Money Market vs. High-Yield Savings: Choosing the Best Account

Money market account versus high yield savings account selecting the ideal account for your needs sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

When it comes to managing your hard-earned cash, choosing the right savings account can make a big difference. Two popular options often top the list: money market accounts (MMAs) and high-yield savings accounts (HYSA). While both offer a safe place to park your funds, they differ in their features, interest rates, and potential benefits.

This guide will delve into the nuances of each account type, helping you make an informed decision about which best suits your financial goals.

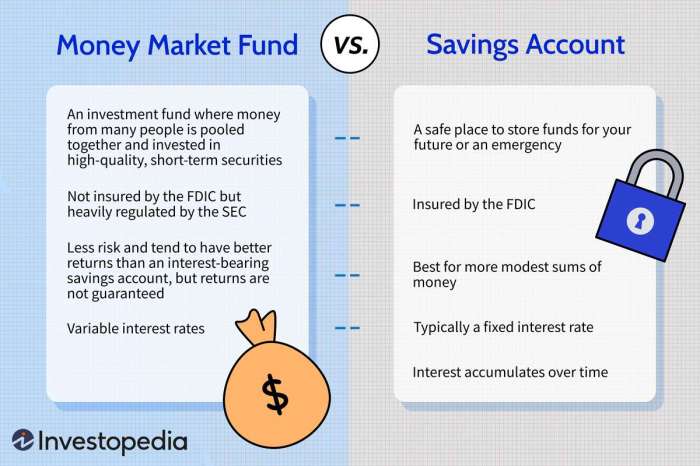

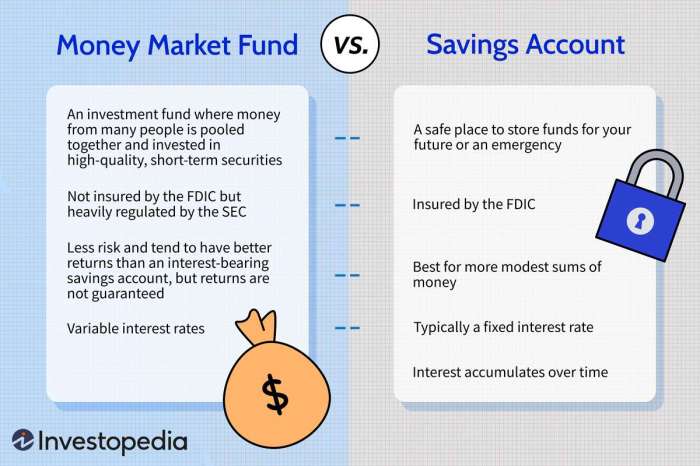

Understanding the distinctions between MMAs and HYSAs is crucial for maximizing your savings potential. MMAs often provide slightly higher interest rates but may come with minimum balance requirements and limited check-writing privileges. HYSAs, on the other hand, typically have lower minimum balances and offer convenient access to your funds.

By examining the pros and cons of each, you can determine which account aligns better with your individual needs and financial aspirations.

Choosing the Right Account: Money Market vs. High-Yield Savings: Money Market Account Versus High Yield Savings Account Selecting The Ideal Account For Your Needs

Navigating the world of personal finance can be overwhelming, especially when it comes to choosing the right account for your savings. Two popular options are money market accounts (MMAs) and high-yield savings accounts (HYSA). While both offer safe ways to store your money and earn interest, understanding their key differences is crucial for making an informed decision.

This article will explore the characteristics, advantages, and disadvantages of MMAs and HYSAs, providing you with the information needed to determine which account best suits your financial goals and needs.

Key Factors to Consider

When choosing between a money market account and a high-yield savings account, several factors play a crucial role in your decision. These factors will help you assess which account aligns better with your financial objectives and risk tolerance.

- Interest Rates:HYSAs typically offer higher interest rates compared to MMAs. This is because HYSAs are designed for long-term savings, while MMAs are more flexible and provide access to funds for short-term needs.

