Market Response to US Jobless Claims: Stocks, Bonds, and More

Market response to us jobless claims stocks bonds and more – Market Response to US Jobless Claims: Stocks, Bonds, and More sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The US jobless claims report, a weekly snapshot of the labor market, holds immense power in influencing investor sentiment and shaping market movements.

It’s a powerful indicator that reveals insights into the health of the economy, driving shifts in stock prices, bond yields, and even influencing economic policy decisions.

This report acts as a compass, guiding investors through the intricate landscape of the financial world. When jobless claims rise, it signals a potential slowdown in economic growth, causing investors to become cautious and seek safe havens like bonds. Conversely, a decline in jobless claims suggests a strengthening economy, often leading to increased investor optimism and a surge in stock prices.

Understanding how jobless claims data influences market behavior is crucial for navigating the complexities of the financial world.

Jobless Claims and Market Response

Jobless claims, a weekly indicator of the number of people filing for unemployment benefits, provide valuable insights into the health of the labor market. The relationship between jobless claims and stock market performance is complex and multifaceted, influencing investor sentiment and investment decisions.

The market’s reaction to US jobless claims, stock performance, and bond yields is a complex dance influenced by a multitude of factors. Global events, like the unfolding economic crisis in Pakistan, can significantly impact sentiment and investment decisions. It’s crucial to consider how challenges like Pakistan’s economic crisis, analyzing challenges and charting a path to financial stability , ripple through global markets, influencing investor behavior and shaping market trends.

Investor Interpretation of Jobless Claims Data, Market response to us jobless claims stocks bonds and more

Investors closely monitor jobless claims data, interpreting it as a leading indicator of economic activity. A decline in jobless claims suggests a robust labor market, indicating increased consumer spending, business expansion, and economic growth. Conversely, a rise in jobless claims signals potential weakness in the economy, potentially leading to reduced consumer spending and business investment.

Market Response to Different Levels of Jobless Claims

The market’s response to jobless claims data varies depending on the level of claims and the broader economic context. Generally, a significant decline in jobless claims is viewed positively by investors, as it indicates a strengthening labor market and potentially higher economic growth.

This can lead to stock market gains, as investors become more optimistic about future corporate earnings. However, the market’s response can be more muted if the decline in jobless claims is already expected or if other economic indicators suggest weakness.

Conversely, a significant rise in jobless claims is typically interpreted negatively by investors, as it suggests a weakening labor market and potentially slower economic growth. This can lead to stock market declines, as investors become more cautious about future corporate earnings.

Impact of Jobless Claims on Specific Industries and Sectors

Jobless claims data can have a significant impact on specific industries and sectors. For example, a rise in jobless claims in the manufacturing sector could lead to lower demand for raw materials and industrial equipment, negatively affecting related industries. Conversely, a decline in jobless claims in the technology sector could indicate strong demand for tech products and services, benefiting companies in that sector.

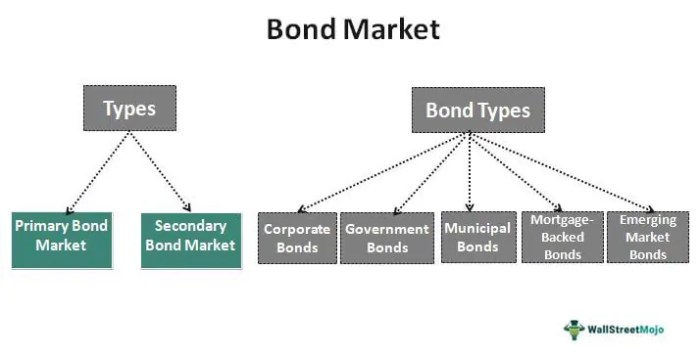

Bonds and Jobless Claims: Market Response To Us Jobless Claims Stocks Bonds And More

The relationship between jobless claims and bond yields is an important aspect of understanding the interplay between the labor market and the financial markets. Jobless claims, a measure of the number of people filing for unemployment benefits, provide insights into the health of the economy, and consequently, influence the demand for bonds.

The Correlation Between Jobless Claims and Bond Yields

Jobless claims and bond yields generally exhibit an inverse relationship. When jobless claims rise, it signals a weakening economy, leading to a decrease in demand for bonds. Conversely, when jobless claims fall, it indicates economic strength, boosting demand for bonds.

This inverse relationship stems from the impact of jobless claims on inflation expectations and the risk-free rate of return.

The Influence of Jobless Claims on Bond Demand

Changes in jobless claims data influence the demand for bonds in several ways:

- Inflation Expectations:Rising jobless claims suggest a weakening economy, potentially leading to lower inflation. Low inflation is generally favorable for bondholders as it preserves the real value of their investments. This increased demand for bonds pushes bond prices up and yields down.

- Risk-Free Rate:Jobless claims data influences the risk-free rate, which is the return on a risk-free investment like U.S. Treasury bonds. A weak economy often leads to a decrease in the risk-free rate as investors seek safer investments. This lower risk-free rate can also contribute to a decrease in bond yields.

