US Stock Futures On Edge: Economic Events & Fed Meeting

Market watch us stock futures on edge ahead of crucial economic events and federal reserve meeting – US Stock Futures On Edge: Economic Events & Fed Meeting – The market is holding its breath as investors brace for a flurry of crucial economic events and the highly anticipated Federal Reserve meeting. This week’s economic calendar is packed with data releases that could significantly impact market sentiment, including inflation figures, retail sales, and manufacturing data.

The Federal Reserve’s decision on interest rates and its outlook on the economy will also be closely watched, with the potential to trigger significant market movements.

The upcoming economic events and the Fed’s monetary policy decisions will be critical factors influencing the direction of the market. Traders and investors are closely analyzing the potential implications of these events, seeking to anticipate how they might impact the stock market and individual sectors.

This period of heightened uncertainty is creating a volatile market environment, making it crucial for investors to carefully assess their positions and strategies.

Market Volatility and Economic Events

US stock futures are currently trading with a noticeable degree of uncertainty, reflecting the upcoming release of crucial economic data and the Federal Reserve’s monetary policy decision. The market is poised for potential volatility as investors grapple with the implications of these events on the broader economic outlook.

The market’s on edge, watching US stock futures closely ahead of the crucial economic events and the Federal Reserve meeting. While we wait for the Fed’s decision, it’s worth remembering that opportunities exist beyond the traditional stock market. Consider exploring the world of soft commodities trading, like coffee, cocoa, cotton, and sugar, as detailed in this informative article: soft commodities trading know the opportunities in coffee cocoa cotton and sugar.

These markets offer unique investment opportunities, often driven by factors distinct from the broader stock market. As we navigate the current economic landscape, diversifying our investment strategies is crucial, and soft commodities may offer a compelling alternative.

Economic Events and Their Potential Impact

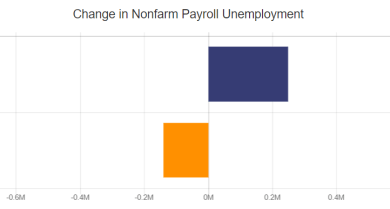

The upcoming economic events are expected to provide insights into the health of the US economy and the Federal Reserve’s future course of action. These events include the release of inflation data, employment figures, and retail sales reports. The potential impact of these events on the market can be significant.

For instance, a higher-than-expected inflation reading could lead to concerns about the Federal Reserve’s commitment to fighting inflation, potentially triggering a sell-off in stocks. Conversely, positive economic data, such as a strong employment report, could bolster investor confidence and drive stock prices higher.

Historical Relationship Between Economic Events and Market Performance

Historically, there has been a clear correlation between economic events and market performance. For example, periods of high inflation have often been associated with stock market declines, while periods of economic growth have typically coincided with stock market rallies.However, the relationship between economic events and market performance is not always straightforward.

Other factors, such as geopolitical events, investor sentiment, and monetary policy, can also influence market movements.

Wall Street is holding its breath this week as investors anxiously await the Federal Reserve’s decision on interest rates, a move that could significantly impact the trajectory of the stock market. Meanwhile, Bank of America is making aggressive moves to expand its reach across four US states, aiming to close the gap with its rival, JP Morgan, as reported by The Venom Blog.

This strategic expansion could influence the financial landscape, adding another layer of complexity to the already volatile market climate.

Comparing Current Market Sentiment with Historical Responses

Current market sentiment is cautious, with investors weighing the potential impact of upcoming economic events against the backdrop of ongoing geopolitical uncertainty and rising interest rates. This sentiment is somewhat similar to the market response to previous periods of economic uncertainty, such as the 2008 financial crisis and the COVID-19 pandemic.However, there are also some key differences.

For example, the current economic environment is characterized by higher inflation and tighter monetary policy than in previous periods of uncertainty. This suggests that the market’s response to upcoming economic events could be more volatile than in the past.