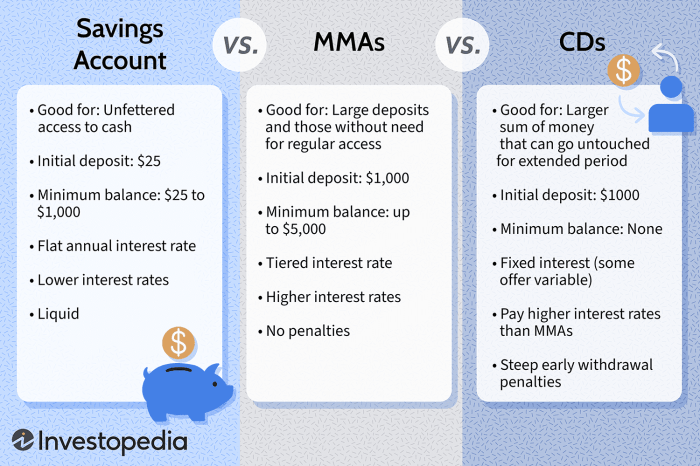

- Minimum Balance Requirements:MMAs often have higher minimum balance requirements than HYSAs. This can be a barrier for individuals with limited funds, but it can also provide incentives for larger deposits. HYSAs usually have lower or no minimum balance requirements, making them more accessible to a wider range of savers.

- Fees:MMAs may have more fees associated with them, such as monthly maintenance fees or fees for transactions. HYSAs generally have fewer fees, making them a more cost-effective option for many savers.

- Transaction Limits:MMAs usually allow for more transactions than HYSAs. This is because MMAs are designed for short-term needs, while HYSAs are intended for long-term savings. However, excessive transactions can lead to fees in both account types.

- Liquidity:Both MMAs and HYSAs are considered liquid, meaning you can access your funds quickly. However, MMAs typically offer more flexibility in terms of withdrawals and transactions.

Money Market Accounts

Money market accounts (MMAs) are a type of savings account that typically offer higher interest rates than traditional savings accounts. They are FDIC-insured, which means your deposits are protected up to $250,000 per depositor, per insured bank, in case of bank failure.

MMAs are popular for those who want to earn a slightly higher return on their savings while still having easy access to their funds.MMAs offer a variety of features that make them attractive to savers. They often come with check-writing privileges, allowing you to write checks directly from your account.

Some MMAs also offer debit cards, allowing you to withdraw funds from ATMs.

Interest Rates Offered by Money Market Accounts

Interest rates on money market accounts can vary depending on the financial institution and the current market conditions. However, they generally offer higher rates than traditional savings accounts. The interest rates are typically variable, meaning they can fluctuate based on the prevailing market rates.Here are some examples of typical interest rates offered by money market accounts as of January 2023:

- Online banks: 4.00% – 4.50% APY

- Traditional banks: 0.50% – 1.50% APY

Potential Risks Associated with Money Market Accounts

While MMAs offer higher interest rates than traditional savings accounts, they also carry some potential risks:

- Interest rate risk: The interest rate on your MMA can fluctuate, potentially decreasing the return on your investment. If interest rates rise, you may earn a lower return than you would have if you had invested in a fixed-rate account.

- Liquidity risk: While MMAs generally offer check-writing privileges, there may be limitations on how much you can withdraw or the number of checks you can write each month. If you need to access your funds quickly, you may face penalties or delays.

- Investment risk: Some MMAs invest in securities that are not FDIC-insured. If these securities lose value, your investment could be at risk. It’s crucial to understand the specific investment strategy of your MMA before investing.

High-Yield Savings Accounts

High-yield savings accounts (HYSA) are a popular option for individuals looking to earn a higher interest rate on their savings compared to traditional savings accounts. They offer a competitive interest rate, FDIC insurance, and easy access to your funds.

Interest Rates Offered by High-Yield Savings Accounts

High-yield savings accounts typically offer higher interest rates than traditional savings accounts because they are offered by online banks or credit unions that have lower overhead costs. The interest rates offered by HYSA can vary depending on the institution and current market conditions.

Deciding between a money market account and a high-yield savings account depends on your financial goals and risk tolerance. If you’re seeking a secure, accessible place to park your emergency fund, a high-yield savings account might be the right choice.

