Oil Prices Hit Five-Month Low: US Exports and OPEC Doubts

Oil prices hit five month low due to high us exports and opec doubts – Oil prices hit five-month low due to high US exports and OPEC doubts, a trend that has sent ripples through global markets. This decline, driven by a confluence of factors, highlights the evolving dynamics of the oil industry and raises questions about future price stability.

The recent drop in oil prices is a significant event, with implications for consumers, industries, and the global economy.

The US has become a major player in the global oil market, with its exports reaching record highs. This surge in US oil exports, fueled by increased domestic production and a relaxed export policy, has contributed to the price decline.

Meanwhile, OPEC, the oil cartel that historically has wielded significant influence over prices, has been facing challenges in maintaining its grip. Doubts about OPEC’s ability to control production and influence prices have further contributed to the current downward trend.

Oil Price Decline: Oil Prices Hit Five Month Low Due To High Us Exports And Opec Doubts

The recent dip in oil prices, reaching a five-month low, is a significant event in the global energy market. This decline is a result of various factors, including increased US oil exports and growing doubts about the effectiveness of OPEC+ production cuts.

Historical Context and Comparison

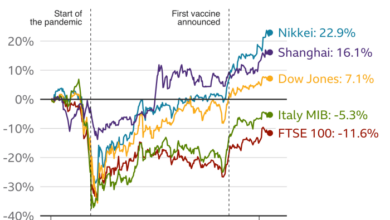

Oil prices have always been volatile, fluctuating due to geopolitical events, economic conditions, and supply and demand dynamics. For example, the 2008 financial crisis led to a sharp decline in oil prices, while the Arab Spring in 2011 caused a surge.

This recent decline, while notable, is not unprecedented. It’s important to compare it to past price movements to understand its significance.

Current Oil Price and Impact

The current oil price is [insert current oil price] per barrel, reflecting a [percentage] decline from its recent peak. This decline has a significant impact on global markets.

- Consumersbenefit from lower fuel prices, which can boost spending power and stimulate economic activity.

- Oil-producing nations, particularly those heavily reliant on oil exports, may face reduced revenue and economic challenges.

- Oil companiesmight experience lower profits, potentially impacting investment in exploration and production.

US Exports and Their Influence

The surge in US oil exports has been a significant factor in the recent decline in oil prices. As the US has become a major oil producer, it has also emerged as a major exporter, influencing global supply and demand dynamics.The increase in US exports has put downward pressure on oil prices, as it has added to the global supply of crude oil.

This has also altered the balance of power in the global oil market, as the US is now a key player in determining prices.

Oil prices have taken a tumble, hitting a five-month low due to a combination of high US exports and doubts about OPEC’s ability to manage supply. This downward pressure on oil prices is further amplified by the global demand slowdown, as evidenced by the sharp 145% drop in Chinese exports during July.

With global economic headwinds growing, it remains to be seen whether oil prices will continue their downward trajectory or find a footing in the coming months.

Key Export Destinations and Demand, Oil prices hit five month low due to high us exports and opec doubts

The US exports oil to a wide range of countries, with major destinations including:

- China:China is the largest importer of US oil, driven by its robust economic growth and increasing energy demand.

- India:India is another major importer of US oil, as its economy continues to grow and its energy needs expand.

- Canada:Canada is a significant importer of US oil, with a strong trading relationship between the two countries.

- South Korea:South Korea is a major importer of US oil, fueled by its industrial growth and energy consumption.

- Netherlands:The Netherlands is a major hub for oil trading and refining, and it imports a significant amount of US oil.

The demand for US oil in these countries is driven by factors such as economic growth, industrial activity, and energy security concerns. The US has become a reliable source of oil for many countries, and its exports have helped to diversify their energy sources.

Impact of US Export Policies

US export policies have a significant impact on global oil markets. The US has implemented various policies to encourage oil exports, including:

- Lifting of the Export Ban:In 2015, the US lifted its longstanding ban on oil exports, opening up the market for international trade.

- Increased Production:The US has seen a dramatic increase in oil production in recent years, thanks to technological advancements in shale oil extraction. This has led to a surplus of oil, which has been exported to meet global demand.

- Trade Agreements:The US has negotiated trade agreements with various countries, including Canada and Mexico, that facilitate the flow of oil exports.

These policies have contributed to the growth of US oil exports, influencing global oil prices and supply dynamics. The US has become a more prominent player in the global oil market, and its export policies have had a significant impact on the industry.

OPEC’s Role and Uncertainty

The recent decline in oil prices has been attributed to various factors, including increased US oil exports and doubts surrounding OPEC’s ability to effectively influence the market. While OPEC’s decisions on production levels can significantly impact global oil supply, the organization’s influence has been waning in recent years.

This section delves into the uncertainties surrounding OPEC’s role and its impact on oil prices.

OPEC’s Recent Production Decisions and Their Impact

OPEC’s recent production decisions have been met with mixed reactions from the market. The organization’s attempts to manage supply and stabilize prices have been hindered by various factors, including the emergence of new oil producers, technological advancements in shale oil extraction, and geopolitical tensions.

Oil prices have dipped to a five-month low, driven by increased US exports and doubts about OPEC’s ability to control supply. This downward pressure on energy costs comes at a time when the US economy is grappling with rising interest rates.

Mortgage rates, for example, have climbed for the sixth consecutive week, reaching a new high of 7.63 percent, as reported by The Venom Blog. This trend of rising interest rates could further dampen demand for oil, adding to the downward pressure on prices.

For example, in 2022, OPEC+ agreed to reduce oil production by 2 million barrels per day, a move intended to support prices. However, this decision was met with criticism from Western countries, who accused OPEC of exacerbating the energy crisis following the Russian invasion of Ukraine.

