Oracle Earnings: Wall Streets Reaction

Oracle earnings wall street reaction – Oracle Earnings: Wall Street’s Reaction sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Oracle, a tech giant known for its database software and cloud services, recently released its earnings report, sparking a flurry of activity on Wall Street.

Analysts and investors dissected the numbers, scrutinizing Oracle’s financial performance and its future prospects. This blog post delves into the intricacies of Oracle’s earnings report, analyzing Wall Street’s reaction and exploring the key factors that influenced investor sentiment.

The report revealed key financial metrics, including revenue growth, profitability trends, and the impact of Oracle’s cloud computing business on its overall performance. Wall Street reacted swiftly, with analysts and investors weighing the implications of these figures on Oracle’s future.

This blog post explores the nuances of Wall Street’s reaction, examining stock price movements, analyst ratings, and price targets. It also delves into the role of Oracle’s guidance for future quarters, the impact of macroeconomic factors, and a comparison of Oracle’s performance to its competitors in the cloud computing market.

By analyzing these factors, we can gain a deeper understanding of the forces shaping investor sentiment and the long-term implications for Oracle’s growth prospects.

Wall Street’s Reaction

Oracle’s earnings report generated a mixed reaction from Wall Street analysts and investors. While the company exceeded revenue expectations, its profit margin came in slightly lower than anticipated. This sparked a debate among analysts regarding the company’s future growth prospects and its ability to navigate the current economic climate.

Oracle’s earnings report sent Wall Street into a frenzy, with investors eager to see how the tech giant is navigating the evolving landscape of cloud computing. But amidst the excitement, there’s another story brewing in the world of finance – the senates most prominent advocate for cryptocurrency known as the crypto queen has unveiled a far reaching new bill focused on bitcoin.

This new legislation could have a significant impact on the future of cryptocurrency, and its implications for Oracle’s cloud offerings remain to be seen. As the tech sector continues to evolve, it’s clear that both traditional and emerging technologies will play a crucial role in shaping the future of business.

Stock Price Movement

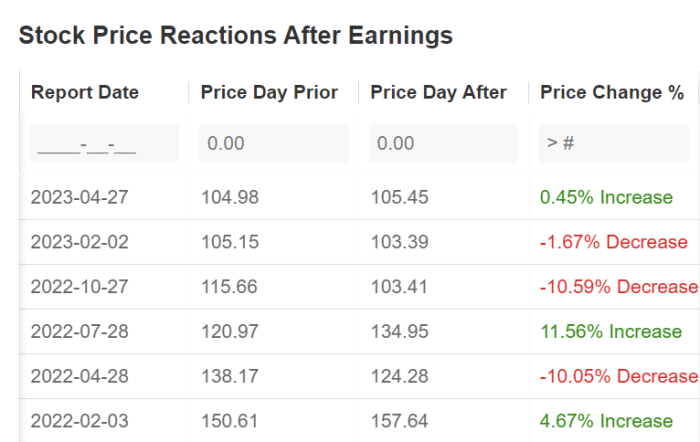

The stock price of Oracle (ORCL) experienced a mixed reaction in the days following the earnings release. On the day of the announcement, the stock initially rose by over 2% in pre-market trading. However, the stock gave up most of its gains during the regular trading session, closing the day with a slight increase of less than 1%.

Oracle’s earnings report sent Wall Street into a frenzy, with analysts dissecting every detail. While the focus was on cloud growth and margins, I couldn’t help but think about the broader economic picture, and how it relates to the future of transportation.

Is it any wonder that the debate about gas vs electric vehicles which is a better deal know the experts suggestions is heating up? Ultimately, Oracle’s performance is a reflection of the global economy, and how it’s shaping our choices, from technology to transportation.

In the subsequent trading days, the stock continued to fluctuate, but ultimately closed the week with a net gain of approximately 1%.

Analyst Ratings and Price Targets, Oracle earnings wall street reaction

The earnings report prompted some analysts to adjust their ratings and price targets for Oracle. Some analysts maintained their “buy” or “outperform” ratings, citing the company’s strong revenue growth and its position as a leader in the cloud computing market.

Oracle’s earnings report sent Wall Street into a frenzy, with analysts dissecting every detail. But while investors focused on cloud growth and margins, another story unfolded across the Atlantic. Spain just slapped Amazon and Apple with a hefty €194 million fine for anticompetitive practices , highlighting the growing scrutiny of tech giants’ market dominance.