However, if you’re willing to take on a bit more risk for the potential of higher returns, you might consider exploring alternative investments like cryptocurrency, as outlined in this cryptocurrency investment strategies profitable guide for maximum returns. Ultimately, the best account for you will depend on your individual needs and financial situation.

However, they generally provide a significantly higher return on your savings compared to traditional savings accounts. As of November 2023, some of the highest APYs offered by high-yield savings accounts are around 4.5%.

Potential Risks Associated with High-Yield Savings Accounts

While high-yield savings accounts offer a competitive interest rate, there are some potential risks to consider:

- Interest Rate Fluctuations:Interest rates on HYSA can fluctuate based on market conditions. While interest rates are typically higher than traditional savings accounts, they may not always be the highest available option. It’s essential to monitor interest rates and consider switching to a different account if you find a better rate.

Deciding between a money market account and a high-yield savings account can be a tough call, especially when you consider the potential for higher returns. While the stability of a money market account is appealing, the higher interest rates offered by high-yield savings accounts can be tempting.

For those seeking a more dynamic investment approach, you might consider exploring the world of soft commodities trading, as outlined in this article on soft commodities trading know the opportunities in coffee cocoa cotton and sugar. Ultimately, the best account for you will depend on your individual financial goals and risk tolerance.

- Limited Access to Funds:Some high-yield savings accounts may have restrictions on the number of withdrawals you can make per month. This can be a drawback if you need to access your funds frequently. Ensure you understand the withdrawal limits before opening an account.

- Potential for Fraud:As with any financial account, there is a risk of fraud associated with high-yield savings accounts. It’s important to choose a reputable financial institution and take steps to protect your account information.

Comparing Money Market Accounts and High-Yield Savings Accounts

Choosing between a money market account (MMA) and a high-yield savings account (HYSA) can be a challenging decision, especially for those seeking a secure place to park their savings. Both account types offer FDIC insurance and the potential for earning interest on your funds.

However, they differ in key features, including interest rates, accessibility, and fees.

Choosing between a money market account and a high-yield savings account depends on your financial goals and risk tolerance. Just like understanding the factors that influence the price of cryptocurrencies, like supply and demand, adoption, and technological advancements, decoding crypto prices understanding how cryptocurrencies are valued , understanding the nuances of traditional banking products is crucial.

A money market account might offer higher interest rates but comes with more restrictions, while a high-yield savings account offers flexibility and FDIC insurance, making it ideal for long-term savings.

Key Features Comparison

To help you make an informed decision, let’s compare the key features of MMAs and HYSAs:

| Account Type | Interest Rate | Minimum Balance | FDIC Insurance | Access Limitations | Fees |

|---|---|---|---|---|---|

| Money Market Account (MMA) | Typically higher than HYSAs | Often higher than HYSAs | Up to $250,000 per depositor, per insured bank | May have a limited number of free withdrawals per month | May charge fees for exceeding withdrawal limits or for certain transactions |

| High-Yield Savings Account (HYSA) | Generally lower than MMAs | Usually lower than MMAs | Up to $250,000 per depositor, per insured bank | Typically no limitations on withdrawals | May charge fees for inactivity or exceeding withdrawal limits |

Interest Rate Comparison

MMAs generally offer higher interest rates than HYSAs, although this is not always the case. The difference in interest rates is usually small, but it can be significant over time, especially for larger balances.

Liquidity and Accessibility of Funds

HYSAs typically offer greater liquidity and accessibility than MMAs. You can generally withdraw funds from a HYSA without any limitations or fees. MMAs, on the other hand, may have restrictions on the number of withdrawals you can make each month.

Fees

Both MMAs and HYSAs can have fees associated with them. MMAs may charge fees for exceeding withdrawal limits or for certain transactions. HYSAs may charge fees for inactivity or exceeding withdrawal limits.

Selecting the Ideal Account for Your Needs

Choosing between a money market account (MMA) and a high-yield savings account (HYSA) depends on your individual financial goals and risk tolerance. Both offer FDIC insurance and are excellent for building your emergency fund or saving for short-term goals, but their features and benefits can differ significantly.