Federal Reserve Meeting and Monetary Policy

The Federal Reserve’s upcoming meeting is a crucial event for investors, as the central bank is expected to make decisions that will impact the direction of the US economy and stock market. The Fed’s monetary policy, which includes setting interest rates and managing the money supply, plays a significant role in influencing inflation, economic growth, and the overall health of the financial system.

Interest Rate Decisions and Monetary Policy

The Federal Open Market Committee (FOMC), the policymaking body of the Federal Reserve, is expected to announce its decision on interest rates at the upcoming meeting. Market participants are closely watching to see whether the Fed will continue its recent trend of raising rates to combat inflation or pause to assess the impact of previous hikes.

The Fed’s decision will be influenced by various economic indicators, including inflation data, employment figures, and consumer spending.

Implications for the US Stock Market

The Federal Reserve’s actions have a significant impact on the US stock market. When the Fed raises interest rates, it becomes more expensive for companies to borrow money, which can slow down economic growth and potentially lead to a decline in stock prices.

Conversely, when the Fed lowers interest rates, it becomes cheaper for companies to borrow, which can stimulate economic activity and boost stock prices. Investors carefully analyze the Fed’s statements and actions to gauge the potential impact on the market.

The Fed’s Stance on Inflation and Economic Growth

The Federal Reserve’s primary mandate is to maintain price stability and maximum employment. This means that the Fed aims to keep inflation at a target level while promoting economic growth. The Fed’s current stance on inflation is that it is still too high and requires further action to bring it back down to its 2% target.

The Fed is also concerned about the potential for a recession, as rising interest rates can slow down economic activity.

Historical Comparison

The Fed’s current monetary policy can be compared to its historical responses to similar economic conditions. During periods of high inflation, the Fed has typically raised interest rates aggressively to cool down the economy and bring inflation under control. However, the Fed also needs to be cautious about raising rates too quickly, as this can lead to a recession.

The market is holding its breath as we head into a week packed with crucial economic data releases and the highly anticipated Federal Reserve meeting. It’s a time for investors to be on their toes, carefully analyzing every piece of information.

But amidst the financial frenzy, there’s a bit of social media news that might catch your eye: Threads introduces new feature delete your profile on threads without removing your whole instagram account. While the stock market is focused on economic indicators, Threads is offering users a bit more control over their online presence.

We’ll see if this newfound flexibility impacts user engagement in the long run, but for now, it’s a welcome change in the world of social media.

The Fed’s current approach is a balancing act between fighting inflation and supporting economic growth.

Investor Sentiment and Market Outlook: Market Watch Us Stock Futures On Edge Ahead Of Crucial Economic Events And Federal Reserve Meeting

Investor sentiment is a key indicator of market direction. It reflects the overall mood and expectations of investors, influencing their trading decisions and ultimately shaping market trends. Currently, investors are navigating a complex landscape marked by economic uncertainty, geopolitical tensions, and ongoing inflation.

Factors Influencing Investor Sentiment

Investor sentiment is driven by a confluence of factors, including:

- Economic Data:Recent economic data, such as inflation reports, employment figures, and consumer spending, provides insights into the health of the economy and its potential impact on corporate earnings and stock valuations. For instance, a surge in inflation could lead to higher interest rates, potentially dampening economic growth and reducing corporate profits.

- Corporate Earnings:Companies’ earnings reports offer a glimpse into their financial performance and future prospects. Strong earnings growth can boost investor confidence, while disappointing results can trigger sell-offs.

- Geopolitical Events:Global events, such as the ongoing conflict in Ukraine, can create market volatility and influence investor sentiment. For example, escalating geopolitical tensions can lead to uncertainty about global supply chains and economic stability, potentially prompting investors to seek safe haven assets.

Key Sectors and Industry Performance

The upcoming economic events and the Federal Reserve meeting will likely have a significant impact on various sectors of the US economy. Understanding these potential impacts and analyzing recent sector performance is crucial for investors seeking to navigate the market volatility.