- Economic Outlook:When jobless claims rise, it indicates a slowdown in economic activity, which can make investors less optimistic about future economic growth. This uncertainty can lead to a decrease in demand for bonds, particularly longer-term bonds, as investors may prefer shorter-term investments with lower risk.

The Impact of Jobless Claims on Bond Prices

The impact of jobless claims on bond prices is primarily driven by the demand for bonds. When jobless claims rise, indicating a weaker economy, demand for bonds tends to decrease, leading to lower bond prices. Conversely, when jobless claims fall, indicating economic strength, demand for bonds increases, pushing bond prices up.

Potential Risks and Opportunities for Investors

Investors can utilize jobless claims data and bond market trends to identify potential risks and opportunities:

- Rising Jobless Claims:Investors may consider reducing their exposure to bonds, particularly longer-term bonds, as the risk of falling bond prices increases in a weakening economy. They may also seek investments in assets that are less sensitive to economic downturns, such as gold or short-term bonds.

- Falling Jobless Claims:Investors may consider increasing their exposure to bonds, particularly longer-term bonds, as the risk of rising bond prices increases in a strengthening economy. This strategy can be particularly attractive when interest rates are expected to remain low or decline further.

Economic Indicators and Jobless Claims

Jobless claims, a measure of the number of individuals filing for unemployment benefits, provide valuable insights into the health of the labor market and, by extension, the broader economy. Understanding the relationship between jobless claims and other key economic indicators is crucial for comprehending the dynamics of economic growth, inflation, and consumer sentiment.

Relationship with Other Economic Indicators

Jobless claims are closely intertwined with other key economic indicators, providing a comprehensive picture of the economic landscape.

- GDP Growth: A decline in jobless claims often signals a healthy labor market, indicating increased hiring and economic expansion. Conversely, a surge in jobless claims can suggest a weakening economy and potential for a decline in GDP growth. For instance, during the 2008 financial crisis, a dramatic increase in jobless claims coincided with a sharp contraction in GDP.

- Inflation: The relationship between jobless claims and inflation is less straightforward. In periods of high inflation, businesses may be more likely to lay off workers, leading to an increase in jobless claims. However, a strong labor market with low unemployment can also fuel inflationary pressures as workers demand higher wages.

The market’s reaction to recent US jobless claims, stock and bond movements, and other economic indicators is a complex dance. But amidst the uncertainty, one company’s story offers a glimmer of hope: Overstock’s transformation of Bed Bath & Beyond’s revival with a digital relaunch suggests that even in challenging times, innovation and strategic pivots can pave the way for success.

As we continue to watch the market’s response to economic data, it’s important to remember that resilience and adaptation are key to navigating turbulent waters.

- Consumer Confidence: Rising jobless claims can erode consumer confidence, as individuals become concerned about job security and their future earning potential. Conversely, declining jobless claims can boost consumer confidence, leading to increased spending and economic growth.

Predicting Future Economic Trends

Jobless claims data can serve as a leading indicator of future economic trends. By analyzing the trend in jobless claims, economists can gain insights into the direction of the labor market and the overall economy.

The market is closely watching jobless claims, stock performance, and bond yields to gauge the health of the economy. But amidst these indicators, another factor looms large: the resumption of federal student loan payments. This could have a significant impact on consumer spending, potentially influencing everything from retail sales to housing demand.

For a comprehensive guide on navigating this change, check out this helpful resource. Ultimately, understanding the interplay between these economic factors is crucial for navigating the current market landscape.

- Early Warning Signal: A sudden increase in jobless claims can be an early warning signal of an impending economic slowdown or recession. For example, the rise in jobless claims in the months leading up to the 2008 recession provided a warning sign of the economic downturn to come.

- Assessing Economic Strength: Sustained low levels of jobless claims indicate a strong labor market and a healthy economy. Conversely, persistently high jobless claims suggest a weak labor market and potential economic challenges.

Impact on Economic Policy Decisions

Jobless claims data plays a significant role in shaping economic policy decisions. Policymakers closely monitor jobless claims to assess the health of the labor market and guide their decisions on monetary and fiscal policy.

- Monetary Policy: Central banks often use jobless claims data to inform their decisions on interest rate adjustments. For example, if jobless claims are rising, the central bank may consider lowering interest rates to stimulate economic growth and encourage hiring.

- Fiscal Policy: Governments may use jobless claims data to guide their spending and tax policies. For instance, during periods of high unemployment, governments may implement stimulus programs to create jobs and boost economic activity.

Examples of Interactions

The interplay between jobless claims and other economic indicators can be observed in real-world scenarios.

- The 2008 Recession: The 2008 financial crisis was marked by a sharp increase in jobless claims, signaling a weakening labor market and a contraction in economic activity. This surge in unemployment led to a decline in consumer spending and a further contraction in GDP.

