is showing positive momentum as the debt ceiling agreement takes shape, with Marvell surging. This is a great time to learn the basics of stock market investing, and there are plenty of resources available to help you get started.

Check out tips for beginners to invest in the stock market learn the basics of stock market for some valuable insights. With the right knowledge and a bit of research, you can take advantage of the current market conditions and potentially make some solid returns.

Key Economic Indicators

The agreement has created a positive outlook for the US economy, with several key economic indicators suggesting a path toward sustained growth. The unemployment rate remains low, indicating a robust labor market. Consumer spending, a significant driver of economic growth, continues to show resilience, fueled by strong employment and wage growth.

The manufacturing sector is also exhibiting signs of recovery, indicating a potential for increased production and investment.

Impact on Future Economic Growth and Investment

The debt ceiling agreement provides a crucial foundation for long-term economic growth and stability. By averting a default, the agreement allows businesses and investors to plan for the future with greater certainty. This, in turn, is likely to lead to increased investment, job creation, and economic expansion.

The agreement also strengthens the US dollar’s position in the global market, enhancing its attractiveness for foreign investors.

Sector Performance and Market Trends

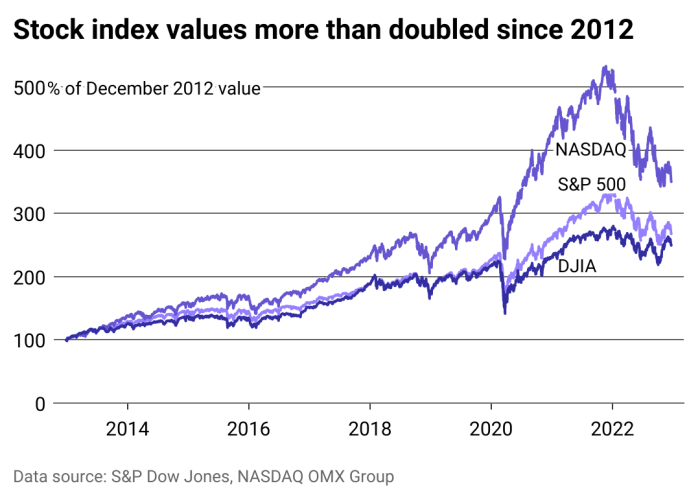

The US stock market’s recent surge, fueled by the debt ceiling agreement and positive economic indicators, has seen diverse performance across different sectors. Some industries are thriving on growth drivers, while others face headwinds. This analysis delves into the performance of various sectors, identifies key industry trends, and examines the impact on investor strategies.

Technology Sector Performance

The technology sector has been a key driver of the recent market rally. The sector has benefited from strong demand for semiconductors, artificial intelligence (AI) software, and cloud computing services.

- Semiconductors: Companies like Marvell Technology, Nvidia, and Broadcom have seen significant growth due to the global demand for chips in various industries, including smartphones, data centers, and automotive.

- AI Software: The rapid adoption of AI across industries has boosted the demand for AI software solutions. Companies like Microsoft, Google, and Amazon are investing heavily in AI research and development, driving growth in this sector.

- Cloud Computing: Cloud services providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform continue to benefit from the increasing shift towards cloud-based infrastructure and applications.

The technology sector’s strong performance is expected to continue in the coming months, driven by ongoing investments in digital transformation and technological innovation.

Investor Sentiment and Market Psychology

The recent positive momentum in the US stock market, fueled by the debt ceiling agreement and strong corporate earnings, has been accompanied by a noticeable shift in investor sentiment. Optimism is on the rise, with investors increasingly confident about the economic outlook and the potential for continued growth.

This sentiment is reflected in various market indicators and psychological factors that contribute to the positive market momentum.

Indicators of Investor Confidence and Risk Appetite, Positive us stock market momentum as debt ceiling agreement takes shape marvell surges

Investor confidence and risk appetite are key drivers of market behavior. Several indicators provide insights into these sentiment shifts.

- VIX Index:The VIX, or Volatility Index, measures market volatility and is often referred to as the “fear gauge.” A lower VIX indicates reduced investor anxiety and increased risk appetite. Recent declines in the VIX suggest that investors are becoming less concerned about potential market downturns.

- Investor Surveys:Regular surveys conducted by organizations like the American Association of Individual Investors (AAII) gauge investor sentiment. A higher percentage of bullish investors in these surveys reflects increased confidence and a willingness to take on more risk.

- Market Breadth:Market breadth refers to the number of stocks advancing versus declining. When a broad range of stocks is moving higher, it suggests a positive market sentiment and widespread confidence.