This raises questions about how Oracle’s own cloud strategy might be viewed in the future, especially as regulators crack down on potential abuses of market power.

However, other analysts downgraded their ratings or lowered their price targets, expressing concerns about the company’s profit margin and its ability to compete effectively in the highly competitive cloud market. For example, Morgan Stanley maintained its “overweight” rating on Oracle, citing the company’s strong cloud growth and its ability to generate cash flow.

However, the firm lowered its price target to $105 from $110, reflecting concerns about the company’s profit margin. In contrast, Bank of America downgraded its rating on Oracle to “neutral” from “buy,” citing concerns about the company’s competitive position in the cloud market.

“While Oracle continues to grow its cloud business, the company is facing intense competition from other cloud providers such as Amazon Web Services and Microsoft Azure. This competition is likely to intensify in the coming years, which could put pressure on Oracle’s profit margins.”

Key Factors Influencing the Reaction

Oracle’s earnings report sparked a mixed reaction from Wall Street, with investors carefully weighing the company’s performance against a backdrop of macroeconomic uncertainty and intense competition in the cloud computing market. Several key factors influenced this reaction, shaping the overall sentiment surrounding the company’s future prospects.

Oracle’s Guidance

Oracle’s guidance for future quarters played a crucial role in shaping Wall Street’s reaction. Investors closely scrutinized the company’s projections for revenue growth, profitability, and cloud computing adoption. If Oracle’s guidance signaled strong growth and continued momentum in its cloud business, it could have boosted investor confidence and fueled a positive market response.

Conversely, any indication of slowing growth or challenges in the cloud market could have dampened investor enthusiasm and led to a more cautious reaction.

Long-Term Implications: Oracle Earnings Wall Street Reaction

Oracle’s recent earnings report and Wall Street’s reaction provide valuable insights into the company’s long-term trajectory. The performance, coupled with strategic initiatives, paints a picture of Oracle’s future in the dynamic cloud computing landscape.

Oracle’s Long-Term Growth Prospects

The impact of Oracle’s earnings on its long-term growth prospects hinges on several key factors. A strong performance, reflected in revenue growth and profitability, can bolster investor confidence, leading to increased valuations and potentially attracting new investments. Conversely, a disappointing performance could dampen investor sentiment, impacting stock prices and future growth potential.

The market’s reaction, as observed in stock price fluctuations and analyst ratings, provides valuable clues about investor confidence and future expectations.

Oracle’s Strategic Initiatives in the Cloud Market

Oracle is actively pursuing several strategic initiatives to maintain its competitive position in the cloud market. These initiatives are aimed at enhancing its cloud offerings, expanding its customer base, and driving innovation.

- Cloud Infrastructure Expansion:Oracle is investing heavily in expanding its cloud infrastructure, including data centers and network capacity, to meet the growing demand for cloud services. This expansion ensures scalability and reliability, attracting businesses seeking robust cloud solutions.

- Product Innovation:Oracle is continuously innovating its cloud products, introducing new features and functionalities to enhance its competitiveness. These innovations cater to evolving customer needs and address emerging trends in cloud computing.

- Strategic Partnerships:Oracle is forging strategic partnerships with other technology companies to broaden its reach and offer comprehensive cloud solutions. These partnerships leverage complementary strengths and provide customers with integrated solutions.

- Customer Acquisition and Retention:Oracle is focused on acquiring new customers and retaining existing ones through targeted marketing campaigns, competitive pricing, and exceptional customer support. This strategy ensures sustainable growth and revenue generation.

Emerging Trends and Challenges

Oracle’s future performance will be influenced by emerging trends and challenges in the cloud computing market.

- Increased Competition:The cloud market is highly competitive, with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) vying for market share. Oracle needs to continuously innovate and differentiate its offerings to stay ahead of the competition.

- Data Security and Privacy:Data security and privacy are paramount concerns for businesses adopting cloud solutions. Oracle must invest in robust security measures and comply with evolving regulations to maintain customer trust.

- Hybrid Cloud Adoption:Businesses are increasingly adopting hybrid cloud models, combining on-premises infrastructure with public cloud services. Oracle needs to provide seamless integration between its cloud offerings and on-premises systems to cater to this trend.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML are transforming cloud computing, enabling intelligent automation and data-driven insights. Oracle must incorporate these technologies into its cloud offerings to remain competitive.