- The COVID-19 Pandemic: The COVID-19 pandemic resulted in an unprecedented spike in jobless claims, reflecting widespread job losses due to lockdowns and business closures. This surge in unemployment had a significant impact on consumer confidence and economic activity.

Market Volatility and Jobless Claims

Jobless claims, a key economic indicator, are closely watched by investors and analysts as they provide insights into the health of the labor market. The relationship between jobless claims and market volatility is complex and often intertwined, with unexpected changes in jobless claims data having the potential to significantly impact market sentiment.

Impact of Jobless Claims Data on Market Uncertainty

Jobless claims data can contribute to market uncertainty in several ways. When jobless claims rise unexpectedly, it can signal a weakening labor market, leading to concerns about slowing economic growth. This uncertainty can cause investors to become more cautious, potentially leading to increased volatility in the stock market.

Conversely, a decline in jobless claims, especially when it surpasses expectations, can signal a strengthening labor market and boost investor confidence, potentially leading to a more stable market.

Impact of Unexpected Jobless Claims Releases on Market Sentiment

Unexpected jobless claims releases can have a significant impact on market sentiment, often causing sharp reactions in stock prices and other asset classes. For instance, if jobless claims are unexpectedly high, it can lead to a sell-off in the stock market as investors become concerned about the health of the economy.

Conversely, if jobless claims are unexpectedly low, it can trigger a rally in the stock market as investors become more optimistic about economic growth prospects.

Examples of Jobless Claims Influencing Market Volatility

Historically, there have been several instances where jobless claims data has significantly influenced market volatility.

- In 2008, during the financial crisis, a surge in jobless claims contributed to the sharp decline in the stock market. The rising unemployment rate, as reflected in the jobless claims data, heightened fears about a recession, causing investors to sell off their stocks.

- In 2020, during the COVID-19 pandemic, a dramatic increase in jobless claims, reaching record highs, triggered significant market volatility. The unprecedented job losses caused by the pandemic led to widespread economic uncertainty, causing investors to sell off stocks and other assets.

- In 2023, a decline in jobless claims, signaling a strong labor market, contributed to a rally in the stock market. The data suggested that the economy was recovering from the pandemic, boosting investor confidence and leading to higher stock prices.

Long-Term Trends and Jobless Claims

The number of jobless claims, a key indicator of labor market health, exhibits long-term trends that provide insights into the economy’s performance and potential future trajectory. Understanding these trends is crucial for investors, policymakers, and businesses alike.

Historical Trends and Contributing Factors

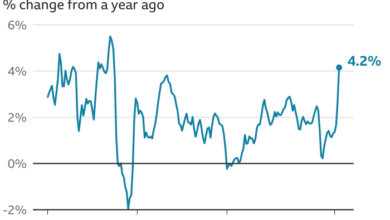

Analyzing historical jobless claims data reveals several long-term trends.

- Declining Trend:Overall, jobless claims have generally declined over the past several decades, reflecting improvements in labor market conditions and economic growth. This decline is attributed to factors like technological advancements, globalization, and a shift towards a more service-oriented economy.

- Cyclical Fluctuations:Jobless claims exhibit cyclical fluctuations, rising during economic downturns and falling during periods of expansion. These fluctuations are influenced by factors such as business cycles, consumer confidence, and government policies.

- Seasonal Variations:Jobless claims also exhibit seasonal variations, typically rising in the winter months and falling in the summer months. This pattern is influenced by factors such as holiday hiring and seasonal employment.

Impact of Long-Term Trends on the Economy and Markets

Long-term trends in jobless claims have significant implications for the economy and markets.

- Economic Growth:A declining trend in jobless claims generally signals a healthy economy with strong job creation and low unemployment. This can lead to increased consumer spending, business investment, and overall economic growth.

- Inflation:A tight labor market, as reflected by low jobless claims, can contribute to inflationary pressures. When businesses struggle to find workers, they may raise wages to attract and retain employees, which can lead to higher prices for goods and services.

- Market Performance:Jobless claims are closely watched by investors as a gauge of the economy’s health. A decline in jobless claims can boost investor confidence, leading to higher stock prices and lower bond yields. Conversely, a rise in jobless claims can signal economic weakness, potentially leading to market declines.

Historical Jobless Claims Data and Market Performance

The following table presents historical jobless claims data alongside corresponding market performance, highlighting the relationship between jobless claims and market movements:

| Year | Initial Jobless Claims (Average) | S&P 500 Index Return (%) | 10-Year Treasury Yield (%) |

|---|---|---|---|

| 2000 | 277,000 | -9.10 | 6.57 |

| 2005 | 324,000 | 4.91 | 4.24 |

| 2010 | 467,000 | 14.96 | 3.27 |

| 2015 | 274,000 | 1.38 | 2.24 |

| 2020 | 718,000 | 16.30 | 0.93 |

It is important to note that this table presents a simplified view of the relationship between jobless claims and market performance. Other factors, such as interest rate policies, global economic conditions, and geopolitical events, also play a significant role in shaping market movements.