Impact on Key Sectors

The sectors most likely to be affected by the upcoming economic events and Federal Reserve meeting include:

- Technology:The tech sector is often sensitive to interest rate changes, as higher rates can impact growth valuations. Recent performance has been mixed, with some tech giants showing resilience while others struggle.

- Financial Services:The financial services sector benefits from rising interest rates, which can boost profits for banks. However, concerns about economic slowdown could dampen performance.

- Energy:Energy prices have been volatile in recent months, influenced by global supply chain disruptions and geopolitical tensions. The Fed’s actions could impact energy prices and the performance of energy companies.

- Consumer Discretionary:This sector includes companies selling non-essential goods and services, which are sensitive to consumer spending patterns. Inflation and rising interest rates could impact consumer confidence and spending.

Recent Sector Performance

Recent performance of key sectors has been mixed, reflecting the ongoing economic uncertainty:

- Technology:The tech-heavy Nasdaq Composite has underperformed the broader S&P 500 in recent months, reflecting concerns about growth valuations.

- Financial Services:The financial sector has performed relatively well, driven by rising interest rates and strong bank earnings.

- Energy:Energy prices have been volatile, but the energy sector has benefited from strong demand and high prices.

- Consumer Discretionary:The consumer discretionary sector has been under pressure due to inflation and rising interest rates, which have impacted consumer spending.

Impact of Economic Events and Monetary Policy

The upcoming economic events and the Federal Reserve meeting could have significant implications for various industries:

- Inflation and Interest Rates:Higher interest rates could impact companies that rely heavily on debt financing, such as technology and consumer discretionary companies.

- Economic Growth:A slowdown in economic growth could negatively impact industries that are sensitive to consumer spending, such as retail and hospitality.

- Geopolitical Risks:Geopolitical tensions, such as the ongoing conflict in Ukraine, can disrupt supply chains and impact global economic growth, affecting various industries.

Investment Opportunities

The current market environment presents both risks and opportunities for investors:

- Value Stocks:Investors may seek value stocks, such as those in the financial and energy sectors, which could benefit from rising interest rates and strong demand.

- Defensive Sectors:Defensive sectors, such as healthcare and utilities, may provide some protection against market volatility.

- Growth Stocks:Growth stocks, such as those in the technology sector, could benefit from a potential rebound in economic growth.

Technical Analysis and Market Indicators

Technical analysis plays a crucial role in understanding market trends and predicting potential price movements. By studying historical price data, volume, and other technical indicators, traders can identify patterns and make informed trading decisions.

Support and Resistance Levels

Support and resistance levels are key price points where the market has historically found difficulty breaking through. Support levels represent the price floor, where buying pressure is expected to outweigh selling pressure, preventing further price declines. Conversely, resistance levels represent the price ceiling, where selling pressure is anticipated to exceed buying pressure, hindering further price increases.

Moving Averages, Market watch us stock futures on edge ahead of crucial economic events and federal reserve meeting

Moving averages are trend-following indicators that smooth out price fluctuations by calculating the average price over a specific period. Common moving averages include the 50-day moving average and the 200-day moving average. When the price crosses above a moving average, it suggests a bullish trend, while a cross below indicates a bearish trend.

Volume Trends

Volume trends provide insights into the strength of market movements. High volume accompanying a price increase suggests strong buying pressure, while high volume accompanying a price decline indicates strong selling pressure. Conversely, low volume during a price movement suggests weak participation and potential for a reversal.

Significance of Technical Indicators

Technical indicators are valuable tools for traders and investors to identify potential market trends and make informed decisions. However, it is essential to note that technical analysis should be used in conjunction with fundamental analysis, which considers factors such as company earnings, economic data, and industry trends.

Comparing Technical Analysis and Fundamental Factors

Technical analysis provides a short-term perspective on market movements, while fundamental analysis offers a long-term view. By combining both approaches, traders can gain a comprehensive understanding of market dynamics and make informed trading decisions.