Factors Influencing Account Selection

Understanding the factors that influence the choice between a MMA and a HYSA can help you make an informed decision.

- Interest Rates:MMAs often offer higher interest rates than HYSAs, but this can vary. However, MMAs may have higher minimum balance requirements, which can make them less appealing for smaller balances.

- Fees:Both MMAs and HYSAs may have fees associated with them. MMAs may have higher fees for transactions or maintenance, while HYSAs may have a monthly fee if your balance falls below a certain threshold.

- Liquidity:Both MMAs and HYSAs are highly liquid, meaning you can access your funds quickly. However, MMAs may have restrictions on the number of withdrawals you can make per month.

- Check-Writing Privileges:MMAs often offer check-writing privileges, which can be convenient for paying bills or making large purchases. HYSAs typically do not offer this feature.

Financial Goals and Risk Tolerance

Your financial goals and risk tolerance are key factors in deciding which account is right for you.

- Short-Term Savings Goals:If you are saving for a short-term goal, such as a down payment on a car or a vacation, a HYSA might be a better option. You can easily access your funds when needed, and the higher interest rate will help your savings grow faster.

- Emergency Fund:Both MMAs and HYSAs are suitable for building an emergency fund. However, MMAs might be more advantageous if you prefer the added convenience of check-writing privileges.

- Risk Tolerance:If you are risk-averse, a HYSA might be the better choice. They offer a lower risk profile compared to MMAs, which can be more volatile due to their investment component.

Determining the Best Account

To determine the best account for your specific needs, consider the following:

- Balance Requirements:MMAs often have higher minimum balance requirements than HYSAs. Ensure you can meet the requirements to avoid fees or penalties.

- Interest Rates:Compare the interest rates offered by different MMAs and HYSAs to find the highest return on your savings.

- Fees:Review the fee structure of each account to understand the potential costs associated with each option.

- Features:Consider the features that are most important to you, such as check-writing privileges or online banking access.

- Customer Service:Choose an account from a financial institution with excellent customer service and a reputation for reliability.

Additional Considerations

While choosing between a money market account and a high-yield savings account is a crucial first step, there are additional factors to consider to ensure your savings strategy aligns with your financial goals and the current economic landscape.

Impact of Inflation on Savings

Inflation, the steady rise in the price of goods and services, can significantly erode the purchasing power of your savings. When inflation outpaces the interest earned on your savings account, your money is effectively losing value over time. This means that the same amount of money will buy less in the future than it does today.

For example, if your savings account earns 1% interest annually, but inflation is 3%, your savings are losing 2% of their purchasing power each year.

To mitigate the impact of inflation, consider investing in assets that have the potential to outpace inflation, such as stocks or real estate. However, these investments carry higher risks, and it’s essential to consult with a financial advisor to determine the appropriate strategy for your situation.

Maximizing Interest Earnings

While both money market and high-yield savings accounts offer relatively low interest rates, there are strategies to maximize your earnings:

- Choose the highest-yielding account:Regularly compare interest rates offered by different financial institutions and switch accounts when necessary to secure the best return.

- Maintain a high balance:Some banks offer tiered interest rates, where higher balances earn a higher interest rate. Aim to keep your balance above the threshold for the highest tier.

- Consider a certificate of deposit (CD):CDs offer fixed interest rates for a specific term, typically ranging from a few months to several years. While you cannot access your funds during the term, CDs often offer higher interest rates than savings accounts.

Diversifying Your Savings, Money market account versus high yield savings account selecting the ideal account for your needs

Placing all your savings in a single account, even a high-yield savings account, can expose you to significant risk. Diversifying your savings across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk and potentially enhance returns.

- Stocks:Represent ownership in publicly traded companies and offer the potential for high returns, but also carry higher risk.

- Bonds:Debt securities issued by governments or corporations, offering lower risk and returns compared to stocks.

- Real estate:Can provide rental income and potential appreciation, but also involves significant upfront investment and ongoing expenses.

Remember, diversification is a long-term strategy and should be tailored to your individual risk tolerance and financial goals. Consulting with a financial advisor can help you develop a diversified savings strategy that aligns with your needs.