While the production cuts initially led to a short-term increase in prices, they ultimately failed to achieve long-term stability.

Doubts Surrounding OPEC’s Influence on Oil Prices

Several factors have contributed to the growing doubts surrounding OPEC’s ability to effectively control oil prices.

- Increased US Oil Production:The US has become a major oil producer in recent years, thanks to technological advancements in shale oil extraction. This increased production has reduced US reliance on imports and given the country more leverage in the global oil market.

Oil prices have dropped to a five-month low, driven by increased US exports and doubts about OPEC’s ability to manage supply. This, coupled with the wall street anticipates soft start as rate uncertainties persist , is creating a volatile market environment.

It’s a reminder that the energy sector is heavily influenced by global economic trends and geopolitical events, making it a challenging space to navigate for investors.

- Emergence of New Oil Producers:The rise of new oil producers, such as Brazil and Guyana, has further diversified global oil supply, reducing OPEC’s market share and influence.

- Geopolitical Tensions:Geopolitical tensions, such as the ongoing conflict in Ukraine, have created uncertainty in the oil market, making it difficult for OPEC to predict future demand and adjust production accordingly.

- Shifting Energy Landscape:The transition to renewable energy sources is gradually reducing the global demand for oil, further diminishing OPEC’s influence on the market.

Comparison of OPEC’s Current Strategy to Past Production Decisions

OPEC’s current strategy of managing production levels to stabilize prices has been met with skepticism, particularly in light of the organization’s past production decisions.

“OPEC’s current strategy of managing production levels to stabilize prices has been met with skepticism, particularly in light of the organization’s past production decisions.”

- Past Production Cuts:In the past, OPEC has implemented production cuts to support prices, but these efforts have often been unsuccessful in the long term. The organization’s attempts to control supply have often been undermined by the actions of individual member states, who have sometimes deviated from agreed-upon production quotas.

- Impact of External Factors:OPEC’s influence on oil prices has been further diminished by external factors, such as economic recessions and geopolitical events, which can significantly impact global demand.

- Lack of Transparency:Critics have argued that OPEC’s lack of transparency regarding its production decisions and internal disagreements has eroded market confidence in the organization’s ability to effectively manage supply.

Market Dynamics and Future Outlook

The recent decline in oil prices is a result of the complex interplay of supply and demand forces in the global oil market. While increased US exports have contributed to the downward pressure, uncertainties surrounding OPEC’s production decisions and the potential impact of global economic conditions are also playing significant roles.

Key Factors Influencing Oil Prices

The current oil price landscape is influenced by a number of key factors, including:

- Global Economic Growth:Economic growth, particularly in major oil-consuming regions like China and the United States, directly impacts demand for oil. Slower economic growth can lead to reduced oil consumption and lower prices.

- OPEC Production Decisions:OPEC’s production quotas and decisions have a significant impact on global oil supply. Any changes in OPEC’s production strategy, whether increasing or decreasing output, can significantly influence oil prices.

- US Shale Oil Production:The United States has become a major oil producer, with its shale oil production contributing significantly to global supply. The pace of US shale oil production can influence oil prices, with increased production potentially putting downward pressure on prices.

- Geopolitical Risks:Geopolitical events, such as conflicts in oil-producing regions or sanctions on oil-exporting countries, can disrupt supply chains and impact oil prices.

- Technological Advancements:Advancements in energy efficiency and the development of alternative energy sources, such as renewable energy, can impact oil demand in the long term.

Potential Scenarios for Oil Prices

Given the complexity of factors influencing oil prices, it is difficult to predict with certainty how prices will move in the short and long term. However, based on current trends and potential scenarios, we can consider the following possibilities:

| Scenario | Short Term (Next 6 Months) | Long Term (Next 2-3 Years) |

|---|---|---|

| Scenario 1: Continued Economic Growth and Stable OPEC Production | Oil prices are expected to remain relatively stable, with potential for moderate increases due to increased demand. | Oil prices are likely to remain within a range, with potential for gradual upward movement as demand continues to grow. |

| Scenario 2: Slowing Economic Growth and Reduced OPEC Production | Oil prices could experience a downward correction, with potential for a significant decline due to lower demand and reduced supply. | Oil prices may remain depressed, with potential for a prolonged period of volatility as economic conditions and OPEC production levels fluctuate. |

| Scenario 3: Increased US Shale Oil Production and Technological Advancements | Oil prices could experience downward pressure, with potential for a decline due to increased supply from US shale production. | Oil prices are likely to experience a long-term downward trend as technological advancements and increased renewable energy sources reduce demand for oil. |

“The oil market is a complex system influenced by a multitude of factors. While current trends suggest a potential for lower oil prices, it is crucial to consider the various scenarios and potential shifts in market dynamics that could impact future price movements.”

Impact on Consumers and Industries

The decline in oil prices, driven by increased US exports and uncertainty surrounding OPEC production, has significant implications for consumers and various industries. Lower oil prices translate to reduced fuel costs for individuals and businesses, impacting their spending power and operational costs.

Impact on Consumers

Lower oil prices directly benefit consumers by reducing fuel costs, freeing up disposable income. This translates to more spending on other goods and services, boosting the economy. For example, lower gasoline prices could allow families to allocate more funds towards groceries, entertainment, or savings.

Impact on Industries

The transportation sector, heavily reliant on oil, stands to gain from lower prices. Airlines, trucking companies, and shipping firms experience reduced operational costs, potentially leading to lower fares and freight rates. This can benefit consumers through cheaper travel and goods.

Impact on Manufacturing

The manufacturing sector, reliant on oil-based products like plastics and chemicals, also benefits from lower oil prices. Reduced input costs can lead to lower production costs, potentially translating to lower prices for consumers.